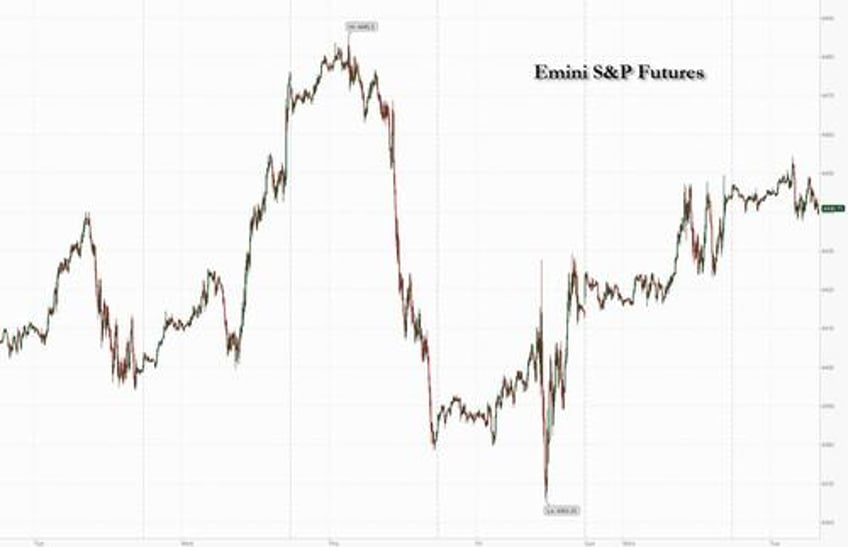

US stock futures erased gains of as much as 0.3% following another parade of modest China stimuli as investors monitored the outlook for interest rates ahead of key inflation and jobs data later this week, with the Federal Reserve’s data dependence in firmly mind. Contracts on the Nasdaq 100 and S&P 500 traded flat by 7:30 a.m. in New York after gaining as much as 0.4% and 0.3%, respectively. In Europe, the Stoxx 600 rises for a second day while Asian stocks closed at the highest level in two weeks, as Chinese equities extended their gains following the country’s market-boosting measures. A fall in Treasury yields also helped sentiment. Treasury yields and the dollar were steady; the USDJPY rose to 146.97, the highest level since November, and a red line for imminent BOJ intervention.

In premarket trading, retailer Best Buy climbed 3.3% ahead of its second-quarter earnings report, while Verizon and AT&T rose after Citigroup upgraded the stocks to buy, saying it sees a more constructive investment case for large-cap telecommunications firms. Here are some other notable premarket movers:

- BigBear.ai Holdings Inc. climbs 2.9% after HC Wainwright & Co LLC started coverage on the application software company with a buy rating and $4 price target.

- Emergent BioSolutions slips 2% after Benchmark Company LLC downgraded it to hold from buy, with the analyst citing restructuring plans that are expected to “slow share price rebound.”

- Jackson Financial rises as much as 7.8% after S&P Dow Jones said the stock is set to join S&P SmallCap 600 index prior to the opening of trading on Sept. 1.

- Nio falls as much as 3.8% after the Chinese electric-vehicle maker reported bigger-than-expected losses in 2Q as competition heated up. Vehicle sales and margins also missed estimates, while guidance for 3Q deliveries was ahead.

- Noco-Noco rises as much as 90%, on track to recoup some of its Monday losses when it slid 53% after the Japanese advanced electric battery technology company made its debut on the Nasdaq.

- PDD Holdings shares surge as much as 13% after the Chinese e-commerce company reported quarterly revenue and earnings well above estimates. Operating and marketing expenses were higher than expected as the company competes with rivals over pricing at home and abroad.

- Verizon and AT&T rise as Citi upgrades to buy, saying it sees a more constructive investment case for large-cap telecommunications firms.

Despite modest gains so far in the final week of August, global stocks are on track for their worst month in almost a year as policy makers remain determined to stifle inflation. Economic reports are assuming even more importance than usual after Federal Reserve Chair Jerome Powell reiterated at Jackson Hole last week that the central bank is ready to raise rates further if the data suggests that is appropriate.

“August has been a challenging month for markets, with investor sentiment cautiously picking up again,” said Victoria Scholar, head of investment at Interactive Investor. “Focus will be on key economic data from the US this week, with hopes that this will fuel expectations that the economy stateside is heading for a soft landing.”

While it's a bumper week for data releases, including payrolls and GDP, today traders will be monitoring the latest job openings and US consumer confidence data. Other reports this week include US employment growth, the core PCE deflator and August’s payrolls and wages data. Euro-area inflation readings will be in focus this week as well.

Miners led an advance in the Stoxx Europe 600 index after China signaled further measures to support its economy. NN Group NV jumped as much as 11% after the financial-services company reported results that beat analysts’ expectations. European bonds gained, with the German 10-year yield falling three basis points to 2.54%. UK stocks outperformed when they reopened after Monday’s holiday. Here are the biggest European movers:

- NN Group surges as much as 11%, the most since March 2020, after the Dutch insurance and investment management firm delivered results that analysts say were ahead of expectations

- Bunzl shares rise as much as 4.8% after the UK distribution and business services company reported a stronger-than-expected margin performance and raised its full-year guidance

- Vestas climbs as much as 3.3% after Nordea raised the the wind-turbine-maker’s recommendation to buy, citing easing headwinds, flattening inflation, stabilizing supply chains and higher US orders

- Heineken rises as much as 2.1% as JPMorgan upgrades the Dutch brewer to overweight from neutral. Share price weakness post first-half results presents an attractive entry point, the broker says

- Britvic shares gain as much as 4%, the most since Nov. 23, after Barclays upgraded its rating on the UK soft-drinks maker to overweight citing multiple top-line and earnings growth drivers

- Zurich Airport rises as much as 3.1% after the Swiss airport operator reported Ebitda for 1H that beat the average analyst estimate. ZKB says the company benefited from a “true travel boom”

- Telecom Italia gains as much as 3% after Italy approved a decree which empowers it to take a stake in the phone company’s network business of as much as a 20%

- NHOA fell as much as 23%, the most on record, after the French maker of renewable-energy equipment launched a €250m capital increase with shareholders’ preferential subscription rights

Earlier in the session, Asian stocks rose 0.8%, climbing for the second day to the highest level in two weeks, as Chinese equities extended their gains following the country’s market-boosting measures. The Hang Seng Index extended its increase into a second day and China’s stocks outperformed, with the Hang Seng China Enterprises Index rising more than 2%. Chinese internet firms Tencent and Alibaba provided the biggest support to the gauge, with a measure of tech firms listed in Hong Kong rising as much as 3%.

In its latest stimulus step, China is poised to cut interest rates on trillions of yuan of outstanding home mortgages for the first time since the global financial crisis, as policymakers dig deeper into their toolkit to shore up growth in the world’s second-largest economy.

“If policy measures continue to be unveiled in the coming weeks, the market narrative may shift from ‘too little, too late’ to a more confident stance as policymakers regain credibility,” UBS Global Wealth Management strategists including Solita Marcelli and Mark Haefele wrote in a note.

In rates, Treasury futures were lower in early US session, paring small gains amassed during Asia session and London morning. US 10-year yield around 4.22%, 2bps cheaper on the day, outperforming gilts in the sector while trailing bunds, stronger following German 5-year note auction. The week's coupon auction cycle concludes with $36b 7-year note sale, following decent demand for Monday’s 2- and 5-year notes.

In FX, the Bloomberg Dollar Spot Index rose to 1244, strengthening against EUR, GBP and CHF, and especially the yen, with the USDJPY surging above 147 for the first time since Nov 2022 and guaranteeing that a BOJ intervention is now inevitable. Meanwhile looking at the BBDXY, Sean Callow, strategist at Westpac Banking said that a move in the index toward 1250 “is still achievable over multi-days or week, but will probably require substantial upside surprises on both NFP and CPI.” The British pound edged higher after the slowest increase in grocery bills in almost a year drove down inflation in shops in August, relieving some of the pressure on the Bank of England to keep raising interest rate hikes.

In commodities, oil climbed toward $81 per barrel as traders waited for the next set of clues on the outlook for crude demand in the US and China. Gold was little changed.

Looking at today's calendar, we get the August Conference Board consumer confidence read (116.0 survey vs. 117.0 prior), July's JOLTS job openings (exp. down to 9.5MM from 9.588MM), and the June FHFA house price index; FDIC will propose new guideline for regional banks today; 7yr auction at 1pm.

Market Snapshot

- S&P 500 futures little changed at 4,442.25

- STOXX Europe 600 up 0.6% to 458.20

- MXAP up 0.7% to 160.84

- MXAPJ up 1.0% to 506.27

- Nikkei up 0.2% to 32,226.97

- Topix up 0.2% to 2,303.41

- Hang Seng Index up 1.9% to 18,484.03

- Shanghai Composite up 1.2% to 3,135.89

- Sensex up 0.2% to 65,106.00

- Australia S&P/ASX 200 up 0.7% to 7,210.46

- Kospi up 0.3% to 2,552.16

- German 10Y yield little changed at 2.54%

- Euro little changed at $1.0811

- Brent Futures up 0.3% to $84.68/bbl

- Gold spot up 0.1% to $1,922.94

- US Dollar Index little changed at 104.05

Top Overnight News

- Japan may be at an inflection point in its 25-year battle with deflation as price and wage rises show signs of broadening, the government said on Tuesday, signaling its conviction the economy was nearing an end to prolonged stagnation. RTRS

- Toyota will halt all 14 plants in Japan tonight due to a systems problem, though it doesn't suspect a cyberattack. It's not clear when operations will resume. BBG

- Hong Kong’s lived-in home prices declined for a third straight month in July to a six-month low, reflecting the prevailing sentiment in the city’s property market amid an elevated interest-rate environment. Prices fell 1.1% month on month in July, the biggest drop this year. The widely watched gauge slipped to 343.4 from 347.3 in June, the lowest level since 346.8 in February. SCMP

- China’s biggest state-owned banks are considering lowering deposit rates for at least the third time in a year, according to people familiar with the matter, as they ramp up efforts to boost the economy and protect margins. BBG

- The slowest increase in grocery bills in almost a year drove down inflation in British shops in August, relieving some of the pressure on the BOE to keep raising interest rates. The British Retail Consortium said that shop price inflation fell sharply again to 6.9% in August from 7.6% the month before. Food price led the decline, particularly for meat, potatoes and cooking oils. BBG

- AI technology is actually quite labor-intensive, relying on an army of workers scrubbing the data on which models are being trained. Washington Post

- Today the FDIC will vote on five separate proposals at a meeting, all aimed at ensuring banks with over $100 billion in assets are prepared for their own potential failures, and can be taken apart smoothly and quickly. RTRS

- The Biden administration and its European allies are laying plans for long-term military assistance to Ukraine to ensure Russia won’t be able to win on the battlefield and persuade the Kremlin that Western support for Kyiv won’t waver. WSJ

- Homeowners are increasingly forgoing home insurance, gambling that the likelihood of a disaster isn’t high enough to justify the cost of a policy. Some skipping insurance say they are doing so because they can no longer afford the rising premiums. The national average for home insurance based on $250,000 in dwelling coverage increased this year to $1,428 annually, up 20% from 2022, according to Bankrate. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with an upward bias following the positive lead from Wall Street, with little in terms of fresh catalysts to dictate price action heading into month-end. ASX 200 was supported by its gold, mining, and materials sectors but with the gains modest intraday, with the upside hampered by the index’s IT and Healthcare sectors. Nikkei 225 was caged after opening higher, with the index supported by its machinery sector, while Toyota shares waned after reports it is to suspend operations at all of its 14 Japanese assembly plants amid system failures. Hang Seng and Shanghai Comp saw another session in the green, with the gains in the former more pronounced as index heavyweights are again buoyed by the recent stock support measures.

Top Asian News

- Chinese State media reports PBoC may cut banks' RRR earlier than expected to maintain reasonable ample liquidity, according to reports.

- Chinese banks are considering additional deposit rate cuts to boost growth, according to Bloomberg; Major lenders could lower rates across key tenors by 5-20bps, the plan has been signed off by regulators and the cut could come as soon as Friday.

- China to cut rates on existing mortgages as soon as today, via Bloomberg.

- PBoC sold CNY 385bln via 7-day reverse repos with the rate at 1.80% for a CNY 274bln net injection.

- South Korea plans government spending of KRW 656.9tln (+2.8% from 2023); and sees debt-to-GDP ratio at 51% in 2024 (vs 50.4% in 2023), according to the Finance Ministry.

- Xiaomi (1810 HK) Q2 (CNY): Revenue 67.35bln (exp. 65.84bln), Net 5.14bln (prev. 2.08bln). Smartphone revenue 36.6bln. Will not declare an interim dividend for 6 months.

- Fitch affirms New Zealand at "AA+"; outlook Stable

European bourses are in the green, Euro Stoxx 50 +0.4%, after a constructive open with catalysts light at the time. Following the open, both cash and futures pared some of this move before reverting back towards initial bests on subsequent Chinese source reports. FTSE 100 +1.5% outperforms as it plays catch up to gains elsewhere on Monday's UK Bank Holiday. As mentioned, sentiment saw some modest upside on the sources with ADRs for Chinese stocks seeing upside. Within Europe, sectors are all in the green featuring outperformance in Basic Resources given benchmark and above factors, Real Estate is firmer after pressure in Monday's session while Tech has made its way into the green despite initial marginal pressure. Stateside, futures are in the green though only modestly so with the ES and NQ posting gains of circa. +0.1%; upside which began before the Chinese rate reports, but has picked up further since those aired. Agricultural Bank of China (1288 HK) - H1 (CNY): net profit 133.234bln vs. prev. 128.945bln, net interest income 290.421bln vs. prev. 300.219bln, NIM 1.66%

Top European News

- Riksbank's Bunge says prices are still rising much too fast, right now it looks like the fight against inflation is not over yet. Says the Swedish Crown is undervalued.

FX

- DXY continues to rotate around 104.000 as demand for month-end rebalancing counters softer rates and renewed risk appetite.

- Aussie and Kiwi marginally outperform on 0.6400 and 0.5900 handles against the Buck respectively.

- Yen off worst levels vs. Dollar, but still vulnerable within a 146.60-32 range after an unexpected rise in Japanese unemployment.

- Euro wanes against Greenback and eyes big expiry at 1.0800 plus 200 DMA for support.

- The Yuan saw some two-way action before coming under pressure on source reports that Chinese banks are considering additional deposit rate cuts to support growth, subsequent reports saw some of this briefly pare-back.

- PBoC set USD/CNY mid-point at 7.1851 vs exp. 7.2854 (prev. 7.1856)

- RBA's Bullock says the impact of climate change on the neutral interest rate is not clear cut; could put upward and downward pressure on the neutral rate. Inflation is still too high, and that will be my first priority as Governor.

Fixed Income

- Debt futures pare gains after extending to the upside in early EU trade awaiting a relatively busy PM agenda.

- Bunds retain bid tone within 132.48-13 range amidst decent Bobl sale and demand for 2053 German tap.

- Gilts pullback further between 94.79-24 parameters after return from 3-day UK weekend.

- T-note holding middle ground within 109-28+/21+ bounds.

Commodities

- WTI and Brent Oct’23 are at the top-end of USD 79.79-80.75/bbl and USD 84.11-85.11/bbl parameters. The respective peaks printed following Bloomberg source reports with support via the bullish catalysts of Hurricane Idalia as it continues to intensify as it enters the Gulf.

- Dutch TTF pulls back modestly after Monday's pronounced strike-notice-driven gains, developments since have detailed the potential action workers will take from the 7th.

- Spot gold is in narrow bounds but just about retains a positive bias as the USD picks up, while base metals were already gleaning support from the firmer APAC handover but have extended since.

- NHC says Idalia is now a hurricane and is expected to rapidly intensify into an extremely dangerous major hurricane before making landfall on Wednesday.

- Australian union said workers at Chevron's (CVX) LNG facilities to participate in rolling stoppages, bans and limitations; Industrial action will escalate each week until Chevron agrees to bargaining claims, according to Reuters. Workers at Chevron's Australian LNG facilities plan work stoppages of as long as ten hours from next week, according to Reuters

- Chilean copper miner Codelco makes further staff cuts, according to a statement cited by Reuters.

- Australian Agriculture Minister said the first shipment of Australian barley has been dispatched to China, according to Reuters.

- Ukraine's First Deputy Agriculture Minister says Ukraine's winter wheat sowing area will likely remain unchanged despite the export crisis, according to Reuters.

Geopolitics

- North Korean Leader Kim says the US has turned waters near the Korean Peninsula into the most unstable region with the danger of nuclear war, reported via KCNA. Will deliver new weapons to military units under the policy of expanding tactical nuclear weapons operations.

- US President Biden is to meet with Brazilian President Lula on September 19th, according to Reuters.

- Veteran US diplomat Mark Lambert likely to be named as Assistant Secretary for China and Taiwan, according to Reuters sources; appointment unlikely to change US' China stance.

- Taiwan's Defence Ministry says 12 Chinese military craft entered the ADIZ on Tuesday, seven craft crossed the median line.

US Event Calendar

- 09:00: June S&P/Case-Shiller US HPI YoY, prior -0.46%

- 2Q House Price Purchase Index QoQ, prior 0.5%

- June FHFA House Price Index MoM, est. 0.6%, prior 0.7%

- June S&P/CS 20 City MoM SA, est. 0.80%, prior 0.99%

- June S&P CS Composite-20 YoY, est. -1.60%, prior -1.70%

- 10:00: July JOLTs Job Openings, est. 9.5m, prior 9.58m

- 10:00: Aug. Conf. Board Consumer Confidence, est. 116.0, prior 117.0

- Aug. Conf. Board Present Situation, prior 160.0

- Aug. Conf. Board Expectations, prior 88.3

- Aug. Dallas Fed Services Activity, prior -4.2

DB's Jim Reid concludes the overnight wrap

As the UK returns from the holiday weekend, it’s clear that markets have taken last week’s speeches at Jackson Hole in their stride. That will come as a relief to many, since last year saw the S&P 500 plunge -3.37% on the day of Powell’s hawkish remarks, and we also had a relentless bond selloff that continued into late-October. But this time around, the S&P 500 has advanced on Friday (+0.67%) and again yesterday (+0.63%), just as yields on 10yr Treasuries have kept falling after last week’s highs to trade at 4.19% this morning.

In several respects, Powell’s speech on Friday had quite a few hawkish lines in it. For instance, he reiterated that inflation “remains too high”, and that the Fed was “prepared to raise rates further if appropriate”. He also said that they would be keeping policy “at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.” But on the dovish side, he also acknowledged that inflation had moved lower, and pointed out that there was uncertainty about monetary policy lags. Indeed, Powell said that “there may be significant further drag in the pipeline” from those lags, and he weighed up that there were risks from tightening too little and tightening too much. So it was quite a different tone to last year, when it was abundantly clear that Powell’s message was that the Fed wasn’t about to let-up on inflation.

The most obvious takeaway from this year’s speech is that markets now consider another hike this year as increasingly likely, with futures pricing in a 67% chance of a hike by November. That’s been reflected in front-end yields, with the 2yr Treasury yield closing at a post-2007 high of 5.08% on Friday. Furthermore, the 3m T-bill yield rose to another post-2001 high yesterday of 5.484%. In the meantime, the recent pattern of rate cuts being pushed into the future has continued, and the first full 25bp cut now isn’t priced in until the June 2024 meeting.

Over at the ECB, the debate is also continuing about whether there’ll be another hike at their meeting in two weeks’ time. Currently, markets are considering the decision to be finely balanced, with a 42% chance of a move priced in. This is up from 34% on Friday, as markets took a slightly hawkish interpretation to the lack of a reaction in ECB commentary to last week’s underwhelming PMIs. In her own speech at Jackson Hole, President Lagarde avoided giving a clear signal as well, focusing instead on structural shifts such as changing labour markets, geopolitical divisions and the energy transition. Meanwhile, yesterday saw Austria’s Holzmann push for another hike next month, saying that if “there aren’t any big surprises, I see a case for pushing on with rate increases without taking a pause.”

Looking forward, the question of whether we get more hikes will partly be determined by this week’s data, with several important releases coming up. In the US, the main highlight will be the jobs report on Friday, where our US economists expect nonfarm payrolls to have slowed further to +150k in August. That would be the slowest growth since December 2020, and they see that pushing the unemployment rate up a tenth to 3.6%. One category we’ve been following closely is Temporary Help Services, because that has traditionally been a strong leading indicator in previous cycles, turning down ahead of the overall number. It’s fallen for 6 months in a row now, so one to keep an eye on.

Staying on the US, an important release today will be the JOLTS report for July, which has been closely followed by the Fed to see if the tightness in the labour market is easing. Recent months have seen job openings come down to a 2-year low, albeit to a point that’s still well above pre-pandemic levels. The quits rate will also be an important measure in that release as well, since that’s strongly correlated with wage growth. Otherwise this week, look out for the July PCE inflation report on Thursday, which is the Fed’s preferred measure, along with the ISM manufacturing report for August on Friday, which will be out 90 minutes after the jobs report.

Over in the Euro Area, the main focus will be the flash CPI reading for August, which is out on Thursday. Our European economists see the headline print coming in at +5.5% year-on-year, up two-tenths from July, and they see core inflation at +5.4%. So both headline and core would still be more than twice the ECB’s 2% target, hence there’s still pressure for further rate hikes. Tomorrow we should get an initial indication of where the number might be from the country releases in Germany and Spain. At the same time, we found out yesterday that the Euro Area M3 money supply had seen an annual contraction for the first time since 2010, with a -0.4% year-on-year decline in June. So a fresh sign of how the ECB’s rapid monetary tightening is having an effect.

With all that to look forward to, markets put in a solid performance yesterday, with both the S&P 500 (+0.63%) and Europe’s STOXX 600 (+0.89%) posting steady gains. This makes it the first time in August that the S&P 500 managed to post two consecutive rises (after +0.67% on Friday). It was a similar story for sovereign bonds as well, with yields on 10yr Treasuries coming down -3.3bps to 4.20%. Yields on 10yr bunds were virtually unchanged at +0.2bps, while OAT (-0.4bps) and BTP (-1.9bps) yields saw a slight decline.

That positive mood has continued overnight in Asia, with solid gains for the major indices. Since we weren’t around yesterday, it’s worth mentioning that China announced on Sunday that there would be a cut in the stamp duty on stock trades from 0.1% to 0.05%. That helped trigger an initial surge in the CSI 300 of +5.46% on Monday, although the index pared back those gains through the session to only close up +1.17%. And this morning those gains have continued, with the CSI 300 up another +1.45%.

Other indices across the region seen a consistently positive performance this morning as well, with gains for the Hang Seng (+2.02%), the Shanghai Comp (+1.39%), the Nikkei (+0.31%) and the KOSPI (+0.22%). That’s extended to the US, where futures on the S&P 500 are up another +0.08% this morning. The main negative signal overnight has come from Japan, where the unemployment rate unexpectedly rose to 2.7% in July (vs. 2.5% expected), whilst the jobs-to-applicants ratio slipped further to 1.29.