Submitted by QTR's Fringe Finance

At no other point in history has discussion and free speech in the world of economics and finance been as necessary as it is now.

For those of you cut from the same financial-outlook cloth as I am, I'm sure you've made peace with being called a fear monger by now.

Because apparently, pointing out the basic laws of economics that seem to stand at stark odds with our current, unprecedented Keynesian experiment makes you some type of conspiracy theorist.

As those pushing modern monetary theory are quick to remind us, it is our brains that are broken, not the monetary system or their academic take on the economy. Take it from the woman who authored a book advocating for MMT that was published right before the country found itself mired in 7% inflation:

“The debt isn’t the reason we can’t have nice things. Our broken thinking is. To fix our broken thinking, we need to overcome more than just an aversion to big numbers with the word debt attached. We need to beat back every destructive myth that hobbles our thinking.

—Stephanie Kelton, The Deficit Myth

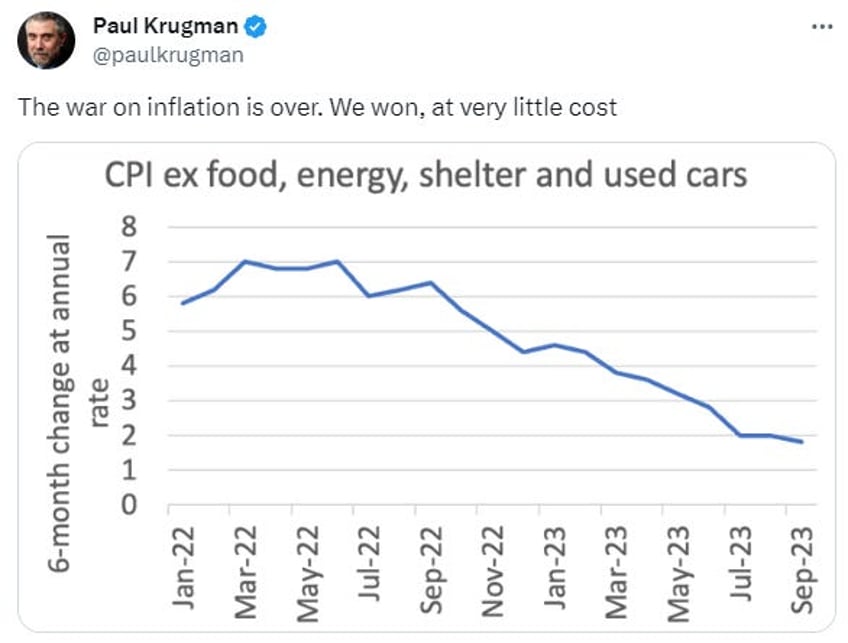

Remember, we’re the idiots. It’s our brains that are broken. Higher rates no longer means there will be a slowdown in spending, contracting GDP no longer means recession, dollars can be printed without any consequence to anyone at any point and the war against inflation has already been won…that is, as long as you subtract food, energy, shelter and used cars from equation.

This inane idiocy will continue, Nobel Prizes and all, until our “conspiracy” (read: math) is eventually proven true.

Free speech is our First Amendment right for a reason: it is of grave importance. Even more important is a reminder we need more and more as the days go by: it is the speech you disagree with the most that is the most important to protect.

In the financial world, this means those of us from the Austrian school (i.e. we can actually balance a budget, believe cash flow is vitally important to a business and understand that productivity and efficiency in an economy doesn’t come from printing dollars) are widely seen as “broken clocks” that are right “only twice a day”. In some respects, I’m fine with this.

After all, it’s tough to argue the point that we are on a treacherous, long-term path that will result in catastrophe at an unknown point in the future because everything that every academic, analyst and media personality is saying and doing is wrong, without looking like a broken clock. Those that read me consistently know that I constantly struggle with whether or not my analysis will wind up being on the right side of history.

But at the very least, you can’t have “rock solid” financial rules, like the ones academics swear by (and the ones that have driven us $33 trillion in debt) without having discourse that tests it regularly. This is a growing discussion we are having on a daily basis the more and more our vision of the stock and bond market, to quote Vincent Laguardia Gambini, gets “out of whack”.

Over the last three years, under the guise of doing what is best for the collective good during a pandemic, we saw people's right to free speech trampled on. People were kicked off social media and ostracized simply for stating their opinion if, in any way, it didn’t gel with the mainstream narrative on Covid. You couldn’t raise critical questions about vaccine safety (which are now becoming commonplace), you couldn’t suggest efficacious alternative treatments for Covid (which are now being widely accepted) and you couldn’t suggest Covid came from a lab (which is now the leading explanation for the virus).

And it wasn’t just a ban from social media: many who expressed the above thoughts were hastily relegated to second class citizens by the same lot who walks around all day screeching about the importance of equality. Some were even fired from their jobs.

As I pointed out in my article about the World Economic Forum earlier this year, the powers that be continue to wage a fight against "misinformation" all of kinds, which — to the best of my understanding — appears to be viewpoints that are at odds with the mainstream media, the government and big tech, regardless of whether or not they are objectively true.

Now take that same rabid willingness to crucify those who don’t agree with the mainstream narrative and move it over to the financial world.

The “official” stance right now — that of the Fed and its disciples — is that the war on inflation has already been won and that we are in for a “soft landing”.

If you look closely you can actually hear her making the “baaaaa” sheep noise.

The objective reality, as we saw by Friday’s trading (gold up 3%, oil up 5%, VIX over 20), is likely nowhere near as rosy as those expectations.

The objective math of 5% rates on the largest debt bubble in history tells even the most lobotomized analysts who hate math, like myself, that we are probably in for a catastrophic economic slowdown. When rates rise and discretionary income dries up, spending stops, as does economic growth.

The geopolitical outlook, given the emerging war in the Middle East, looks as bad as it has been in decades. As I wrote about days ago, for all intents and purposes, it looks as though the stock market is sitting on the edge of the end of the world.

My guess is that as the days go by, the markets will continue to swing wildly. Who knows what will happen next? Maybe Japan will lose control of their bond market. Maybe U.S. equities will have a circuit breaker day lower. Maybe commercial real estate will plunge all at once when people start marking their books for Q3. Maybe the U.S. bond market vigilantes will take rates to 7%? Maybe commodities will explode to new all time highs.

But make no mistake about it, something’s going to break — and it’ll be something that doesn’t fit in the “mainstream narrative” of “running this unprecedented monetary policy absolutely has to result in prosperity only, at all times, because us PhDs said so”. And when that moment comes and the public is guided to the only logical conclusion of pointing their fingers at the powers that be for decades of poor monetary and fiscal policy, the establishment will be forced to look for a villain — somewhere they can deflect blame.

And it’ll be then that those adhering to the Austrian school – and those with just plain old common sense who have been “broken clocks” predicting this catch-22 for years – are likely going to be next to be written off no longer as just plain ole’ conspiracy theorists, but as disinformation artists and the reason for the crash.

I implore people to watch closely as the days march on: it feels as though aggressive actions — like were taken with dissenters during Covid — could come around in the financial world next.

As I’ve said before, I hope I’m wrong about everything and we do have a soft landing. But my common sense simply won’t let me justify that argument in my head. I feel the seeds have already been sown and, with each passing day, the importance of financial free speech rises exponentially.

So, in the words of Big D and the Kids Table, “try out your voice”.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.