US equity futures are slightly lower to close out a blowout week for risk assets. As of 8:00am S&P futures are down 0.1% after the index reached its new ATH on Thursday, the first of the year; Nasdaq futures are unchanged with megacap tech flat this morning (TSLA +57bp) while Russell futs are also down 0.1%. European flash PMIs were mixed with mfg beats for UK/France/Germany/EZ while services were mixed: FTSE -35bps, CAC +95bps, DAX +30bps, Nikkei -7bps, Hang Seng +1.86%, Shanghai +70bps. Trump overnight hinted at a softer approach toward tariffs telling Fox News he’d rather not impose them on China which sent the yuan and Chinese stocks higher. Bond yields are flat around 4.64%, and the USD is modestly lower on the back of EUR strength. Commodities are mixed; precious metals; Ags are mostly lower, while WTI is up 30bps at $74.85; Bitcoin is up 2% to $105,300 after Trump unveiled his much anticipated executive order. Overnight, BOJ hiked 25bp as expected with an on the margin hawkish surprise as no downgrades to economic outlook and inflation outlook was revised higher. However, after initially sliding, the USDJPY has since rebounded and is flat. Today, the key focus will be global PMIs and earnings, with AXP and VZ being the most important ones to provide further color on consumer demand and economic growth. Wall Street estimates PMI-Mfg and PMI-Srvcs to print at 49.8 and 56.5, respectively; we also get the U of Mich (10am), Existing Home Sales (10am), and Kanas City Fed Services (11am).

In premarket trading, Texas Instruments fell 4% after the chipmaker gave a disappointing earnings forecast due to sluggish demand and higher manufacturing costs. Despite the disappointing results, Mag7 stocks were modestly higher: Alphabet (GOOGL) +0.2%, Amazon (AMZN) +0.1%, Apple (AAPL) +0.6%, Microsoft (MSFT) flat, Meta Platforms (META) +0.4%, Nvidia (NVDA) -0.3% and Tesla (TSLA) +0.8%. NVO is up 10% after an experimental shot delivered as much as 22% weight loss in an early-stage trial. Boeing slips 1.6% after the planemaker suffered another quarter of fresh charges and losses, highlighting the long road ahead for Chief Executive Officer Kelly Ortberg as he tries to stabilize the US aircraft manufacturer.; VZ +3% on rev/eps beat; Burberry (BRBY LN) +12.5% on better comp sales (could help luxury retail sentiment). Here are some other notable pre-market movers:

- Affirm Holdings (AFRM) rise 4% after the Wall Street Journal reported that the asset-management unit of Liberty Mutual will provide $750 million in funding to the buy-now-pay-later company.

- American Express (AXP) falls 3% after posting quarterly results.

- CSX (CSX) declines 3% after the railroad’s earnings missed estimates.

- Grindr (GRND) jumps 7% after the dating company boosted its forecast for revenue growth for 2024.

- Intuitive Surgical (ISRG) slips 2% after the robotic-surgery company gave a profit margin forecast for the year that trailed expectations and warned that the potential impact of new tariffs could be material.

- Middleby (MIDD) climbs 6% after the Wall Street Journal reported that Garden Investments has built an activist position in kitchen-equipment maker, citing people familiar with the matter.

- Twilio (TWLO) surges 16% after the software company reported preliminary fourth-quarter revenue growth that topped estimates. The company also authorized a $2 billion share buyback plan.

Global stocks are closing the week at record highs after President Trump appeared to soften his approach toward tariffs on China. In an interview with Fox News, Trump said that he would “rather not” use tariffs against the world’s second-largest economy (which he has said before and he will flipflop again, but algos as usual took this as gospel and hammered the USD). He has also, so far, held back from imposing tariffs on Europe, though he warned of levies against Canada and Mexico. Signs that Trump is open to negotiation has helped lift assets around the world under the shadow of a trade war, from stocks to currencies. Emerging-markets currencies are on course for their best week since July 2023. Europe’s benchmark Stoxx 600 index is on track for a fifth weekly advance after hitting a record. The dollar dropped to a one-month low as investors switched to higher-yielding assets.

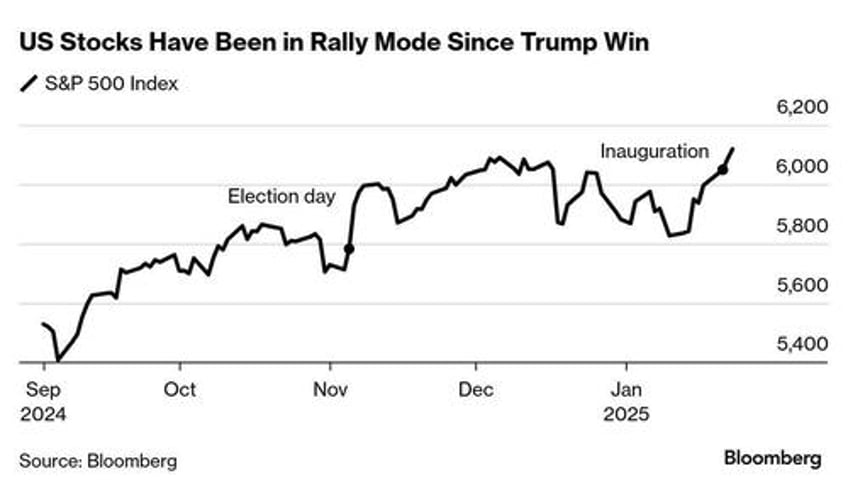

As for the the, the S&P 500 is up 2% this week so far, and is poised for the best start for a new president since Ronald Reagan was sworn in to power in 1985.

“It is early days but nothing that President Donald Trump has said or done has caused a bad reaction in financial markets,” said Chris Iggo, chief investment officer of core investments at AXA Investment Managers. “Quite the contrary. It is paying to stay invested.”

And anyone who is surprised by this outcome is an idiot: Trump has long declared that the stock market is the best, if not only, barometer by which his performance is to be measured. As such, he will redline the market - telling OPEC to cut oil prices and telling Powell to cut rates - until something breaks. For now, the upbeat data, including signs that inflation is easing, is helping both bonds and stocks, according to Goldman Sachs strategist Lilia Peytavin.

“This is adding to the positive earnings we’ve got so far,” she said.

In Europe, the Stoxx 600 added 0.4% as it rose for the eighth consecutive session, benefiting as Asian shares did from hopes US President Trump could take a softer-than-feared stance on tariffs. Sentiment was boosted as traders pared bets on how fast the ECB will lower interest rates this year after the euro area’s private sector returned to growth in January, surprising analysts, with the Composite Purchasing Managers’ Index rising to 50.2. Burberry Group Plc jumped after the maker of upmarket trench coats reported better-than-expected sales. Banca Monte dei Paschi di Siena SpA shares slumped after the Italian lender launched a takeover bid for Mediobanca SpA, whose shares rose.

Earlier in the session, Asian equities climbed to a one-month high, with sentiment buoyed by Trump’s comment that he would rather not have to use tariffs against China. The MSCI Asia Pacific Index jumped as much as 1% to the highest since Dec. 18. The gauge has advanced 2.5% this week to head for its biggest weekly increase since September. Technology shares including Tencent, Alibaba and Xiaomi contributed the most to the gains on Friday. Trump’s reluctance to impose tariffs on Chinese goods sparked a risk-on tone, which helped make shares in Hong Kong and China the region’s best performers. The Hang Seng China Enterprises Index rallied 2.1%, while the CSI 300 Index jumped 0.8%. “Trump’s Lunar New Year gift to China is a sign that negotiations may be progressing well,” said Charu Chanana, chief investment strategist at Saxo Markets. “However, it remains hard to imagine that China will be let go of some hard concessions even if a deal is reached.”

In FX, the Bloomberg Dollar Spot Index falls 0.5%. The yen pared most of its earlier advance seen after the Bank of Japan delivered a widely expected interest rate hike that was accompanied by higher inflation forecasts. The euro climbs 0.7% and made a brief appearance above $1.05 as traders pared bets on how fast the ECB will lower interest rates this year after the euro area’s private sector returned to growth in January, surprising analysts, with the Composite Purchasing Managers’ Index rising to 50.2.

In rates, treasuries are slightly richer led by short maturities, extending Thursday’s pronounced steepening of 2s10s curve, after US President Trump appeared to soften his approach toward tariffs on China; 10-year treasuries are little changed at around 4.64%, is near top of its 4.528%-4.662% weekly range; 2-year TSY yields are 1.5bp richer on the day, steepening 2s10s curve by about a basis point following Thursday’s 4.1bp increase in the spread. In Europe bunds and gilts underperforming by 3bp in the sector after the euro-zone composite PMI beat estimate, lifting German front-end yields.

In commodities, oil prices advance, with WTI rising 0.4% to $74.90 a barrel. Spot gold climbs $18 to $2,773/oz. Bitcoin rises 2% above $105,000.

On today's economic calendar we have the January preliminary S&P Global US manufacturing and services PMIs (9:45am), January final University of Michigan sentiment and December existing home sales (10am) and January Kansas City Fed services index (11am)

Market Snapshot

- S&P 500 futures little changed at 6,148.00

- STOXX Europe 600 up 0.3% to 531.95

- MXAP up 0.7% to 182.94

- MXAPJ up 0.8% to 575.21

- Nikkei little changed at 39,931.98

- Topix little changed at 2,751.04

- Hang Seng Index up 1.9% to 20,066.19

- Shanghai Composite up 0.7% to 3,252.63

- Sensex down 0.5% to 76,139.22

- Australia S&P/ASX 200 up 0.4% to 8,408.87

- Kospi up 0.8% to 2,536.80

- German 10Y yield little changed at 2.57%

- Euro up 0.8% to $1.0503

- Brent Futures up 0.3% to $78.53/bbl

- Gold spot up 0.7% to $2,774.38

- US Dollar Index down 0.63% to 107.37

Top Overnight News

- The US House Republican committee chairs pitched in a private meeting what could add up to between USD 2.5-3 trillion of spending cuts and budget savings to fund Republicans’ reconciliation package, according to Punchbowl News. The Energy and Commerce Committee is eyeing up to USD 2tln of cuts, including per capita caps for Medicaid. Energy-related cuts, such as rolling back tailpipe rules and fuel efficiency benchmarks for cars and light trucks, known as CAFE standards, were also part of the committee’s pitch. The Education and Workforce panel believes it has up to USD 500bln in cuts, largely through targeting student loans. The House Agriculture Committee is targeting between USD 100bln and USD 250bln in cuts. Some would impact SNAP, aka food stamps. The Transportation and Infrastructure panel’s up to USD 26bln in savings would include raising tonnage duties for ships, and electric vehicles fees that would go into the Highway Trust Fund. Ultimately, each and every cut will have to get approved by every Republican member in the House - any GOP member could kill the bill, at least until early April.

- Trump reiterated that he will impose “massive” tariffs on Russia and “big” sanctions if it doesn’t settle the war in Ukraine. Trump also said he’s had “good, friendly” talks with Xi Jinping. BBG

- China’s new rules for mutual funds and major insurers should inject at least 1 trillion yuan ($138 billion) into its ailing stock market this year. The most bullish estimates expect ~13 trillion Yuan over the next 3 years.

- The Bank of Japan raised interest rates on Friday to their highest since the 2008 global financial crisis and revised up its inflation forecasts, underscoring its confidence that rising wages will keep inflation stable around its 2% target. RTRS

- Governor Kazuo Ueda voiced optimism about spring wage talks and market stability in the wake of Trump’s various comments, though cautioned that uncertainty over tariffs remains high. Japan’s key inflation gauge jumped to a 16-month high of 3% in December on higher energy costs. BBG

- The euro climbed as PMI data showed the region’s private sector unexpectedly grew in January. Eurozone flash PMIs for Jan saw strength thanks to upside in manufacturing (46.1 vs. 45.1 in Dec) while services ticked down modestly (51.4 vs. 51.6 in Dec) (one source of concern was a sharp jump in inflation metrics). BBG, S&P

- The ECB rates outlook got less clear, a survey of economists showed. Almost all still expect 25-bp cuts next week and in March, but from April views start to diverge, leaving year-end forecasts between 1.25% and 2.5%. BBG

- The US Treasury said it’s expanding its use of special accounting measures to avert breaching the federal debt limit, which kicked back in earlier this month. BBG

- The Fed should cut rates to ease price pressures on Americans, Trump said, adding that he plans to have a talk with Jerome Powell “at the right time.” BBG

- NVO +10% in the premarket. Novo shares jumped after an experimental shot delivered as much as 22% weight loss in an early-stage trial. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following the continued gains on Wall St and constructive comments from US President Trump related to China tariffs but with the upside capped as the attention turned to the BoJ which delivered a widely expected rate hike. ASX 200 edged mild gains with sentiment helped by the encouraging tariff-related rhetoric by Trump on China. Nikkei 225 initially extended above the 40,000 level but then pared its advances after the BoJ hiked rates by 25bps to 0.50% and raised its Core CPI forecasts across the board which disappointed those that were hoping for an overtly dovish hike. Hang Seng and Shanghai Comp were encouraged by the pre-taped comments from US President Trump that conversations with Chinese President Xi went fine and that he would rather not have to use tariffs over China, although risk sentiment in the mainland was somewhat tempered after the PBoC's MLF operation resulted in a CNY 795bln drain.

Top Asian News

- PBoC conducted a CNY 200bln 1-year MLF operation and left the rate unchanged at 2.00% for a CNY 795bln drain.

- Monetary Authority of Singapore kept the width of the policy band and level where it is centred unchanged but announced to reduce the slope of SGD NEER policy band, while it stated the measured adjustment is consistent with a modest and gradual appreciation path for the SGD NEER policy band, aiming to ensure medium-term price stability.

European bourses (Stoxx 600 +0.3%) began the session almost entirely in the green and continued to gradually extend higher as the morning progressed. A slew of PMI metrics from within the EZ had little impact on the complex. European sectors hold a slight positive bias, with the gainers for the day generally attributed to comments via US President Trump overnight; he noted that that talks with Chinese President Xi went fine and added that he would rather not have to use tariffs over China in a pre-taped interview with Fox News. Basic Resources, Autos and Consumer Products all lead; the latter also benefiting from post-earning strength in Burberry (+15%). Telecoms is the underperformer today, stemming from particular post-earning weakness in Ericsson (-7.9%); the co. reported weak Q4 results and highlighted particular weakness in India. Novo Nordisk (NOVOB DC) has completed the phase 1B/2A trial with subcutaneous Amycretin in people with overweight or obesity. People treated with Amycretin achieved an estimated body weight loss of 9.7% on 1.25mg over the course of 20 weeks, 16.2% on 5mg over 28 weeks and 22% on 20mg over 36 weeks.

Top European News

- Maersk (MAERSKB DC) says will continue to sail around Africa vis Cape of Good Hope until safe passage through Red Sea/Gulf of Aden is ensured for longer term.

- ECB's Lagarde says she has confidence that inflation will continue to slow.

- German Government forecasts 0.3% Economic Growth in 2025, revised down from 1.1%, via Handelsblatt

FX

- Hefty losses in the DXY in a continuation of the price action seen yesterday and overnight after US President Trump suggested a preference of not using tariffs on China, while the greenback was also not helped by Trump's recent calls for lower interest rates during his address to the WEF. Further losses were seen following the EZ PMI metrics (detailed in EUR section). DXY fell from a 108.19 high to a low of 107.27 at the time of writing, dipping under its 50 DMA (107.63) with the next level to the downside the low from 18th December 2024 (106.82).

- EUR is firmer on the back of the aforementioned dollar softness, sanguine Trump tariff rhetoric on China, and with mostly constructive EZ PMI data. To recap, French services missed forecasts and dipped from the prior, in turn dragging down the pan-EZ services metrics. Aside from that, other French metrics beat while all German figures topped forecasts. The EZ-wide figures saw stronger Manufacturing/Composite figures whilst the Services metric was a little lower. EUR/USD rose from a 1.0410 intraday low to test and eventually breach 1.0500 to the upside, rising above its 50 DMA at 1.0431.

- A choppy session for the JPY with the BoJ in focus overnight and in the European morning. The BoJ hiked rates by 25bps to 0.50%, via an 8-1 vote split. Furthermore, the Outlook Report projections were somewhat varied as Core CPI forecasts were lifted across the entire horizon period, while the Real GDP projection was cut for Fiscal 2024 but maintained for the subsequent years after. USD/JPY sits around the middle of a 154.83-156.37 range, back around 155.50, after briefly dipping under its 50 DMA (154.94).

- GBP was supported by the aforementioned weak dollar and boosted by above-forecast UK flash PMIs. GBP/USD resides closer to the top of a 1.2345-1.2447 range as it eyes the 8th January high (1.2494).

- Firmer cross antipodeans amid the softer dollar and after US President Trump suggested a preference of not using tariffs on China.

- PBoC set USD/CNY mid-point at 7.1705 vs exp. 7.2779 (prev. 7.1708).

Fixed Income

- JGBs came under modest pressure on the BoJ announcement which saw a hike, 8-1 vote split, and upgrades to the inflation forecasts. Thereafter, a more pronounced move was seen at Governor Ueda’s press conference with his initial remarks around the spring wage talks weighing on JGBs which slipped from 140.72 to 140.61 over the course of six minutes. Following this, JGBs lifted from 140.62 to 140.78, echoing the upward move in USD/JPY, as Ueda said they have no preset idea on future adjustments.

- USTs are moving in tandem with JGBs, Bunds and Gilts thus far. However, USTs remain just about in the green at the low end of a 108-09+ to 108-19+ band. US Flash PMIs due later.

- For Bunds, initial action modestly influenced by JGBs. Thereafter, no move on the French Flash PMIs (beats, ex-Services). Thereafter, the German figures printed firmer than forecast with Composite surprisingly returning to expansionary territory. A print that weighed on Bunds to the tune of 20 ticks with the contract slipping further to a 131.29 low just before the pan-EZ figure. Thereafter, the UK numbers (see below) added to this and a 131.12 trough printed.

- Gilts followed the above into their own data releases, however Gilts were initially outperforming after gapping higher by a handful of ticks and thereafter hit a 92.25 session high. Thereafter, the session’s main move came on the Flash PMI release for January which beat across the board and weighed on Gilts by 20 ticks in an immediate move, taking it below 92.00 and thereafter extended further to a 91.55 session low.

Commodities

- Crude holds a modest upward bias on Friday with prices still taking a breather following the declines yesterday owing to comments from US President Trump who told the WEF in Davos that he will be asking Saudi Arabia and OPEC to bring down the cost of oil. Brent Mar sits in a USD 77.60-78.61/bbl range.

- Precious metals are bolstered by the weaker dollar as the Trump tariffs trade partially unwound following conciliatory commentary from US President Trump on China, whilst Trump also said that he will demand that US interest rates drop immediately. On China, US President Trump said the conversation with Chinese President Xi went fine and responded he can when asked if he can make a deal with China, while he added would rather not have to use tariffs over China in a pre-taped interview with Fox News.

- Firmer trade across base metals on the back of the weaker dollar coupled with US President Trump's constructive remarks on China. 3M LME copper currently resides in a USD 9,216.50-9,362.00/t range.

- UBS says risks to oil prices remain skewed to the upside in the short term. Oil demand should grow in line with long term growth rate of 1.2MBPD, with oil market almost balanced this year. Remain long gold in global strategy with target of USD 2,850/oz by the year end.

- Russian Kremlin (on the prospect of lower oil prices helping to end the war in Ukraine) says the essence of conflict for Russia is based on national security, not oil.

- Ukraine Military says drones struck a Russia's Ryazan oil refinery and other oil facilities in an overnight attack.

- China crude steel output+11.8% Y/Y to 75.0mln tonnes in December 2024; Global crude steel +5.6% Y/Y.

BOJ

- BoJ hiked rates by 25bps to 0.50%, as expected via an 8-1 vote with Nakamura the dissenter, while it reiterated it will continue to raise rates if the economy and prices move in line with forecasts and it will conduct monetary policy as appropriate from the perspective of sustainably and stably achieving the 2% inflation target. BoJ said real interest rates are at very low levels and inflation expectations have risen moderately, as well as noted the chance of Japan's economy moving in line with the forecast is heightening and that many firms are saying they will offer solid pay hikes in this spring's wage talks.

- Dissenter Nakamura said the BoJ should decide on changing the guideline for money market operations after confirming a rise in firms' earnings power from sources, and after checking sources such as financial statements and statistics of corporations at the next monetary policy meeting.

- Furthermore, the Outlook Report projections were somewhat varied as Core CPI forecasts were lifted across the entire horizon period, while the Real GDP projection was cut for Fiscal 2024 but maintained for the subsequent years after.

Ueda presser

- No preset idea on future adjustments. No preconceived ideas around the scope/timing of the next rate rise. Next rate hike will depend less on economic growth but more on price moves.

- Board has judged that spring wage talks will result in strong hikes again this year. Growing number of firms expressed intentions to continue increasing wages steadily. Growing number of firms factoring in plans to raise wages, in view of the medium-term projection.

- Financial markets have been stable as a whole. Markets have been calm post-Trump

Geopolitics: China

- US President Trump said the conversation with China's Xi went fine and responded he can when asked if he can make a deal with China, while he added he would rather not have to use tariffs over China, via a pre-taped interview with Fox News.

Geopolitics: Middle East

- Palestinian TV reported large Israeli forces stormed the city of Tulkarm in the West Bank accompanied by military bulldozers, according to Sky News Arabia.

- Trump administration officials told Israeli officials that he does not intend to start his term with a new war in the Middle East and wants to reach a very strict agreement to prevent Iran from reaching a nuclear weapon, while Trump believes that the Iranians will rush to the negotiating table under his leadership, according to Channel 12.

- UKMTO said it received a report of an incident 86NM northeast of Ras Tanura, Saudi Arabia in which a vessel was approached by a small military craft which kept hailing the vessel to turn to port towards Iranian territorial waters.

Geopolitics: Ukraine

- Russia's Kremlin says President Putin has made clear he wants to restart Nuclear arms cuts talks as soon as possible.

- Russia's Security Council Secretary Shoigu said risk of an armed clash between nuclear powers is growing and accused NATO of increasing activities on the eastern flank of Russia and Belarus and of rehearsing offensive operations there, according to TASS.

- Moscow's Mayor announced that air defence units southeast of Moscow repel attacks by drones headed for the capital, while the Governor of Russia's Ryazan region southeast of Moscow announced that emergency services were responding to an air attack.

Geopolitics: Other

- US Secretary of State Rubio reinforced US commitment to NATO in a call with the NATO Secretary General and discussed the importance of "real burden sharing", as well as the importance of ending Russia's war in Ukraine and the need for a peaceful solution.

US Event Calendar

- 09:45: Jan. S&P Global US Services PMI, est. 56.5, prior 56.8

- 09:45: Jan. S&P Global US Manufacturing PM, est. 49.8, prior 49.4

- 09:45: Jan. S&P Global US Composite PMI, est. 55.6, prior 55.4

- 10:00: Jan. U. of Mich. Sentiment, est. 73.2, prior 73.2

- U. of Mich. Expectations, prior 70.2

- U. of Mich. Current Conditions, prior 77.9

- U. of Mich. 1 Yr Inflation, est. 3.2%, prior 3.3%

- U. of Mich. 5-10 Yr Inflation, est. 3.2%, prior 3.3%

- 10:00: Dec. Existing Home Sales MoM, est. 1.2%, prior 4.8%

- 10:00: Dec. Home Resales with Condos, est. 4.2m, prior 4.15m

- 11:00: Jan. Kansas City Fed Services Activ, prior 2

DB's Jim Reid concludes the overnight wrap

as was widely expected the BoJ have raised rates by 25bps this morning to 0.5%, the first since July when their unexpected hike seemed to kick start a huge but brief global sell-off. This follows CPI ex fresh food coming in at 3%, also inline with expectation but the first time since August 2023 that this measure had hit 3%. All other measures were inline. The BoJ have upgraded their inflation forecasts with the hike which is a bit hawkish but have also cited many uncertainties concerning the outlook. Much will depend on where the emphasis is in Ueda's press conference that starts just before this will hit inboxes.

The Yen has rallied around half a percentage point since the decision which may reflect a couple of big trades rather than any market surprises especially as the Nikkei is trading pretty flat. 10yr JGBs are up +2.7bps as I type though.

Elsewhere in Asia Chinese equities are rallying overnight as Mr Trump has said in an interview with Fox News that the US has great power over China with regards to tariffs but that he would rather not have to use them. Clearly these are off the cuff remarks but it has left the overnight market feeling like there's a scenario where China escapes the worst of the tariff regime. I suspect there's plenty more time for a more aggressive approach but for now the Hang Seng is +2.21% and the Shanghai Comp +0.64%. Elsewhere the KOSPI is +0.71%. US equity futures are down around a tenth of a percent.

Ahead of all that, US and European markets put in a decent performance yesterday, with both the S&P 500 (+0.53%) and the STOXX 600 (+0.44%) advancing to record highs for the first time this year. Markets had initially been fairly quiet, with investors in a holding pattern before the Fed and ECB decisions next week, as well as earnings from 5 of the Magnificent 7. But there were then some larger moves in the US session after remarks from President Trump, who triggered a noticeable decline in oil prices after saying he’d “ask Saudi Arabia and OPEC to bring down the cost of oil”. Brent immediately fell more than -1.5% intra-day from being up for the day. It closed -1.44% lower in the session at $77.86/bbl, which marked a 6th consecutive decline to its lowest level since the US announced a package of sanctions against Russian oil on January 10. And in turn, that helped equities move higher, as the prospect of lower inflation cemented the view that the Fed would still cut rates this year. Just over a week ago we were at around 5-month highs so this fall (-5.7% from the intra-day peaks last Wednesday) has helped markets over the last week.

Trump was speaking virtually before the World Economic Forum’s meeting at Davos, where remarks covered a lot of ground. Aside from the oil comments, a big one from a market perspective was “I’ll demand that interest rates drop immediately”. The Fed independence angle got further attention after the US close, as Trump questioned the Fed Chair’s decision making on interest rates in comments to reporters, saying “I think I know interest rates much better than they do, and I think I know it certainly much better than the one who’s primarily in charge of making that decision” and adding that he planned to speak to the Fed Chair “at the right time”. Otherwise, Trump said he wanted to cut corporate taxes further, saying that “we’re going to bring it down from 21 to 15% if there’s a big if, if you make your product in the US”. And there were also critical remarks towards the EU, saying that “From the standpoint of America, the EU treats us very, very unfairly, very badly” and denouncing EU cases against US tech giants as “a form of taxation”.

With oil prices moving lower, that added some growing confidence that the Fed would be cutting rates this year. For instance, the amount of cuts priced in by the December meeting inched up +0.9bps on the day to 40bps. That saw 2yr Treasury yields fall also by -0.9bps on the day to 4.29%, having been on track to closer higher before Trump’s remarks. However, long-end yields weren’t affected as much, with the 10yr yield ticking up +3.3bps to 4.64%, which in turn led to the sharpest daily steeping of the 2s10s curve so far this year.

Aside from Trump’s remarks though, markets had been fairly subdued yesterday, with several factors restraining the advance. One was the US weekly jobless claims, where the continuing claims moved up to their highest level since November 2021, at 1.899m (vs. 1.866m expected). In addition, the initial jobless claims ticked up to a 6-week high of 223k (vs. 220k expected). While this created a bit of doubt about the state of the US labour market, the increases were predominantly driven by California, so likely reflecting the impact of the wildfires there.

Turning to equities, these saw a broad-based rise yesterday, with all 11 major sector groups in the S&P 500 moving higher. However, we did see a headwind from AI stocks, with semiconductors moving lower after SK Hynix’s results weren’t as stellar as some had hoped. On one level the results weren’t too bad, but given the hype around AI, the bar for a positive market reaction is so high that even beating expectations can lead to a pullback on the grounds that they didn’t beat by even more. In Europe , ASML (-4.38%) posted its biggest decline in two months, although over in the US a late rally helped Nvidia (+0.10%) recover after trading -2.3% down early on.

European markets generally saw a solid session yesterday, with both the STOXX 600 (+0.44%) and the DAX (+0.74%) moving up to all-time highs. For bonds, the German 10yr bund yield was only up +1.7bps on the day, a smaller increase than for US Treasuries, whilst the euro itself (+0.17%) ticked up slightly against the US Dollar. Increasingly in Europe, the focus is turning towards the ECB decision next week, who are widely expected to cut rates by 25bps. Ahead of that, our economists have put out a preview for Thursday’s meeting, where they stick to their view of 25bp cuts at each of the four Governing Council meetings in H1.

To the day ahead now, and data releases include the January flash PMIs from the US and Europe, and in the US there’s also the University of Michigan’s final consumer sentiment index for January, and existing home sales for December. Central bank speakers include the ECB’s Lagarde and Cipollone.