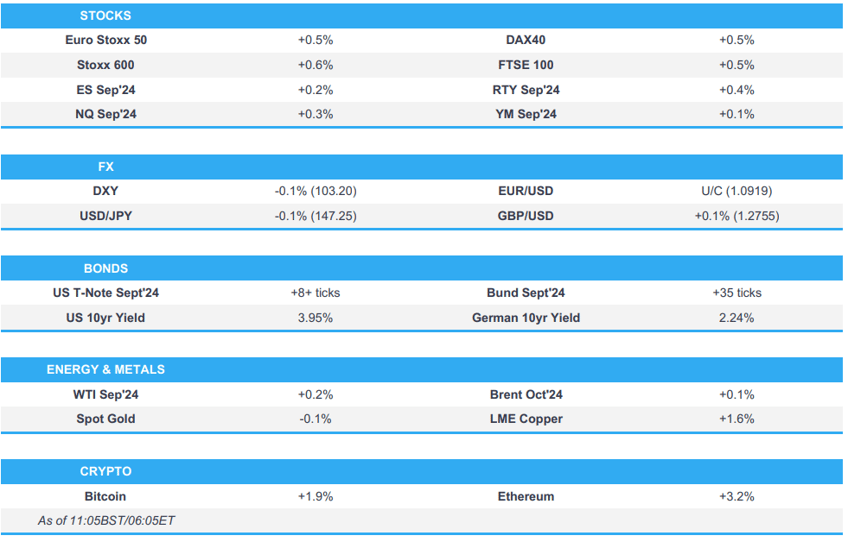

- European bourses & US futures firmer with newsflow light and the move a continuation of Thursday's data-driven upside

- DXY slightly softer but holding firmly above 103.00 with G10s generally rangebound

- Fixed bid but in familiar territory, USTs have recovered from supply-induced pressure on Thursday

- Crude contained with geopolitics still in focus, NatGas benchmarks slip as flows continue through Ukraine, base metals benefit from Chinese CPI

- Looking ahead, highlights include Canadian Employment

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are firmer, Euro Stoxx 50 +0.4%, having begun the session with modest gains in limited newsflow and have been extended modestly on opening levels thereafter.

- Sectors primarily in the green, action overall though somewhat modest given the lack of specific drivers. Materials and Energy outperform slightly, with Chinese CPI and geopolitics respectively assisting.

- Breakdown has slight outperformance in the FTSE 100 +0.5%, with the region's housing sector performing well after Hargreaves Lansdown accepted a takeover offer.

- Stateside, futures are in the green with the tone largely a continuation of the post-claims move, ES +0.2%, NQ +0.4%; as above, specifics light and the docket ahead devoid of US-related Tier 1 catalysts or earnings.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is slightly softer but still holding steady above the 103.00 mark and by extension Thursday's 102.91 base.

- G10s are rangebound; EUR and GBP both slightly firmer vs. the USD with the single currency just above 1.09 and Cable around 1.2750.

- JPY essentially unchanged despite posting a fairly large range overnight, though one that is dwarfed in comparison to the WTD band of 141.66-147.89.

- NOK unreactive to an in-line CPI-ATE print when compared to market expectations but one that came in 0.3pps lower than the Norges Bank's view for the month.

- CAD holding steady into jobs data for the region this morning.

- PBoC set USD/CNY mid-point at 7.1449 vs exp. 7.1690 (prev. 7.1460)

- Peru Central Bank cut its reference rate by 25bps to 5.50% (exp. unchanged at 5.75%), while it stated that future rate changes will be dependent on new information about inflation and its determinants.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Overall, benchmarks are bid but with specifics light and action thus far in familiar ranges.

- USTs firmer and just shy of the 113-00 handle having picked up from a 112-17+ base after a particularly poor 30yr tap last night.

- Bunds in the green, but again only modestly so. No reaction to final inflation metrics from Germany or Italy.

- For reference, next week's auction docket for EZ member nations generally has been heavily trimmed, as is usually the case given low summer liquidity.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks have been steady thus far, despite the ongoing creeping up of geopolitical tensions.

- Geopols. remain in focus and a potential market-driver over the next few sessions, as it stands talks are ongoing regarding a ceasefire while language from the IRGC remains escalatory.

- NatGas is in the red, with lows still running smoothly from Russia to Europe through Ukraine thus far. However, lows still running smoothly from Russia to Europe through Ukraine thus far.

- Metals mixed with spot gold softer as the risk tone is becoming incrementally more constructive while base metals continue to climb after firmer-than-expected Chinese inflation.

- Ukraine gas transmission operator says Russian gas transit via Ukraine is flowing normally.

- Click for a detailed summary

NOTABLE DATA RECAP

- Norwegian Core Inflation YY (Jul) 3.3% vs. Exp. 3.3% (Prev. 3.4%); Consumer Price Index YY 2.8% vs. Exp. 2.8% (Prev. 2.6%)

NOTABLE EUROPEAN HEADLINES

- China Commerce Ministry says findings in the EU's EV prelim ruling lacks factual and legal basis and seriously violate WTO rules. Resorted to the dispute mechanism of the WTO.

NOTABLE US HEADLINES

- Fed's Goolsbee (non-voter) said the Fed watches markets but they do not drive policy, while he added they are getting back to more normal conditions in the US economy and the question is if the job market will hold or keep worsening. Furthermore, he said that they need to see more than payrolls and more than one month, as well as noted they need to watch the real economy if they are too tight for too long.

- Fed's Schmid (non-voter) said if inflation continues to come in low, it will be appropriate to adjust policy, as well as noted the current stance of Fed policy is not that restrictive and the Fed is close but still not quite there on reaching 2% inflation goal. Furthermore, Schmid said the path of Fed policy will be determined by data and the strength of the economy, while he would not want to assume any particular path or endpoint for the policy rate.

- Fed's Collins (2025) on Thursday said: if the data continue the way that I expect, I do believe that it will be appropriate soon to begin adjusting policy and easing how restrictive the policy is.

GEOPOLITICS

MIDDLE EAST

- Qatari, Egyptian and US leaders said it is time to conclude a Gaza ceasefire agreement and release hostages and prisoners, while they have worked for months to reach a framework agreement and it is now on the table, with only details of implementation missing. Furthermore, they called on the sides to resume urgent talks on Thursday, August 15th, in Doha or Cairo to bridge all remaining gaps and start implementing an agreement without any delay.

- CNN source said lead mediators will attend the next round of negotiations with the CIA director to lead the US delegation, while the meeting that is being planned is expected to take place but needs the approval of Israel and Hamas, while it was later reported that Israeli PM Netanyahu's office said Israel will send negotiators for August 15th meeting on a Gaza deal and a Hamas official also said that they are ready for ceasefire negotiations to stop the bloodshed, according to source on X

- US senior administration official said President Biden and Defense Secretary Austin reviewed Middle East military deployments, while the official added that there is no expectation that an agreement will be signed by next Thursday and that issues on the table include the sequencing of the exchange. The official added that it is a negotiation and they need some things from the Israelis and the Hamas side, as well as noted that an Iranian escalation would jeopardise hope of getting a ceasefire deal because the focus would shift.

- US Secretary of Defence Austin briefed his Israeli on the nature of the deployment of US forces in the Middle East and stressed the importance of the ceasefire agreement in Gaza, while Austin said the arrival of F-22 jets in the region is part of the efforts to deter, defend Israel and protect US forces.

- Officials believe an Iran assault could be more sudden, larger and longer possibly lasting several days instead of several hours and could also be a coordinated barrage from multiple directions involving Iranian proxies in Iraq, Yemen, Syria and Lebanon, according to Washington Post.

- US CENTCOM said the US military destroyed two Houthi cruise missiles targeting ships.

- Rockets were fired at Kiryat Shmona and Manara settlement in northern Israel, while the Israeli army said air defence systems intercepted a rocket fired from the Gaza Strip towards Zikim and Ashkelon south of Israel, according to Al Arabiya.

- Yemeni sources noted US-British raids on Houthi military sites in Ras Issa and Salif areas in Hodeidah, according to Sky News Arabia.

- "The Israeli army announces the start of an "offensive" military operation in the city of Khan Yunis in the Gaza Strip", according to Sky News Arabia.

- Iran's Tasnim says the Iranian Guards Navy's new missiles have capabilities such as a "highly explosive warhead", which is undetectable; added "large number" of anti-ship missiles to the IRGC navy.

OTHER

- Sevastopol authorities announced a state of air emergency and the shooting down of a Ukrainian anti-ship missile, while it was also reported that a state of emergency was declared after a march attack on Belgorod and Voronezh, according to Al Arabiya.

- Source on X reported that residents said there was a huge blast heard in Rylsk, Rostov-On-Don, Russia.

- A fire broke out at a military airfield in Russia's Lipetsk region, according to agencies cited by AFP.

- Russia declares Federal emergency in Kursk region, according to RIA.

- Russian official says fighting is ongoing several dozen kilometres from Kurchatov, where Kursk nuclear plant is located.

CRYPTO

- Bitcoin is in the green and back above the USD 60k mark, but has eased back from a USD 62.7k high which printed in APAC trade.

APAC TRADE

- APAC stocks took impetus from the relief rally on Wall St where sentiment was underpinned after a larger-than-expected decline in Initial Jobless Claims soothed some of the recent labour market concerns.

- ASX 200 gained with outperformance in tech front-running the advances seen across all sectors.

- Nikkei 225 briefly reclaimed the 35,000 status and momentarily turned positive for the week after fully recovering from Monday's turmoil, but later faltered heading into the Japanese long weekend.

- Hang Seng and Shanghai Comp. were positive after encouraging signals from China's inflation data and with notable strength in China's largest chipmaker SMIC after its Q2 results which showed profits dropped sharply but beat expectations and revenue climbed, while it also forecasts double-digit percentage sequential revenue growth for Q3. However, the gains in the mainland were limited after the PBoC's open market operations for this week resulted in the largest net liquidity drain in four months.

NOTABLE ASIA-PAC HEADLINES

- TSMC (2330 TT) July Sales TWD 256.95bln (207.8bln in June).

- China's Industry Association reports July vehicles sales -5.2% Y/Y (prev. -2.7%), January-July +4.4% (prev. +7.9%); NEV July sales +27 Y/Y.

DATA RECAP

- Chinese CPI MM (Jul) 0.5% vs. Exp. 0.3% (Prev. -0.2%); YY (Jul) 0.5% vs. Exp. 0.3% (Prev. 0.2%)

- Chinese PPI YY (Jul) -0.8% vs. Exp. -0.9% (Prev. -0.8%)