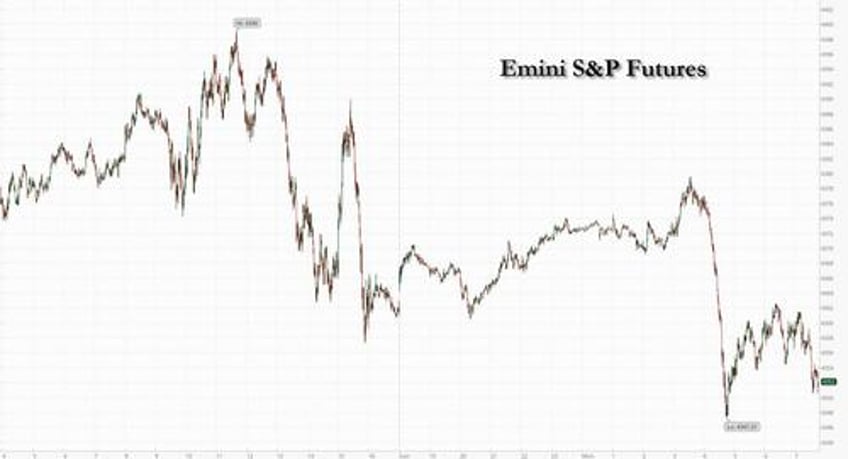

Global markets started the new week on the back foot with US equity futures, European bourses and Asian markets all sliding as Treasury yields resumed their grind higher, with 10Y yields rising above 4.50% and 30Y TSYs rising 6bps to 4.59% - both new cycle highs - as traders speculated central banks will keep interest rates elevated to quell inflation. The dollar hit its highest level since March as investors sought the "safety" of the "strong" US economy amid hopes the US can somehow decouple from the recession in Europe and China for the foreseeable future. The mood was depressed following the worst weekly selloff on Wall Street since March, and as of 7:45am, S&P 500 and Nasdaq 100 futures edged 0.2% lower while rates climbed across the board, mirroring moves in European and UK bond markets. WTI traded unchanged around $90/barrel, while gold and Bitcoin fell.

In premarket trading, Warner Bros Discovery climbed about 4%, Disney was up 1%, and Netflix up 1.3%, leading film and TV producers higher, after striking Hollywood screenwriters reached a tentative new labor agreement. By contrast, Foot Locker and Nike were poised for a lower open as Jefferies analysts downgraded the stocks over looming consumer headwinds. Alector delined 3.6% after Goldman gives the clinical stage biopharmaceutical company its only sell rating in an initiation note, citing “significant clinical risk.”

After the barrage of central bank decisions last week, traders are increasingly concerned that rising oil prices will further fan inflation, which will make it difficult for policymakers to reduce rates anytime soon. Oil resumed a rally as hedge funds piled on bets tightening supplies will stoke demand. Bloomberg’s Dollar Spot Index rose to the highest since March.

“All central banks need to stick to this higher-for-longer rhetoric as inflation is nowhere close to their mandate,” said Pooja Kumra, senior European rates strategist at Toronto-Dominion Bank. Which is great, the only problem is that it means that US housing market is now effectively frozen for the middle class where nobody can afford to pay the current insane mortgages, and so it is only a matter of time before this become a major political issue.

The monthly mortgage payment for purchasers of existing homes, using the 30-year average mortgage rate, stands at $2,309. This is a substantial increase from $977 in March 2020. pic.twitter.com/JQHIJGQp9u

— Michael McDonough (@M_McDonough) September 25, 2023

Two Fed officials said at least one more rate hike is possible and that borrowing costs may need to stay higher for longer for the central bank to ease inflation back to its 2% target. While Boston Fed President Susan Collins said further tightening “is certainly not off the table,” Governor Michelle Bowman signaled that more than one increase will probably be required.

Meanwhile, the "shocking" surge in oil prices - which apparently nobody could have anticipated even though the senile occupant of the White House intentionally drained half the SPR just to lower gas for a few months and oil is now back above the average price at which SPR oil was sold - and a massive fiscal deficit are spurring losses in government debt, sending Treasury yields across the maturity curve the highest levels in more than a decade. The Treasury 10-year yield may rise to 4.75% before softer risk sentiment and tighter financial conditions push it lower into year-end, according to BofA strategists.

European stocks were broadly lower, sending the Stoxx 600 down 0.8%; dragged by mining shares as China’s property problems weighed on the outlook for natural resources. Travel, mining and consumer products were the worst performing sectors in Europe after the German IFO business climate topped expectations. Here are the biggest European movers:

- SBB shares surge as much as 40%, most since June 2 after selling a stake in subsidiary EduCo to Brookfield for SEK242m and being repaid an inter-company loan.

- Bpost shares rise as much as 14% after the postal company finalized three compliance reviews and took a provision of €75m, which is well below KBC (hold) initial assumption of between €112 and €375m.

- Italian lenders outperformed after Bloomberg reported that they will be allowed to avoid paying a controversial windfall tax introduced last month if they set aside additional capital reserves, citing a government amendment.

- Ubisoft shares gain as much as 7.3% after BNP Paribas upgraded the shares to outperform, saying the market underestimates upside from new game releases.

- Anima shares rise as much as 4.9% in Milan trading - highest since March, after newspaper La Stampa reported on Sunday Amundi may raise its stake in the Italian asset manager and could consider a full takeover.

- Close Brothers shares gain as much as 2.8% as JPMorgan upgrades to neutral from underweight, noting the lender has materially lagged other UK banks over the past year.

- European miners and steelmakers shares fall after iron ore slumped as China’s persistently weak property market causes construction companies to hold back restocking of steel before the National Day holiday period.

- Aperam shares plunge as much as 12% after the steelmaker cut its outlook for third-quarter volumes, citing two “unforeseen” events. Degroof Petercam says co. faces a tough quarter after warning 3Q will “significantly” miss expectations and previous guidance.

- Victoria shares drop as much as 13%, to the lowest in about four months, after FT Alphaville noted the flooring company’s recent delay of audited results and statements made by auditor Grant Thornton relating to Victoria’s Hanover subsidiary.

- Alphawave IP shares drop as much as 11% after the semiconductor-intellectual-property firm gave a forecast that was no better than market expectations.

- Entain shares fall as much as 11% after the gambling company said net gaming revenue was “softer than anticipated” after the summer, and noted a simplification of group structures to reduce costs.

- Salzgitter shares drop as much as 3.9% after JPMorgan lowered its price target on the steel producer to a new Street low, citing downside risk to 2023 consensus and 2024 estimates after the company recently cut its guidance.

Earlier in the session, Asian stocks also fell, extending last week’s loss, as Chinese stocks slid on renewed property-related concerns while investors also weighed the prospects of US interest rates remaining higher for longer. The MSCI Asia Pacific Index declined as much as 0.4%, with Tencent and AIA Group among the biggest drags. Asian equities have fallen below key support levels this month as worries over China’s economic woes in addition to high US rates and surging global crude prices weaken the case for region’s risk assets. The regional benchmark is on track for a second-straight monthly loss.

- Benchmarks fell in Hong Kong and mainland China, with property stocks sliding after distressed developer Evergrande scrapped a key creditor meeting added to fears about its debt pile. That’s compounding concern that global growth will stall as the economic engine of China sputters. Furthermore, China Aouyuan shares dropped by over 70% on the resumption of trade following a 17-month hiatus.

- Nikkei 225 outperformed amid stimulus hopes with the government considering 5yr-10yr tax benefits for firms producing semiconductors and storage batteries, as well as providing support in areas where firms face high entry risk and will reportedly boost take-home pay for part-time workers.

- Australia's ASX 200 was marginally lower with losses in mining stocks and financials overshadowing the resilience in the consumer and tech sectors.

In FX, the Bloomberg Dollar Spot Index reversed modest losses to gain 0.2%, up a fourth day. Investors mulled the week ahead that includes plenty of Fed speakers, jobless claims and PCE deflator data, with increasing concern about potential for a US government shutdown. The euro traded off the lows after German IFO beat expectations, although the single currency is still down 0.2% versus the greenback. The Swiss franc and Aussie dollar were the worst performers in G-10, falling 0.4%; the franc was the worst-performer in G-10 as it remains under pressure after SNB kept rates unchanged last week. USDJPY extended through 148.50, adding to cheapening pressure on Treasury yields.

In rates, treasuries bear-steepened with long-end yields cheaper by up to 7bp on the day and 2s10s, 5s30s spreads near session wides heading into early US session. 10-year TSY yields were around 4.49% (after touching a fresh 2007 high of 4.50%) and more than 5bp higher on the day, near top of Friday session range and 30-year yields rose 6bps to 4.59% - a new cycle high; the German benchmark jumped six basis points to 2.80%, the highest since 2011. Long-end-led losses prolong curve-steepening trend, leaving US 2s10s, 5s30s spreads wider by 5.5bp and 3bp on the day; 2s10s reached -62bp, least inverted since May 24. Treasuries led by price action in core European rates, where German 30-year yields are cheaper by almost 9bp on the day. Into the move, German 10-year yields rise to highest since 2011 as central banks remain in higher for longer mode. Dollar IG issuance slate contains three names so far; weekly volume is expected to total $15b-$20b. Treasury sells 2-, 5- and 7-year notes this week with auctions starting Tuesday.

In commodities, oil prices pared an earlier gain. Spot gold fell 0.2%. Bitcoin prices remain subdued around the USD 26k mark. Mixin Network suspended services after a hack involving USD 200mln in funds, according to The Block.

Today's calendar is relatively sparse: we get the Dallas Fed manufacturing activity at 10:30am. At 6pm Minneapolis Fed President Kashkari speaks

Market Snapshot

- S&P 500 futures little changed at 4,360.25

- STOXX Europe 600 down 0.4% to 451.27

- MXAP down 0.5% to 159.33

- MXAPJ down 0.7% to 493.69

- Nikkei up 0.9% to 32,678.62

- Topix up 0.4% to 2,385.50

- Hang Seng Index down 1.8% to 17,729.29

- Shanghai Composite down 0.5% to 3,115.61

- Sensex little changed at 66,042.86

- Australia S&P/ASX 200 up 0.1% to 7,076.53

- Kospi down 0.5% to 2,495.76

- German 10Y yield little changed at 2.78%

- Euro down 0.2% to $1.0632

- Brent Futures up 0.7% to $93.92/bbl

- Gold spot down 0.2% to $1,922.02

- U.S. Dollar Index up 0.12% to 105.71

Top Overnight News

- China central bank advisor says the country should pursue structural reforms instead of further monetary easing to bolster growth. RTRS

- Chinese property stocks tumble after China Evergrande Group suffered another setback in its restructuring and may be forced to liquidate. BBG

- China prevents a senior Nomura banker from leaving the mainland as part of an investigation, a move likely to further undermine global business community confidence in the country. FT

- Japan is considering a series of tax breaks to lower production costs in critical industries such as semiconductors, batteries, and biotechnology. Also, Japan is likely to come under growing pressure to intervene and stabilize the yen, w/the 150 level considered a potential trigger point. Nikkei

- ECB’s Villeroy says the recent rise in energy prices won’t derail the Eurozone’s underlying disinflation, as the goal is still to achieve 2% inflation in 2025. BBG

- Italy will allow banks to avoid a controversial windfall tax if they put 2.5x the tax amount toward strengthening their common equity tier 1 ratio. BBG

- Trump has a 10-point lead over Biden in a new Washington Post-ABC poll, and 3 in 5 Dems/Dem-leaning independents say they would prefer someone other than Biden on the ticket. WaPo

- Screenwriters reached a tentative deal with Hollywood studios, settling one of two walkouts that have shut down production. The writers gained concessions on key points, including higher wages, people familiar said. Initial votes on the pact by union boards may come as soon as tomorrow. The focus will then shift to reaching a deal with striking actors. Netflix and Disney gained premarket. BBG

- The US economy faces a slew of headwinds during the final months of the year, including the lagged effect of monetary tightening, the UAW strike, a potential gov’t shutdown, elevated oil/gas prices, and the resumption of student loan payments. WSJ

- Per GS’s PB book US equities were heavily net sold last week, driven almost entirely by short selling, which in notional terms was the largest since Sep ’22, driven by Macro Products and Single Stocks (~70/30 split). HFs have been pressing US shorts for 3 straight weeks (5 of the past 6). In cumulative notional terms over any 6-week period, the amount of shorting in US equities since mid-August is the largest in six months and ranks in the 98th percentile vs. the past decade. GSPB

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed albeit with a mostly negative bias following the lack of major catalysts from over the weekend and amid Chinese developer woes, while attention this week turns to data releases and the US government shutdown deadline. ASX 200 was marginally lower with losses in mining stocks and financials overshadowing the resilience in the consumer and tech sectors. Nikkei 225 outperformed amid stimulus hopes with the government considering 5yr-10yr tax benefits for firms producing semiconductors and storage batteries, as well as providing support in areas where firms face high entry risk and will reportedly boost take-home pay for part-time workers. Hang Seng and Shanghai Comp were pressured amid developer-related concerns with Evergrande shares down more than 20% after it cancelled its creditor meeting and is scrapping its USD 35bln debt restructuring plan, while the Co. said it is unable to issue new debt under the present circumstances citing an investigation into its subsidiary Hengda Real Estate. Furthermore, China Aouyuan shares dropped by over 70% on the resumption of trade following a 17-month hiatus.

Top Asian News

- PBoC adviser said China has limited room for further monetary policy easing and should pursue structural reforms such as encouraging entrepreneurs instead of relying on macroeconomic policies to revive growth, according to Reuters.

- Chinese state asset manager, China Reform Holdings is to set up a strategic emerging industry fund worth at least CNY 100bln, according to Bloomberg.

- Evergrande (3333 HK) cancelled its creditor meeting set for early this week and is scrapping its USD 35bln debt restructuring plan, while it noted that it is necessary to re-assess the terms of the proposed restructuring. Co. also stated that it is unable to issue new debt under the present circumstances citing an investigation into its subsidiary Hengda Real Estate.

- Chinese President Xi said in a meeting with South Korea’s PM that he welcomes a summit between China, South Korea and Japan at an opportune time and will seriously consider visiting South Korea, according to Reuters.

- US Department of Defense said the US and China will hold a working-level meeting on cyber issues and strategy, according to Reuters.

- EU’s Dombrovskis said the EU has no intention to decouple from China but needs to protect itself when its openness is abused. Dombrovskis also said that cooperation with Europe and China remains essential and if they talk candidly, they can make paths converge and re-energise engagement. Furthermore, he said that de-risking is a strategy to maintain openness not undermine it and that the strongest headwind is Russia's aggression against Ukraine and how China positions itself on the issue.

- Japan’s government is considering 5yr-10yr tax benefits for firms producing semiconductors and storage batteries as part of an upcoming economic stimulus package, while the government is considering providing support in areas where private-sector firms face high entry risks.

- Japan is to boost take-home pay for part-time workers, according to Yomiuri.

- BoJ Governor Ueda reiterated that BoJ must patiently maintain monetary easing; Japan's economy is recovering moderately. He added the policy framework has a big simulative effect on the economy but at times could have big side effects. Ueda noted stable and sustainable achievement of 2% inflation is not yet in sight, and Japan's economy is at a critical stage on whether it can achieve positive wage-inflation cycle. Japanese firms are changing prices more frequently than in the past, which is an important sign suggesting wages and inflation could move in tandem. Ueda said it is important for FX to move stably reflecting fundamentals; BoJ hopes to work closely with the government and scrutinise the impact of FX moves on the economy and prices. BoJ Governor Ueda said the BoJ will not directly target FX in guiding monetary policy.

European bourses extended on losses since the cash open, despite no obvious catalyst to drive price action, and with no initial move seen in response to the German Ifo metrics - a release which on balance was better-than-expected. Sectors in Europe are lower across the board with Travel & Leisure and Basic Resources, and Consumer Products as the biggest laggards, while Healthcare, Energy, and Banks see their losses cushioned in comparison. US futures reversed their earlier gains and saw an acceleration in losses at one point despite a lack of fresh drivers at the time. The futures have since stabilised around flat levels intraday.

Top European News

- UK PM Sunak is facing a renewed backlash from within the Tory party and opposition Labour politicians, as well as business executives and university leaders after the government refused to rule out scrapping the northern leg of the HS2 rail project, according to FT.

- BoE is reportedly set to delay the implementation of some Basel III reforms for a further 6 months but will disappoint banks by reducing the phase-in period, according to FT.

- ECB’s Villeroy said the recent increase in oil prices won’t derail the ECB’s fight to tame inflation and stated that patience is more important than raising rates further, according to Bloomberg citing an interview with France Inter ECB's Villeroy said maintaining the current level of interest rates will lower inflation, and sees a risk that the ECB could do too much in the future. He said they should focus on the persistence of rates rather than pushing rates up, and markets should not expect rate cuts before a sufficiently long time.

- ECB's De Cos said must avoid insufficient and excessive tightening; and if rates are kept at the current 4.0% long enough, we should reach the 2% goal, according to Bloomberg.

- Bundesbank faces hundreds of job reductions under a modernisation plan by Boston Consulting Group which was hired in an effort to make the central bank more agile and efficient, according to FT.

- Italy revisited the windfall tax on banks to give lenders the option to boost reserves instead of paying a levy, according to Reuters.

- Germany is to scrap stricter building insulation standards to help prop up the struggling property sector and Chancellor Scholz is to meet property industry leaders today.

FX

- DXY retains an underlying bid in the wake of recent Fed rhetoric underlining that inflation remains too high, while the USD also benefits from a retreat in the Yuan on the back of Evergrande woe plus ongoing weakness in the Yen and Franc on policy divergence dynamics.

- AUD is among the laggards amid contagion from the Yuan and the decline in base metal prices, particularly iron and copper, while the CAD is underpinned by resilient crude prices.

- Sterling slipped to a new multi-month low against the USD, whilst the Euro faded above 1.0650 against its US counterpart even though German Ifo survey metrics either beat or matched expectations. Instead, EUR/USD seemed more inclined to remarks from ECB’s Villeroy and de Cos backing the rates have peaked scenario.

- Barclays on month-end rebalancing: model suggests strong USD buying vs. all majors as US equities have trimmed gains alongside a hawkish hold from the FOMC.

Fixed Income

- Bears remain in control of proceedings as alluded to earlier, and momentum is building with little sign of underlying buyers turning the tide as more technical and psychological support levels are breached

- Bunds have now been down to 128.87 from a peak at 129.56 that matched their previous Eurex close.

- Gilts are now probing 95.50 to the downside after failing to retain 96.00+ status very early on Liffe, and T-note is rooted to the base of its 108-11/25+ range.

- Yields are extending to fresh peaks, and there may be some respite for bonds if the 10-year German benchmark holds around 2.80% and its US equivalent is capped at circa 4.50%.

Commodities

- Crude November futures are firmer intraday despite the firmer Dollar, downbeat mood across stocks, and the Chinese property woes overnight, underpinned by bullish fundamentals.

- Dutch TTF prices are on the rise this morning despite bearish fundamentals at face value, with the Australian LNG strikes averted and Norway also ramping up gas output. There is no obvious reason for the surge in TTF prices which has also been gradual in nature.

- Spot gold briefly topped its 200 DMA (1,925.93/oz) but remains within Friday’s USD 1,918.95-28.89/oz range, while spot silver briefly rose above its 50 DMA at USD 23.63/oz before reversing back to session lows.

- Base metals are lower across the board, with the initial downside emanating from the losses across Chinese property names overnight, while the deterioration in sentiment in the European morning keeps industrial metals under pressure.

- Saudi Foreign Minister said the kingdom is keen to maintain stability, reliability, sustainability and security of oil markets, according to Reuters.

- EU energy official said Europe will have to rely on US fossil fuels for decades, according to FT.

- Russia mulls tweaks to exempt some oil productions from the export ban; Exemptions on bunker fuel and gasoils from its fuel ban, via Bloomberg.

Geopolitics

- Ukrainian President Zelensky said he met with Mike Bloomberg and other top US financiers during his US visit to discuss reconstruction and investment, according to Reuters.

- Russian Foreign Minister Lavrov said the Ukraine peace formula is not feasible, while he stated regarding the latest proposals by the UN Secretary-General to revive the Black Grain deal that they do not reject them but noted the proposals are simply not realistic, according to Reuters.

- Iranian President Raisi told CNN that Iran has not said it does not want IAEA nuclear inspectors in the country, while he added that Israeli normalisation with Gulf Arab states will see no success.

- Iran’s intelligence ministry said 30 simultaneous explosives were neutralised in Tehran and 28 terrorists were arrested.

- French President Macron announced that France is to end its military cooperation with Niger in the months ahead following the military coup and decided to recall its ambassador from the African country, according to Reuters.

- US President Biden’s administration is reportedly in talks for a major arms transfer to Vietnam that may include fighter jets.

- Philippines strongly condemned the Chinese Coast Guard’s installation of a 300-metre floating barrier preventing Filipino boats from entering the Scarborough Shoal in the South China Sea.

US Event Calendar

- 08:30: Aug. Chicago Fed Nat Activity Index, est. 0.05, prior 0.12

- 10:30: Sept. Dallas Fed Manf. Activity, est. -13.0, prior -17.2

Central Bank speakers

- 18:00: Fed’s Kashkari Speaks

DB's Jim Reid concludes the overnight wrap

It's nice to get back to the free form creativity of research after an highly scheduled weekend in sole charge of the kids as my wife went on a reverse hen do (2yrs after a covid wedding!). I was given a 3-page itinerary and instructions that included meal plans, 3 lots of swimming lessons, 2 separate golf lessons, violin and piano practise, Maths and English homework, a friend’s 8th birthday party and helping to design 2 fireworks posters. Oh and I had to lend the tooth fairy some money. I’m dropping them off to school this morning and then straight to the peace and quiet of a 7-hour flight to New York. Bliss.

This week one of the main highlights will take markets through a full on Back to the Future and Quantum Leap (my favourite show as a teenager) moment as the-every-5-years US GDP revisions take place on Thursday alongside the final Q2 2023 revisions (unch at 2.4% expected). DB's Brett Ryan talks about the revisions here but he discusses how GDP will be revised from Q1 2005 through Q1 2023, although revisions prior to the first quarter of 2013 will be offsetting across industries within each period. Gross domestic income (GDI) and select income components will be revised from Q1 1979 through Q1 2023. You'll see our CoTD from a couple of weeks ago here that discussed how the current big gap between US GDI and GDP could possibly be explained by erroneous recent data showing that net interest payments have been going down in the US as rates and yields have been soaring in the last 2 years. It's possible that revisions could make GDI look more healthy (interest payments add income to parts of the economy) but also make interest costs in the economy look more realistic and hurt fundamental models of interest cover for those indebted. This is just an educated guess at this stage. Anyway, the revisions are potentially an important event and could make us think differently about the US economy in the recent past and therefore the future. It's also possible not much changes of course. That would make a boring time travel movie though.

Outside of this the core PCE deflator on Friday is as important. Our economists point out that the data from the August CPI and PPI releases point to a slightly softer reading (+0.20% vs. +0.22% last month), which would have the effect of lowering the year-over-year growth rate by a little over 30bps (to 3.9%). As they highlight, the Fed's latest SEP forecast for Q4/Q4 core PCE inflation last week was 3.7%, which implies a modest re-acceleration in the monthly prints. This is one reason why our economists believe the bar is relatively high for the Fed to hike again before year-end. Staying with inflation, over in Europe, the flash September CPIs kick off with prints from Germany on Thursday. The numbers for the Eurozone, France and Italy will be out on Friday. Friday also sees Tokyo CPI which is an important economy wide lead indicator as the BoJ considers more radical changes to its monetary policy soon.

Elsewhere in the US we have new home sales and consumer confidence tomorrow, durable goods on Thursday with trade numbers and personal income and consumption numbers on Friday.

In Europe, Germany sees the Ifo survey today, consumer confidence on Wednesday and labour market data on Friday. In France, consumer confidence will be out on Wednesday and consumer spending data is due Friday. Sentiment gauges will also be out in Italy and the Eurozone on Thursday.

Asian equity markets are mostly retreating this morning with Chinese stocks leading losses amid persistent concerns over the property market after embattled real estate developer Evergrande Group indicated that it will be unable to issue new debt due to an ongoing government investigation into its unit Hengda Real Estate Group. In terms of specific index moves, the Hang Seng (-1.43%) is emerging as the biggest underperformer while the CSI (-0.62%) and the Shanghai Composite (-0.42%) are also trading in negative territory. Elsewhere, the KOSPI (-0.57%) is also weak in early trade while the Nikkei (+0.58%) is bucking the regional trend. US stock futures are indicating a rebound though with those on the S&P 500 (+0.27%) and NASDAQ 100 (+0.34%) moving higher. 10yr US yields are back up +2.4bps to 4.458% as I type .

This morning, Marion Laboure and Cassidy Ainsworth-Grace in my team have published the first instalment of their new series on the Future of Money – Cryptocurrencies: The return of faith, trust and, fairy dust. Focusing on the hot topic of cryptocurrencies, followed by a deep dive on stablecoins, they argue that despite the bankruptcies and negative news over the last 18 months, the crypto ecosystem has edged closer to the established financial sector. As a result, digital assets are here to stay. You can find their report here.

Looking back on last week now, we had a run of flash PMI data on Friday. Starting with the US, the flash composite PMI for September surprised to the downside at 50.1 (vs 50.4 expected), with services weaker at 50.2 (vs 50.7 expected) and at its lowest level since January. Manufacturing on the other hand was stronger than forecast, at 48.9 (vs 48.2 expected). Digging deeper, in the services PMI, the employment component bounced to 52.6, the highest level in a year, pointing to a still robust US labour market. All other details were on the softer side, with backlogs in particular at its lowest level since the pandemic, at 44.5.

The moderating activity signal of the PMIs on Friday helped US fixed income recoup some of its losses earlier in the week. US 10yr Treasury yields fell -6.1bps, and 2yr yields fell -3.4bps. However, 10yr yields still rose +10.1bps week-on-week to 4.435%, their highest weekly close since 2007. This followed on from the hawkish Fed meeting on Wednesday, and a strong weekly jobless claims print on Thursday that affirmed a higher-for-longer approach by the Fed. As such, the expected rate for December 2024 rose by +13.0bps week-on-week to 4.67% (-3.6bps Friday) .

The European PMIs were a bit more of a whirlwind relative to the US. The composite PMI surprised to the upside, rising +0.3pts to 47.1 (vs 46.5 expected). The increase was driven by a +0.5pts increase in services (48.4 vs 47.6 expected), while manufacturing was mostly unchanged at 43.4 (vs 44.0 expected). However, the interesting tidbit came with the divergence between France and Germany. For the former, the composite PMI surprised to the downside, falling to 43.5 (vs 46.0 expected), whereas German PMI rose to 46.2 (vs 44.7 expected). Off the back of this, German 10yr bund yields traded largely flat on the day (+0.3bps). In weekly terms, the 10yr bund yield followed the US, up +6.4bps.

Equities struggled last week against the backdrop of rising yields, as the S&P 500 fell -2.93% week-on-week (-0.23% Friday) in its largest down move since March (and its lowest level since early June). Tech stocks saw a modest outperformance on Friday, with the NASDAQ down a marginal -0.09%. However, the tech-heavy index slipped -3.82% in weekly terms, its third consecutive week of losses, and a c.8% decline from its July peak. In Europe, the STOXX 600 laboured last week, falling back -1.88% (and -0.31% on Friday).

Finally, in commodities, the oil price rally ran out of steam last week.Brent was down -0.70% to $93.27/bbl (-0.03% Friday) after rising by over +11% over the previous three weeks. WTI saw a similar down move of -0.82% to $90.03 (+0.45% Friday). Nonetheless, energy supply risks remained in focus last week. For instance, on Thursday Russia temporarily banned most gasoline and diesel exports with immediate effect .

We’ll see how we go this week as we hit the business month-end on Friday.