Things are moving so fast it's becoming pointless to do static market wraps like this one, but may as well try even if it will be completely irrelevant the minute we publish this.

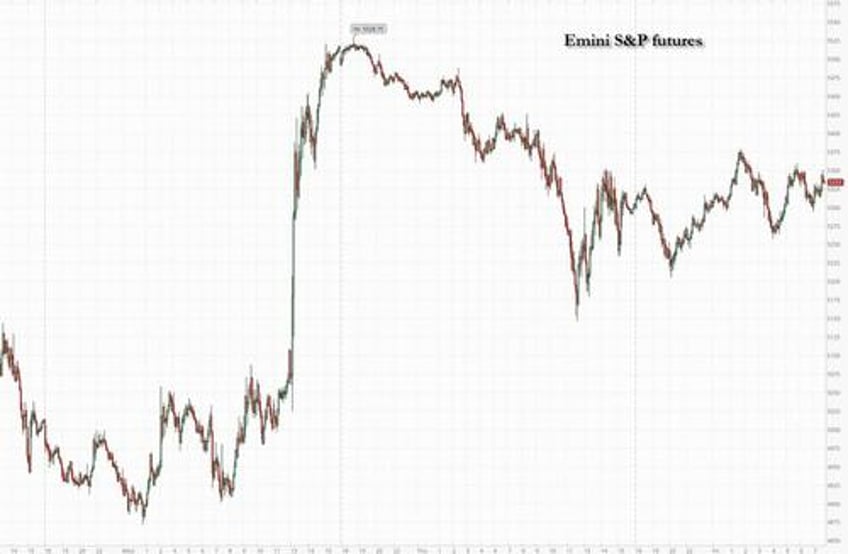

US equity futures are slightly higher, having reversed steep overnight losses. What is remarkable however is that even after China announced a decision to raise tariffs on all US goods from 84% to 125%, stocks initially dippped by have since recovered. As of 8:40am, S&P futures are up 0.6% helped by solid earnings from JPM and Morgan Stanley, while Nasdaq futures gained 0.8%, lifted by solid Mag7 performance.

More importantly, the dollar (DXY index) plunged below 100 for the first time since 2023 on concerns its status as the world’s reserve currency is being eroded as the US-China trade war intensifies (spoiler alert: it's not, because very soon we are about to see China, Japan and Europe unleashing a monetary bazooka to preserve their export industries (i.e. economy) pushing the euro topped to a 3 year high much to the horror of Europe's exporters while the yen also exploded higher, sending the country's exporting industries in a crisis.

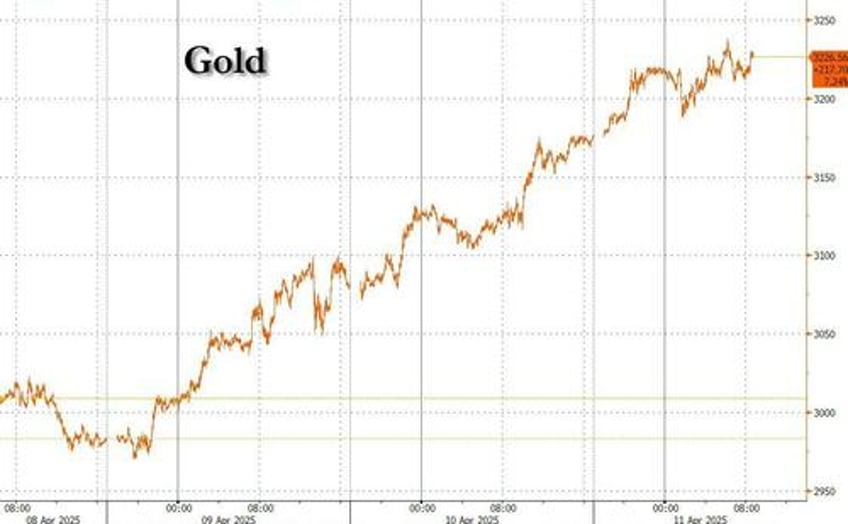

And amid this fiat carnage, gold soared to a fresh record high and even bitcoin is starting to catch a bid as algos slowly but surely realize that if the dollar is no longer the world's reserve currency, and every other fiat currency is worse than the dollar, then... yeah.

In premarket trading, Mag 7 stocks were mixed after China’s decision to raise tariffs on all US goods from 84% to 125%.

Tesla -0.3%, Amazon +0.2%, Meta +0.7%, Apple +0.06%, Alphabet +0.6%, Microsoft +0.3%, Nvidia +1%). Shares in companies working on biotech AI models gain after the FDA said it plans to phase out animal testing requirements for monoclonal antibodies and other drugs (Recursion Pharmaceuticals +14%, Absci +15%, Certara +20%, Schrodinger +14%, Nuvation Bio +2.9%). US-listed Chinese stocks are holding onto their gains after the latest escalation in trade tensions that saw China raising levies on US goods to 125%, but saying it won’t match further US tariff hikes (Alibaba + 2.2%, Baidu 3.6% +4.1%, NetEase +2.1%). Here are some other notable premarket movers:

- American Express (AXP) climbs 2.6% as BofA turns bullish, seeing the credit card provider as recession resilient.

- Cinemark Holdings (CNK) rises 3% as JPMorgan upgrades to overweight, saying the cinema company is one of the least economically exposed firms in the current volatile environment.

- EQT (EQT US) shares slip 1.6%. The gas producer expects to report a total derivatives loss of $679 million for the three months ended March 31, according to a statement.

- JPMorgan (JPM) rises 1% as the bank’s stock traders took in a record haul in the first quarter but its FICC and iBanking revenues missed.

- Morgan Stanley (MS) rises 3% as 1Q net revenue tops estimates.

- Stellantis (STLA) shares fall 2.8% after the carmaker said shipments dropped 9% in the latest three month period.

- Verve Therapeutics (VERV) gains 6.6% after saying that the FDA granted fast track designation for VERVE-102.

- Wells Fargo (WFC) gains 1.7% after posting quarterly results.

As Bloomberg notes, in a week that’s seen the biggest swings in decades erupt across stock and bond markets, currency moves took the spotlight on Friday. In the latest tit-for-tat move, China announced it would raise tariffs on all US goods from 84% to 125% and warned that it plans to “resolutely counterattack and fight to the end” if the US continues to infringe on its rights and interests. The Ministry of Finance also called the Trump administration’s actions a “joke” and said it no longer considers them worth matching.

“The question of a potential dollar confidence crisis has now been definitively answered – we are experiencing one in full force,” ING Bank NV strategists including Francesco Pesole wrote in a note. “The dollar collapse is working as a barometer of ‘sell America’ at the moment.”

JPM shares rose as much as 4% in US premarket trading before fading all gains, after the bank boosted loan-loss provisions and bolstered its reserves. Rival Morgan Stanley also climbed after reporting soaring trading revenue amid market volatility.

“The economy is facing considerable turbulence,” JPMorgan CEO Jamie Dimon said in commentary accompanying the results. “Clients have become more cautious amid an increase in market volatility driven by geopolitical and trade-related tensions.”

BlackRock Inc. reported lower-than-expected net inflows in the quarter with CEO Larry Fink likening current conditions to the “structural shifts” seen during the global financial crisis and the Covid pandemic. “Uncertainty and anxiety about the future of markets and the economy are dominating client conversations,” Fink said in a statement.

Earlier, Bank of America's Michael Hartnett said President Donald Trump’s tariffs and the resulting market turmoil were turning US exceptionalism into “US repudiation.” He advised investors sell any rallies until the Federal Reserve steps in and the US and China de-escalate, recommending a short position on stocks — until the S&P 500 hits 4,800 points — and a long bet on two-year Treasuries. Higher bond yields, lower stocks and a weaker dollar are “driving global asset liquidation, will likely force policymakers to act,” Hartnett wrote in a note. But investors should “sell the rips in risk assets.”

A Citi index shows analysts are slashing estimates at a pace that is generally seen during growth shocks, such as the pandemic. Meanwhile, Bank of America data shows massive inflows to passive equity funds, while Treasuries had their biggest weekly inflow ever.

Meanwhile, Trump’s second term is now off to one of the worst starts for the stock market since the Herbert Hoover era in 1929, tying with George W. Bush. Other assets also faced more turbulence, with the dollar extending losses after its biggest plunge in three years, gold hitting a new high and oil prices on track for a second straight weekly decline.

In Europe, the Stoxx 600 is down 1.5% with industrial goods and travel and leisure stocks were the biggest laggards, while the utilities and food and beverage sectors performed better than the wider benchmark. Here are the biggest movers on Friday:

- Argenx shares gain as much as 4.3%, after the US Food and Drug Administration approved a new option for patients to self-inject Vyvgart Hytrulo with a prefilled syringe

- Schott Pharma shares jump as much as 13%, after the German healthcare supplier released preliminary figures for the second quarter that were ahead of market estimates

- K+S shares rise as much as 6.4% after being upgraded by analysts at Stifel, which sees the chemicals company hitting the top-end of its earnings guidance range this year

- Havas shares rise as much as 8.6% after the communications company delivered good organic growth in the first quarter and confirmed its guidance for the full year

- BP shares decline as much as 3.5% after debts mounted in 1Q, a period when upstream production dropped and gas-trading performance was also weak

- NIOX Group shares tumble as much as 22% after Keensight Capital said it doesn’t intend to make an offer for the UK pharma company because of the prevailing macroeconomic conditions

- Steyr Motors shares fall 12% after investment firm Mutares sells 910,000 of the engine company’s shares at a 14% discount to Thursday’s closing price

Earlier in the session, Asian stocks edged higher, reversing earlier losses, led by gains in Taiwan and India. The MSCI Asia Pacific Index gained as much as 0.4%, with Taiwanese firms TSMC and Hon Hai Precision among the biggest boost. Stocks in India advanced in a catch-up as trading resumed after a holiday. Investors are awaiting US President Donald Trump’s response after China raised levies on US goods to 125%. This comes as Washington clarified that tariffs on Chinese imports rose to 145%. Tensions between the world’s two largest economies have spiraled in recent days, which have raised concerns over the impact on US and global growth. Taiwanese shares rose amid foreign inflows. Equities traded lower in Japan and Korea, while those in Hong Kong rose for a fourth straight day.

In FX, the Bloomberg Dollar Spot Index fell as much as 1.3% to the lowest level since Oct. 3, after China said it will raise tariffs on all US goods from 84% to 125% starting April 12. The euro outperformed all its Group-of-10 peers as it’s haven dynamics further gain traction; EUR/USD rallies by 2.4% to 1.1473, a three-year high, before paring gains.

In rates, treasuries reversed modest gains and slumped to session lows as the unwinding basis trade pushed yields to highs of the session just shy of 4.50%. Longer-dated gilts underperform the rest of the curve with UK 30-year borrowing costs rising 6 bps to 5.49%. Bund yields are broadly lower.

US economic calendar includes March PPI (which came in ice cold and in deflation across the board) and April preliminary University of Michigan sentiment (10am). Fed speaker slate includes Kashkari (8am), Collins (9am), Musalem (10am) and Williams (11am)

Top Overnight News

- China will raise tariffs on all US imports to 125% from tomorrow. Beijing also said it won’t pay attention to further hikes from Washington as the excessively high numbers are “economically meaningless” and “a joke.” It will, however, continue to fight to protect its interests. BBG

- Beijing clarified that its tariffs would only apply to chips based on where they are manufactured, not the parent company’s country of origin (since most major US chips, including ones from Nvidia and Qualcomm, are made outside the US, this means they won’t be hit with the tariffs, at least for the time being). RTRS

- Rep. Chip Roy said he voted for the Senate’s reconciliation blueprint only after being reassured by Republican leaders that they would embrace more aggressive spending cuts, including to Medicaid. NYT

- China recently discussed with some of the country’s largest companies about potentially delisting from American stock exchanges. WSJ

- EU threatens to impose tariffs on American services (including US tech giants) if trade negotiations w/the White House don’t yield a deal. FT

- EU leaders will travel to Beijing in Jul for a summit with Chinese President Xi as the world establishes new trade relationships in the wake of Trump’s tariff war. SCMP

- Russia could be forced to begin cutting spending (including support for its war in Ukraine) as soon as this summer given the sharp drop in oil prices. NYT

- UK economic data outperforms expectations, with upside readings on GDP (+0.5% M/M vs. the Street +0.1%), industrial production (+1.5% M/M vs. the Street +0.1%), and manufacturing production (+2.2% M/M vs. the Street +0.2%). WSJ

Trade/Tariffs

- Apr 11th: China raises tariffs on the US to 125% from 84%

- China unveils additional tariff measures on US goods; to raise additional tariffs on US goods to 125% from 84%. Effective April 12th. Finance Ministry "if the US continues to impose additional tariffs on Chinese goods exported to the US, China will ignore it". “Given that there is no longer any possibility of market acceptance for US goods exported to China under the current tariff levels, if the US side subsequently continues to impose tariffs on Chinese goods exported to the US, the Chinese side will pay no attention to it,”. If the US insists on infringing on China's interests in a substantive way, China will resolutely take countermeasures.

- China's Commerce Ministry says the US' repeated imposition of abnormally high tariffs on China has become a "numbers game" and has no practical economic significance.

- Global Times Editor Hu Xijin tweets "With tariffs already so high on both sides, to be honest, we no longer see it as anything extraordinary."

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly followed suit to the declines on Wall St where the major indices gave back a chunk of their historic gains as tariff uncertainty lingered and with the US clarifying China tariffs were at 145%, not 125%. ASX 200 was pressured amid underperformance in energy, healthcare and tech, while gold miners outperformed after prices of the precious metal extended to fresh record highs. Nikkei 225 briefly fell beneath the 33,000 level with exporters hit by a firmer yen and global trade uncertainty. Hang Seng and Shanghai Comp initially conformed to the downbeat mood after the US clarified its tariff on China was at 145% although Chinese markets gradually recouped losses amid hopes of the PBoC to step in with monetary policy support.

Top Asian News

- PBoC will implement a moderately loose monetary policy, support the smooth operation of financial markets, and consolidate the continued recovery of the economy. It was also reported that PBoC's Deputy Governor attended the ASEAN, China, Japan, and South Korea Finance and Central Bank deputies meeting on April 8th-9th where the impact of US tariffs on global and regional macroeconomic situation was discussed.

- EU leaders plan a trip to Beijing in July for a summit with Chinese President Xi Jinping, while it was separately reported that Spanish PM Sanchez called for mutually beneficial relations with China during a visit to Beijing.

- China Jan-Mar vehicle sales +11.2% Y/Y (prev. +10.6% Y/Y); March +8.2% (prev. +34.4% Y/Y)

European bourses (STOXX 600 -0.9%) opened entirely in the green, attempting to build on the prior day’s gains. However, indices rapidly turned negative after China announced additional tariffs on US goods, taking the total to 125% from 84%; these will come into effect on April 12th. European sectors opened almost entirely in the green, but the picture quickly turned negative after the aforementioned Chinese tariff announcement. There is now a clear defensive bias in Europe; Utilities leads, alongside Healthcare. The typical cyclical sectors find themselves towards the foot of the pile; Travel & Leisure, Autos and Basic Resources are all lower.

Top European News

- Germany to provide EUR 11bln in military funding support for Ukraine until 2029, according to Ukrainian Defence Minister.

FX

- Another downbeat session for the Dollar following Thursday's detrimental losses which saw the index slip from a 102.95 peak to a 100.69 trough on Thursday, before extending downside to a 99.71 low in APAC hours - falling beneath 100 for the first time since July 2023. The index then took another dive lower after China raised its tariffs on the US to 125% from 84% in a retaliatory move. DXY has dived to an intraday 99.01 low from a 100.63 intraday high at the time of writing.

- EUR has been bolstered by the collapse of the Dollar coupled with its status as a liquid reserve currency, and the market belief that the EU will not escalate the US trade war - with US tariffs on the EU trimmed to 10% from 20% whilst the EU also paused its tariffs in tandem. Further upside is seen after China raised its tariffs on the US to 125% from 84% in a retaliatory move, which took EUR/USD to north of 1.1400.

- JPY is benefitting from the softer Dollar and ongoing tit-for-tat tariffs between the world's two largest economies. JPY was further bolstered by China raising its tariffs on the US to 125% from 84% in a retaliatory move. USD/JPY resides towards the bottom of a 142.08-144.60 range, with participants looking for further trade updates for impetus.

- GBP is lifted by the softer Dollar, the UK's favourable relationship with the US, and above-forecast GDP metrics. UK GDP printed firmer across the board, albeit the data is for February and is thus stale given the US tariffs.

- Mixed trade across the antipodeans with the Aussie hampered by the fallout of US tariffs on the Chinese economy and in turn demand for Australian natural resources, whilst the Kiwi benefits via the AUD/NZD cross.

- PBoC set USD/CNY mid-point at 7.2087 vs exp. 7.3104 (Prev. 7.2092).

- SNB spokesperson declined to comment when question on the CHF's strength and if any steps are planned.

Fixed Income

- A softer start to the day but one that leaves USTs just off the overnight 110-01+ trough, a low which printed as the benchmark faded initial strength on Thursday despite a strong 30yr tap. Action occurred as the risk tone stateside began to lift and as the yield curve steepened further. Only a modest uptick in USTs to the latest additional Chinese tariffs, keeping them within the existing 110-01+ to 110-15 band.

- Bunds began softer and printed a 129.92 low, however the benchmark was holding onto most of the upside that emerged in the latter half of Thursday's session. Unreactive to the final German CPI but was lifted into the green and to a 130.70 peak by China retaliating to the US tariffs - this upside has since continued to a fresh 130.75 peak.

- Gilts opened lower by a handful of ticks at 91.62 before slumping to a 90.78 trough as it reacted to the strong GDP data (though, this will likely be looked through), overnight bearishness in peers and in a pull back from the marked strength seen on Thursday. For the week as a whole, Gilts are set to end it with losses of around 300 ticks but are over 100 ticks above the 89.99 trough.

- UK DMO to sell GBP 1.5bln of 0.125% 2028 Gilt via tender on April 16th.

- Italy sells EUR vs exp. EUR 7.25-9.0bln 2.65% 2028, 3.15% 2031, 0.95% 2032 & 3.25% 2038

Commodities

- Crude is lower, in what has been a choppy session thus far. The complex was initially firmer in early European trade, but rapidly turned negative after China raised additional tariffs on US goods to 125% from 84%. Brent Jun'25 currently trading at the lower end of a USD 62.77-64.37/bbl range.

- Firmer trade across precious metals with the complex bolstered by the demise of the Dollar coupled by flight to quality amid the latest chapter in the trade saga. Spot gold topped USD 3,200/oz for the first time overnight and continues grinding higher at the time of writing, currently in a USD 3,177.26-3,227.45/oz intraday range.

- Modest gains across base metals space amid ongoing hopes of Chinese economic support in the face of US tariffs. 3M LME copper trades on either side of USD 9,000/t and resides in a USD 8,934.65-9,170.80/t range.

Geopolitics

- US aggression targeted several areas in Yemen's capital with a series of raids, according to Al Jazeera.

- Iran Foreign Ministry spokesperson says Tehran is giving talks with the US a genuine chance and intends to assess the other side's intent and resolve this Saturday.

- Iran wants to explore an interim nuclear deal in talks with the US before pursuing negotiations over a comprehensive deal, according to a European diplomat and a source cited by Axios.

- "US sources: The likelihood that Iran will make a decision to build nuclear weapons has increased due to the ongoing military conflicts in the Middle East", according to Sky News Arabia.

- British troops could be deployed in Ukraine for five years under plans being discussed by allies, according to The Telegraph.

- Trump envoy Witkoff to travel to Russia to meet with Russian President Putin, according to Axios; If no ceasefire is reached by the end of the month, Trump could move forward with additional sanctions on Russia.

US Event Calendar

- 8:30 am: Mar PPI Final Demand MoM -0.4%, est. 0.2%, prior 0%

- 8:30 am: Mar PPI Ex Food and Energy MoM -0.1%, est. 0.3%, prior -0.1%

- 8:30 am: Mar PPI Final Demand YoY, 2.7%, est. 3.3%, prior 3.2%

- 8:30 am: Mar PPI Ex Food and Energy YoY 3.3%, est. 3.6%, prior 3.4%

- 10:00 am: Apr P U. of Mich. Sentiment, est. 53.5, prior 57

DB's Jim Reid concludes the overnight wrap

The past 24 hours saw Wednesday’s strong relief rally turn into a broad slump for US assets across equities, rates and FX. The S&P 500 fell -3.46% yesterday while 30yr Treasury yields (+13.3bps yesterday) are on course for their largest weekly rise since the 1980s. The dollar has also seen a historic weakening, with the euro on Thursday posting its biggest gain against the greenback since 2015 (+2.30%) and gold trading at an all-time of $3,215/oz this morning. US equity futures have seen some stabilization overnight, with those on the S&P +0.20% higher. But there has been little respite for the dollar, with the dollar index down another -0.75% this morning as markets continue to reassess how much of the historical premium for US assets stemming from American exceptionalism is still justified under the radical vision and volatile policy of the new US administration.

The main driver of the renewed market pressure was an increased focus on the US-China escalation, with yesterday’s market downturn accelerating after a White House clarification that total tariffs on China would now be 145% rather than 125% (so stacking on top of the earlier 20% fentanyl-related tariffs). While this difference is negligible in any practical economic sense, the market reaction showed an increased sensitivity to the risks of a disorderly economic decoupling between the world’s two largest economies that we highlighted yesterday. Neither the US nor China are showing signs of backing down, with President Trump expressing confidence in his tariff plans yesterday, even as he acknowledged potential "transition problems". US-China concerns outweighed other ostensibly more positive tariff headlines – the EU delaying its previously announced retaliatory tariffs by 90 days, the US beginning formal talks with Vietnam and Politico reporting that Treasury Secretary Scott Bessent was now at the helm of the administration’s trade team.

Back to the market moves, and in the equity space, the S&P 500 (-3.46%) yesterday reversed just over a third of Wednesday’s +9.52% relief spike. This marked a remarkable fifth day in a row with an intra-day range of more than 6% for the S&P. Based on data going back to the 1920s, the only runs longer than this were at the peak of the GFC in October 2008 and during the early pandemic turmoil in March 2020. Underperformance of cyclical stocks saw the NASDAQ (-4.97%) and the Russell 2000 (-4.27%) post even larger declines. The VIX rose by +7.10pts to 40.72.

Despite the risk-off tone, we saw a renewed bond market sell-off, with 10yr Treasury yields closing +9.2bps higher at 4.43% and 30yr yields +13.3bps at 4.87%. Higher yields came as the House narrowly passed the Senate-approved budget outline that envisages cutting taxes by up to $5.3 trillion over a decade, in exchange for only minimal spending cuts. The bond sell-off continued during the US afternoon despite a brief rally following a solid 30yr auction that saw $22bn of bonds issued at 4.813%, -2.6bps below the pre-sale yield. 30yr yields are another +2bps higher this morning, and on course for a +48bps weekly increase, which would be their largest since the 1980s. So there is some déjà vu of the bond market moves that Jim highlighted in his “Danger Zone” CoTD on Wednesday morning (link here) and which were followed by President Trump’s pullback on reciprocal tariffs. As a reminder, our head of US rates strategy Matt Raskin discussed the conditions under which the Fed might intervene to preserve market functioning in a note on Wednesday.

Treasuries had actually rallied earlier on yesterday following a very soft US CPI print for March. Headline inflation (-0.1% mom vs +0.1% expected) saw its largest monthly decline since early Covid restrictions in spring 2020, while core inflation (+0.1% vs +0.3%) saw its smallest monthly rise since January 2021 with the data showing little evidence of price pressures from the early rounds of tariffs. Our US economists did note that the read-through into the Fed’s preferred core PCE measure was not as weak as the headline CPI readings and they will be keeping a close eye on today’s PPI print. See their full reaction here.

The weaker inflation data saw investors increase their expectations for rate cuts, with a 25bps Fed cut being again fully priced in by the June meeting. The Fed pricing did reverse slightly as a host of Fed speakers signaled continued patience on future cuts. Boston Fed President Collins said tariff-related inflation could further delay rate cuts, Chicago Fed President Goolsbee noted that the bar for adjusting rates was a “little higher” with the stagflationary shock from tariffs and Kansas Fed President Schmid said he “would be hesitant” to view the effects of tariffs on inflation as temporary. But with a risk-off tone continuing overnight, the amount of Fed cuts priced by year-end is back up to 92bps this morning, from 80bps this time yesterday.

Overnight in Asia, equity markets are following yesterday’s declines on Wall Street. Japan’s Nikkei, which had seen a +9.13% gain yesterday, is the notable underperformer, down -4.03% as I type. The risk-off mood has also spilled over to rest of the region with the KOSPI (-0.92%) and the S&P/ASX 200 (-1.35%) seeing notable declines. Elsewhere, Chinese markets are broadly stable, with the Hang Seng (+0.56%), the CSI (-0.10%) and the Shanghai Composite (+0.12%) all showing relative composure versus their peers. In the FX space, the risk-off sentiment has seen the Japanese yen soar to around 142.91 against the dollar, a level not seen since October.

In the commodity space, Brent crude oil fell -3.28% yesterday to $63.33/bbl. In addition to the broader risk-off tone, oil prices weren’t helped by the latest monthly EIA report which downgraded expected 2025 global oil demand growth by -400kb/day. On the other hand, copper recovered by another +4.45%, while gold (+3.03% after +3.43% on Wednesday) has seen its biggest two-day move since March 2020. DB’s precious metals analyst Michael Hsueh had outlined his structurally positive gold view in a note on Wednesday (link here).

Earlier yesterday, European equities had seen strong gains, catching up to the late US rebound the previous day. The STOXX 600 (+3.70%) had its best day since March 2022, while the DAX (+4.53%), CAC (+3.83%) and FTSE MIB (+4.73%) posted even larger gains. In the bond space, yields on 10yr bunds (-1.3bps), OATs (-4.0bps) and BTPs (-6.0bps) all saw moderate declines, while gilts (-13.9bps) outperformed as they reversed much of Wednesday’s +17.4bps spike.

To the day ahead now and data releases include the US PPI reading for March along with the University of Michigan’s preliminary consumer sentiment index for April. From central banks, we’ll hear from Fed’s Musalem and Williams. The obvious highlight will be the start of the Q1 earnings season with JPMorgan Chase, Morgan Stanley, Wells Fargo and BlackRock reporting.