Since the last FOMC statement on June 12, oil, gold, stocks, the dollar, and even some of the bond market are higher (in price)...

Source: Bloomberg

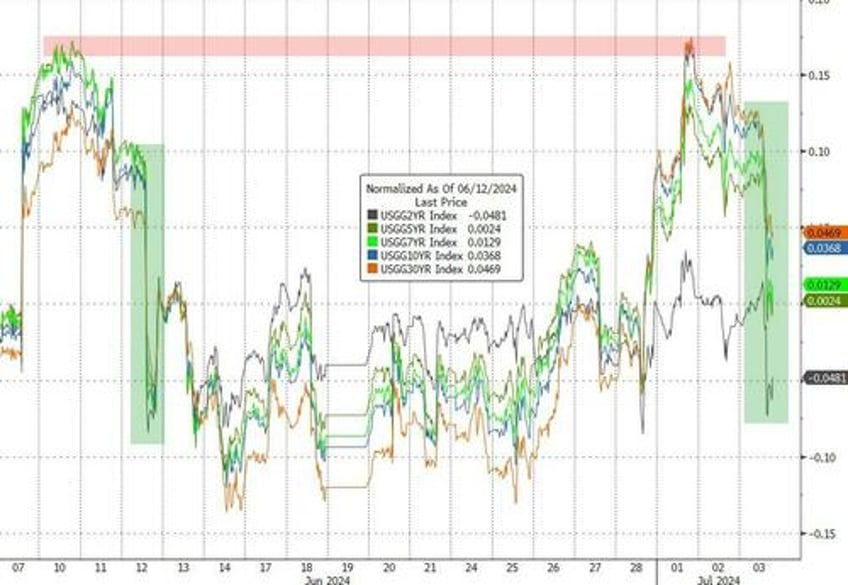

The shorter-end of the curve is now lower in yield since the last FOMC, but the long-end still higher (even with today's yield tumble)...

Source: Bloomberg

The US macro picture has deteriorated even more significantly relative to expectations, now at its weakest since Dec 2015...

Source: Bloomberg

And thanks to today's macro weakness, rate-cut expectations have risen back to the same levels they were immediately after Powell's press conference...

Source: Bloomberg

So, given the hawkish shift in the DOTS, what does The Fed want us to know from today's Minutes.

Here are the key takeaways from minutes of the Federal Reserve's June 11-12 meeting, released Wednesday (via Bloomberg):

Willing to wait...

Officials did not expect it would appropriate to lower borrowing costs until “additional information had emerged to give them greater confidence” that inflation was moving toward their 2% goal

Economic expectations...

The “vast majority” of Fed officials assessed that economic growth “appeared to be gradually cooling...

...and most participants remarked that they viewed the current policy stance as restrictive”

Officials said inflation progress was evident in smaller monthly gains in the core personal consumption expenditures price index and supported by May consumer price data that were released hours before the rate decision

They appear set of the narrative that AI will save the world too (through deflation)...

Participants highlighted a variety of factors that were likely to help contribute to continued disinflation in the period ahead. The factors included continued easing of demand–supply pressures in product and labor markets, lagged effects on wages and prices of past monetary policy tightening, the delayed response of measured shelter prices to rental market developments, or the prospect of additional supply-side improvements.

The latter prospect included the possibility of a boost to productivity associated with businesses’ deployment of artificial intelligence–related technology. Participants observed that longer-term inflation expectations had remained well anchored and viewed this anchoring as underpinning the disinflation process. Participants affirmed that additional favorable data were required to give them greater confidence that inflation was moving sustainably toward 2 percent

But The Fed seems divided on how to 'react' to data (markets or macro)...

Some officials emphasized the need for patience in allowing high rates to continue to restrain demand...

...while others noted that if inflation were to remain elevated or increase further, rates “might need to be raised”

A “number” of officials said the Fed needs to stand ready to respond to unexpected weakness, and several flagged that a further drop in demand may push up unemployment rather than just reduce job openings

WSJ Fed-Watcher Nick Timiraos chimes in to confirm the more dovish bias of the Minutes...

While there isn't an obvious signal about the policy path in the FOMC minutes, the discussion about inflation and labor market developments offers little to suggest fear of overheating or policy being too loose.

— Nick Timiraos (@NickTimiraos) July 3, 2024

• For example, discussion of businesses' reduced pricing power: pic.twitter.com/vvorZHy8jv

Read the full Minutes below: