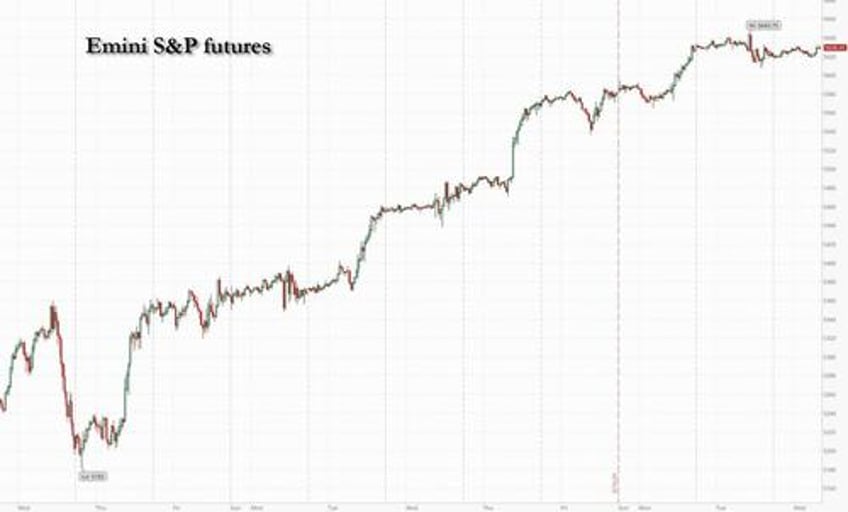

Global markets and US equity futures rose as investors awaited the annual BLS payrolls revisions - where as many as 1 million jobs can be eliminated - due at 10am ET, as well as the FOMC meeting minutes for further clues on interest rate cuts. US equity futures pointed to small moves at the Wall Street open as Europe’s Stoxx 600 edged 0.2% higher amid thin volumes while Asian stocks snapped a 3-day winning spree. As of 7:45am S&P futures were up 0.2% at 5,629 having fully recovered from the early August swoon; Nasdaq futures also gained 0.2%. The yield on 10-year Treasuries was steady at 3.81%, while the dollar paused a three-day run of declines. Oil was flat, halting the recent rout.

In premarket trading, technology stocks dipped on concerns over the country’s consumption outlook, Walmart’s planned sale of its stake in JD.com Inc. and poor earnings from key players including Kuaishou Technology. JD.com ADRs dropped 7% after Walmart raised about $3.6 billion by selling its stake in the Chinese e-commerce firm. Macy’s fell 7% after slightly missing analysts’ estimates for its quarterly revenue and lowering its outlook for sales during the rest of the year, while Target rose 12% after ending a string of sales declines in the 2Q, citing improved discretionary spending. Here are some other notable premarket movers:

- Arch Resources gains 3% after agreeing to be bought by Consol Energy (CEIX) for $2.3 billion as the transition to greener fuels threatens the industry’s long-term outlook.

- BigBear.ai surges 26% after the artificial intelligence software developer said it received an award as a subcontractor to Concept Solutions.

- Keysight Technologies rises 12% after the measurement instruments company issued a 4Q forecast range with a midpoint that came in ahead of the analyst consensus.

- Macy’s falls 7% after slightly missing analysts’ estimates for its quarterly revenue and lowering its outlook for sales during the rest of the year.

- Stronghold Digital Mining soars 60% after Bitfarms Ltd. agreed to acquire the company.

- Vector Group gains 7% after the discount cigarette maker agreed to be acquired by JT Group for about $2.4 billion.

Today's main event is the annual payrolls revision where Goldman and Wells Fargo economists expect the government’s preliminary benchmark revisions on Wednesday to show payrolls growth in the year through March was at least 600,000 weaker than currently estimated. While JPMorgan forecasters see a decline of about 360,000, Goldman indicates it could be as large as a million. Investors will also be watching the latest FOMC minutes for further clues on the Fed's September rate cut.

Beyond today's FOMC minutes, anticipation is mounting before Fed Chair Jerome Powell’s Jackson Hole speech at the end of the week that could decide whether the market rebound has further to run. As traders look to Wednesday’s payrolls revisions, there’s concern signs of excessive weakness will revive fears the Fed is behind the curve on lowering rates.

“Given that the US labor market is at the center of the Fed’s policy, the publication is of unusually high interest,” said Amanda Sundstrom, interim chief strategist for Norway at SEB AB. “A large downward revision in the number of new jobs created could add new fuel to concerns that the Fed has waited too long to cut interest rates.”

A lot of Fed-related negatives appear to be priced in already as the US rates market prices in almost 100 basis points of cuts this year, he said. Gold held steady near a record high after the dollar’s recent run of losses. A weaker greenback typically aids gold as it is priced in the US currency.

European stocks make modest but broad gains as miners outperform. Basic resources is the strongest-performing sector, while energy is the biggest laggard. The Stoxx 600 Europe index is up 0.4% near session highs. Here are some of the biggest European movers on Wednesday:

- European miners are outperforming as iron ore rises for a third straight session. The commodity recovered more of its 9% plunge last week on signs Chinese authorities will take further steps to revive the country’s moribund property market.

- Biggest gainers by points are Rio Tinto (+2.2%), Anglo American (+1.9%), Glencore (+2.1%), Antofagasta (+2.0%) and steelmaker ArcelorMittal (+1.5%)

- Demant gains as much as 4.9%, its biggest advance since February, after Morgan Stanley double-upgrades the stock to overweight from underweight. Broker says the current “extreme” valuation levels provide an attractive entry point for the Danish hearing-aid company.

- Mobico shares rise as much as 19%, the most since March 2022, after the passenger transportation company reported first-half results and reiterated profit guidance. Analysts note that the sale of Mobico’s American school bus business is underway, which could be a positive catalyst for the stock.

- Elementis shares rise as much as 4.7% as the British specialty chemicals firm gets an upgrade to overweight from Barclays, which sees further upside from the strategic review of Talc business and sets price target for the stock at Street high.

- Alcon’s shares fall as much as 3.3% in Zurich after the Swiss eye-care products maker’s second-quarter sales undershot expectations. Analysts pointed to weakness in the vision care segment after a supplier-related quality issue affected its operating margin.

- Sonova shares drop as much as 4% after Morgan Stanley downgraded its recommendation on the hearing-aids maker to underweight from equal-weight, noting the “all-time high” valuation compared with Demant and other peers.

- Grieg Seafood declines as much as 16%, the most since September 2022, after the Norwegian seafood and salmon farming firm reported an operational loss for the second quarter of NOK35m, in stark contrast with an expected profit of NOK132m.

- SoftwareOne shares fall as much as 5.2% to the lowest since May after the Swiss IT service provider reported a first-half adjusted Ebitda miss, cut its full-year revenue guidance and said it was in talks about a potential sale. Baader sees an improvement in coming quarters despite the weaker-than-expected second-quarter results.

Meanwhile, stocks in Asia snapped a three-day winning streak, dragged down by Chinese stocks in Hong Kong. The MSCI Asia Pacific Index dropped as much as 0.7%, after gaining nearly 4% over the previous three sessions. The biggest contributors to the gauge’s slide included TSMC, Commonwealth Bank and JD.com. Hong Kong was among the worst-performing markets in the region, with JD.com leading a rout in the tech sector on Walmart’s sale of its stake in the Chinese e-commerce company. Kuaishou Technology also tumbled, after reporting mixed earnings.

In FX, the dollar rises 0.1%, snapping a three-day decline. The Japanese yen is the weakest of the G-10 currencies, falling 0.5% against the greenback. British pound holds above $1.30. Rate-cut bets have driven a bout of dollar weakness, but the US currency halted the slide on Wednesday on speculation the drop may be overdone. “The dollar selloff is taking a breather given the speed of recent losses,” said Valentin Marinov, a Credit Agricole strategist in London.

In rates, treasuries are slightly cheaper across the curve, erasing a portion of Tuesday’s gains, as investors look ahead to the release at 10am New York time of revisions to US labor-market data. US session also includes 20-year bond auction at 1pm. Treasury yields cheaper by about 2bps across the curve with 10-year around 3.81%; bunds in the sector trade keep pace with Treasuries while gilts outperform by around 1bp. Most curve spreads are within 1bp of Tuesday’s close, which saw 2s10s steepen as additional Fed easing was priced into swaps; around 97bp remains priced in over the year’s three remaining policy meetings. Treasury issuance resumes at 1pm with $16 billion 20-year new-issue auction; WI yield is around 4.180%, 28.6bp richer than last month’s sale.

In commodities, oil prices advance, with WTI rising 0.4% to trade near $73.50. Gold held steady at $2,512/oz near a record high after the dollar’s recent run of losses. A weaker greenback typically aids gold as it is priced in the US currency.

Bitcoin is steady and holds just beneath USD 60k; Ethereum briefly topped USD 2.6k, but has since slipped below the level. Mt.Gox transferred USD 75mln in Bitcoin to BitStamp, according to Arkham cited by Block Pro.

Looking at today's calendar, US economic data calendar only includes the BLS payroll revisions which will be closely watched to see just how many jobs are wiped out from the historical record. The Fed speaker slate is empty with the July FOMC meeting minutes release at 2pm.

Market Snapshot

- S&P 500 futures little changed at 5,620.00

- STOXX Europe 600 up 0.1% to 513.02

- MXAP down 0.5% to 184.20

- MXAPJ down 0.5% to 572.68

- Nikkei down 0.3% to 37,951.80

- Topix down 0.2% to 2,664.86

- Hang Seng Index down 0.7% to 17,391.01

- Shanghai Composite down 0.4% to 2,856.58

- Sensex little changed at 80,791.00

- Australia S&P/ASX 200 up 0.2% to 8,010.50

- Kospi up 0.2% to 2,701.13

- German 10Y yield little changed at 2.22%

- Euro down 0.1% to $1.1117

- Brent Futures little changed at $77.24/bbl

- Gold spot down 0.2% to $2,509.31

- US Dollar Index little changed at 101.53

Top Overnight News

- Bond traders are taking on a record amount of risk as they bet big on a Treasury market rally fueled by expectations the Federal Reserve will embark on its first interest-rate cut in more than four years.

- China set its daily reference rate for the yuan broadly in line with expectations for the first time in more than a year, signaling its comfort with current currency levels following a rebound.

- US job growth in the year through March was likely far less robust than initially estimated, which risks fueling concerns that the Federal Reserve is falling further behind the curve to lower interest rates.

- Russian air defenses shot down 10 drones approaching Moscow in what Mayor Sergei Sobyanin called one of the largest attacks on the capital since the beginning of the war on Ukraine.

- Barack and Michelle Obama delivered blistering critiques of Republican nominee Donald Trump while painting Vice President Kamala Harris as the heir of their historic political legacy in addresses that capped the second night of the Democratic National Convention.

- A signal from the Bitcoin derivatives market points to the growing risk of a “short squeeze” that can stoke sharp rallies in the largest digital asset, according to cryptocurrency specialist K33 Research.

A more detailed look at global markets courtesy of newsquawk

APAC stocks were subdued following the lacklustre performance stateside where the major indices traded sideways and finished with mild losses amid the absence of macro drivers ahead of the FOMC Minutes. ASX 200 declined amid a deluge of earnings with underperformance in energy following a retreat in oil prices and with Santos shares pressured after it reported an 18% drop in H1 underlying profit. Nikkei 225 slumped at the open amid pressure from recent currency strength but is off worst levels. Hang Seng and Shanghai Comp. retreated with the former ragged lower by tech weakness as JD.com suffered a double-digit drop after reports Walmart is seeking to offload its USD 3.5bln stake in the Co. However, the losses in the mainland are limited following the PBoC's firm liquidity effort.

Top Asian News

- China Automobile Manufacturers Association firmly opposes the EU Commission's final draft on high tariffs on Chinese-made electric vehicles and said the tariff decision brings enormous risks and uncertainty for Chinese firms’ operations and investment in the EU, according to CCTV.

- Chinese Commerce Ministry launched an anti-subsidy investigation into dairy products imported from the EU from August 21st; dairy product probe includes Ireland, Austria, Italy, Belgium and Finland.

- China Financial Regulator Official says will strengthen supervision of the behaviour of major shareholders of small and medium size financial institutions.

- Chinese Chamber of Commerce for Machinery and Electronics says China will continue to respond on behalf of China's EV industry and will resolutely defend the rights of their firms through various means.

- Xiaomi (1810 HK) Q2 (CNY): Revenue 88.9bln (85.8bln), Adj. Net 6.2bln (exp. 4.8bln), Repurchase programme of HKD 10bln; June MAUs reached another record high at 675.8mln.

European bourses, Stoxx 600 (+0.2%) are mostly firmer, in contrast to a largely subdued APAC session overnight. European sectors are mixed and with the breadth of the market fairly narrow. Basic Resources takes the top spot, benefiting from gains in underlying metals prices. Energy is found at the foot of the pile, hampered by losses in the crude complex. US Equity Futures (ES U/C, NQ U/C, RTY +0.3%) are flat/firmer, finding its footing following the modest pressure seen in the prior session. There are two notable releases on the docket for today; US Payrolls Revisions and the FOMC Minutes thereafter.

Top European news

- UK Chancellor Reeves plans to increase social housing rents by more than inflation for the next 10 years to boost the building of affordable homes, according to FT.

FX

- DXY is sitting just above the 101.50 mark with the USD mostly marginally firmer vs peers. US payrolls revisions will be in focus today with Goldman Sachs suggesting that the data series in the year to March could be revised lower by as much as 1 million, a potential driver for Dollar selling.

- EUR is trivially lower vs. the USD but still holding onto a 1.11 handle. The next upside target for EUR/USD comes via the December 2023 high at 1.1139.

- GBP is marginally softer vs. the USD but with Cable still maintaining its position on a 1.30 handle.

- JPY is the laggard across the majors with not much in the way of fresh fundamental drivers. USD/JPY still has some way to go before approaching yesterday's 147.34 peak.

- Antipodeans are both a touch softer vs. the USD in quiet newsflow after a recent run of gains. AUD/USD has maintained a footing on the 0.67 handle.

- PBoC set USD/CNY mid-point at 7.1307 vs exp. 7.1303 (prev. 7.1325).

Fixed Income

- USTs are unchanged ahead of payroll revisions, and within a six tick range and holding in proximity to Tuesday's 113-20 peak. Significant downward revisions could spark a dovish move as it adds to the factors in favour of the Fed commencing the easing cycle in September.

- Bunds are slightly softer after being the relative outperformer in Tuesday's European session. Currently holding just above the 134.50 mark with a double-bottom from Monday/Tuesday at 134.09 providing near-term support. Bunds were unreactive to the German 2034 auction.

- Gilts are flat and pivoting the 100.00 mark. No real move to the morning's PSNB release or the region's auction.

- UK sells GBP 3.75bln 3.75% 2027 Gilt: b/c 3.33x (prev. 3.26x), average yield 4.068% (prev. 4.441%) & tail 0.3bps (prev. 0.4bps)

- Germany sells EUR 3.67bln vs exp. EUR 4.5bln 2.60% 2034 Bund: b/c 2.0x (prev. 1.8x), average yield 2.22% (prev. 2.43%), retention 18.44% (prev. 17.16%).

Commodities

- Crude is flat/choppy start to the European session following a subdued APAC trade after recent declines amid China demand concerns and Gaza ceasefire efforts, while the latest private sector inventory data showed a surprise build in headline crude stockpiles. Brent Oct in a USD 76.95-77.46/bbl parameter.

- Mixed/uneventful trade across precious metals with the complex taking a breather following yesterday's price action. XAU within a tight USD 2,507-519/oz range.

- Base metals are mostly firmer but to varying degrees despite the firmer Dollar and tentative risk tone.

- ANZ Research sees Gold price to hit fresh highs to USD 2550/oz later this year.

- Earthquake of magnitude 5.58 strikes the Jujuy province in Argentina, according to GFZ.

- US Private Inventory Data (bbls): Crude +0.3mln (exp. -2.7mln), Distillate -2.2mln (exp. -0.2mln), Gasoline -1.0mln (exp. -0.9mln), Cushing -0.6mln.

Geopolitics - Middle East

- "Israel Broadcasting Corporation: The meeting between Blinken and Netanyahu did not succeed in reducing the gaps and did not make progress on the deal", according to Al Jazeera"Differences on outstanding issues have not been resolved despite optimistic US statements".

- Israeli raids were reported on towns in Baalbek, eastern Lebanon, while Hezbollah said it confronted an Israeli warplane that violated Lebanese airspace in the southern region with a surface-to-air missile, according to Sky News Arabia. Furthermore, Lebanese media reported that 4 people were killed and 10 others wounded in Israeli raids on the Bekaa region.

- Islamic Resistance in Iraq said it attacked a vital target in Eilat, according to Al Jazeera.

- A deal to bring an end to the fighting in Gaza was said to be on the brink of collapsing and there is no clear immediate alternative agreement that could be put forward in its place, according to two US and two Israeli officials cited by POLITICO.

- Israeli PM Netanyahu met with Finance Minister Smotrich over the past two days to convince him to support the hostage deal, according to sources cited by Walla News.

- Hamas refuted US President Biden's claim that it is backing away from a Gaza ceasefire and hostages deal, while it insisted that the US is yielding to Israel's interests in negotiations, according to FT.

- US Secretary of State Blinken said they need to get a ceasefire and hostage release agreement over the finish line now, while he said they will do everything possible over the coming days to get Hamas on board with the bridge proposal.

- UK Foreign Secretary Lammy said he spoke with US Secretary of State Blinken to discuss the ongoing Gaza ceasefire negotiations, while he added that an immediate cessation of fighting in Gaza and release of all hostages is vital.

- Qatari Foreign Minister told US Secretary of State Blinken that Qatar is committed to its mediating role with Egypt and the US to end the war in Gaza.

Geopolitics - Ukraine

- Russian air defences repelled a Ukraine drone attack on Moscow, according to the Moscow Mayor.

- Russia's foreign intelligence agency said, without providing evidence, that Ukraine's incursion into Kursk was prepared with the participation of the US, UK, and Poland, while it added that NATO advisers are providing assistance to Ukraine in its incursion into Kursk, according to TASS.

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications, prior 16.8%

- 10:00: BLS releases preliminary annual payrolls benchmark revision

- 14:00: July FOMC Meeting Minutes

Central Banks

- 14:00: July FOMC Meeting Minutes

DB's Jim Reid concludes the overnight wrap

After a significant rally for risk assets, the market advance finally came to a halt over the last 24 hours, with the S&P 500 (-0.20%) falling back after its longest run of gains so far this year. There wasn’t an obvious catalyst, and the index was little changed on the day, but it was always going to be tough to sustain such a long run of gains, and several risks are now coming into focus again. In particular, today will bring the preliminary benchmark revision to US nonfarm payrolls, and given the recent jobs report, there’s quite a bit of concern this will show a weaker labour market than previously thought.

The revisions are happening because each year, the payroll numbers are benchmarked against the Quarterly Census of Employment and Wages (QCEW) for March. At the last QCEW, employment growth through end 2023 was running at +1.5%, which was beneath the +2.0% year-on-year growth in nonfarm payrolls. So that points to a downward revision in the payroll numbers. However, the important thing to note, whatever the numbers show today, is that these revisions would only affect the numbers up to the March payrolls, and don’t cover the job gains since. And ultimately, it’s those more recent numbers that really matter for the Fed and the pace of any future rate cuts.

With those revisions in focus, a more risk-off tone prevailed yesterday, and investors moved to raise the probability that the Fed will start cutting rates with a 50bp move in September. Indeed by the close, futures had increased the likelihood of a 50bp cut to 34%, up from 24% the previous day. That narrative also got a further boost from the latest Canadian CPI data, which showed that core inflation was weaker than expected in July. Specifically, the median core measure was down to +2.4% (vs. +2.5% expected), and the trim core measure was down to +2.7% (vs. +2.8% expected). In turn, that led to growing confidence that the Bank of Canada were on course to deliver another rate cut in September, and yields on 10yr Canadian government bonds were down -5.8bps.

That dovish narrative was evident elsewhere, as Sweden’s Riksbank had already cut their policy rate yesterday morning by 25bps to 3.5%. The move was in line with expectations, but they also said in their statement that if the inflation outlook was unchanged, then “the policy rate can be cut two or three more times this year.” That’s their second rate cut this year, and it adds to the signs that the global monetary policy cycle has now turned, with most of the major central banks now either cutting rates or moving closer towards cuts (with the notable exception of the Bank of Japan).

All these developments supported a sizeable bond rally on both sides of the Atlantic. In the US, it saw the 10yr Treasury yield fall by -6.4bps to 3.81%, and the 30yr yield (-6.2bps) fell to a YTD low of 4.06%. That marked the largest decline for both since the July payrolls release on August 2 and leaves the 10yr yield not far away from its recent closing low of 3.79% on August 5. And with investors dialling up the likelihood of a 50bp cut, the 2yr yield came down by an even larger -8.2bps to 3.99%. That helped the US Dollar to weaken further, pushing the dollar index (-0.44%) to its lowest level since December. Meanwhile in Europe, yields on 10yr bunds (-3.2bps), OATs (-2.4bps) and BTPs (-2.3bps) all saw a smaller decline, whilst the Euro closed at its highest level so far this year, at $1.1130.

When it came to equities, the relentless rally over recent sessions finally ran out of steam, and the S&P 500 (-0.20%) had a small decline. On a sectoral basis, the biggest underperformer were energy stocks (-2.65%), which lost ground as oil prices fell for the 5th time in the last 6 sessions, and Brent crude (-0.59%) closed at a two-week low of $77.20/bbl. The Magnificent 7 (-0.33%) were weighed down by a -2.12% decline for Nvidia, which also saw the Philadelphia Semiconductor Index fall -1.33% on the day. There were also broader elements of softness, with the equal weighted S&P 500 down -0.42% and the small-cap Russell 2000 (-1.17%) underperforming.

That weakness was clear amongst other risk assets, and the VIX Index of volatility (+1.23pts) ticked up to 15.88pts, ending a run of 5 consecutive declines. Similarly, US IG spreads were up +2bps to 97bps, which is their biggest daily move wider in the last two weeks, whilst US HY spreads widened by +6bps to 318bps. Over in Europe it was much the same story, with the DAX (-0.35%) finally ending a run of 10 consecutive daily gains, and the broader STOXX 600 (-0.45%) also lost ground.

Many of those themes have continued in Asian markets overnight, with losses across the major equity indices. In Hong Kong, the Hang Seng (-0.95%) is the biggest underperformer, having been pulled lower by JD.com (-10.25%). That comes as several outlets including Bloomberg have said that Walmart are selling their stake in the firm. Other indices also fell back, with losses for the Shanghai Comp (-0.39%), the CSI 300 (-0.10%), the Nikkei (-0.33%) and the KOSPI (-0.05%). However, US and European equity futures are now pointing to gains, with those on the S&P 500 (+0.12%) and the STOXX 50 (+0.14%) both higher this morning.

Overnight, we’ve also had the latest data on Japan’s trade balance, which showed that export growth accelerated up to +10.3% year-on-year (vs. +11.5% expected), whilst imports were up by +16.6% (vs. +14.6% expected), which is the fastest growth for imports since January 2023. Yesterday however, there wasn’t much data of note, although the final release for Euro Area inflation in July was confirmed at +2.6%, in line with the flash estimate. Similarly, the core inflation reading was unchanged at +2.9%. In Germany, we had the latest PPI reading for July, which came in at -0.8% year-on-year as expected. It was also the highest reading since June 2023, after falling as low as -9.1% in September 2023.

To the day ahead now, and data releases include the UK public finances for July, whilst in the US, the Bureau of Labor Statistics will release the preliminary estimate of the annual benchmark revision to payrolls. From central banks, we’ll get the minutes from the FOMC’s July meeting and hear from the ECB’s Panetta. Finally, today’s earnings releases include Target.