- Sentiment lifted after the US Commerce Secretary suggested Trump could potentially reduce tariffs on Canada and Mexico, perhaps as soon as Wednesday.

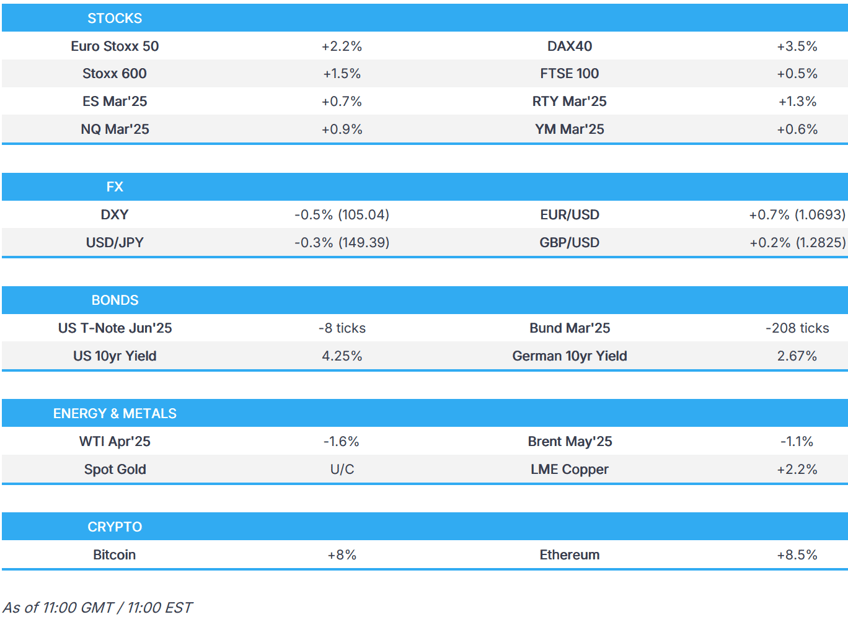

- European bourses at session highs; DAX 40 +3% outperforms; US equity futures broadly higher with the RTY +1.2%.

- EUR surges on German spending plans, DXY around 1.05 after breaking below its 200DMA.

- Bunds battered by Merz's fiscal reform, USTs await data and tariff updates.

- Crude subdued continuing recent action & failing to benefit from China's support which has bolstered base metals.

- Looking ahead, US ADP National Employment, US Factory Orders, ISM Services, Fed’s Beige Book, BoE Treasury Select Hearing, Speakers including BoE's Bailey, Pill, Taylor and Greene. Earnings from Abercrombie & Fitch, Foot Locker & Marvell.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US Commerce Secretary Lutnick said he thinks US President Trump will meet Mexico and Canada in the middle on tariffs and they're probably going to be announcing that tomorrow (i.e. Wednesday 5th), while he added if USMCA rules are followed, Trump is considering relief, according to a Fox Business interview. Lutnick also said that President Trump is to move with Canada and Mexico but not all the way and that Trump may roll back Canada and Mexico tariffs on Wednesday.

- US and Canadian officials are in talks to possibly roll back Trump’s tariffs, according to WSJ. However, it was separately reported that US President Trump signalled privately he will stick with tariffs, according to NYT.

- US Department of Commerce preliminarily determined Canadian softwood lumber is being dumped into the US.

- Canada's Foreign Minister Joly is set to speak with US Secretary of State Rubio on Wednesday, according to the BBC.

- US President Trump's administration is readying an order to bolster US shipbuilders and punish China, while the draft order includes measures such as raising revenue from Chinese ships and tax credits and grants for shipyards, according to WSJ.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +1.5%) are entirely in the green, with sentiment boosted by several factors, which include; a) Lutnick suggesting Trump will scale back Canada/Mexico tariffs, b) Germany agreeing to debt brake reform, c) China’s Official Work Report which maintained its annual growth target and pledged measures including a boost in spending. Price action today has really only been one way, and that’s upward; as it stands, indices generally reside at session highs.

- European sectors hold a positive bias, with the key movers today attributed to the aforementioned German debt brake reform agreement. Construction & Materials tops the pile, joined closely by Industrial Goods and Services, Autos and then Tech; the latter two, buoyed by the risk-tone given the optimism surrounding a rolling back of US tariffs on Canada/Mexico.

- US equity futures (ES +0.6% NQ +0.7% RTY +1.2%) are entirely in the green, with sentiment lifted after US Commerce Secretary Lutnick said Trump could potentially scale back tariffs on Canada and Mexico, perhaps as soon as Wednesday.

- Tesla's (TSLA) German sales fell 76% in February in rising EV market, via Bloomberg.

- Saudi Aramco said to mull bid for BP's (BP/ LN) Castrol, via Bloomberg; will study bid for part, or all of Castrol's businesses; said to be particularly interested in Castrol India; Aramco deliberations at an early stage, may not lead to bid.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is extending its downside for a third consecutive session as gains in the EUR act as a drag on the index. DXY has fallen from the 107.56 level seen at the start of the week to a current session trough at 104.85, taking out its 200DMA at 105.00 in the process. Headwinds for the DXY aren't just a case of EUR strength, it is also in the context of domestic weakness following a recent run of soft data prints. And on the trade front, US Commerce Secretary Lutnick suggested Trump could potentially reduce tariffs on Canada and Mexico, perhaps as soon as Wednesday. Today's data slate sees US ADP and ISM services PMI with the former taking place in the context of Friday's NFP print.

- EUR is the clear outperformer across the majors with the obvious catalyst for recent price action being the latest updates out of Germany. To recap, the measures announced by Merz and others include a special EUR 500bln 10yr fund for infrastructure investments, changes to the debt brake to exempt defence spending of more than 1% of GDP, a loosening of the regional balanced budget requirement and a new instrument to provide EUR 150bln of loans. Subsequently, EUR/USD has surged from the circa 1.0388 level seen at the start of the week to a multi-month peak at 1.0722, brining it in touching distance of its 200DMA at 1.0725.

- JPY is firmer vs. the broadly weaker USD. On the domestic front, BoJ Governor Ueda noted that diverging monetary policy stance among countries could potentially increase volatility, have destabilising effects on exchange-rate dynamics. Elsewhere, BoJ Deputy Governor Uchida said he does not have a preset idea in mind on the pace of future rate hikes and does not think it is good communication for the BoJ to judge whether market pricing of future moves are appropriate or not. USD/JPY has delved as low as 149.11 but stayed clear of yesterday's 148.08 YTD trough.

- Cable is up for a third session in a row, clearing the 1.28 mark and its 200DMA at 1.2803, printing a fresh YTD peak at 1.2854. Newsflow for the UK remains on the light side asides from reporting via the BBC that the Treasury will inform the OBR of its "major measures" on Wednesday aimed at reducing spending by billions pounds.

- Antipodeans both faded some of their recent gains as the greenback recouped lost ground and amid the mixed risk sentiment in Asia, while there was little reaction seen following better-than-expected Australian GDP data or from the announcement that RBNZ Governor Orr resigned.

- Hotter-than-expected Swiss inflation metrics from Switzerland triggered a knee-jerk lower in EUR/CHF from 0.9470 to 0.9453 before paring almost all of the move. The release exceeded expectations but fell in-line with the SNB's Q1 projection of 0.3%.

- PBoC set USD/CNY mid-point at 7.1714 vs exp. 7.2575 (prev. 7.1739).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds are under marked pressure following the CDU, CSU and SPD leaders announcing an agreement on the first phase of debt break reform which they hope to pass in the next week as such get through under the current Bundestag configuration where a two-thirds majority for constitutional reform can be attained. At most, the planned reform has weighed on Bunds by over 250 ticks to a 129.66 trough vs Tuesday’s 132.24 close. Since, Bunds have made their way off the 129.66 base and are back above 130.00 with support coming via downward revisions to some Final PMIs this morning, as the equity rally took a slight breather and on profit taking from the marked bearish action.

- USTs are under modest pressure, following the lead from Bunds, but to a much lesser degree. Due to the German measures not having any direct fiscal implications for the US and as the region remains more focused on growth concerns; ISM Services & Factory Orders are the next points to watch on this alongside ADP ahead of Friday’s Payrolls. USTs have been down to a 110-27 base but have spent much of the European morning and APAC session holding at the 111-00 mark.

- US yields are bid across the curve with the belly leading, as has been the case in recent sessions. On the trade front, US Commerce Secretary Lutnick suggested Trump could scale back the Mexican/Canada tariffs, and could be announced on Wednesday.

- Gilts are softer following the lead from Bunds. Trading much closer to Bunds than USTs in terms of magnitudes with Gilts down to a 92.11 low at worst vs the 93.50 close on Tuesday. Pressure which comes as Gilts play catchup to the Merz announcement, with USTs having already reacted in Tuesday’s session, and as the focus returns to the UK’s own fiscal fortunes. On this, multiple outlets have reported that Chancellor Reeves is to present the OBR with her latest potential fiscal adjustments which the BBC, citing sources, reports include several billion pounds of draft spending cuts to welfare & other departments. Most recently, no move to a strong UK auction which saw a b/c in excess of 3x.

- UK sells GBP 4.25bln 4.375% 2030 Gilt: b/c 3.39x (prev. 3.05x), average yield 4.311% (prev. 4.276%) & tail 0.3bps (prev. 0.5bps)

- Click for a detailed summary

COMMODITIES

- Crude is on the backfoot, continuing the pressure seen in overnight trade which failed to materially benefit from the latest private sector inventory data which showed a surprise draw in headline crude. A softer Dollar, positive risk tone and China pledging to boost spending has failed to lift sentiment in the complex; focus may be on Ukrainian President Zelensky who said that Ukraine is ready to come back to the table to sign a minerals deal - tariff uncertainty and recent OPEC+ action also factor. Brent and WTI trading at USD 67.47/bbl and USD 70.55/bbl respectively.

- Precious metals are mixed, with gold flat whilst Silver gains; the softer Dollar and China's Official Growth Report manages to keep the yellow-metal afloat, despite the risk-on mood. Gold trades indecisively but towards its USD 2,922/oz high, after remaining above the USD 2,900/oz mark for most of Monday’s session.

- Base metals are entirely in the green, with the complex boosted after China's Official Growth Report which maintained a growth target of around 5% and pledged measures to boost spending. 3M LME Copper above the USD 9.5k mark compared to Tuesday’s USD 9.34k close.

- Private inventory data (bbls): Crude -1.5mln (exp. +0.3mln), Distillate +1.1mln (exp. +0.2mln), Gasoline -1.2mln (exp. -0.4mln), Cushing +1.6mln.

- 5.6 magnitude earthquake in Oaxaca, Mexico, via GFZ.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swiss CPI YY (Feb) 0.3% vs. Exp. 0.2% (Prev. 0.4%); MM (Feb) 0.6% vs. Exp. 0.5% (Prev. -0.1%)

- French Industrial Output MM (Jan) -0.6% vs. Exp. 0.3% (Prev. -0.4%, Rev. -0.5%)

- Spanish Services PMI (Feb) 56.2 vs. Exp. 55.3 (Prev. 54.9)

- Italian HCOB Services PMI (Feb) 53.0 vs. Exp. 50.9 (Prev. 50.4); HCOB Composite PMI (Feb) 51.9 (Prev. 49.7)

- EU HCOB Services Final PMI (Feb) 50.6 vs. Exp. 50.7 (Prev. 50.7); EU HCOB Composite Final PMI (Feb) 50.2 vs. Exp. 50.2 (Prev. 50.2)

- German HCOB Services PMI (Feb) 51.1 vs. Exp. 52.2 (Prev. 52.2); HCOB Composite Final PMI (Feb) 50.4 vs. Exp. 51 (Prev. 51)

- French HCOB Services PMI (Feb) 45.3 vs. Exp. 44.5 (Prev. 44.5); HCOB Composite PMI (Feb) 45.1 vs. Exp. 44.5 (Prev. 44.5)

- UK S&P Global Composite PMI (Feb) 50.5 vs. Exp. 50.5 (Prev. 50.5); Global Service PMI (Feb) 51.0 vs. Exp. 51.1 (Prev. 51.1)

- EU Producer Prices YY (Jan) 1.8% vs. Exp. 1.4% (prev. 0.0%, rev. 0.1%); Producer Prices MM (Jan) 0.8% vs. Exp. 0.5% (Prev. 0.4%, Rev. 0.5%)

- Italian Retail Sales NSA YY (Jan) 0.9% (Prev. 0.6%); Retail Sales SA MM (Jan) -0.4% (Prev. 0.6%)

NOTABLE EUROPEAN HEADLINES

- UK Treasury has earmarked several billion pounds of draft spending cuts to welfare and other departments, via BBC citing sources; Treasury will inform the OBR of its "major measures" on Wednesday.

- UK Chancellor Reeves is set to submit plans this week to the OBR detailing billions of GBP of spending reductions, according to the FT.

- German new passenger car registrations (Feb) -6.4% to 203,434, according to KBA

NOTABLE US HEADLINES

- US President Trump said in his Address to the Joint Session of Congress that America is back and they have taken swift and relentless action and are just getting started. Trump announced he will create a new office of shipbuilding in the White House and will offer new tax incentives for shipbuilding, while he is fighting every day to make America affordable again and reiterated his call to drill for more oil. Furthermore, Trump said they will eliminate inflation by reducing all fraud, waste and theft of public money and stated that reciprocal tariffs will kick in on April 2nd.

GEOPOLITICS

MIDDLE EAST

- White House said the Gaza reconstruction plan adopted by Arab states does not address the reality that Gaza is 'currently uninhabitable' and that President Trump stands by his proposal to rebuild Gaza 'free from Hamas'.

- Russian President Putin agreed to act as a mediator between Iran and the US, according to Zvezda citing the Kremlin. It was also reported that a Kremlin aide said Iran was discussed at Russia-US talks in Riyadh and that Russia and the US agreed to hold separate talks on Iran, according to Interfax.

RUSSIA-UKRAINE

- US President Trump said in his Congress address that he received an important letter from Ukrainian President Zelensky who said he is ready to come back to the table and Ukraine is ready to sign a minerals deal.

- US and Ukraine plan to sign minerals deal and President Trump has told advisers he wanted to announce the Ukraine minerals deal during Tuesday's speech to Congress, according to sources cited by Reuters although they cautioned that the deal had yet to be signed and the situation could change.

Other

- China's Coast Guard said the Philippines sent a civilian boat to deliver supplies to its 'illegally grounded' warship at Second Thomas Shoal, while China urged the Philippines to honour its commitments and work with China to manage the maritime situation.

CRYPTO

- Bitcoin is on a firmer footing and has climbed back above USD 88k; Ethereum also higher and sits just above USD 2.2k.

APAC TRADE

- APAC stocks traded mixed following the whipsawing stateside on Trump's tariffs, subsequent retaliation and Commerce Secretary Lutnick's suggestion of a potential rollback, while the region also digested a slew of commentary from China’s Official Work Report and President Trump’s Address to the Joint Session of Congress.

- ASX 200 was dragged lower by underperformance in the consumer and energy sectors, while better-than-expected Australian GDP data failed to inspire a recovery.

- Nikkei 225 price action was initially choppy but gradually edged higher amid a weaker currency.

- Hang Seng and Shanghai Comp were positive after better-than-expected Chinese Caixin Services PMI data and with the attention on the NPC and the Official Work Report in which China maintained its annual growth target of around 5% and pledged measures including a boost in spending, while there was notable outperformance in Hong Kong where CK Hutchison surged by more than 20% after agreeing to sell its Panama Canal Ports stake to BlackRock.

NOTABLE ASIA-PAC HEADLINES

- Foxconn (2317 TT) February revenue rose at a rate of +56.43% Y/Y (vs +3.2% Y/Y in January).

- China targets 2025 GDP growth of around 5% and CPI at around 2%, while it sees the 2025 budget deficit at 4% of GDP and said it will adopt more proactive fiscal policy. China will re-capitalise major state banks with CNY 500bln from special treasury bonds and will issue CNY 1.3tln in ultra-long-term special treasury bonds in 2025 vs CNY 1tln in 2024, while it set the 2025 quota on local government special bonds at CNY 4.4tln vs. CNY 3.9tln in 2024, according to the Official Work Report.

- China's NDRC said it will boost domestic demand and will promote integrated advancements in technological and industrial innovation and will use monetary policy instruments to adjust both the monetary aggregate and structure, while it added that China will lower banks' reserve requirement ratios and interest rates at the right timing. NDRC said China will support the fundraising of micro and small businesses, well accelerate efforts to foster a complete system of domestic demand and make domestic demand the main engine and anchor of economic growth.

- China's financial regulator head said will support the property market, lengthen the white list, and ensure delivery of housing, while China will increase the supply of credit to more private enterprises and will reduce comprehensive financing costs of private enterprises. Furthermore, China approved an additional CNY 60bln of insurance funds for long-term investment in capital markets.

- China Cabinet Research Office head said fully confident in achieving the 2025 economic growth target and that China’s economy has shown steady improvement over 2025 so far, while the official added that macro policy measures will provide strong support to the economy.

- RBNZ Governor Orr resigned and Deputy Governor Hawkesby will be Acting Governor until March 31st, while RBNZ Chair Quigley said Governor Orr resigned for personal reasons and feels like 'he's done the job'.

DATA RECAP

- Chinese Caixin Services PMI (Feb) 51.4 vs. Exp. 50.8 (Prev. 51.0); Composite PMI (Feb) 51.5 (Prev. 51.1)

- Australian Real GDP QQ SA (Q4) 0.6% vs. Exp. 0.5% (Prev. 0.3%); YY SA (Q4) 1.3% vs. Exp. 1.2% (Prev. 0.8%)