- APAC stocks traded lower following the weak handover from the US where the tech sector led the declines.

- US President Trump said they are on time with tariffs and tariffs are going forward; also reportedly looking to tighten chip controls on China.

- EU and UK are to discuss a Europe-wide defence fund amid fear of US pullback, according to FT.

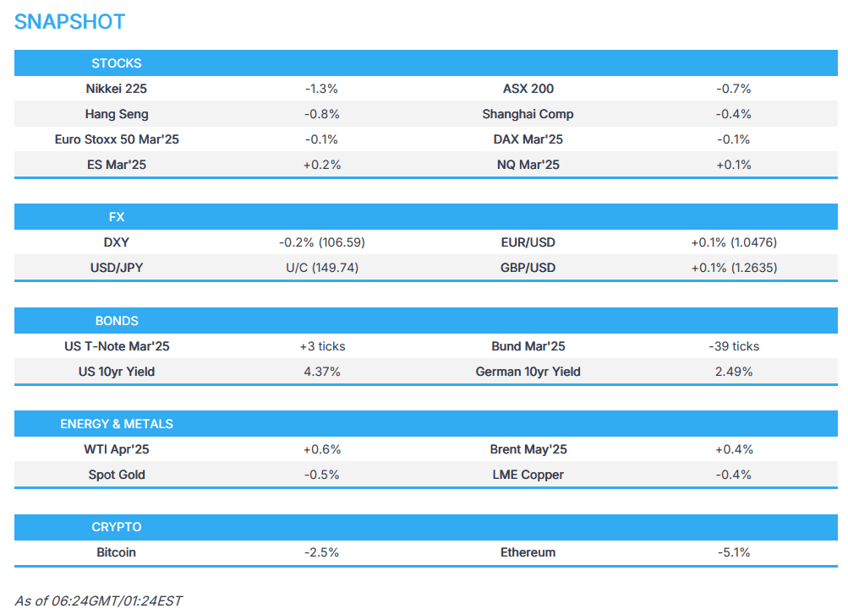

- European equity futures indicate a marginally lower cash open with Euro Stoxx 50 future down 0.1% after the cash market closed with losses of 0.4% on Monday.

- FX markets are steady with the USD mildly softer vs. peers, EUR/USD remains on a 1.05 handle and USD/JPY sub-150.

- Looking ahead, highlights include German GDP Detailed (Q4), US Consumer Confidence, Richmond Fed Index, ECB Euro Area Indicator of Negotiated Wage Rates, NBH Policy Announcement, Fed Discount Rate Minutes, RBA's Jones, Fed’s Logan, Barr, Barkin, ECB’s Schnabel & BoE’s Pill, Supply from UK, Italy & Germany.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks were mostly lower and extended on Friday losses as the pullback from recent ATHs continued, while there were few fresh drivers for the downside although the overhang of tariffs and uncertainty on geopolitics continued to weigh. Sectors were mixed as tech underperformed ahead of NVDA earnings mid-week and amid reports about Microsoft (MSFT) cancelling leases for data centres, which brought into question the large CapEx expectations from the tech sector as they look to bolster AI technology.

- SPX -0.50% at 5,983, NDX -1.21% at 21,352, DJI +0.08% at 43,461, RUT -0.78% at 2,178.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they are on time with tariffs and tariffs are going forward, while he added they are on schedule and moving along rapidly. Furthermore, he said all they want is reciprocity and the US will be liquid and rich again.

- US President Trump's team is seeking to tighten chip controls on China with the US said to be pressing Japan and Netherlands to align on China restrictions, while it is weighing tighter controls on Nvidia (NVDA) chip exports to China, as well as considering more restrictions on SMIC (981 HK) and CXMT. Furthermore, US officials reportedly met with Japanese and Dutch counterparts to restrict Tokyo Electron (8035 JT) and ASML (ASML NA) engineers from maintaining semiconductor equipment in China, according to Bloomberg.

- US lawmakers are introducing bipartisan legislation to toughen trade enforcement laws and address concerns about China's trade practices, according to Reuters.

- Mexico studies tariffs on China in a bid to strike a deal with US President Trump, while Mexican President Sheinbaum said she sees agreements with the US by Friday and that Mexican officials are in Washington studying possible China levies, according to Bloomberg.

- EU expands tariff list in US President Trump’s looming metals trade dispute.

- WTO panel is to examine measures adopted by Turkey targeting Chinese EV imports.

- French President Macron said he hoped he convinced Trump on trade and noted that they do not tariff the US, while he added that they don't need a trade war and the urgency is to increase security expenditure.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said if the administration enacts policies that drive up prices, the Fed has to take them into account by law, while he added that auto parts suppliers have expressed concerns about tariffs and before the Fed can go back to cutting rates, it needs more clarity. Furthermore, Goolsbee said the full details of the administration’s policy package are still to be determined and they have to take a wait-and-see posture.

- Elon Musk said subject to the discretion of the President, employees will be given another chance and a failure to respond a second time will result in termination.

APAC TRADE

EQUITIES

- APAC stocks traded lower following the weak handover from the US where the tech sector led the declines and risk appetite was sapped amid ongoing uncertainty surrounding tariffs and geopolitics.

- ASX 200 retreated with underperformance seen in the tech, consumer discretionary and financial sectors, while defensives showed resilience and energy was also lifted following a jump in Woodside Energy's profit.

- Nikkei 225 slumped at the open on return from the long weekend but was off worse levels as shares of Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo rallied following reports late last week that Berkshire Hathaway plans to gradually raise its investments in Japanese trading houses.

- Hang Seng and Shanghai Comp conformed to the negative mood amid headwinds from trade frictions with the US seeking to tighten chip controls on China and after the PBoC's MLF operation resulted in a net drain of CNY 200bln. Nonetheless, Chinese markets were well off today's worst levels as the heavy slump at the open spurred some dip buying.

- US equity futures (ES +0.2%) languished near the prior day's lows with the rebound contained amid light fresh catalysts.

- European equity futures indicate a marginally lower cash open with Euro Stoxx 50 futures down 0.1% after the cash market closed with losses of 0.4% on Monday.

FX

- DXY traded rangebound after ultimately recovering yesterday from initial losses as the March 4th deadline for US tariffs on Mexico and Canada approaches, while there was a lack of firm conviction amid a light calendar and ahead of PCE data later in the week, while the recent updates from the US centred around trade and geopolitics with President Trump stating that tariffs are going forward and that they're getting very close on the Ukrainian minerals deal.

- EUR/USD remained contained beneath the 1.0500 handle after fluctuating post-German election, while ING recently noted they remain reluctant to chase EUR/USD beyond 1.0500 and expect to see a return below 1.04 over the next four weeks citing the looming risk of US tariffs on the EU and the ECB's resolutely dovish stance.

- GBP/USD was uneventful after it recently stalled and pulled back from just shy of the 1.2700 handle and with BoE's Dhingra noting that taking a “gradual” approach on rates would still leave monetary policy as a drag on the economy this year.

- USD/JPY initially edged higher and briefly reclaimed the 150.00 status but then faded the gains amid the broad downbeat risk tone across the region and following Services PPI data from Japan which slightly accelerated as expected.

- Antipodeans attempted to nurse recent losses but with the rebound limited owing to the risk-off mood and quiet calendar.

- PBoC set USD/CNY mid-point at 7.1726 vs exp. 7.2530 (prev. 7.1717).

FIXED INCOME

- 10yr UST futures traded uneventfully but held on to the prior day's gains which were facilitated by a flight to safety.

- Bund futures were subdued after the recent choppy performance in the aftermath of the German election and mixed Ifo data, while participants await German GDP data and looming Bund supply.

- 10yr JGB futures resumed last Friday's advances on return from the long weekend amid softer JGB yields although price action was capped following weaker results at the enhanced liquidity auction for 20yr, 30yr & 40yr JGBs.

COMMODITIES

- Crude futures kept afloat after the prior day's gains as markets digested Iraq supply, geopolitics and fresh Iranian sanctions.

- US President Trump commented on Truth that they want the Keystone XL Pipeline built and suggested easy approvals.

- Spot gold pulled back overnight after having notched a fresh record high yesterday alongside the risk aversion.

- Copper futures were subdued owing to the downbeat mood across the Asia-Pac region although the downside was limited and there were also recent favourable forecasts by Goldman Sachs which predicts the copper market is set for a sustainable price increase with a new range projected at USD 10,500-11,500 per tonne, while it expects copper deficits of 180,000 tons in 2025 and 250,000 tons in 2026.

CRYPTO

- Bitcoin nursed losses after a heavy sell-off in the US afternoon; sits below the USD 92,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC conducted a CNY 300bln 1-year MLF operation with the rate kept at 2.00% for a net drain of CNY 200bln.

- Huawei improved production of AI chips and achieved a yield close to 40% which marks a breakthrough for China's tech goals, according to the FT.

- Bank of Korea cut its base rate by 25 basis points to 2.75%, as expected, with the rate decision unanimous and interest rates for the special loan programme were also lowered. BoK said US tariff policies, Fed policies, and stimulus measures by the Korean government are some of the uncertainties for the economy, while it noted it is necessary to remain cautious about high FX volatility. BoK Governor Rhee stated that four board members said current policy rates could be maintained for the next three months and two board members said further rate cuts are possible for the next three months, while Rhee added that the market consensus expecting two more rate cuts this year aligns closely with the central bank's views.

DATA RECAP

- Japanese Services PPI (Jan) 3.10% vs Exp. 3.10% (Prev. 2.90%, Rev. 3.00%)

GEOPOLITICS

MIDDLE EAST

- Senior Israeli official told Axios that the abductee deal is "on the verge of an explosion" against the backdrop of Israeli PM Netanyahu's decision to delay the release of the 600 Palestinian prisoners, although talks are underway to find a solution before the return of the four abductees on Thursday.

RUSSIA-UKRAINE

- US President Trump said he could end the war in Ukraine within weeks and would be willing to go to Moscow at an appropriate time but added that May 9th may be too soon for a visit and he would go to Moscow if things get settled. Furthermore, he said Ukraine's land is part of the negotiation and hopes Ukraine can take back some of its land.

- US President Trump said he emphasised the importance of the critical minerals and rare earth deal with Ukraine in meeting with French President Macron, while Trump added that he is in serious discussions with Russian President Putin about ending the war and talks are proceeding very well. Trump also said he was talking with French President Macron about trade deals at the White House and will meet with Ukrainian President Zelensky either this week or next to sign a minerals deal. Trump later said he had great conversations including with Russia on ending the Ukraine war and the meeting with French President Macron is another step forward towards ending the war.

- French President Macron said Europe is willing to step up to be a stronger partner and do more on defence, while he added that the strength of US re-engagement is a source of uncertainty for Russian President Putin and noted he is willing to provide security guarantees to Ukraine. Macron also commented after speaking with US President Trump, that they have made substantive steps forward during discussions and that Europe has invested USD 138bln in aid to Ukraine, as well as noted that a minerals deal will help guarantee Ukraine's sovereignty and that Europeans are committed, ready and aware they need to do more.

- French President Macron said they need something substantial for Ukraine and Europe, while he stated his message to US President Trump was to be careful and that they have to go fast but first need a truce in Ukraine. Macron also stated that he thinks he had a strong convergence with Trump on Ukraine and a truce could be reached in the coming weeks, as well as noted that it is feasible to establish a truce at least and start negotiating for peace. Furthermore, Macron said he is working with the UK on a UK-France proposal for presence to maintain peace with US backup and backstop, while he spoke with European leaders and that many are ready to be part of security guarantees.

- EU and UK are to discuss a Europe-wide defence fund amid fear of US pullback, according to FT. It was separately reported that Germany is discussing EUR 200B in emergency defence spending, according to Bloomberg.

- UN General Assembly adopted the amended US-drafted Ukraine resolution that backs Ukraine's sovereignty and territorial integrity, while it approved all proposed European amendments to the US-drafted resolution on Ukraine and rejected the proposed Russian amendment to the US-drafted resolution on the Ukraine war anniversary. It was later reported that Russia failed at the UN Security Council to amend the US-drafted resolution on Ukraine and vetoed a European attempt to amend the US-drafted resolution on Ukraine, while the UN Security Council adopted the US-drafted resolution on Ukraine.

- Russian President Putin held a meeting on rare earth metals and said Russia would be ready to offer joint work to US public and private entities, while he added that Trump's position is not in Russia's interests and is in Ukraine's interests. Putin also said Russia and the US could consider working together on aluminium production and could think of a joint project with the US in Russia.

- Poland scrambled aircraft to ensure airspace security after Russia launched strikes on Ukraine, while all of Ukraine was reportedly under air raid alerts as the air force warned of Russian missile attacks.

EU/UK

NOTABLE HEADLINES

- BoE's Dhingra said they are already at a high level of monetary policy restrictiveness and that medium-term inflation pressures are easing. Dhingra added that food prices are ticking up, but they are not seeing the same rise in import costs as before. Furthermore, she said everyone on the MPC has a different definition of the pace of rate cuts implied by "gradual" and her definition of gradual rate cuts does not mean 25bps per quarter, while she added if you cut rates by 25bps at a quarterly pace, you will still be in restrictive territory all of this year.