This morning, General Motors announced it will take over $5 billion in noncash charges and write-downs to address its declining business in China, reflecting the challenges faced by global automakers in the world’s largest car market, according to Bloomberg and Wall Street Journal.

A company 8-K filed ahead of today's GM investor presentation said:

On December 2, 2024, the Audit Committee of the Board of Directors of the Company concluded a material impairment of the Company’s interest in SGM was required based on a determination that a material loss in value of our investments in certain of the China JVs is other than temporary in light of the finalization of a new business forecast and certain restructuring actions that SGM is finalizing that are expected to be taken to address market challenges and competitive conditions.

These charges include a $2.9 billion writedown of its joint venture with Chinese partner SAIC Motor Corp. and $2.7 billion related to restructuring costs, such as factory closures and the discontinuation of unprofitable vehicle models, follow up reporting noted.

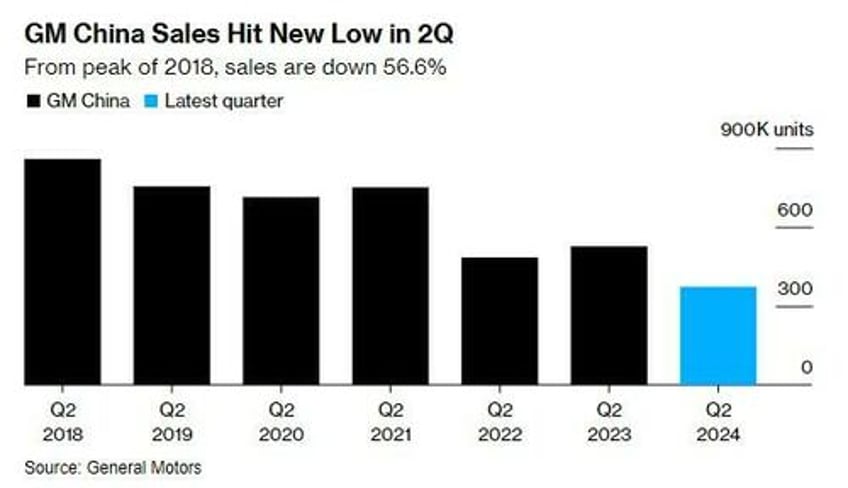

The moves come after years of dwindling market performance. GM, which once sold over four million vehicles annually in China at its 2017 peak, has seen sales nearly halve by 2023.

Profitability has plummeted, with a $347 million loss reported in the first nine months of 2023, compared to a $2 billion profit in 2017. The downturn is largely attributed to the rise of domestic Chinese automakers like BYD, which have benefitted from government subsidies and a surge in demand for electric vehicles.

The restructuring aims to stabilize GM’s joint venture with SAIC, which produces Buicks, Chevrolets, and Cadillacs, and restore profitability without requiring additional capital investment from GM.

Recall, back in August we noted that GM was cutting jobs amidst a "larger structural overhaul" in China. At the time we noted the shift indicated GM likely wouldn't eclipse its peak sales in the country it set in 2017.

Earlier this year they announced they were reducing staff in their China-focused departments, including research and development. At the time, GM and its partner SAIC were expected to discuss potential capacity cuts.

Bloomberg wrote this summer that the overhaul marked a significant change for GM, which once made billions in the Chinese market.

Despite the writedowns, GM says it remains optimistic about the venture's future viability, though the new valuation underscores reduced expectations for earnings in the region.