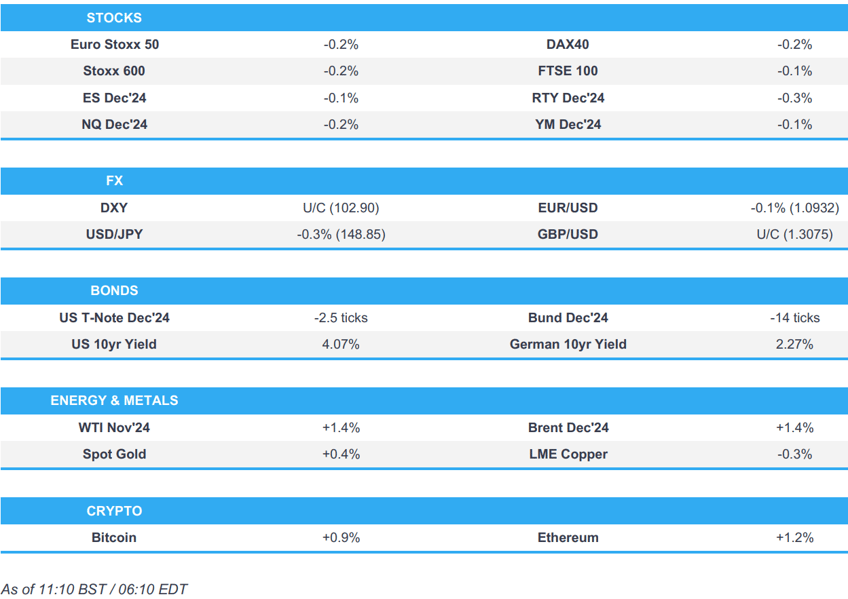

- European bourses are mostly lower and US futures trade tentatively ahead of US CPI.

- DXY is flat, JPY outperforms following hawkish BoJ Himino commentary.

- USTs are modestly lower potentially pressured by FOMC Minutes/30yr concession; Gilts lag after IFS analysis.

- Crude is firmer, XAU gains and holds comfortably above USD 2600/oz and base metals are mostly in the green.

- Looking ahead, US CPI, Initial Jobless Claims, US Federal Budget, NZ Manufacturing PMI, Chinese M2 Money Supply, ECB Minutes, Tesla Robotaxi Event, AMD AI Event, Speakers including Fed’s Cook, Barkin & Williams, Supply from US, Earnings from Delta.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.2%) began the session on a modestly firmer footing, but as the morning progressed, indices generally edged lower. As it stands, indices are mostly in negative territory and to varying degrees.

- European sectors hold a negative bias vs initially mixed at the cash open. Healthcare tops the pile, a beneficiary of the significant gains in GSK (+5.4%) after it settled its Zantac litigation case. Tech is found towards the foot of the pile.

- US Equity Futures (ES -0.2%, NQ -0.2%, RTY -0.1%) are softer across the board, in a slight paring to some of the gains seen in the prior session; traders are also very mindful of the upcoming US CPI result. AMD (+0.2%) will host its AI event and Tesla (+0.8%) is firmer ahead of its Robotaxi event.

- Huawei smartphone sales within China surpassed Apple's (AAPL) in August 2024, via CINNO Research; for the first time in almost four-years.

- Four Taiwanese employees at a Foxconn (2354 TW) run facility in China which makes products for Apple (AAPL) have been detained by local authorities, via WSJ citing Taiwanese officials; said to have been accused of offenses similar to a breach of trust.

- PRIMER - TESLA (TSLA) ROBOTAXI EVENT: Tesla will hold its “Robotaxi Day” today at Warner Brothers Discovery (WBD) studio in Burbank, California. The event is expected to unveil the next-generation Robotaxi with updated AI hardware and version 13 of FSD, aimed for late 2026, along with a second version of Optimus. Truist’s analysts expressed caution regarding the event, stating it is unlikely to serve as a positive catalyst for Tesla shares. (Full primer on Newsquawk)

- PRIMER - AMD (AMD) AI EVENT: AMD is set to showcase new technologies at its 2024 Advancing AI event today, including Instinct GPU accelerators and EPYC server processors. Analysts view this as a potential “catch-up catalyst” for AMD in the AI accelerator market, where it currently holds 5-7% share compared to Nvidia’s (NVDA) over 80%. AMD aims to increase its share of the market to 10% by 2026, potentially generating an additional USD 5bln in sales. (Full primer on Newsquawk)

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Dollar is essentially flat and trading within a very tight 102.83-96 range, with the best for today just shy of Wednesday’s peak. Today’s US CPI release will be the next inflection point for the index.

- EUR is incrementally lower but within recent ranges; today’s low is just beneath its 100 DMA at 1.0933. Today sees the ECB Minutes release for the September meeting, but will likely have little impact on pricing given the developments of survery data and inflation metrics.

- GBP follows peers, and trades within a very tight 1.3063-1.3089 range; the high for today is a little shy of its 50 DMA at 1.3093. UK-specifics light, but focus is on the upcoming UK Budget; think tank IFS, writes that Chancellor Reeves “must find billions more” in time for the Budget.

- JPY is firmer vs the Dollar with USD/JPY trading within a 148.84-149.54 range. The pair saw some downside after BoJ's Himino said "we are witnessing record high corporate profits and record high wage increase in Japan… if the outlook for economic activity and prices presented in July report is achieved, BoJ will accordingly raise interest rates".

- The Antipodeans started the European session on a firmer footing and remained as the marginal G10 outperformers throughout the morning; largely a factor of a slight paring of the losses seen in the prior session.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are pressured with the FOMC minutes potentially weighing alongside a mixed 10yr auction and concession into the 30yr. Thus far, USTs at a 112-01+ trough, a couple of ticks below Wednesday’s base to a fresh WTD low. US CPI is also on the docket, which is expected to cool slightly from the prior pace.

- Bunds are in the red; the paper saw some brief two-way action on account of German Retail Sales, which was much firmer than expected. Focus for EGBs later in the day will be on the French PM and his Budget/Finance Ministers where they are set to present the budget to other cabinet members.

- Gilts are lagging down to a 96.19 trough which marks a fresh WTD and multi-week low, next point of support potentially at 95.47 from early-July. UK-specific newsflow light ahead of the UK Budget on Oct 30th; Institute for Fiscal Studies report ahead of this cautions that an additional GBP 20bln, or more, could be required to meet the ‘no return to austerity’ pledge.

- Click for a detailed summary

COMMODITIES

- A firmer session for crude benchmarks. Hurricane Milton made landfall overnight as a Category 3 storm, details on the damage to energy infrastructure light thus far. As for geopols, Guy Elster reported that the Israel security cabinet will be meeting tonight to discuss the potential attack. Brent'Dec currently trading around USD 77.50/bbl.

- Spot gold is firmer and sitting comfortably above the USD 2600/oz mark and extending as high as USD 2617/oz, though the yellow metal has lost a little bit of its shine as the session progresses

- Base metals performed well in APAC trade, bolstered by outperformance in China on the latest support measures. However, this narrative has faded in the European session somewhat with copper now unchanged as the European risk tone tempers.

- Fortum (FORTUM FH) CEO says they have spotted drones and suspicious people around their Finnish energy assets on a monthly basis. Being targeted by cyber attacks.

- UBS says "we forecast Gold to reach USD 2850/oz by mid-2025".

- CEO of Russia's Gazprom says there is artificial destruction of gas demand on the European gas market.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK RICS Housing Survey (Sep) 11.0 vs. Exp. 4.0 (Prev. 1.0)

- Norwegian Core Inflation YY (Sep) 3.1% vs. Exp. 3.3% (Prev. 3.2%); CPI YY 3.0% vs. Exp. 3.2% (Prev. 2.6%)

- German Retail Sales MM Real (Aug) 1.6% vs. Exp. 0.1% (Prev. -1.2%); YY 2.1% (Prev. -1.7%)

- Italian Industrial Output MM SA (Aug) 0.1% vs. Exp. 0.2% (Prev. -0.9%, Rev. -1.0%); Industrial Output YY WDA (Aug) -3.2% (Prev. -3.3%)

NOTABLE EUROPEAN HEADLINES

- Institute for Fiscal Studies sees risk of a large UK tax increase to ease the spending squeeze and said UK Chancellor Reeves may need to announce a GBP 25bln tax rise in her first Budget on October 30th to shore up public services, while the think-tank also noted that past governments have raised taxes sharply after elections.

- Fortum (FORTUM FH) CEO says they have spotted drones and suspicious people around their Finnish energy assets on a monthly basis. Being targeted by cyber attacks.

NOTABLE US HEADLINES

- Fed's Daly (voter) said she fully supported a half-point rate cut and is quite confident they are on the path to 2% inflation, while she added that they are at full employment and will watch the data, as well as monitor the labour market and inflation. Furthermore, Daly said the size of the September rate cut does not say anything about the pace or size of the next cuts and noted that one or two more cuts this year are likely.

- Fed's Collins (2025 voter) reiterated her support for more US rate cuts.

- Former US President Trump pledged to the end double taxation of Americans abroad, according to WSJ.

GEOPOLITICS

MIDDLE EAST

- "Israel security cabinet will meet this evening to discuss on the planned attack on Iran", via journalist Elster

- Israel PM Netanyahu will ask the security cabinet to give him and Defence Secretary Galant the mandate to decide on the attack on Iran, according to Israeli press. It was also previously reported that PM Netanyahu asked to understand the American position and get support, according to Israel's Channel 12.

- Israeli Defence Minister said the attack on Iran will be fatal, accurate and surprising, according to Al Arabiya.

- Israeli and US officials believe that tit-for-tat exchanges of fire will continue between Iran and Israel, even after the Israeli retaliatory strike soon against Iran, according to OSINTDefender on X.

- Israel conducted a new raid on Haret Hreik in the southern suburbs of Beirut and conducted a raid on the heights of the town of Jinta near the Lebanese-Syrian border, while it was also reported that a large force of Israeli soldiers raided the town of Idna, west of Hebron, in the southern West Bank.

- Israeli aggression was reported on Hasiya Industrial City in Syria's Homs countryside, according to Syrian state TV.

- US warplanes flew over areas controlled by Iranian militias in Deir Ezzor, Syria, according to Sky News Arabia. It was later reported by media loyal to the Syrian regime that there was a bombing believed to be American on the city of Albu Kamal in the countryside of Deir Ezzor, according to Al Jazeera.

OTHER

- Ukrainian Presidential Advisor Lytvyn has denied earlier reports in Corriere della Sera that Zelensky would be "willing to accept a ceasefire along the current line - without recognizing a new official border - in exchange for certain Western commitments".

- Russian ballistic missile strike on port infrastructure in Ukraine's southern Odesa region killed six people and wounded 11 others on Wednesday, according to AFP News Agency.

- Taiwan President Lai said China has no right to represent Taiwan and he will uphold the commitment to resist annexation or encroachment, while he added that Taiwan is resolved in commitment to upholding peace and stability in the Taiwan Strait and achieving global security and prosperity. Taiwan will become more calm, more confident, and stronger, as well as noted that the determination to defend their national sovereignty remains unchanged.

CRYPTO

- Bitcoin edges higher and holds just beneath USD 60.9k, with Ethereum just shy of USD 2.4k.

APAC TRADE

- APAC stocks were higher following the record closes on Wall Street despite light macro catalysts as the latest Fed rhetoric and FOMC Minutes did little to spur a reaction, while the attention now shifts to looming US CPI data.

- ASX 200 mildly gained amid strength in real estate and the mining-related industries with the latter helped by M&A news after Rio Tinto announced a definitive agreement to acquire Arcadium Lithium.

- Nikkei 225 was underpinned at the open but with gains capped amid quiet newsflow and firmer-than-expected PPI data.

- Hang Seng and Shanghai Comp rallied with significant outperformance in the Hong Kong benchmark after returning to above the 21,000 level, while the mainland conformed to the broad upbeat mood which also followed the PBoC's announcement to establish a securities and funds swap facility of CNY 500bln to enhance the internal stability of the capital market.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced to establish a securities and funds swap facility of CNY 500bln to enhance the internal stability of the capital market, while it started accepting applications from securities firms, funds and insurers to join the swap scheme.

- Fast Retailing (9983 JT) FY (JPY) Op Profit 500.9bln (exp. 478.26bln), Pretax Profit 557.2bln (exp. 546.65bln); sees FY op. income 520bln.

- BoJ Deputy Governor Himino says "We are witnessing record high corporate profits and record high wage increase in Japan"; If the outlook for economic activity and prices presented in July report is achieved, BoJ will accordingly raise interest rates. The policy board is going to look at the totality of the data as it makes decisions meeting by meeting. "We have many real interest rates and they vary significantly but all of them are negative". Later in the year, "we will have more data on the pass through of wage hikes on prices, and next year's wage negotiations". "We will also now more about pass through of YEN - Dollar rate on inflation via import prices". Course is not pre-set. BoJ will consider adjusting degree of monetary conditions if the board has greater confidence in the outlook. "The data to focus on shifts as it comes in, today US employment and consumption and Chinese consumption may deserve more attention than before". "We monitor data to detect developments that are not already covered in our risk scenarios, looking at data outside of the priority is equally important". There is no clear consensus among the board members about future approaches on better communication.

- Japan's Former FX Diplomat Kanda says heightened FX volatility has a largely adverse impact on Japan

- China's State Planner publishes draft guidelines on private economy promotion law. Will be improving investment and the financing environment while reducing transaction costs.

- China prelim auto sales September, PCA: +2% Y/Y, +8% M/M. NEV: +51% Y/Y, +9% M/M.

DATA RECAP

- Japanese Corporate Goods Price MM (Sep) 0.0% vs. Exp. -0.3% (Prev. -0.2%); YY 2.8% vs. Exp. 2.3% (Prev. 2.5%, Rev. 2.6%)