Remember how AI was going to save the world, give us all more leisure time because of its massive boost to productivity?

Well, in Q1 in the US... it failed to show up as non-farm productivity - or nonfarm employee output per hour - rose at a measly 0.3% annualized rate after an upwardly revised 3.5% gain in the prior period (well below expectations)...

Source: Bloomberg

On the flip-side of that - and echoing the market-worrying ECI data earlier this week - Unit Labor Costs soared 4.7% in Q1 (well above the 4.0% expected and the 0.4% rise in Q4)...

Source: Bloomberg

So wage inflation is confirmed - rising at the fastest pace in a year - as all the gains we have been told to expect from AI just aren't there in the data.

While quarterly productivity figures are quite volatile, a sustained slowdown represents another hurdle for the Federal Reserve’s inflation fight. With interest rates expected to stay at a two-decade high for awhile longer, business investment in equipment will likely continue to be a weak factor in overall economic growth.

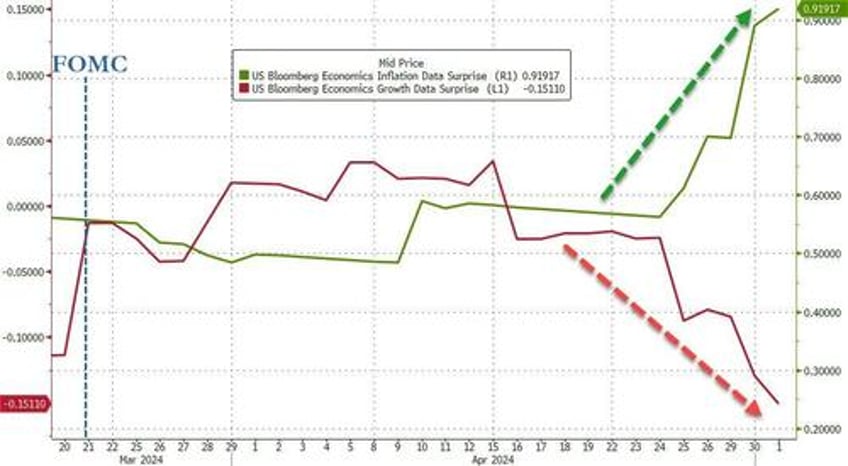

Today's data corroborates other data that showed gross domestic product cooled in the first quarter while employment costs rose by the most in a year. As a result, inflation is proving stubborn, supporting the Fed’s pivot to a more hawkish stance that will keep interest rates higher for longer than anticipated.

Of course, Fed Chair Powell told us yesterday that he "doesn't see the stag or the flation" in US data...

Maybe he needs to subscribe to ZeroHedge to see the real picture.