Update:

After Beijing’s overnight inaction in response to President Trump’s new 104% effective-rate tariff on Chinese goods—and the release of a white paper on trade between the two superpowers—there now appears to be a response from the Chinese side.

*CHINA RAISES TARIFFS ON US GOOD TO 84%

— zerohedge (@zerohedge) April 9, 2025

Bloomberg reports that China plans to counter Trump's tariffs with an effective tariff rate of around 84%, escalating the trade war. These countermeasures go into effect on Thursday.

More from Bloomberg:

A day earlier, China vowed to "fight to the end" if the US insists on new tariffs. Chinese exports were already facing blanket levies imposed this year and punitive taxes from Trump's first term and the following Biden administration. China also added six firms to its unreliable entity list, and 12 US entities to its export control list. Initially, Trump justified the 34% tariff hike on China as a fair way to match the barriers that Beijing has in place against US firms and goods, and then added to them after Beijing retaliated with its own levies.

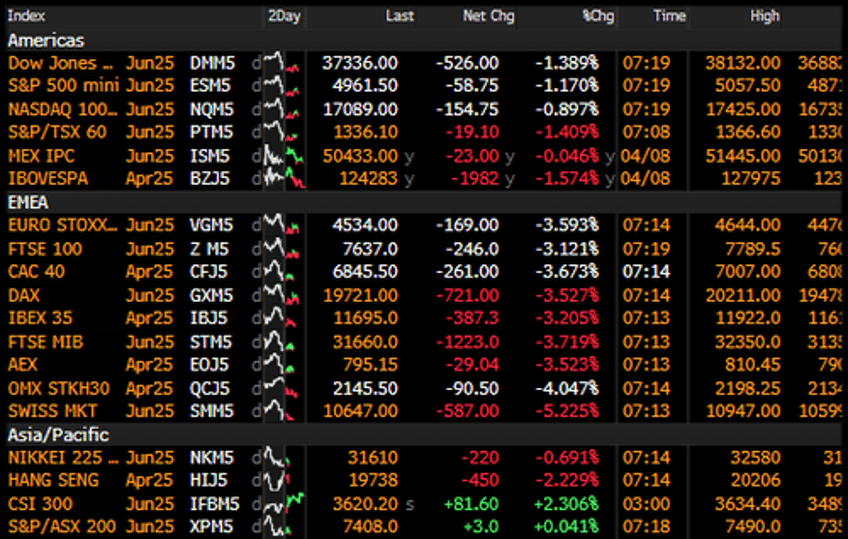

In markets, European equity futures are down more than 3%. Equity futures in the US are down over 1% for the S&P500 and Nasdaq.

And what a mess. The PboC has been propping up Chinese markets, wile the Federal Reserve has been stuck in wait-and-see mode as the basis trade unravels (read: here).

* * *

President Donald Trump's reciprocal tariffs took effect at 12:01 a.m. Wednesday in Washington, sending shockwaves through global markets as he advances the 'America First' agenda to reshape the international economic order. In a notable shift from the previous tariff rounds, Beijing refrained from immediately firing back with countermeasures to the new 104% effective-rate tariffs. Instead, Beijing released a 28,000-character white paper detailing its economic relationship with the US as foundational to global stability.

China's State Council Information Office released the white paper on Wednesday titled "China's Position on Some Issues Concerning China-U.S. Economic and Trade Relations." The paper provides statistics about China-U.S. economic and trade relations.

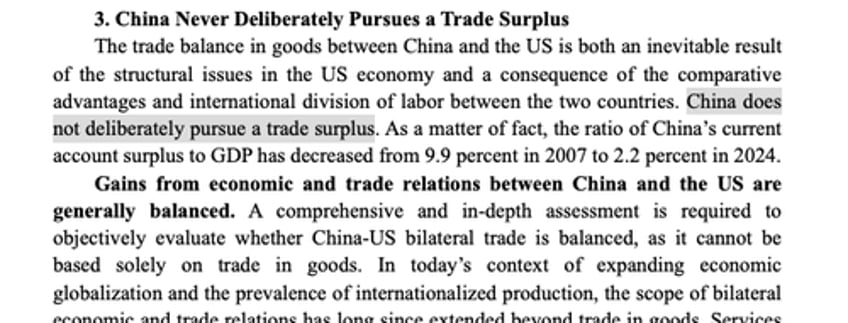

"China does not deliberately pursue a trade surplus," the white paper said, adding, "The trade imbalance in goods between China and the U.S. is both an inevitable result of structural issues in the U.S. economy and a consequence of the comparative advantages and international division of labour between the two countries."

Chinese state media Xinhua News Agency provided more details about the white paper:

The white paper came as rising unilateralism and protectionism in the United States have significantly impeded normal economic and trade cooperation between the two countries.

. . .

These measures -- revealing the isolationist and coercive nature of US conduct -- run counter to the principles of the market economy and multilateralism, and will have serious repercussions for China-U.S. economic and trade relations, the white paper said.

In response to the US moves, China has taken forceful countermeasures to defend its national interests, and has remained committed to resolving disputes through dialogue and consultation, with multiple rounds of consultations with the US side to stabilize bilateral economic and trade relations, according to the document.

The Chinese side has always maintained that China-U.S. economic and trade relations are mutually beneficial and win-win in nature, the white paper said.

The White Paper concluded that cooperation—not confrontation—between both sides is essential for global economic growth, technological governance, and security, urging the US for a winnable solution through dialogue:

Trade wars produce no winners, and protectionism leads up a blind alley. The economic success of both China and the US presents shared opportunities rather than mutual threats

The reason for the Chinese restraint remains unclear, though Bloomberg noted that President Xi Jinping "could still hit back later today as U.S. markets open, or in the coming week."

On Tuesday, two Chinese bloggers leaked potential countermeasures Beijing could unleash on the US, such as banning imports of US poultry and Hollywood films.

Commenting on markets, Goldman analysts told clients:

Surprise move from HK/China markets where we saw incremental recovery, in a tape where trade war headlines had turned worse. Beijing's lack of an immediate response to new incremental US tariffs (104%), was a departure from last two episodes of President Trump hiking duties (Last two instances, Beijing hit back within minutes).

Around 3 p.m. local time, Beijing released a 28,000-character white paper on trade with the US Accompanying it was a question-and-answer document in which the Ministry of Commerce reiterated China is willing to talk with the US

HSI saw a reversal of ~4% over the day, from being more than 3% weaker at the open to ending 70bps above water. Southbound net buying a record $4.6Bn was the most notable metric for the day, as support from retail and foreign investors accelerated. Turnover remained upbeat and above the HK$400Bn mark.

Earlier, Xinhua reported that Beijing would fight until the end if the US deepens the trade war. The Ministry of Commerce said it has "abundant means" to take countermeasures. It noted that Beijing and Washington could resolve trade differences through dialogue.

In a separate report, Reuters said top officials in Beijing plan to meet and discuss measures to boost the economy and stabilize capital markets amid the tariff turmoil with the US.

Both sides—Beijing and the US—will likely need stabilizing policies for markets and the economy to fight the trade war.

As we noted on Tuesday, a basis trade blow-up might force the Federal Reserve into emergency QE. Deutsche Bank followed our lead on Wednesday.