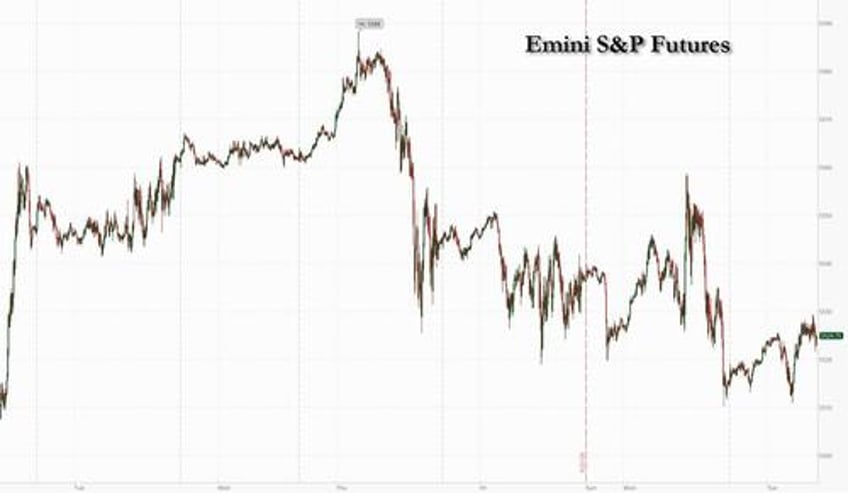

US index futures are higher, led by a rebound in the tech names in general and Nvidia in particular which rose as much as 3.5% in premarket trading after getting routed by a three-day, 13% selloff that wiped out $430 billion in market cap and saw it drop back into 3rd place behind Microsoft and Apple, after briefly becoming the world's most valuable company last week. As of 8:00am ET, S&P futures are up 0.1% while Nasdaq futures gain 0.4%. European stocks are in the red, led lower by industrial names, while Asian equities gained, snapping a three-day losing streak, as advances in value stocks helped offset weakness in the tech sector. Bond yields reversed a modest rebound and have extended their Monday drop with 10Y TSYs trading at session lows of 4.21%, down 2bps, while the USD is at session highs. Commodities are mostly lower, particularly base metals and Ags. Overnight, the news flow was relatively quiet as investors are mostly digesting the tech correction. Today, we will receive Conf. Board Consumer Confidence data at 10am. On earnings, FDX will report after market close.

In premarket-trading, the Mag 7/Semiconductor space rebounded from yesterday’s selloff: NVDA +3.1%, MU +1.5%, AVGO +1.1%, AAPL +38bp, GOOG/L +27bp, AMZN +11bp. Spirit Aero dropped 4% after Bloomberg News reported that Boeing switched its proposed funding from an all-cash offer to a deal funded mostly by stock. Here are some other notable premarket movers:

- Birkenstock (BIRK) falls 3% after holder L. Catterton Management offered 14 million shares.

- Gap (GPS) advances 4% after TD Cowen upgraded the retailer to buy, saying the company is in the “early innings” of a transformation across all four of its brands.

- Pool Corp. (POOL) slides 11% after the distributor of swimming pool supplies slashed its earnings per share forecast for the full year, citing challenges in the discretionary parts of its business amid cautious consumer spending.

- SolarEdge Technologies (SEDG) tumbles 17% after the solar equipment maker said a customer filed for bankrupcy and the company may fail to collect the $11.4 million it is owed.

- Trump Media & Technology (DJT) climbs 8%, putting the stock on track for three straight sessions of gains.

Tech shares have been the focus of US markets this week with traders rebalancing their portfolios as the quarter draws to a close. They’ve been taking profits from the AI-driven frenzy for tech stocks and switched into value shares and other laggards. The retreat in technology shares was “purely an investor/sentiment story,” Danske Bank analysts wrote in a note. “The fundamentals remain unchanged from a week ago.”

Meanwhile, there are signs that calm is returning to French markets, with yield spreads over Germany retreating from the highest level in over a decade. Jordan Bardella, the leader of the National Rally party which is leading the polls, sought to reassure investors on Monday with assurances that he will not upend the country’s finances if his party wins an absolute majority.

Later, the US Treasury kicks off this week’s trio of bond sales with an offering of $69 billion in two-year notes. Demand for the shorter, rates-sensitive debt is expected to be stronger than at last month’s offering, coming ahead of statistics on Friday that are forecast to show a slowdown in the Fed’s favored inflation gauge.

Stocks in Europe retreated 0.3% led by weakness in materials, utilities and communications sectors; markets were weighed by a drop of more than 10% for planemaker Airbus SE, which lowered its guidance amid persistent supply-chain issues. Germany’s Merck KGaA also tumbled, following a second surprise failure of a promising medicine. Here are the most notable European movers:

- Neoen shares gain as much as 2.8% after announcing the signing of an agreement for the purchase by Brookfield of a majority stake in the renewable energy developer from Impala and other shareholders.

- Evotec shares rise as much as 3.7% as the German pharmaceutical company announced a new US Department of Defense contract for its Seattle-based subsidiary Evotec Biologics.

- Hornbach shares climb as much as 5% as a strong improvement in first-quarter earnings overshadows cautious full-year guidance from the German building materials retailer.

- Fagerhult shares gain as much as 3.2% following an initiation at buy on the lighting systems manufacturer by SEB Equities, which expects an acceleration in both growth and margins.

- Airbus shares slump as much as 9.8%, the most since Nov. 2021, after lowering both its earnings and aircraft-delivery targets, citing supply-chain issues. Deutsche Bank cuts its rating to hold.

- Merck KGaA shares drop as much as 11% after the German pharmaceutical and chemicals company discontinued late-stage trials of xevinapant in locally advanced head and neck cancer.

- Continental shares fall as much as 1.1% after analysts at Warburg Research cut the German auto supplier’s price target to €75 from €92 on a weaker-than-expected market environment.

- Fluidra shares drop as much as 7.7%. The Spanish swimming pool maker falls after after equipment distributor Pool Corp. issued a profit warning.

- Ocado shares drops as much as 4% after Morgan Stanley slashes its PT to a new Street-low of 215p, with further downside expected following the latest customer fulfillment center postponement.

- Meyer Burger shares jump as much as 27% after the Swiss solar panel maker announced it made progress regarding business relocation to the US and external financing.

- Trigano shares decline as much as 4.6% as analysts become more cautious on the motorhome maker’s prospects in FY25 due to headwinds including lower prices and excess inventory levels.

- Fincantieri shares dropped back on Milan stock exchange in early Tuesday trading, giving up some of Monday’s gains after the Italian shipbuilder launched a €400 million capital increase.

Earlier, Asian markets rebounded as advances in some value stocks helped offset weakness in the tech sector. The MSCI Asia Pacific Index rose as much as 1%, led by consumer discretionary and industrial shares. Japan and Australia were the biggest gainers in the region, while a gauge of Chinese stocks listed in Hong Kong climbed as traders moved away from semiconductors into other parts of the market. Chip-related shares extended their recent rout after Nvidia entered a technical correction amid a pause in the AI frenzy. Meanwhile, some of the biggest boosts to the Asian gauge Tuesday included auto, financial and miner stocks.

- Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark advanced as strength in consumer and property stocks atoned for the slack seen in some tech names, while the mainland lagged despite the PBoC's liquidity boost with headwinds from US-China frictions as the Biden administration probes Chinese telcos. Furthermore, Premier Li flagged weak global economic momentum during his WEF address in Dalian.

- Nikkei 225 shrugged off the initial indecision and gradually reverted to above the psychological 39,000 level.

- ASX 200 outperformed with energy and real estate leading the advances amid broad optimism across sectors.

In FX, the Bloomberg Dollar Index gained 0.1%, reversing an earlier loss, with minimal moves across G-10 FX. USD/JPY was down 0.2% to 159.33 and AUD/USD little changed at 0.6659. GBP/USD rises 0.1% to 1.2695 with EUR/USD up 0.1% to 1.0740.

In rates, treasuries reverse earlier losses, with 2-year yields flat at 4.72% while 10-year yields dropped 2bps to 4.21% and 30-year yields were little changed at 4.365% as long-end outperformance deepens inversion of 2s10s spread past 50bp for first time since December. In core European rates, bunds and gilts outperform despite heavy auction slate that included Italy, UK and Germany selling a mix of linkers and bonds. French government bonds gain, outperforming their German peers and narrowing the 10-year yield spread by ~1bps to around 75.5bps. The US auction cycle begins with $69 billion 2-year note sale, followed by $70 billion 5-year and $44 billion 7-year Wednesday and Thursday. WI 2-year yield at around 4.680% is ~24bp richer than May’s, which tailed by 1bp.

In commodities, oil prices decline, with WTI falling 0.5% to near $81.30. Spot gold falls ~$2 to around $2,333. Bitcoin rises over 2%.

Looking at today's calendar, US economic data slate includes June Philadelphia Fed non-manufacturing activity and May Chicago Fed national activity index (8:30am), April S&P CoreLogic home prices (9am), June consumer confidence and Richmond Fed manufacturing index (10am) and June Dallas Fed services activity (10:30am). Fed officials scheduled to speak include Cook (12pm) and Bowman (2:10pm); speaking earlier Tuesday, Bowman reiterated her view that it’s too soon to cut interest rates

Market Snapshot

- S&P 500 futures up 0.1% to 5,523.00

- STOXX Europe 600 down 0.3% to 517.26

- MXAP up 0.9% to 180.55

- MXAPJ up 0.4% to 567.20

- Nikkei up 0.9% to 39,173.15

- Topix up 1.7% to 2,787.37

- Hang Seng Index up 0.3% to 18,072.90

- Shanghai Composite down 0.4% to 2,950.00

- Sensex up 0.8% to 77,959.91

- Australia S&P/ASX 200 up 1.4% to 7,838.79

- Kospi up 0.3% to 2,774.39

- German 10Y yield little changed at 2.41%

- Euro little changed at $1.0733

- Brent Futures little changed at $85.96/bbl

- Gold spot down 0.4% to $2,326.28

- US Dollar Index little changed at 105.47

Top Overnight News

- BOJ could be setting the stage for a “hawkish double surprise” next month with a tapering of QE coupled with a rate hike. RTRS

- Chinese telecom firms (China Mobile, China Telecom, China Unicom) face scrutiny in Washington over their access to American internet data. RTRS

- In November last year, President Biden and Chinese leader Xi Jinping agreed to boost engagement between ordinary Chinese and Americans, part of an effort to repair fraying ties ahead of a tense election year in the U.S. Instead, says Nicholas Burns, Washington’s ambassador in Beijing, China has actively undermined those ties, interrogating and intimidating citizens who attend U.S.-organized events in China, ramping up restrictions on the embassy’s social-media posts and whipping up anti-American sentiment. WSJ

- Trump considering a plan whereby the US would threaten to withhold further aid to Ukraine unless it entered into peace talks w/Russia. RTRS

- Israel’s top court told the government to begin drafting Ultra-Orthodox men for army service and stop funding seminaries whose students avoid conscription. It adds to pressure on PM Benjamin Netanyahu, whose coalition is supported by religious parties that oppose any change. BBG

- Julian Assange has left the UK after striking a plea deal with US prosecutors to end the WikiLeaks founder’s legal saga over leaked documents and allow him to walk free after years of incarceration and confinement. FT

- Brussels has accused Microsoft of anti-competitive behaviour by bundling its Teams app with its Office suite, in the first such antitrust charges brought against the tech group in more than a decade. FT

- Novo Nordisk A/S plans to invest $4.1 billion in another US factory, plowing more money into its biggest market amid rising discontent over the cost of its obesity and diabetes drugs. The project in Clayton, North Carolina, will double the company’s production footprint in the US, adding 1.4 million square feet of space for the final stages of manufacturing in which Novo’s medicines are filled into injector pens and prepared for consumers. BBG

- Boeing offered to buy Spirit AeroSystems in a mostly-stock deal that values the supplier at about $35 per share, people familiar said. The change from an all-cash bid should ease some of the squeeze on the cash-strapped planemaker. BBG

- Federal judges in Kansas and Missouri blocked parts of President Biden's student debt relief plan, while the White House later said that it strongly disagreed with the ruling on Biden's student loan plan,: Reuters.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive but with some of the gains capped following the mixed lead from Wall St where tech underperformed amid Nvidia's continued retreat from last week's record high into correction territory. ASX 200 outperformed with energy and real estate leading the advances amid broad optimism across sectors. Nikkei 225 shrugged off the initial indecision and gradually reverted to above the psychological 39,000 level. Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark advanced as strength in consumer and property stocks atoned for the slack seen in some tech names, while the mainland lagged despite the PBoC's liquidity boost with headwinds from US-China frictions as the Biden administration probes Chinese telcos. Furthermore, Premier Li flagged weak global economic momentum during his WEF address in Dalian.

Top Asian News

- Chinese Premier Li called for facing up to the difficulty of global economic growth and said that weak global economic growth momentum was hit by Covid, high inflation and increasing debt, while he added that economic growth is becoming more difficult to achieve and noted that decoupling and protectionism will only raise economic costs for the world. Furthermore, he said they should seize the new opportunities of the tech revolution and industrial transformation and they are confident and capable of achieving the full-year growth target of around 5%, as well as noted that the Chinese economy is expected to continue to show steady improvement in Q2.

- US President Biden’s administration is investigating China Telecom (728 HK), China Mobile (941 HK) and China Unicom (762 HK) with the probe focused on potential national security risks from their US cloud and internet infrastructure, according to Reuters sources

- Japan is to revise January-March GDP to reflect corrected data on construction orders from the Land Ministry with the revised figure to be released on July 1st 00:50BST, according to the Cabinet Office.

- Japanese Finance Minister Suzuki says shared serious concerns over weakness of JPY and KRW with the South Korean Finance Minister. Will continue to respond appropriately to excessive FX moves; desirable for FX to move stably.

European bourses, Stoxx 600 (-0.3%) are almost entirely in the red, with sentiment hit following updates from Airbus (-9.8%) and Merck (-9.7%) (detailed in Notable European Headlines). European sectors are mixed; Industrials are the clear laggard after Airbus cut its 2024 delivery guidance, which has weighed on the entire sector. Tech is also towards the foot of the pile, with ASML (-2.2%) and ASM International (-2.1%) both suffering. US Equity Futures (ES +0.1%, NQ +0.3%, RTY +0.2%) are very modestly firmer, with mild outperformance in the NQ as Nvidia (+2.1% pre-market) finally edges higher after dropping around 11% over the past 5 days.

Top European News

- Airbus (AIR FP) cuts 2024 delivery guidance: now targeting around 770 (prev. 800) commercial aircraft deliveries in 2024, the production rate of 75 A320 family aircraft a month is maintained but now expected to be reached in 2027 (prev. 2026); Targets adj. EBIT of around EUR 5.5bln in 2024 (prev. 6.5-7bln). Targets FCF of EUR 3.5bln (prev. 4bln) before customer financing. To record charges of around EUR 900mln in H1'24 accounts. Facing persistent specific supply chain issues mainly in engines, aerostructures, and cabin equipment. Elsewhere, reportedly has a backlog of several undelivered wide-bodied airliners without engines parked outside its Toulouse factory; jets are reportedly waiting for seats, engines and other parts, according to Reuters citing sources. CEO says Spirit AeroSystems (SPR) situation is difficult from an industrial standpoint. Says uncertain outlook for Spirit commitments contributed to the decision to cut Airbus output targets. Supply chain is improving but not in a uniform place. (Newswires/Reuters) Shares - 9.8% in European trade

- Merck (MRK GY) ceased the Phase III TrilynX study for xevinapant in unresected locally advanced squamous cell carcinoma of the head and neck due to unlikely efficacy in extending event-free survival, despite compatible safety data. Merck KHaA will review findings for publication. Shares - 9.9% in European trade

FX

- DXY has been pivoting around the 105.50 mark after yesterday's selling brought it down from a 105.90 high. It can be noted that month-end models point towards USD selling vs. peers. Docket ahead includes Philly Fed Nonmanufacturing Business Outlook Survey, Richmond Fed Index and speak from Fed's Bowman and Cook.

- EUR is steady vs. the USD in quiet newsflow. Focus remains on French political risk, however, broader follow-through into the EUR is contained. For now, EUR/USD sits towards the top end of yesterday's 1.0683-1.0746 range.

- GBP a touch firmer vs. both USD and EUR in quiet newsflow with a lack of tier 1 highlights due this week and the BoE observing its quiet period ahead of next month's UK general election. Cable remains capped by resistance at 1.27. If breached, the 10DMA sits just above at 1.2704 with the 20th June high at 1.2724.

- JPY is edging mild gains vs. the USD after topping out yesterday at 159.93. Commentary from Finance Minister Suzuki continued to attempt to talk up the JPY, but sparked little move in the pair. Currently USD/JPY holds around 159.50 with a notable OpEx at 160.00.

- Antipodeans are mixed vs. the USD with AUD the marginal outperformer across the majors. Newsflow for AUD has been light, however, AUD/USD has been able to build on the prior day's gains. NZD/USD is currently tucked within yesterday's 0.6104-40 range.

- PBoC set USD/CNY mid-point at 7.1225 vs exp. 7.2587 (prev. 7.1201).

Fixed Income

- USTs are rangebound and essentially unchanged ahead of survey data, June's Consumer Confidence and then the beginning of the week's supply docket with a USD 69bln 2yr sale. USTs currently sits around 110-18.

- Bunds are contained with specific macro drivers sparse thus far though Bunds are at the lower-end of 132.42-65 parameters (132.47 is a 50% Fib of Monday's move).

- Gilt price action is in-fitting with peers with the docket once again sparse as we count down to the upcoming election. Holding in a very slim 14 tick range which is entirely within Monday's 98.38-98.76 bounds.

- UK sells GBP 1.5bln 0.75% 2033 I/L Gilt: b/c 2.89x (prev. 3.4x) and real yield 0.518% (prev. 0.440%)

- Italy sells EUR 2.5bln vs exp. EUR 2-2.5bln 3.20% 2026 Short Term BTP and EUR 2.25bln vs exp. EUR 1.25-2.25bln 0.40% 2030 & 2.40% 2039 BTPei

- Germany sells EUR 3.646bln vs exp. EUR 4.5bln 2.90% 2026 Schatz: b/c 2.4x (prev. 2.7x) & avg. yield 2.8% (prev. 3.01%) and retention 18.98%% (prev. 18.02%)

Commodities

- Crude is modestly softer on the session, having traded within a contained range for the majority of the European morning. Brent is holding just above USD 85.60/bbl.

- Precious metals are mixed, having spent much of the morning pressured; thereafter, spot gold climbed into the green, benefiting from the downbeat Dollar; the yellow metal currently sits above USD 2330/oz.

- Base metals are incrementally firmer, tracking US equity futures and the overall positive handover from the APAC session irrespective of downbeat European price action.

Geopolitics: Middle East

- Israeli media reported news about the killing of the sister of the head of Hamas' political bureau, Ismail Haniyeh, in an Israeli bombardment that targeted the beach camp west of Gaza which killed 13 people, according to Sky News Arabia.

- US Secretary of State Blinken emphasised to Israel's Defence Minister Gallant the need to take additional steps to protect humanitarian workers in Gaza and deliver assistance in coordination with the UN, while Blinken underscored the importance of avoiding escalation and reaching a diplomatic resolution that allows both Israeli and Lebanese families to return home, according to the State Department.

- There were initial rumours on social media that something of note occurred in the Black Sea and that a US drone had been shot down although there was no confirmation, according to Faytuks News via social media platform X. However, social media reports later noted that a US defence official said no incident involving a US surveillance drone occurred today over the Black Sea, despite claims earlier by several Russian sources

Geopolitics: Other

- Ukraine will start EU accession talks on Tuesday and will meet with EU ministers in Luxembourg to officially begin a process that is set to take years but which represents a symbolic moment, according to FT.

- Russian President Putin said in a message to North Korean leader Kim that his recent visit to North Korea raised ties to an unprecedentedly high level of partnership, while he added that Kim is an honoured guest Russia waits for, according to KCNA.

- South Korean President Yoon criticised North Korea's balloon sending and vowed a strong response to North Korean provocation, according to Yonhap.

US Event Calendar

- 08:30: June Philadelphia Fed Non-Manufactu, prior -0.6

- 08:30: May Chicago Fed Nat Activity Index, est. -0.25, prior -0.23

- 09:00: April S&P CS Composite-20 YoY, est. 7.00%, prior 7.38%

- April S&P/CS 20 City MoM SA, est. 0.30%, prior 0.33%

- April FHFA House Price Index MoM, est. 0.3%, prior 0.1%

- 10:00: June Conf. Board Consumer Confidenc, est. 100.0, prior 102.0

- June Conf. Board Present Situation, prior 143.1

- June Conf. Board Expectations, prior 74.6

- 10:00: June Richmond Fed Index, est. -3, prior 0

- 10:30: June Dallas Fed Services Activity, prior -12.1

Fed Speakers

- 07:00: Fed’s Bowman Speaks on Monetary Policy, Bank Capital Reform

- 12:00: Fed’s Lisa Cook Speaks on Economic Outlook

- 14:10: Fed’s Bowman Gives Recorded Opening Remarks

DB's Jim Reid concludes the overnight wrap

Nvidia has been driving markets again over the last 24 hours, as its share price came down another -6.68%, building on its -4.03% decline over the previous week and -16.1% from the intra-day high on Thursday. In turn, that held down US equity returns more broadly, as the losses for Nvidia pushed the NASDAQ (-1.09%) and the S&P 500 (-0.31%) into negative territory for the day. This decline came even as 70% of the S&P 500 constituents were higher yesterday, with the equal-weighted version of the index up +0.50%. Energy stocks (+2.73%) led on the upside, boosted by rising oil prices as Brent crude reached its highest level since April (+0.90% to $86.01/bbl).

The positive tone was more dominant in Europe, where markets continued to strengthen despite the political uncertainty as we head to the weekend French polls. For instance, the CAC 40 (+1.03%) closed at its highest level since the turmoil began, having advanced by +2.71% since its closing low on June 14. Banks were among the strongest performers, including BNP Paribas (+3.27%), Société Générale (+2.06%) and Crédit Agricole (+2.00%). And this strength was echoed among other indices across the continent, with the STOXX 600 (+0.73%), the DAX (+0.89%) and the FTSE MIB (+1.58%) all posting solid gains.

That European advance came despite another batch of weak data, as Germany’s Ifo survey for June came out. That saw the business climate indicator unexpectedly fall to 88.6 (vs. 89.6 expected), which is the second month in a row that it’s declined. Moreover, the e xpectations indicator fell back after a run of 4 consecutive monthly gains, with the measure falling to 89.0 (vs. 90.7 expected). And that follows some underwhelming flash PMI releases on Friday, where both the Euro Area and German numbers surprised on the downside.

When it comes to the politics, that will really ramp up this week, with financial markets keenly focused on the first round of the French election this Sunday. Ahead of that, an Ifop poll showed that Marine Le Pen’s National Rally was on 36%, ahead of the left-wing alliance on 29.5%, and President Macron’s centrist alliance on 20.5%. In seat terms, that would give the National Rally 220-260, short of the 289 required to win a majority in the National Assembly. The left-wing alliance would be on 185-215, and President Macron’s alliance would be on 70-100. A reminder of our joint econ/strategy webinar tomorrow at 3pm London time on the election and the market implications. Register here. Elsewhere, there are just 9 days to go until the UK’s election, and a Redfield and Wilton poll out yesterday had the opposition Labour Party in the lead on 42%, followed by Nigel Farage’s Reform UK on 19%, and the governing Conservatives on 18%.

Back to France, and the Franco-German 10yr spread tightened by -3.2bps to 77bps and away from Friday's close which was the highest spread since 2012. That came as Jordan Bardella of the National Rally said that he would seek to repair France’s “degraded public finances”, and would “bring the country back to reasonable budgets”. Other countries’ spreads also tightened, as the 10yr bund yield rose by +1.0bps, underperforming the rest of Europe.

Meanwhile in the US, a late rally saw the 10yr Treasury yield close -2.4bps lower on the day at 4.23% where it's stayed in Asia this morning. The rally was helped along by dovish-leaning comments from San Francisco Fed President Daly, who said that “ Future labor market slowing could translate into higher unemployment ”, adding “At this point, inflation is not the only risk we face”.

Asian equity markets are mostly trading higher this morning shrugging off the US tech weakness. The Nikkei (+0.51%), Hang Seng (+0.33%), KOSPI (+0.49%) and the S&P/ASX 200 (+0.94%) are all advancing. Elsewhere, Chinese stocks are extending recent losses with the CSI (-0.42%) and the Shanghai Composite (-0.38%) lower. S&P 500 (+0.08%) and NASDAQ 100 (+0.19%) futures are bouncing back slightly as I type.

Early morning data showed that Japan’s services producer price index climbed +2.5% y/y in May and less than the market expected gain of +3.0% as against a downwardly revised increase of +2.7% in April. The yen (+0.08%) has edged higher for a second day but at 159.51 against the dollar, it is still languishing near levels not seen since late April when the Japanese authorities intervened in the FX market. More broadly it remains very close to its 30 plus year lows.

To the day ahead now, and data releases from the US include the Conference Board’s consumer confidence measure for June, the Richmond Fed’s manufacturing index for June, and the FHFA house price index for April. We’ll also get Canada’s CPI for May. From central banks, we’ll hear from the ECB’s Stournaras, Makhlouf and Nagel, along with the Fed’s Bowman and Cook.