- FOMC Minutes stated that some officials would have preferred a 25bps cut, though a substantial majority supported 50bps

- Biden-Netanyahu call was positive; US does not yet know the timing of the strike against Iran

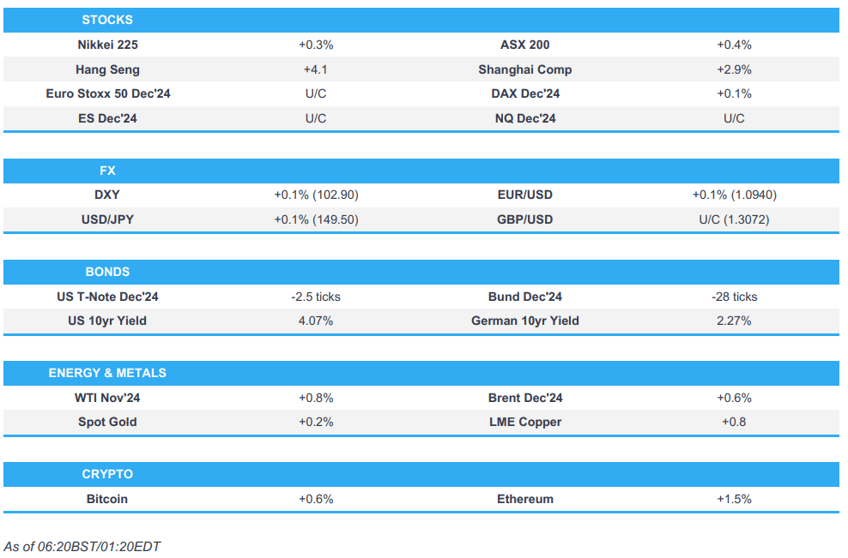

- APAC stocks traded higher, significant outperformance in Hong Kong on fresh PBoC support. European futures point to a slightly firmer open

- DXY rangebound, NZD & AUD outperform given the above and after Wednesday's pressure

- Fixed benchmarks remain near Wednesday's lows while Crude continues to move higher

- Looking ahead, highlights include Italian Industrial Output, US CPI, Initial Jobless Claims, US Federal Budget, NZ Manufacturing PMI, Chinese M2 Money Supply, ECB Minutes, Tesla Robotaxi Event, AMD AI Event, Speakers including Fed’s Cook, Barkin & Williams, Supply from US, Earnings from Domino's Pizza & Delta.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks gained in which both the S&P 500 and Dow notched fresh record closes with outperformance in the latter and the small-cap Russell 2000 lagged but still finished in the green, while sectors were predominantly firmer with Healthcare, Technology and Industrials leading the advances and Financials also saw decent gains ahead of the start of earnings season. Nonetheless, macro catalysts were light as the latest Fed rhetoric and FOMC Minutes did little to spur a reaction with the latest CPI data on the horizon.

- SPX +0.71% at 5,792, NDX +0.80% at 20,269, DJIA +1.03% at 42,512, RUT +0.26% at 2,201

- Click here for a detailed summary.

FOMC MINUTES

- FOMC Minutes stated a substantial majority backed a half-point rate cut but some officials would have preferred a quarter-point cut. The participants that backed a 50bps cut generally observed that such a recalibration of the stance of monetary policy would begin to bring it into better alignment with recent indicators of inflation and the labour market. They also emphasized that such a move would help sustain the strength in the economy and the labour market while continuing to promote progress on inflation, and would reflect the balance of risks. Conversely, some participants noted they would have preferred a 25bps cut at September's meeting and a few others indicated they could have supported that, while several participants discussed the importance of communicating quantitative tightening could continue for 'some time' even as rates are reduced.

NOTABLE HEADLINES

- Fed Vice Chair Jefferson said the underlying trend is inflation dropping towards 2% and cooling of the US labour market has been orderly, while he reiterated that risks to the mandate remain roughly in balance.

- Fed's Daly (voter) said she fully supported a half-point rate cut and is quite confident they are on the path to 2% inflation, while she added that they are at full employment and will watch the data, as well as monitor the labour market and inflation. Furthermore, Daly said the size of the September rate cut does not say anything about the pace or size of the next cuts and noted that one or two more cuts this year are likely.

- Fed's Collins (2025 voter) reiterated her support for more US rate cuts.

- Former US President Trump pledged to the end double taxation of Americans abroad, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks were higher following the record closes on Wall Street despite light macro catalysts as the latest Fed rhetoric and FOMC Minutes did little to spur a reaction, while the attention now shifts to looming US CPI data.

- ASX 200 mildly gained amid strength in real estate and the mining-related industries with the latter helped by M&A news after Rio Tinto announced a definitive agreement to acquire Arcadium Lithium.

- Nikkei 225 was underpinned at the open but with gains capped amid quiet newsflow and firmer-than-expected PPI data.

- Hang Seng and Shanghai Comp rallied with significant outperformance in the Hong Kong benchmark after returning to above the 21,000 level, while the mainland conformed to the broad upbeat mood which also followed the PBoC's announcement to establish a securities and funds swap facility of CNY 500bln to enhance the internal stability of the capital market.

- US equity futures plateaued overnight and held on to the prior day's spoils.

- European equity futures are indicative of a slightly positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed up by 0.7% on Wednesday.

FX

- DXY took a breather after climbing to just shy of the 103.00 level yesterday despite a lack of drivers as recent comments from Fed officials and the FOMC Minutes had little effect on the dollar. Attention now turns to the upcoming US CPI data.

- EUR/USD was stuck near its worst levels in almost two months owing to the firmer dollar, while ECB Minutes are due later.

- GBP/USD traded rangebound amid light UK-specific catalysts and after the recent failed attempt at the 1.3100 handle.

- USD/JPY held on to its gains above the 149.00 level after recently benefitting from dollar strength and firmer US yields.

- Antipodeans clawed back some of the prior day's losses with the rebound facilitated by the positive risk tone.

FIXED INCOME

- 10yr UST futures languished near the prior day's lows after yields crept higher amid the prevailing view that the Fed's 50bps move in September was likely a one-off, while mixed 10yr auction results and a looming 30yr issuance also kept prices in check.

- Bund futures continued to trickle lower following recent supply, while German Retail Sales and ECB Minutes loom.

- 10yr JGB futures tracked the declines in peers but with losses stemmed by a floor around the 144.00 level and as participants reflected on the mixed results from the 5yr JGB auction.

COMMODITIES

- Crude futures gradually extended on the recent rebound as markets continued to await Israel's response to Iran.

- Spot gold eked mild gains north of the USD 2,600/oz level with the upside limited heading into US CPI.

- Copper futures clawed back some of the prior day's losses alongside the constructive mood.

CRYPTO

- Bitcoin mildly gained overnight and approached closer to retesting the USD 61,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced to establish a securities and funds swap facility of CNY 500bln to enhance the internal stability of the capital market, while it started accepting applications from securities firms, funds and insurers to join the swap scheme.

DATA RECAP

- Japanese Corporate Goods Price MM (Sep) 0.0% vs. Exp. -0.3% (Prev. -0.2%); YY 2.8% vs. Exp. 2.3% (Prev. 2.5%, Rev. 2.6%)

GEOPOLITICS

MIDDLE EAST

- US President Biden and Israeli PM Netanyahu held a call which took place in a positive atmosphere and focused on the Israeli response to Iran, while Biden said Israel should start planning for the next phase of fighting on the Lebanon front, according to Israel's Channel 12.

- White House said Biden’s call with Israel's Netanyahu was direct and productive, while it added that discussions on the Iran attack continued and the call lasted 30 minutes. It was separately reported that Washington does not yet know the timing of the strike against Iran, nor the nature of the objectives, while Israel's US envoy said the Biden-Netanyahu call was positive and Israel appreciates the support of the US.

- Members of the Biden administration were still relatively satisfied with the level of detail that was shared in the call with Israeli PM Netanyahu, according to ABC News citing a US official.

- Israel PM Netanyahu will ask the security cabinet to give him and Defence Secretary Galant the mandate to decide on the attack on Iran, according to Israeli press. It was also previously reported that PM Netanyahu asked to understand the American position and get support, according to Israel's Channel 12.

- Israeli Defence Minister said the attack on Iran will be fatal, accurate and surprising, according to Al Arabiya.

- Israeli and US officials believe that tit-for-tat exchanges of fire will continue between Iran and Israel, even after the Israeli retaliatory strike soon against Iran, according to OSINTDefender on X.

- An Israeli warship was spotted at sea off the city of Tyre, southern Lebanon, according to Sky News Arabia.

- Iran’s Foreign Minister said stopping Israeli attacks on Gaza and Lebanon is necessary to prevent escalation of tension and the outbreak of a full-scale conflict, according to Al Jazeera.

- Pro-Iranian militias in Iraq evacuated some of their sites in Baghdad due to a fear of an Israeli attack, according to a Kann News correspondent citing Saudi TV sources.

- Israel conducted a new raid on Haret Hreik in the southern suburbs of Beirut and conducted a raid on the heights of the town of Jinta near the Lebanese-Syrian border, while it was also reported that a large force of Israeli soldiers raided the town of Idna, west of Hebron, in the southern West Bank.

- Israeli aggression was reported on Hasiya Industrial City in Syria's Homs countryside, according to Syrian state TV.

- US warplanes flew over areas controlled by Iranian militias in Deir Ezzor, Syria, according to Sky News Arabia. It was later reported by media loyal to the Syrian regime that there was a bombing believed to be American on the city of Albu Kamal in the countryside of Deir Ezzor, according to Al Jazeera.

OTHER

- Russian ballistic missile strike on port infrastructure in Ukraine's southern Odesa region killed six people and wounded 11 others on Wednesday, according to AFP News Agency.

- EU envoys agreed to contribute up to EUR 35bln towards the G7 loan to Ukraine which would total EUR 45bln with the loan to be backed by frozen Russian central bank assets and secured by EU budget headroom, according to Reuters.

- US senior official said Beijing is increasingly using normal political events as a pretext for military pressure on Taiwan, while the US is prepared for China using the October 10th celebration as a pretext for military pressure on Taiwan and sees no justification for it doing so.

- Taiwan President Lai said China has no right to represent Taiwan and he will uphold the commitment to resist annexation or encroachment, while he added that Taiwan is resolved in commitment to upholding peace and stability in the Taiwan Strait and achieving global security and prosperity. Taiwan will become more calm, more confident, and stronger, as well as noted that the determination to defend their national sovereignty remains unchanged.

EU/UK

NOTABLE HEADLINES

- Institute for Fiscal Studies sees risk of a large UK tax increase to ease the spending squeeze and said UK Chancellor Reeves may need to announce a GBP 25bln tax rise in her first Budget on October 30th to shore up public services, while the think-tank also noted that past governments have raised taxes sharply after elections.

DATA RECAP

- UK RICS Housing Survey (Sep) 11.0 vs. Exp. 4.0 (Prev. 1.0)