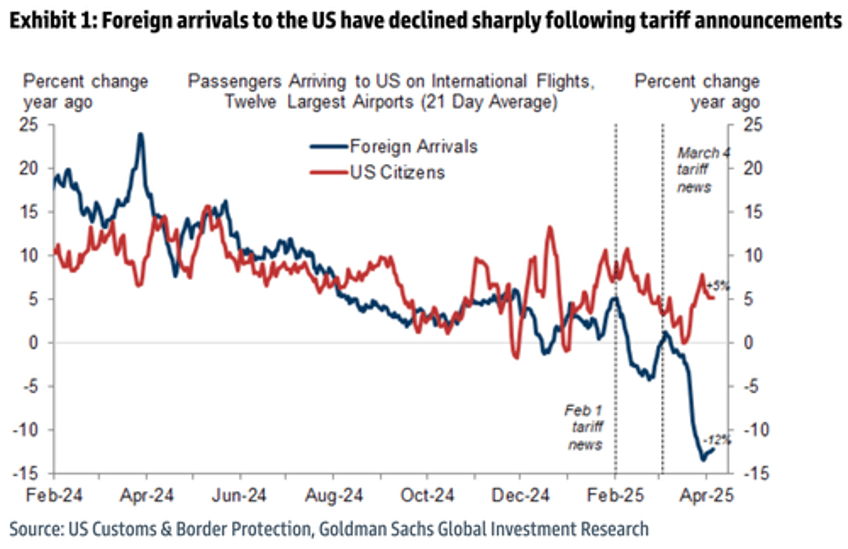

From President Trump's long-threatened trade war on day one to last week's "Liberation Day" tariff blitz, the escalating trade war with China and other major trading partners appears to have triggered a foreign traveler boycott of the U.S.—even as domestic travel by U.S. citizens remains solid.

Goldman analysts Catherine O'Brien and Jack Ewell told clients Monday that U.S. airlines recently slashed revenue guidance, citing transitory factors, reduced government travel, and economic uncertainty affecting last-minute bookings. They said that while there were earlier signs of recovery in future peak travel periods, growing economic and geopolitical instability is now expected to weigh further on demand.

O'Brien pointed out that non-U.S. citizen traffic at U.S. airports declined sharply in recent weeks—dropping from +1% a month ago to -7% two weeks ago, and now -12%. This trend only suggests it will continue accelerating to the downside.

The analysts noted that economic uncertainty prompted them to "reduce our outlook for the US airlines"...

Here's more on the outlook:

We are reducing our outlook for the U.S. airlines as we incorporate a worse 1Q 2025 exit rate on increasing economic and geopolitical uncertainty, and assume this lower level of demand holds for the rest of 2025. This drives a material cut to our outlook. However, the rate at which the industry is cutting capacity is encouraging, particularly for historically higher growth airlines that are now producing lower-than-historical margins. As such, we expect the lower demand environment to be partially offset by industry capacity cuts in the second half of 2025. We are not incorporating a full recessionary scenario into our forecast which would likely drive further downside risk to our outlook (see our recession scenario analysis here), but note that the GS macro team is now forecasting a 45% probability of a U.S. recession.

We expect the industry overall to perform better in an economic slowdown than it has previously, as it is more consolidated, less levered, and revenue is more diversified. We continue to believe that segmentation and revenue diversification will drive changes to relative profitability across the industry, with Buy-rated Delta and United benefiting from a better ability to compete profitably across various demand segments. In a slowdown, this would be the first cycle with a mature basic economy product rolled out, excluding the pandemic which is not comparable to a typical economic downturn in our view.

While we expect relatively better performance across the airlines than in prior slowdowns, we are shifting our positioning to be relatively more defensive given the current level of economic and geopolitical uncertainty, and are downgrading AAL shares to Sell and upgrading SKYW shares to Buy. American's operating leverage and balance sheet drives relatively higher downside to our outlook vs. the industry, but AAL shares have essentially performed in-line with the industry since February. Conversely, SkyWest is one of the most insulated in our airlines coverage given its revenue is primarily contractual, but SKYW shares are down nearly in-line with the industry since February.

Beyond the downgraded airline outlook for the U.S. market, what stands out most is the emerging foreign traveler boycott amid the escalating trade war. This trend may signal a broader downturn for the U.S. travel industry and other tourism-dependent service sectors.