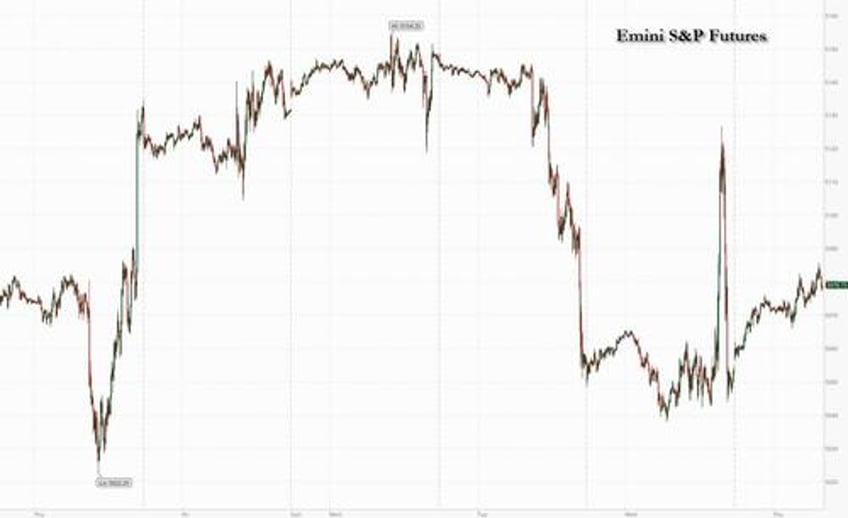

After a bizarre reversal when US stocks first slumped and then dumped after Powell's very dovish FOMC statement and press conference, US equity futures have regained their footing this morning and advanced as traders took comfort from the Fed’s signal that there’s no plan to raise interest rates and looked ahead to Apple’s earnings after the close. As of 7:40am, S&P 500 contracts climbed 0.7%, while Nasdaq 100 contracts add 0.9% with Apple, Amazon.com and Nvidia all posting small gains in pre-market trading.

The yen was the center of attention in foreign exchange, after what appeared to be another intervention by Japanese authorities to support the currency.

Treasuries extended gains following the dovish remarks from Powell, which coupled with the Fed tapering QT by more than expected, soothed fears of a rate hike. Traders now turn their attention to a string of US data, including jobless claims and factory orders on Thursday and the nonfarm payrolls report on Friday. The dollar eased against most Group-of-10 currencies with the yen the notable outlier. Oil prices advance, with WTI rising 1% to trade near $79.80. Spot gold falls 0.7%.

In premarket trading, used-car retailer Carvana soared 35% after the car retailer reported a surprise profit, even as the US consumer is increasingly squeezed. DoorDash tumbled 11% after the food-delivery company gave a forecast for adjusted Ebitda that trailed the average analyst estimate at the midpoint. Freshworks crashed 26% after the application software company cut its full-year revenue forecast and announced a CEO transition. Here are some other notable premarket movers:

American International Group (AIG) gains 2% after reporting profit above analysts’ estimates in the first quarter.

- Aspen Aerogels (ASPN) soars 27% after the insulation products provider reported a narrower loss per share for the first quarter and boosted its 2024 revenue guidance.

- Carvana (CVNA) soars 35% after the car retailer reported a surprise profit.

- DoorDash (DASH) falls 11% after the food-delivery company gave a forecast for adjusted Ebitda that trailed the average analyst estimate at the midpoint.

- Emergent BioSolutions soars 58% after the company’s first-quarter earnings-per-share report bucked analysts’ expectations of a loss. The drugmaker also announced job cuts.

- Enovix jumps 26% after the maker of lithium-ion batteries posted 1Q revenue that topped estimates and said it reached a development agreement with a smartphone original equipment manufacturer.

- Freshworks falls 26% after the application software company cut its full-year revenue forecast and announced a CEO transition.

- Novocure gains 9% after the oncology therapy company reported net revenue for the first quarter that beat the average analyst estimate.

- Peloton gains 9% as Chief Executive Officer Barry McCarthy is stepping down from the role and the company plans to cut about 15% of its global workforce.

- Qorvo drops 11% after the chipmaker forecast adjusted EPS and revenue for the fiscal first quarter that trailed the average analyst estimate.

- Rush Street climbs 17% after the online casino and sports betting company boosted its full-year revenue and adjusted Ebitda targets after its first quarter results handily topped expectations.

- Wolfspeed falls 10% after the semiconductor device company gave an outlook that is seen as weak, prompting at least two downgrades.

After a inexplicable swoon in the last 30 minutes of trading on Wednesday, when all the post-dovish FOMC gains were promptly erased, markets celebrated the fact that the Fed struck a more dovish note than some had expected, even after a slew of statistics pointed to sticky inflation pressures. Chair Powell said it’s unlikely the central bank’s next move would be to raise rates, saying authorities would need to see persuasive evidence that policy isn’t tight enough to bring inflation back toward the 2% target.

“All in all, it’s a bull message for markets,” said Benjamin Melman, chief investment officer at Edmond de Rothschild Asset Management. “We’ve got the confirmation that Powell doesn’t want to raise rates.”

Further insight into the health of the US economy will come from initial jobless claims and factory orders on Thursday, though the main focus will be April non-farm payrolls data due at the end of the week. A Bloomberg Economics model points to an unchanged unemployment rate of 3.8%. That suggests “hiring likely remains too hot for the Fed,” economists Andrej Sokol and Scott Johnson wrote in a note.

Additionally, Apple’s earnings, which are due after the US market closes, will give investors a better sense of how the iPhone maker is weathering a sales slump, due in part to a sluggish China market.

“Earnings are looking quite resilient, quite constructive on the equities side,” John Woods, CIO for Asia Pacific at Lombard Odier, said in an interview on Bloomberg Television. “It’s overwhelmingly a US story for now.”

In Europe, stocks had small moves amid mixed company reports with the Stoxx 600 down 0.3%. Novo Nordisk drops on disappointing results and Moller-Maersk, a bellwether for global trade, also retreats. Shell Plc advanced after the energy producer posted a profit beat and announced a $3.5 billion share buyback. Here are the biggest movers Thursday:

- GN Store Nord gains as much as 15% after the Danish hearing-aid and audio equipment firm’s first-quarter growth and most other metric beat expectations in an “impressive” print

- Standard Chartered jumps as much as 7.2% after the bank delivered a big beat across the board in the first quarter, driven by strong results from its trading and wealth divisions

- Teleperformance surges as much as 19% after the French call-center operator reported stronger-than-expected organic sales growth in the first quarter, while maintaining guidance

- Bayer jumps as much as 5.4% after it persuaded a US court to throw out a $185m award to three persons who blamed exposure to the firm’s toxic chemicals for their brain injuries

- Worldline shares gain as much as 8.9% after the payments firm reported stronger-than-expected organic revenue growth in 1Q, with results offereing some reassurance after a growth slowdown

- Pandora shares rise as much as 7.1%, the most in six months, after the Danish jewelery company beat expectations in the first quarter and raised its sales guidance

- Novo Nordisk falls as much as 3.6% in Copenhagen after the Danish drugmaker reported first-quarter results that included weaker-than-expected sales for its Wegovy weight-loss drug

- Maersk falls as much as 5.6% after the Danish shipping giant reported earnings DNB says were weighed down by a poor outlook and higher expectations than sell-side consensus accounted for

- Vestas shares drop as much as 5.5%, the most in seven months, after the Danish wind turbine maker posted an unexpected loss in the first-quarter on back of a sharp decline in orders

- Hiscox falls as much as 4.2% after first-quarter earnings, with analysts noting further growth headwinds and uncertainty around Baltimore losses, with RBC noting further headwinds in 2024

- Cargotec drops as much as 4.9%, with an upgrade by analysts at Carnegie not enough to stoke a longer rally for the Finnish crane and cargo-handling equipment firm after its record earnings

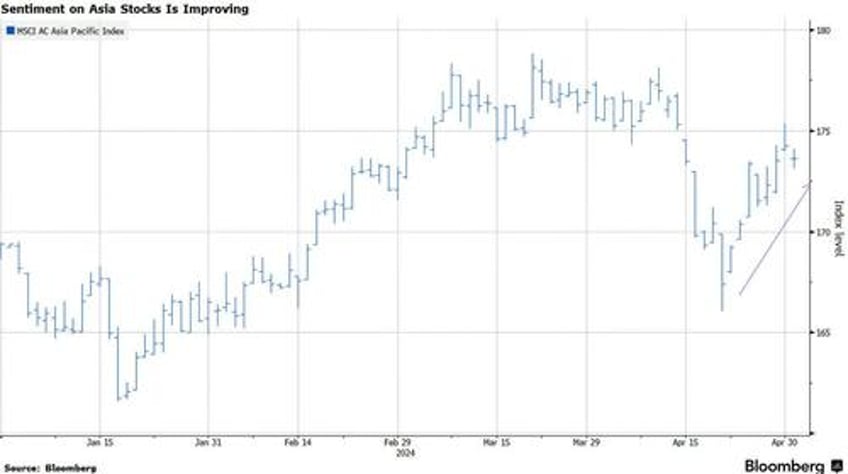

Earlier in the session, the MSCI Asia Pacific Index climbed as much as 0.9%, with Tencent and Meituan among the biggest contributors. Key indexes in Hong Kong surged more than 2%, with the Hang Seng Index on track to enter a bull market, in a sign that global funds are trickling back into the market. Hong Kong’s currency peg to the greenback is burnishing its haven appeal amid the threat of higher-for-longer US interest rates. Stocks rose in Singapore and Australia, while Taiwanese and South Korean benchmarks traded lower. Japanese stocks fluctuated with the yen amid speculation authorities intervened for a second time this week to support the currency.

“The continued easing bias by the Fed is a welcome development for Asian risk assets,” said David Chao, a strategist at Invesco Asset Management in Singapore. “Global growth, led by the US, appears to be reaccelerating, which is positive for the Asian economies and markets.”

Thursday’s gain pushes the MSCI Asia gauge into the green for May after it dropped 1.5% in April amid worries about higher-for-longer interest rates. A world-beating rally in Hong Kong, helped by mainland Chinese investors, has supported a rebound in the broader Asia index in the past couple of weeks.

In FX, the Bloomberg dollar index dipped while the Swiss franc topped the G-10 FX pile, rising 0.4% versus the greenback after CPI jumped more than economists anticipated to a four-month high. The yen fell as much as 1.1% to 156.28 per dollar after a surge in late New York trade fueled speculation Japanese authorities had once again intervened in the market; Japan’s top currency official Masato Kanda had nothing to say on whether authorities intervened in the foreign currency market after the yen sharply strengthened against the dollar. Tehe USDJPY was last seen trading down to 154.82.

“USD positioning remains a key concern, especially after intervention of this scale, and so further bouts of BOJ action could trigger a deeper flush through the recent 154.50-155.00 area,” Richard Franulovich, head of FX strategy at Westpac, wrote in a note. “However, the 152.00-153.00 area should provide another strong support zone for repositioning basis the underlying fundamental divergence”

In rates, treasuries are richer across the curve, supported by gains seen in European rates as Wednesday’s Fed policy meeting continues to be digested by investors, along with volatility in currencies after Bank of Japan accounts suggested authorities likely intervened in the currency market for possibly the second time this week. Treasury yields richer by 1.5bp to 3bp across the curve with gains led by belly, extending Wednesday’s steepening move in the 5s30s spread by around 2bp, topping through 12bp; 10-year yields around 4.60%, richer by 3bp on the day with bunds outperforming by 1.5bp. Bunds and gilts outperform as they catch up with Wednesday’s post-Fed rally in US government bonds. The US session focus includes jobless claims and factory orders.

In commodities, oil clawed back losses from Wednesday and gold advanced.

Bitcoin finds some reprieve following the FOMC, and currently sits just under USD 58k.

Looking ahead, US economic data slate includes April Challenger jobs cuts (7:30am), 1Q unit labor costs, initial jobless claims, March trade balance (8:30am), factory orders, durable good orders (10am). Fed members’ scheduled speeches resume Friday with Goolsbee and Williams at a panel event

Market Snapshot

- S&P 500 futures up 0.6% to 5,077.50

- STOXX Europe 600 down 0.1% to 503.71

- MXAP up 0.9% to 175.18

- MXAPJ up 0.6% to 541.42

- Nikkei little changed at 38,236.07

- Topix little changed at 2,728.53

- Hang Seng Index up 2.5% to 18,207.13

- Shanghai Composite down 0.3% to 3,104.82

- Sensex up 0.3% to 74,702.33

- Australia S&P/ASX 200 up 0.2% to 7,586.97

- Kospi down 0.3% to 2,683.65

- German 10Y yield little changed at 2.55%

- Euro little changed at $1.0702

- Brent Futures up 0.7% to $84.06/bbl

- Gold spot down 0.6% to $2,305.54

- US Dollar Index little changed at 105.76

Top Overnight News

- The yen reversed much of its gains after spiking more than 3% in the last hour of New York trading. The BOJ’s accounts point to another round of intervention totaling about ¥3.5 trillion ($22.6 billion). The currency may weaken to 165 as official buying will only work if coordinated with the US. US officials may resort to more “specific” and “public” rhetoric to help stabilize the yen, Jim O’Neill said. The risk of more intervention over the long weekend is forcing Tokyo FX traders to plan on remaining at their desks. Japanese markets are closed tomorrow and Monday. BBG

- US reportedly discussed finalizing bank capital rules as soon as August, while the Fed, FDIC, and OCC won't completely redo the July 2023 proposal, according to Bloomberg. BBG

- Chinese property stocks extended their gains on Thurs after gov’t officials signal additional policies will be forthcoming to bolster the industry. RTRS

- A group of Midwestern Senate Democrats, joined by Majority Leader Chuck Schumer, are urging the Biden administration to raise tariffs on China, warning that any cuts to Trump-era duties could hurt U.S. workers — and, implicitly, give the former president an electoral attack line on Democrats. Politico

- Huawei is secretly funding cutting-edge research at American universities including Harvard through an independent Washington-based foundation. The Chinese giant, which is blacklisted by the US, is the sole funder of a research competition that has awarded millions of dollars to scientists around the world, including from universities that ban researchers from working with the company, according to documents and people familiar. BBG

- Swiss CPI for Apr jumps by more than anticipated, coming in at +1.4% (up from +1.1% in Mar and above the Street’s +1.1% forecast). BBG

- The world economic outlook is perking up as growth proves more resilient and inflation is set to cool faster than previously expected in many countries, the OECD said. It raised its 2024 global GDP forecast to 3.2% from 2.9% in February, with notable improvements in its expectations for the US, China and India. BBG

- Yemen’s Iranian-backed Houthis are threatening merchant ships hundreds of miles out in the Indian Ocean after striking a container vessel well beyond the Red Sea last week, maritime officials and experts have warned. FT

- TSLA's move this week to lay off much of the team responsible for creating the largest and most successful electric-vehicle charging network in the U.S. threw the industry into a state of shock and confusion. WSJ

- Exxon Mobil is set to close its $60 billion megadeal for Pioneer Natural Resources following an agreement with antitrust enforcers not to add former Pioneer Chief Executive Officer Scott Sheffield to its board of directors, according to people familiar with the matter. WSJ

Earnings

- Qualcomm (QCOM) Q2 2024 (USD): Adj. EPS 2.44 (exp. 2.32), Revenue 9.39bln (exp. 9.34bln). QCT revenue USD 8.03bln (exp. 8.01bln). Internet of Things revenue USD 1.24bln (exp. 1.25bln). Guides Q3 Adj. EPS USD 2.15-2.35 (exp. 2.16). Guides Q3 rev. USD 8.8bln-9.6bln (exp. 9.08bln). +4.70% in pre-market trade

- DoorDash (DASH) Reported Q1 EPS of -0.06 (exp. -0.04), Q1 revenue of USD 2.51bln (exp. 2.45bln); Q1 total orders +21% to 620mln (exp. 608mln), Q1 adj. EBITDA USD 371mln (exp. 368.5mln).-12.70% in pre-market trade

- Novo Nordisk (NOVOB DC) Q1 (DKK): Sales 65.35bln (exp. 63.2bln), Wegovy sales 9.38bln (exp. 10.55bln), Total GLP-1 34.98bln (exp. 34.78bln, prev. 26.7bln), Ozempic 27.8bln (prev. 19.6bln).

- Shell (SHEL LN) Q1 (USD): Total Revenue 74.4bln (exp. 89.9bln), adj. EBITDA 18.71bln (exp. 16.82bln), adj. EPS 1.20 (exp. 1.09), Net Income 7.4bln (exp. 6.5bln), FCF 9.8bln. New share buyback programme of USD 3.5bln.

- Maersk (MAERSKB DC) Q1 (USD): Revenue 12.36bln (exp. 12.26bln). EBIT 177mln (exp. 165.4mln). EBITDA 1.59bln (exp 1.56bln). Ocean Revenue 8.01bln (exp. 7.57bln). Sees FY global container trade at the high end of +2.5-4.5% range.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly positive but with the upside for most bourses limited as the region reflected on the recent FOMC meeting and suspected Japanese currency intervention. ASX 200 was led higher by gold miners, financials and tech which benefitted from softer yields, while participants also digested earnings releases including from NAB and Woolworths. Nikkei 225 clawed back opening losses and returned to flat territory as effects of suspected intervention subsided. Hang Seng outperformed on return from the holiday closure despite the continued absence of mainland participants and Stock Connect flows with developers helped after China's Politburo pledged efforts to support the property sector, while tech rallied as the unlikelihood of a US rate hike also bodes well for Hong Kong stocks given the HKMA's requisite to move in lock-step with the Fed.

Top Asian News

- HKMA maintained its base rate unchanged at 5.75%, as expected and in lock-step with the Fed.

- Senate Democrats reportedly urge the Biden administration to raise tariffs on China and warned that any cuts to Trump-era duties could hurt US workers, according to Politico.

- BoJ March Meeting Minutes stated many members shared the view long-term rates should be set by markets and a few members said the BoJ should at some point in the future reduce bond buying amount and shrink its bond holdings, while a few members said the BoJ's March move is different from the monetary tightening phase experienced in US and Europe. Furthermore, one member said the impact of the rise in short-term rate to around 0.1% will likely be limited and one member said BoJ should slowly but steadily move towards policy normalisation with an eye on economic and price developments.

- RBNZ's Deputy Governor Hawkesby said the economy is evolving largely as they expected, while mortgage arrears have risen and are not projected to rise as far as they were, according to Reuters.

- Japan's Top Currency Diplomat Kanda says cannot overlook excessive FX moves having a major impact on Japan's economy, via JiJi; No comment on FX intervention.

- BoJ data suggested Japanese FX intervention on May 1st, according to Reuters; may have spent JPY 3.26-3.66tln

European bourses, Stoxx600 (-0.2%) are mixed, unable to significantly benefit from the FOMC and mostly positive APAC trade overnight. Price action has been fairly contained around session lows. European sectors are mixed; Banks have been lifted following post-earnings strength in Standard Chartered (+5.9%) and ING (+5.5%). Energy is the clear laggard amid broader weakness in the crude complex, whilst Tech lags. US Equity Futures (ES +0.5%, NQ +0.7%, RTY +1.1%) are entirely in the green, though very much off post-FOMC peaks. In terms of individual movers, Qualcomm (+4.1%) gains pre-market after beating on top/bottom line.

Top European News

- OECD Growth Forecasts: Fed seen cutting rates from Q3 to 3.75-4.00% by end-2025; ECB seen cutting from Q3 to 2.5% by end-2025. Global 2024: 3.1% (prev. 2.9%). 2025: 3.2% (prev. 3%). US 2024: 2.6% (prev. 2.1%). 2025: 1.8% (prev. 1.7%). EZ 2024: 0.7% (prev. 0.6%). 2025: 1.0% (prev. 1.2%) UK 2024: 0.4% (prev. 0.7%). 2025: 1.0% (prev. 1.2%).

FX

- DXY is flat after yesterday's wild ride which saw the index sold in the wake of the FOMC before being dealt another hammer blow following touted JPY intervention. DXY went as low as 105.43 before staging a marginal recovery, but is yet to reapproach 106. Price action today has been confined to a 105.55-85 range.

- EUR/USD is holding onto 1.07 status and respecting yesterday's 1.0649-1.0732 range, with the 200DMA currently bang on the 1.07 mark.

- Yet more erratic price action for USD/JPY after the pair dropped aggressively late in the US session amid suspected FX intervention (according to Reuters calculations). The pair fell from circa 157.50 to a low around the 153 mark. However, has since pared around half the move, and currently sits around 155.20.

- CHF is top of the leaderboard following firmer-than-expected Swiss inflation metrics. USD/CHF has subsequently been dragged lower from a 0.9173 peak to a 0.9101 tough.

Fixed Income

- USTs in the red but action more modest than the marked two-way moves seen around the FOMC. Where the headline message was more hawkish than the last gathering but not unexpectedly so. Currently, USTs in a sub-20 tick range at 114-23.

- Bunds are catching up from Wednesday's market holiday. The resumption of trade overnight was a choppy one, but since the benchmark has been grinding higher as it reacts to the FOMC. Bunds top out at 130.67, 30 ticks shy of Tuesday's best and a couple more from the 130.98 WTD peak.

- Gilts are firmer despite a lack of specific action as pricing for the BoE, which has been clear on its policy roadmap recently despite dissent, reacts to the net-dovish reaction to the Fed. Gilts gapped higher by 50 ticks to 96.05 and despite a brief foray to a 96.31 WTD peak, just shy of last week's 33 best.

- France sells EUR 11.926bln vs exp. EUR 10.5-12bln 3.50% 2033, 1.25% 2034, 2.50% 2043, and 3.25% 2055 OAT:

Commodities

- Upward bias across the crude complex, but more so an attempted recovery after futures settled almost USD 3/bbl lower with steep losses on Wednesday amid a surprise EIA crude build coupled with ongoing ceasefire talks. Brent July within a 83.51-84.24/bbl range.

- Mostly softer trade across precious metals in a continuation of the post-Powell unwind with newsflow this morning on the lighter side. XAU trimmed some of yesterday's move, which saw prices shoot higher from USD 2,281.68/oz to USD 2,328.43/oz.

- Base metals are mostly trading with modest gains with price action choppy as news flow remains thin ahead of US IJC later and NFP tomorrow, whilst APAC trade lacked a firm direction amid the absence of Chinese markets for the rest of the week.

- Shell (SHEL LN) CFO says they continue to see crude oil market tightening in H2 this year; Co. sees an uptick in LNG demand in South Asia

- Ukrainian drones damaged energy infrastructure and caused power cuts in Russia's central Oryol region, while it was separately reported that Ukrainian drones tried to attack energy infrastructure in Russia's Smolensk region.

Geopolitics

- "Senior Egyptian official told local media that there is 'positive progress' in the the truce negotiations between Israel and Hamis amid 'extensive Egyptian contacts with all parties'. Hamas has not responded yet on the latest proposal", via Walla News

- "Israel Broadcasting Corporation: Pessimism in Israel about the possibility of reaching an agreement to release hostages", according to Sky News Arabia.

- US Secretary of State Blinken said Israel has made very important compromises over the proposal for the hostage deal, while he added they have seen real and meaningful progress in recent weeks.

- Hamas official reportedly expressed opposition to latest hostage deal offer, but the group said talks continue, according to the Times of Israel via social media platform X.

- US, UK and Canadian cybersecurity agencies warned that pro-Russian “hacktivists” are attempting to compromise computer networks for critical industrial sectors of the economy in North America and Europe, according to Bloomberg.

US Event Calendar

- 07:30: April Challenger Job Cuts -3.3% YoY, prior 0.7%

- 08:30: 1Q Unit Labor Costs, est. 4.0%, prior 0.4%

- 1Q Nonfarm Productivity, est. 0.5%, prior 3.3%

- 08:30: April Initial Jobless Claims, est. 211,000, prior 207,000

- April Continuing Claims, est. 1.79m, prior 1.78m

- 08:30: March Trade Balance, est. -$69.7b, prior -$68.9b

- 10:00: March Factory Orders, est. 1.6%, prior 1.4%

- March Factory Orders Ex Trans, prior 1.1%

- March Durable Goods Orders, est. 2.6%, prior 2.6%

- March Durables-Less Transportation, est. 0.2%, prior 0.2%

- March Cap Goods Orders Nondef Ex Air, prior 0.2%

- March Cap Goods Ship Nondef Ex Air, prior 0.2%

DB's Jim Reid concludes the overnight wrap

I'm looking bleary eyed at the FOMC reaction this morning after the most spectacular electrical storm at around 2-3am last night led to a very distressed Brontë the dog jumping up onto our bed and refusing to move from being on top of us and costing me well over an hours' sleep. It was the worst kind of storm, i.e. one without any hot weather preceding it. Only cold!

The main flashes from the Fed last night was that while the FOMC made several hawkish tweaks, Powell signalled that rate hikes remained unlikely and the Fed announced a slightly-larger-than-expected slowing of QT. It's hard to say it was a dovish meeting but given the recent inflation prints it could have been a lot more hawkish.

This result helped drive a relief rally for bonds, with 2yr Treasury yields (-7.5bps) seeing their largest fall since the day of the previous FOMC decision six weeks ago. Bonds were also supported by weaker US data and a sharp decline in oil prices. However, it was far from plain sailing for risk assets. Equities saw a strong rally in response to Powell's very early comments in the presser that rates are unlikely to move higher (S&P +1.2% at the peak from slightly down before he spoke), but reversed this move late on, with the S&P 500 down -0.34% by the close. However S&P (+0.5%) and Nasdaq (+0.63%) futures are back up this morning. Adding to the overnight fun and games we have seen renewed speculation that the BoJ intervened in FX markets, after the yen spiked sharply near the US close. More below.

Starting with the Fed details, the FOMC kept rates unchanged and maintained its implicit easing bias but made a few hawkish changes compared to the last meeting. The press release added that “In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective”, with Powell emphasising that the data “so far have not given us this greater confidence” on inflation normalisation. Powell’s prepared remarks removed the wording that dialing back policy restraint was likely “this year”, with a shift away from any calendar-based guidance also evident during the Q&A. That said, the FOMC was focused on holding rates steady for longer as needed, rather than considering rates hike. Powell noted that renewed hikes were “unlikely” and would require “persuasive evidence that our policy stance is not sufficiently restrictive”. Following the meeting, our US economists continue to see the first cut as coming in December. Please see their full reaction note here.

On the balance sheet side, the Fed announced a slowing in the pace of QT. Specifically, the monthly cap on Treasuries runoff will decline from $60bn to $25bn a month starting in June, with the MBS cap kept at $35bn. The decline in the Treasuries cap was on the steeper end of expectations, which appeared to favour a $30bn pace after the minutes of the March meeting supported reducing “runoff by roughly half”.

The avoidance of major hawkish signal coupled with the QT adjustment left markets breathing a sigh of relief, in line with the pattern of yields declining on FOMC meetings that we noted yesterday. Fed funds futures priced as much as +8bps of extra cuts for 2024 as Powell signaled a high bar for rate hikes, with 35bps of cuts this year priced by the close (+6.7bps on the day). A decent move, though this is still nearly 50bps less easing than was priced just after the March FOMC. 2yr Treasury yields fell by -7.5bps to 4.96% from their post-November high the previous day. Bonds did give up some of their initial post-FOMC gains late on, with 10yr yields closing at 4.63% (-5.2bps on the day) after trading as low as 4.58% during Powell’s press conference. Overnight, 10yr UST yields are a basis point lower, trading at 4.62% as I type.

The late reversal was even sharper for equities. As discussed in the intro, the S&P 500 moved from being slightly lower on the day to as much as +1.2% higher as Powell spoke, before fully giving up these gains to close -0.34% lower before the recovery in Asia. We did see the Dow Jones (+0.23%) and Russell 2000 (+0.32%) post modest gains, with the losses for the S&P 500 led by information technology (-1.26%) and energy (-1.60%) stocks. Chipmakers underperformed as Super Micro Computer, the manufacturer of servers whose stock had been up +200% YTD thanks to AI-driven demand, fell -14.03% after its results the previous evening. This saw the Philadephia semiconductor index decline -3.54% and Nvidia -3.93% on the day. Tech performance will again be in focus this evening with Apple’s results after the US close.

Supporting assets yesterday was a sizeable decline in oil prices, which came as the latest EIA inventory report showed a jump in US crude inventories to their highest level since last June. Brent crude prices fell -5.03% to a 7-week low of $83.44/bbl, with WTI down -3.58% to $79.00/bbl (though the daily declines were exaggerated by the change in the benchmark month).

Overnight in Asia, the top story is renewed speculation that BoJ intervened in FX markets after the yen spiked by nearly 3% late on in the US session (from 157.5 to 153.0 per dollar). Japan’s top currency official Masato Kanda had “nothing to say now” on whether authorities intervened, but it is hard to think of an alternative explanation for such a sharp move in thin trading, which follows another sudden swing on Monday. T he yen has reversed much of its initial spike overnight though, trading around 155.77 per dollar as I type.

Asian equity markets are mostly higher this morning led by the Hang Seng (+2.13%) after returning from a midweek holiday with the S&P/ASX 200 (+0.37%) and the Nikkei (+0.21%) also edging higher. Elsewhere, the KOSPI (-0.20%) is bucking the regional trend with mainland Chinese markets remaining shut through the rest of the week.

Ahead of the Fed’s decision, US Treasury yields had already moved lower thanks to some weaker growth and labour market data. For instance, the JOLTS report showed that job openings were down to a 3-year low of 8.488m in March (vs. 8.680m expected). Moreover, the quits rate of those voluntarily leaving their jobs fell to 2.1%, which is its lowest since August 2020, and is a concerning sign given how that indicator is correlated with the strength of the labour market. There wasn’t much respite elsewhere, as the ISM manufacturing print for April fell back into contractionary territory at 49.2 (vs. 50.0 expected), and the new orders subcomponent was also down to 49.1. To be honest, the main factor preventing an even larger decline in yields was the prices paid indicator, which rose to its highest level since June 2022, up to 60.9. So that’s another concerning signal for the Fed on inflationary pressures.

Earlier in the day, we also had the US Treasury’s latest Quarterly Refunding Announcement, where they said they’d be selling $125bn of securities next week. In addition, the statement said that “ Treasury does not anticipate needing to increase nominal coupon or FRN auction sizes for at least the next several quarters.” Alongside that, they announced their new buyback program, where the first operation is intended for May 29.

Meanwhile for European markets, it was an incredibly quiet day as much of the continent had a public holiday. The main exception to that was here in the UK (our holiday isn’t until Monday), where bonds and equities both sold off. Indeed, the 10yr gilt yield (+2.0bps) climbed up to 4.365%, which is its highest closing level in nearly six months. Meanwhile, the FTSE 100 fell -0.28%, although the FTSE SmallCap was near flat at +0.03%. At the margins, the data was also a bit more positive in the UK, as the final manufacturing PMI for April was revised up four-tenths from the flash release to 49.1.

Staying on the UK, local elections are taking place today, which will be the last major electoral test for the political parties ahead of the next general election. There are several votes to look out for, but one of the biggest will be the London mayoral election, where incumbent Sadiq Khan is running for a third term. In political terms, two other important contests will be the mayoral elections in the West Midlands and the Tees Valley, as both are currently held by the governing Conservatives, but the opposition Labour Party are trying to take control. So if Labour managed to win either of those, that would suggest they remain in a strong position ahead of the next general election, which has to be held by January at the latest.

To the day ahead now, and US data releases include the weekly initial jobless claims, the trade balance and factory orders for March, along with preliminary nonfarm productivity for Q1. Today’s earnings releases include Apple. Finally in the political sphere, there are local elections taking place in the UK.