- APAC stocks were mostly positive albeit with gains capped amid a lack of fresh macro drivers.

- Israel Defence Forces said during the weekend that it struck Hezbollah targets in Lebanon; added that strikes would continue and intensify.

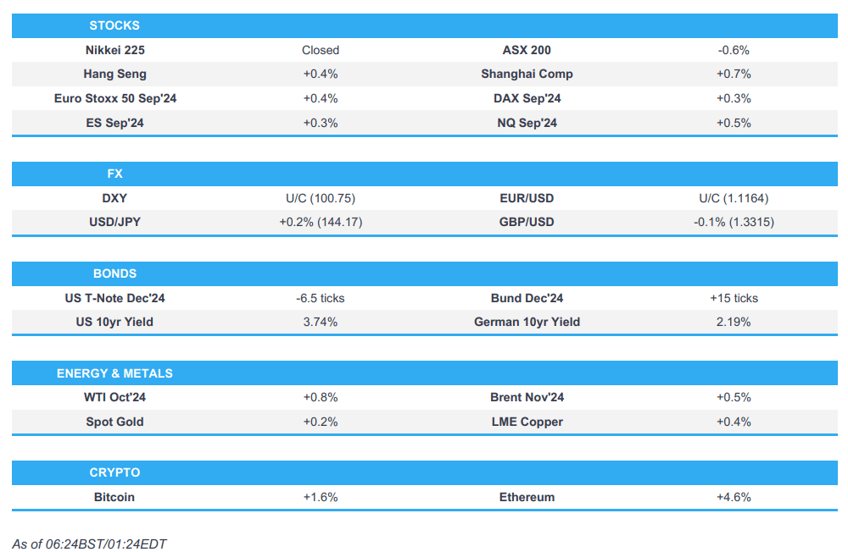

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 1.5% on Friday.

- DXY is flat, AUD is the marginal outperformer, JPY the laggard, other majors are contained.

- Looking ahead, highlights include EZ, UK, US PMIs (Flash), Comments from ECB’s Elderson & Cipollone, Fed’s Bostic, Kashkari & Goolsbee, Supply from the EU.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

- US stocks were choppy on Friday amid quad witching but ultimately closed mixed in which the Dow slightly outperformed to print another record closing high while the S&P and Nasdaq finished with slight losses and the Russell 2000 was the worst hit, while sectors were predominantly lower with Industrial, Materials and Tech the laggards.

- SPX -0.19% at 5,703, NDX -0.24% at 19,791, DJIA +0.09% at 42,063, RUT -1.10% at 2,228

- Click here for a detailed summary.

NOTABLE HEADLINES

- US VP Harris is expected to release new economic proposals this week with the proposals aimed at middle-class wealth-building and the economic incentives for business to facilitate that, according to Reuters sources. It was also reported that Harris accepted a CNN debate invitation and challenged former President Trump to a debate although Trump rejected the offer and said it was 'too late' for another debate.

- US House Republicans unveil three-month stopgap bill to avert a government shutdown which would fund the government through December 20th and omits changes to voter registration that Trump had called for.

- Fed’s Bowman (voter) said on Friday regarding dissent that she agreed it was appropriate to recalibrate the Fed Funds Rate, but she preferred a smaller first move and sees a risk that the FOMC's larger policy action could be interpreted as a premature declaration of victory on inflation. Bowman added that they have not yet achieved the inflation goal and believes moving at a measured pace towards a more neutral policy stance will ensure further progress is made in returning inflation to the 2% goal.

- Fed‘s Waller (voter) said on Friday that 50bps was the right number and they are at the point where the economy is strong and that they want to keep it that way. Waller said Core PCE is running below their target and inflation is softening much faster than he thought it was going to which is what made him support a 50bps cut, while he could imagine going 25bps at the next meeting or two if the data comes in fine but noted the Fed could do more if the labour market worsens and inflation data softens quicker, or could even pause depending on the data. Furthermore, he would support aggressive rate cuts and is fine with moving in 50bps to get to where they want to go if inflation is soft.

- Fed's Harker (non-voter) said on Friday that risks to inflation and employment are balanced, while he added that there are risks inflation could stall and the US labour market could soften.

APAC TRADE

EQUITIES

- APAC stocks were mostly positive albeit with gains capped amid a lack of fresh macro drivers and as weekend newsflow was dominated by geopolitical-related headlines, while Japanese participants were away for the Autumnal Equinox holiday.

- ASX 200 was led lower by the consumer-related sectors and with sentiment also not helped by a deterioration in the latest flash PMIs.

- Hang Seng and Shanghai Comp gained after the PBoC cut the 14-day reverse repo rate ahead of next week's National Day holiday although this was not much of a surprise given that it was the first such operation since the PBoC's short-term funding rate cuts in July, while automakers were mixed after reports the Biden administration is to propose barring Chinese software and hardware in connected vehicles.

- US equity futures edged slightly higher (ES +0.3%) in a catalyst-light session and with market focus this week likely to be on the data releases, culminating with the Fed's preferred inflation metric on Friday.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 1.5% on Friday.

FX

- DXY traded flat beneath the 101.00 level in the absence of fresh catalysts and with PCE data due later this week, while there are flash PMI data releases from the US and comments from several Fed officials scheduled today.

- EUR/USD was flat to start the week with little to spur price action and with some ECB commentary also due later.

- GBP/USD took a breather after last week's advances and just about remains in 1.3300 territory.

- USD/JPY extends on its recent upside despite the lack of fresh developments and the absence of Japanese participants.

- Antipodeans were kept afloat with AUD/USD marginally supported amid expectations for the RBA to keep rates on hold and stick to a hawkish tone in tomorrow's rate announcement, while NZD/USD was indecisive following mixed trade data including weaker monthly exports.

FIXED INCOME

- 10yr UST futures were lacklustre after last Friday's whipsawing and with overnight cash treasuries trade shut due to the Tokyo closure.

- Bund futures eked marginal gains just above the 134.00 level after exit polls showed German Chancellor Scholz's SPD narrowly defeated the far-right AfD in the eastern German state of Brandenburg election.

COMMODITIES

- Crude futures remained underpinned after last week's gains and with weekend newsflow dominated by geopolitical-related headlines.

- Spot gold was rangebound although slightly extended on its record all-time high north of the USD 2600/oz level.

- Copper futures were contained amid a lack of fresh drivers and the somewhat contained risk appetite.

CRYPTO

- Bitcoin gradually advanced overnight and climbed back above the USD 64,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 160.1bln via 7-day reverse repos with the rate maintained at 1.70% and injected CNY 74.5bln via 14-day reverse repos with the rate lowered by 10bps to 1.85% from 1.95%, which follows the cuts to other funding rates in July.

- US President Biden said his view is that Chinese President Xi is looking to buy diplomatic space to aggressively pursue China’s interests and is trying to minimise turbulence in diplomatic relations. Biden said that China continues to behave aggressively in the South China Sea and Taiwan Straits, while he noted the US sees engagement with China as important for conflict prevention and crisis management, according to Reuters.

- US President Biden’s administration is to propose barring Chinese software and hardware in connected vehicles on US roads with the Commerce Department expected to propose making prohibitions on software effective in the 2027 model year and prohibitions on hardware would be in January 2029, according to Reuters sources.

- US President Biden and Japanese PM Kishida reaffirmed a commitment to developing and protecting technologies like AI and semiconductors while increasing resilience to economic coercion, while they also discussed diplomacy with China and destabilising activities including in the South China Sea during a meeting on Saturday.

DATA RECAP

- Australian Judo Bank Manufacturing PMI Flash (Sep) 46.7 (Prev. 48.5)

- Australian Judo Bank Services PMI Flash (Sep) 50.6 (Prev. 52.5)

- Australian Judo Bank Composite PMI Flash (Sep) 49.8 (Prev. 51.7)

- New Zealand Trade Balance (Aug) -2203.0M (Prev. -963.0M, Rev. -1016M)

- New Zealand Annual Trade Balance (Aug) -9.29B (Prev. -9.29B, Rev. -9.35B)

- New Zealand Exports (Aug) 4.97B (Prev. 6.15B, Rev. 6.09B)

- New Zealand Imports (Aug) 7.17B (Prev. 7.11B, Rev. 7.10B)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said that they inflicted a series of blows on Hezbollah in the past few days that it never imagined.

- Israel Defence Forces said during the weekend that it struck Hezbollah targets in Lebanon after over 100 rockets were fired towards northern Israel by the military group, while it added that strikes would continue and intensify against Hezbollah, according to Reuters. It was separately reported that IDF announced on Monday that it conducted widespread strikes on Hezbollah targets in Lebanon.

- Israel’s Defence Minister said Hezbollah is beginning to feel some of Israel’s military capabilities and Israel will continue its operations against the group until northern Israel residents can return home safely, according to Reuters.

- Israel’s military chief said operations against Hezbollah are a message to anyone in the Middle East looking to harm Israeli citizens, while he added that Hezbollah will keep getting hit until it understands that Israel will return its citizens to their homes safely. Furthermore, he said Israel is well-prepared for the next stages planned in the coming days, according to Reuters.

- IDF spokesman said they have monitored preparations by Hezbollah to launch attacks on Israel and Hezbollah has turned southern Lebanon into a confrontation arena, while the spokesman added that they will hit Hezbollah hard and will work to reduce its power and keep it away from the border. Furthermore, Israeli media stated that warplanes attacked deep into Lebanon 120 km from the border, as well as noted that Hezbollah is preparing to carry out intensive attacks in the coming hours, while the IDF spokesman responded that the army will do whatever it takes to restore security to northern Israel when asked about the possibility of a ground incursion into Lebanon.

- Hezbollah said it targeted Ramat David Airbase with dozens of missiles in response to repeated Israeli attacks on Lebanon, according to a statement. Hezbollah also stated its top commander Ahmed Wahbi was killed during Israel’s strike on Beirut suburbs.

- Hezbollah’s Deputy Leader said the confrontation with Israel entered a new phase of an open-ended battle of reckoning.

- Islamic Resistance in Iraq launched cruise missiles and explosive drones towards Israel’s north and south, while it said it targeted with drones a military post in northern Israel on Sunday morning and launched a drone attack on a target in Jordan Valley in ‘occupied territories’.

- Iran’s Supreme leader Khamenei said Israel is committing “shameless crimes” against children, not combatants, while he called for inner strength among Muslims to eliminate the ‘malignant cancerous tumour’ from Palestine.

- Iranian Supreme Leader Khamenei's Chief of Staff said on Friday that a response to Haniyeh's assassination will come soon, according to Al Arabiya.

- Iran’s Revolutionary Guards said they arrested 12 operatives collaborating with Israel and planning actions against Iran’s security, according to SNN.

- US directly warned Israel against a full-blown war with Hezbollah, according to the FT. It was separately reported that the UN special coordinator in Lebanon said with the region on the brink of imminent catastrophe, it cannot be overstated enough that there is no military solution that will make either side safer, according to Reuters.

- Qatari Al Jazeera TV said Israeli forces stormed its bureau in West Bank’s Ramallah with a military order to close it for 45 days.

- A bomb explosion killed a police officer in the security details of foreign ambassadors in northwest Pakistan, while all foreign diplomats were safe and were reported to travel back to the capital of Islamabad.

OTHER

- Ukrainian President Zelensky thanked the military for a new attack on Russian arsenal and said the end of the war against Russia depends on the decisiveness of Ukraine’s partners, as well as noted that Ukraine’s defences would be better if its partners provided the needed weapons and permission to use them.

- Russian Defence Ministry said Russia hit Ukrainian energy facilities with high-precision weapons and drones, according to agencies.

- Russian Foreign Ministry said Moscow will take no part in the follow-up to the Swiss-organised peace summit.

- US official said Quad leaders expressed concern about the Russian-North Korean relationship, as well as about the South China Sea and maritime disputes.

EU/UK

NOTABLE HEADLINES

- French PM Barnier did not rule out a tax hike for the rich and is open to changes in pension reform with input from employers and unions, while he said they must protect France’s credibility with investors and the government will take pragmatic measures to limit immigration.

- French President’s Chief of Staff said Antoine Armand was named as Finance Minister and Jean-Noel Barrot was named as Foreign Minister, while Bruno Retailleau was named as Interior Minister.

- German Chancellor Scholz’s SPD narrowly beat the far-right AfD in elections in the eastern state of Brandenburg as exit polls showed the SPD at 31%-32% vs AfD at 29%-30%, according to BBC.

- Fitch affirmed Portugal at A- and revised the outlook to Positive.