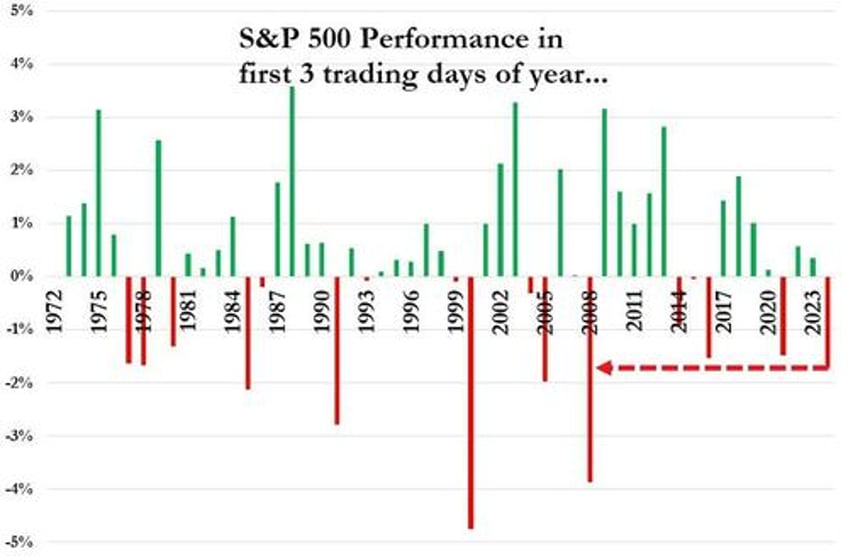

What was already the worst start to a new year for stocks since 2008...

... was set to turn even uglier with futures and global markets sliding on the last day of the first week of 2024, which is set to be the biggest weekly retreat since October, fuelled by specualtion that a resilient labor market - expected in Friday’s December jobs report (full preview here) - may delay interest-rate cuts by the Fed. Global stocks sank and the dollar strengthened for a sixth day as 10Y Treasury yields rose above 4%, last trading at 4.04% or 5bps higher, after flirting with the "nice round number" level for the past 3 days.

In premarket trading, Apple shares are down 0.7%, putting the stock on track for its fifth straight decline. The company has had a rough start to the year, with at least two brokers downgrading the stock on iPhone demand concerns. Here are some other notable premarket movers:

- Agilon Health sinks 25% after cutting its adjusted Ebitda outlook for the year, missing estimates.

- Allogene Therapeutics shares fall 28% as analysts noted that the company’s plan to streamline its trial footprint could cause delays entering the market. JMP cut its rating to market perform.

- Beyond Inc. gains 3.7% after the company behind Bed Bath & Beyond and Overstock is upgraded to buy from hold at Needham & Co. due to the household goods retailer’s self-help initiatives.

- Carnival shares are up 1% after Wells Fargo Securities upgraded the cruise operator to overweight from equal-weight.

- PayPal Holdings drops 1% after picking up a second downgrade this week.

- Peloton rises 4.7%. The stock surged 14% on Thursday amid residual optimism over the company’s partnership with TikTok for a new fitness hub, which Evercore ISI analysts said is positive.

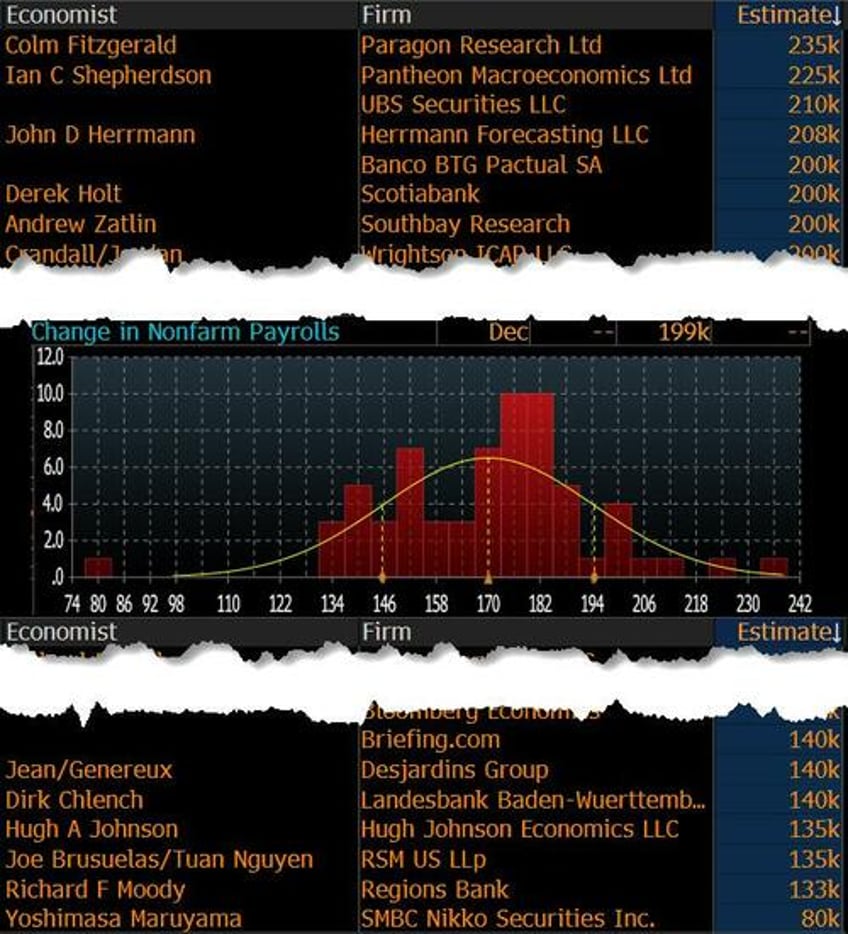

Traders are now waiting for the latest US nonfarm payroll report, which is expected to show that employers added 175,000 positions last month, although there is a wide divergence in opinions among sellside strategists, while the whisper number edges up to 189k following Thursday’s ADP employment change and weekly jobless claims data.

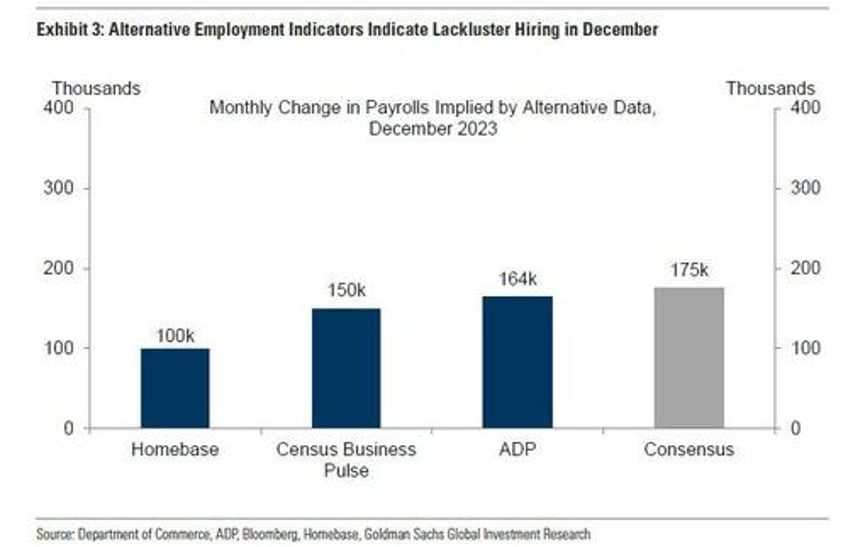

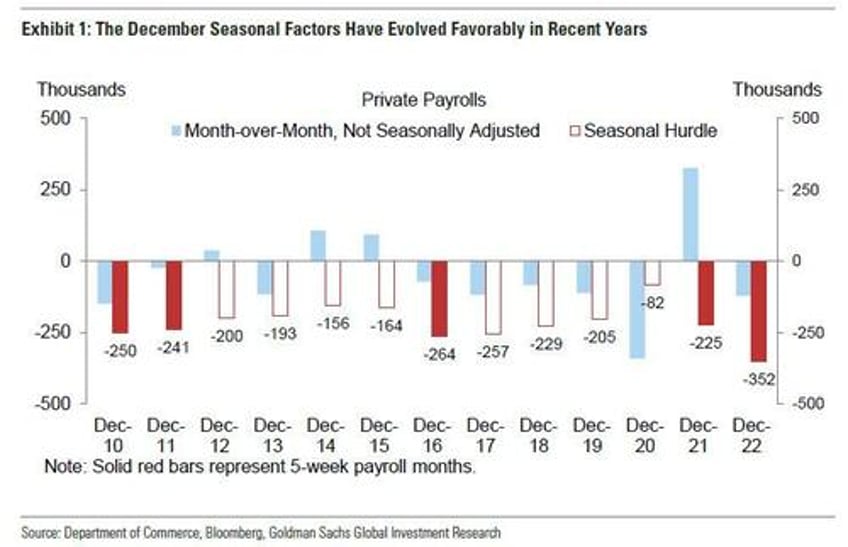

That said, the whisper is higher than the consensus, with Goldman expecting a number just shy of 200K as it reflects a "boost from mild winter weather and a favorable swing in the December seasonal factors (worth roughly +50k). While Big Data employment indicators indicate a lackluster pace of hiring, initial jobless claims fell further, consistent with fewer end-of-year layoffs."

While the consensus estimate reflect slower hiring pace than November, it would still suggest economic strength and add to evidence that wagers on easier monetary policy have gone too far (full preview available here).

Meanwhile, with data coming in hotter than expected so far in 2024, swaps traders now see around a 65% chance the Fed will cut rates by the Fed’s March meeting, down from almost fully pricing such a move a week ago. As a result, investors are backtracking on some of last year’s most popular trades. Futures on the tech-heavy Nasdaq 100 Index slid 0.3% on Friday and the index has lost more than 3% so far this week. The yield on 10-year notes is back above 4%.

“We are seeing a bit of scaling back,” said Timothy Graf, head of EMEA macro strategy at State Street. “The only thing that can change things dramatically is a super-weak or super-strong NFP number today, an on-consensus print wont change anything."

“Equity valuations are largely priced for a very benign macro outcome which makes it tough for the market to move higher from here,” said Wolf von Rotberg, equity strategist at Bank J. Safra Sarasin. “The first half of 2024 may thus be a difficult one for equity markets as downside risks prevail.”

The Vol market is currently pricing in just a 67bp move for S&P through Friday's s close; here is how the Goldman trading desk is thinking about S&P’s reaction function to the headline print:

- >250k S&P sells off at least 150bps

- 200k – 250k S&P sells off 75 – 150bps

- 150k – 200 S&P + / - 50bps

- 50k - 150k S&P rallies 50 – 100 bps

- <50k S&P sells off at least 75bps

European stocks and bonds also fall in tandem as traders also pared bets on interest-rate cuts from the ECB and Bank of England following key inflation data in the region on Friday. The pace of Euro-zone price growth quickened for the first time since April, in line with expectations, the data showed. Money markets now see less than 145 basis points of cuts from the European Central Bank by the end of 2024.

Europe’s Stoxx 600 benchmark fell around 1%, on track to end a seven-week run of gains. Remy Cointreau SA and Pernod Ricard SA led a drop in liquor stocks as China launched an anti-dumping investigation into products like brandy from the European Union. All subindexes trade in the red, with retail the biggest laggard. Here are the biggest movers Friday:

- Remy Cointreau falls as much as 12% to May 2020 lows and was among several liquor stocks suffering after China launched an anti-dumping investigation into liquor products from the EU

- Ubisoft falls as much as 6.8% after JPMorgan lowers price target on the French video game maker for a second time in a month, citing signs of weakness in sales of its Avatar game

- Croda shares fall as much as 2.1% as Berenberg says it sees another round of cuts to FY24 consensus ahead of the specialty chemicals firm’s results

- Swatch shares fall as much as 2.2% after both Stifel and Vontobel cut their estimates and price targets on the luxury Swiss watchmaker, citing headwinds from the Swiss franc’s strength

- Signify falls as much as 3.3% after receiving its only negative analyst rating, as Barclays initiated the lighting manufacturer at underweight due to its exposure to non-residential spending

- Endeavour Mining shares in London fall as much as 15%, the most on record, after firing president and chief executive Sébastien de Montessus for serious misconduct

- Ithaca Energy drops as much as 3.9% to the lowest level since Aug. 31 after announcing that CEO Alan Bruce is standing down to pursue new opportunities, with the CFO named as interim CEO

- Clarkson shares surge as much as 9.7%, to highest since 2022, after the shipping company guided that underlying pretax profit will probably come in ahead of expectations

- Redcare Pharmacy rises as much as 6.4%, while DocMorris surges as much as 12%, after Berenberg upgraded both stocks to buy, citing positive momentum for e-prescriptions

- Ariston and Nibe rise after being both initiated at overweight by Barclays, saying the heat pump producers are well positioned with the industry’s structural oversupply narrative looking overdone

“A tempering of rate cut expectation euphoria will inevitably translate into soggier market performance,” said Charles Hepworth, Investment Director, GAM Investments. “That is what we are seeing so far this year.”

Earlier in the session, Asian equities seesawed, with a regional gauge headed for its worst start to a year since 2016 as investors remain cautious ahead of the US jobs report later today. The MSCI Asia Pacific Index swung between a gain of as much as 0.3% and a drop of 0.1%, as the measure heads for a weekly loss of about 2%. Benchmarks in Korea and China were also set for their worst first week of trading in at least eight years. Regional stocks’ lackluster start to the year matches that of global peers as doubts over the Federal Reserve’s scope to cut interest rates and China’s continued weak economic momentum cloud the outlook for Asian stocks. “In the lead-up to the upcoming US job numbers, sentiment is back to wait-and-see,” said Jun Rong Yeap, a strategist at IG Asia. “We may have to see a substantial weakening of the US labour market to justify market pricing of a rate cut as early as March,” he said.

- Hang Seng and Shanghai Comp moved between gains and losses but held a downside bias towards the end of the session, whilst the PBoC drained a net CNY 2.423tln through open market operations this week, marking the biggest weekly cash withdrawal on record, according to Reuters calculations.

- ASX 200 was initially supported by gold-related names alongside the Financials and Healthcare sectors, but gains were later countered by losses in Tech.

- Nikkei 225 outperformed and briefly topped 33,500 with the weak JPY providing tailwinds, although the index closed under the level.

- KOSPI fell into the red after South Korea ordered an evacuation on Yeonpyeong Island near the North Korean border "due to the situation related to North Korea's provocation".

In China, shadow banking giant Zhongzhi Enterprise Group filed for bankruptcy. The downfall marks one of China’s biggest-ever corporate collapses, putting more stress on already fragile consumer and investor sentiment.

In FX, the Bloomberg Dollar Spot Index adds 0.2% and up a total of 1.4% in six trading sessions; the dollar has risen for a six straight trading session - the longest winning streak since late September - ahead of payrolls data; all G-10 currencies retreated, led by the Swedish krona and Norwegian krone.

- EUR/USD resumes decline, down for the third time in four days to 1.0920.

- GBP/USD falls 0.2% to 1.2662, down the first time in three days

- USD/JPY extends gains for a 4th day, the longest winning streak since Nov. 13; the pair now trades at 145.15, back to levels seen before the Dec. 13 FOMC meeting

- USD/CHF rises 0.4% to 0.8533, up for a second day

In rates, Treasuries extended this week’s losses ahead of December payrolls data, following wider selloff seen across core European rates and bunds and gilts underperform. US yields are cheaper by 4bp across the curve with front-end leading losses on the day, flattening 2s10s, 5s30s spreads by 0.3bp and 1.5bp; 10-year yields around 4.035% with bunds and gilts underperforming by 1.2bp and 4bp in the sector. Gilts lead the selloff in European government bonds, with UK 10-year yields rising 8bps.

In commodities, oil prices advanced, with WTI rising 0.6% to trade near $72.60. Spot gold falls 0.2%.

To the day ahead now, US data includes December non-farm payrolls, unemployment rate, average hourly earnings, factory, durable and capital goods orders as well as the ISM Services Index. Fed’s Barkin is scheduled to speak to Maryland Bankers Association at 1:30pm ET

Market Snapshot

- S&P 500 futures down 0.2% to 4,721.75

- STOXX Europe 600 down 0.8% to 474.00

- German 10Y yield little changed at 2.15%

- Euro down 0.2% to $1.0927

- Brent Futures up 1.0% to $78.36/bbl

- MXAP down 0.1% to 165.52

- MXAPJ down 0.4% to 515.34

- Nikkei up 0.3% to 33,377.42

- Topix up 0.6% to 2,393.54

- Hang Seng Index down 0.7% to 16,535.33

- Shanghai Composite down 0.9% to 2,929.18

- Sensex up 0.3% to 72,091.70

- Australia S&P/ASX 200 little changed at 7,489.07

- Kospi down 0.3% to 2,578.08

- Brent Futures up 1.0% to $78.36/bbl

- Gold spot down 0.1% to $2,042.16

- U.S. Dollar Index up 0.18% to 102.61

Top Overnight News

- Taiwan’s CPI for Dec comes in firmer than anticipated, including +2.71% headline (vs. the Street +2.6% and vs. +2.9% in Nov) and +2.43% core (vs. the Street +2.3% and vs. +2.39% in Nov). BBG

- Beijing has informally asked some money managers in China to prioritize the launch of equity funds over other products like bond funds, four sources with direct knowledge of the matter said, as authorities scramble to revive its lagging stock market. RTRS

- China is launching an anti-dumping investigation into liquor products like brandy from the European Union, in a relatively modest step after the bloc opened a probe last fall into its electric vehicle subsidies. BBG

- Biden planning to retain most of Trump’s China tariffs and will increase them on EVs and certain critical materials (like cobalt and lithium) while cuts could take place on certain consumer goods. Axios

- Huawei’s newest laptop runs on a 5-nanometer chip made in Taiwan—not China. A TechInsights teardown found a chip made by TSMC, countering speculation that Shanghai-based SMIC may have achieved a major leap in fabrication technique. BBG

- Tesla recalled virtually every car it’s ever sold in China due to issues with the driver-assistance system Autopilot that increase the risk of crashes. The carmaker will deploy an over-the-air software fix to more than 1.6 million vehicles produced between August 2014 and December 2023, including locally built Model 3s and Model Ys and imported premium models, the State Administration for Market Regulation said in a statement. BBG

- EU inflation mostly inline with expectations, including the Dec headline CPI (+2.9% vs. the Street +2.9% and up from +2.4% in Nov), the Dec core CPI (+3.4% vs. the Street +3.4% and down from +3.6% in Nov), and the Nov PPI (-8.8% vs. the Street -8.6% and up from -9.4% in Oct). BBG

- Fundraising by US venture capital firms hit a six-year low in 2023, an ominous sign for start-ups with dwindling cash reserves and fledging businesses reliant on such backing for survival. The $67bn raised by US VCs in 2023 is the lowest annual total since 2017 and represents a 60 per cent drop from the $173bn raised in 2022, the peak year for fundraising, according to analysis by private markets data provider PitchBook and the National Venture Capital Association. FT

- COST reported core Dec comps +8.1% (about ~80bp ahead of the Street), including the US +7.4% (about ~40bp ahead of the Street) and Canada +11.9% (this is ahead of plan). RTRS

- Goldman estimates nonfarm payrolls rose 190k in December (mom sa), somewhat above consensus of +175k. Our forecast reflects a favorable swing in the December seasonal factors worth roughly +50k and a boost from mild winter weather, as snowfall was minimal in major cities in the Northeast and Midwest. While Big Data employment indicators indicate lackluster hiring, initial jobless claims fell further, consistent with fewer end-of-year layoffs. On the negative side, we assume another sizeable decline in retail payrolls, reflecting soft brick-and-mortar spending trends during the holiday season

A more detailed look at global markets courtesy of Newsquawk

Asian stocks eventually traded mixed as the earlier positivity gradually waned despite a lack of major newsflow but in the run-up to the US NFP and ISM Services PMI. ASX 200 was initially supported by gold-related names alongside the Financials and Healthcare sectors, but gains were later countered by losses in Tech. Nikkei 225 outperformed and briefly topped 33,500 with the weak JPY providing tailwinds, although the index closed under the level. KOSPI fell into the red after South Korea ordered an evacuation on Yeonpyeong Island near the North Korean border "due to the situation related to North Korea's provocation". Hang Seng and Shanghai Comp moved between gains and losses but held a downside bias towards the end of the session, whilst the PBoC drained a net CNY 2.423tln through open market operations this week, marking the biggest weekly cash withdrawal on record, according to Reuters calculations.

Top Asian News

- PBoC drained a net CNY 2.423tln via open market operations this week, marking the biggest weekly cash withdrawal on record, according to Reuters calculations.

- PBoC injected CNY 75bln through 7-day reverse repos at a maintained rate of 1.80% for a net drain of CNY 411bln.

- Nikkei published an article titled "BoJ easing exit in the first half still on the table despite earthquake" citing market implied rates, and noted that if the Yen avoids a sharp upswing, "we can thoroughly gauge domestic wages and prices," according to a BoJ insider.

- Foxconn (2317 TT) December Sales -26.89%; overall operations in Q1-2024 gradually entering the traditional off-peak season. Outlook for Q1 expected to decrease Y/Y.

- China shadow bank Zhongzhi files for bankruptcy; Beijing court says application was on the grounds that it could not pay off its due debts and its assets were insufficient to pay off all its debt.

European equities, Eurostoxx50 (-0.9%), extended losses throughout the session following a negative APAC handover with newsflow light and data having little equity follow through. European sectors are entirely in the red; Retail slumps following dire German Retail Sales, whilst Energy fares best amid higher Crude prices. US Equity Futures are lower, though not the same magnitude as their European peers, with the tone a touch more cautious stateside into NFP; ES -0.3%.

Top European News

- Maersk (MAERSKB DC) says all of its vessels travelling through Red Sea and Gulf of Aden are to be diverted South around the Cape of Good Hope for the foreseeable future; situation is constantly evolving, remains highly volatile, security risks still elevated.

- China's Commerce Ministry is launching an anti-dumping investigation on brandy imported from the EU; Remy Cointreau (-9.9%), Pernod Ricard (-5.5%)

FX

- DXY is firmer, peaking at 102.80 thus far, in a seemingly safe-haven play as participants position ahead of US NFP later today, also deriving strength from pressure in the EUR.

- EUR was initially weighed on by broader Dollar strength before then being dragged lower post softer German Retail Sales, testing but not losing 1.09. Unreactive to Flash EZ HICP.

- The Yen continues its horror run as the USD/JPY jumps above the 145.00 mark; 145.99 marks the 13th Dec high before the round 146 level.

- Antipodeans continue to sink as risk sentiment remains subdued.

- PBoC set USD/CNY mid-point at 7.1029 vs exp. 7.1593 (prev. 7.0997)

- China's major state-owned banks have been seen active in USD/CNY swaps and selling USDs for Yuan in the spot-FX market during the week, via Reuters citing sources; seen curtailing Yuan lending in offshore FX on Friday

Fixed Income

- USTs are directionally led by EGBs, but with magnitudes slightly more contained ahead of December Payrolls and ISM services thereafter; yields firmer across the curve and slightly steeper.

- Bunds began with a dovish reaction on soft Retail Sales, lifting the benchmark to a 136.13 peak; though entirely pared the move and continue to move lower, currently pivoting the 135.52 trough.

- Gilts conformed with broader price action alongside peers; action slightly more pronounced with specifics light but perhaps some influence from Halifax House Prices, though this is caveated by being supply rather than demand driven.

Commodities

- WTI and Brent are firmer but well within Thursday's boundaries amid reports that the US is drafting plans to respond to Houthi militants.

- As such, benchmarks are shy of their respective USD 74.00/bbl and USD 79/42/bbl WTD peaks.

- Spot Gold is marginally weaker amid the recent strength in the Dollar but struggling for direction somewhat into payrolls; Base Metals hold a negative bias in-fitting with the broader risk tone.

- China's oil trade talks with Iran has stalled after Tehran sought higher prices, via Reuters citing sources; seeks to narrow discounts on Crude sales to China by USD 4-5/bbl

Geopolitics - Middle East

- The US military is drafting plans to hit back at Iran-backed Houthi militants who have been attacking commercial shipping in the Red Sea, according to Politico sources; plans also include striking Houthi targets in Yemen. "Biden administration officials are drawing up plans for the US to respond to what they’re increasingly concerned could expand from a war in Gaza to a wider, protracted regional conflict" "Four officials familiar with the matter, including a senior administration official, described internal conversations about scenarios that could potentially draw the US into another Middle East war."

- US State Department said Secretary of State Blinken will visit Turkey, Greece, Saudi, Israel, West Bank, and Egypt from Jan 4th-11th; Blinken to raise the need to take steps to deter the Houthis' attacks on shipping in the Red Sea.

- UK maritime security firm Ambrey received intelligence of missiles fired from Yemen's Taiz towards Bab Al Mandab, according to an advisory note.

- US Pentagon official said the US carried out a strike in Baghdad that killed a leader of an Iraqi faction loyal to Iran that was involved in attacks on US forces, according to Sky News Arabia.

- Iraqi armed factions announce the attack on a US base in the field of Omar in Syria with drones, according to Sky News Arabia.

Geopolitics - Korea

- Yonhap, "due to the situation related to North Korea's provocation".

- North Korean military fired over 200 coastal artillery shells between 9-11 am (local time) in the northern part of Baeknyeong Island and Yeonpyeong Island, no damage was reported from South Korea, and shells landed north of the northern limit line, according to Yonhap and Reuters.

- South Korea is preparing a show of force after North Korea fired artillery near Yeonpyeong Island; South Korea to carry out live-fire drills in response to North Korean artillery near Yeonpyeong Island, according to Yonhap.

- Residents of a second South Korean island asked to evacuate, according to AFP citing a local official.

US Event Calendar

- 08:30: Dec. Change in Nonfarm Payrolls, est. 175,000, prior 199,000

- 08:30: Dec. Change in Private Payrolls, est. 130,000, prior 150,000

- 08:30: Dec. Change in Manufact. Payrolls, est. 5,000, prior 28,000

- 08:30: Dec. Unemployment Rate, est. 3.8%, prior 3.7%

- 08:30: Dec. Labor Force Participation Rate, est. 62.8%, prior 62.8%

- 08:30: Dec. Underemployment Rate, prior 7.0%

- 08:30: Dec. Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- 08:30: Dec. Average Weekly Hours All Emplo, est. 34.4, prior 34.4

- 08:30: Dec. Average Hourly Earnings YoY, est. 3.9%, prior 4.0%

- 10:00: Nov. Factory Orders, est. 2.3%, prior -3.6%

- 10:00: Nov. Factory Orders Ex Trans, est. -0.1%, prior -1.2%

- 10:00: Nov. Durable Goods Orders, est. 5.4%, prior 5.4%

- 10:00: Nov. Durables-Less Transportation, est. 0.5%, prior 0.5%

- 10:00: Nov. Cap Goods Ship Nondef Ex Air, prior -0.1%

- 10:00: Nov. Cap Goods Orders Nondef Ex Air, prior 0.8%

- 10:00: Dec. ISM Services Index, est. 52.5, prior 52.7

DB's Jim Reid concludes the overnight wrap

Morning from a very wet London. I don’t think I can remember being much wetter than during my long walk home from the station last night or seeing bigger lakes form. And then to make matters worse, I scalded myself as soon as I got in from pouring hot water into my daughter’s very long and thin (and cuddly) hot water bottle she got for Xmas that is proving a nightmare to fill every night without accident! Blooming Santa!

The recent extended Santa Claus rally has turned into a little bit of a memory with the New Year hangover continuing as we welcome in yet another payrolls Friday today. DM 10yr government yields sold off 8-12bps yesterday as the 10yr Treasury yield closed above 4% for the first time since mid-December, while the Nasdaq (-0.56%) completed a five-day losing streak for the first time since December 2022. So the set-up is a little weak as we turn to the employment report.

Our US economists see nonfarm payrolls slowing to +150k in December, having been at +199k in November (consensus +175k). That mainly reflects an unwind from the boost by returning auto workers in the November data. Otherwise, they see the unemployment rate moving up a tenth to 3.8% (in line with consensus), and average hourly earnings growth to moderate after November’s spike, coming down two tenths to +0.2% (consensus +0.3%). See here for their full preview and details of how to register for their webinar after the report. After payrolls, the US Services ISM will also be out today.

Ahead of this, the US employment data yesterday was positive which didn't actually help risk much due to the higher yields we saw throughout the day yesterday. This was kick-started by better European PMI data with the euro area composite PMI revised up from the flash reading of 47.0 to 47.6, and with services revised up from 48.1 to 48.8. This upward surprise was broadly shared across the euro area, erasing the PMI decline seen in the flash December reading and with services actually inching up to a 5-month high. We then had the US ADP’s report of private payrolls, which showed an increase of +164k in December (vs. 125k expected). That’s the highest print since August, and it was also the first time since the July print that it had come in above consensus. Then 15 minutes later, we had the latest weekly claims data, which showed initial jobless claims were down to 202k over the week ending December 30 (vs. 216k expected), which was an 11-week low. Xmas seasonals likely lowered this to some degree but it was still a decent number. Continuing claims also surprised to the downside at 1.855m (vs. 1.881m expected) .

With the data looking more promising, yesterday saw investors grow increasingly sceptical about the likelihood of a rate cut by March. For the Fed, the probability of a 25bp cut by March was down to 69% by the close, which is its lowest since the December meeting, back when they published the dot plot that was more dovish than the consensus expected. And in turn, Treasuries sold off across the curve, with the 2yr yield up +5.4bps to 4.39%, whilst the 10yr yield was up +8.3bps to 4.00%. That’s the first time it’s closed above 4% since December 13, the day of the last Fed meeting .

Over in Europe, the sovereign bond sell-off was even bigger, with yields on 10yr bunds (+10.0bps), OATs (+10.0bps), and BTPs (+11.4bps) all seeing sizeable increases even with softer inflation than expected. German CPI was up to +3.8% (vs. +3.9% expected) on the EU-harmonised measure, up from +2.3% in November. But it’s worth noting that was partly down to base effects rolling out of the annual comparison, as support for heating bills last winter had helped push down energy prices. Similarly in France, headline CPI was back up two-tenths to +4.1%, but the reading was in line with expectations .

Later this morning, we’ll also get the euro-area wide release, which will be one to look out for in terms of the potential for any ECB rate cuts. Following the country prints so far, our European economists see the euro-area print tracking in line with consensus at +3.0% yoy for headline and +3.4% yoy for core inflation, though with risks tilted to the downside for core. While for headline inflation this represents a rise from the previous month due to volatile energy base effects, for core inflation this would be the lowest print since March 2022.

Risk appetite had begun to recover again yesterday but lost momentum during the US session, in part held back by the rise in yields. Over in Europe, the STOXX 600 (+0.69%) recorded its first advance of 2024 so far. In the US, the S&P 500 had traded nearly +0.5% up on the day around the time of the European close, but then lost ground over the rest of session to close down -0.34%. Tech stocks lost ground as the NASDAQ (-0.56%) fell for a 5th consecutive session and for the first time in over a year. This included underperformance for the Magnificent Seven (-0.69%). Within the S&P 500, energy stocks also lost ground (-1.63%) after their recent outperformance as oil prices saw a modest retreat again (Brent down -0.84% to $77.59/bbl). Overnight, Brent crude futures (+0.46%) have slightly rebounded as I type.

Asian equity markets are mixed this morning with the Nikkei (+0.68%) leading the way, helped by further weakness in the yen, with the CSI (+0.17%) also seeing gains for the first time this week. Elsewhere, the Hang Seng (-0.14%), the Shanghai Composite (-0.13%) and the KOSPI (-0.40%) are losing ground. US futures are fairly flat.

Early morning data showed that Japan's December service activity expanded at a slightly faster pace after the final estimate of the services PMI climbed to 51.5 in December from 50.8 in November. The expansion was still the second weakest recorded in 2023. In FX, the Japanese yen (-0.15%) is drifting lower for the fourth straight day, trading at 144.85 against the dollar amid significantly reduced bets for a BoJ policy shift in January.

Yesterday did also brighter economic data from the UK. First, mortgage approvals were stronger than expected in November at 50.1k (vs. 48.8k expected), taking them up to a 5-month high. And alongside that, there were positive revisions in the final PMI readings, as the services PMI was revised up to 53.4 (vs. flash 52.7), and the composite PMI was revised up to 52.1 (vs. flash 51.7). There was also a bit more speculation about the date of the next UK election, after Prime Minister Sunak said that his “working assumption is we’ll have a general election in the second half of this year”.

To the day ahead now, and US data releases include the December jobs report, the ISM services index for December, and factory orders for November. Meanwhile in the Euro Area, we’ll get the flash CPI release for December. From central banks, we’ll also hear from Richmond Fed President Barkin.