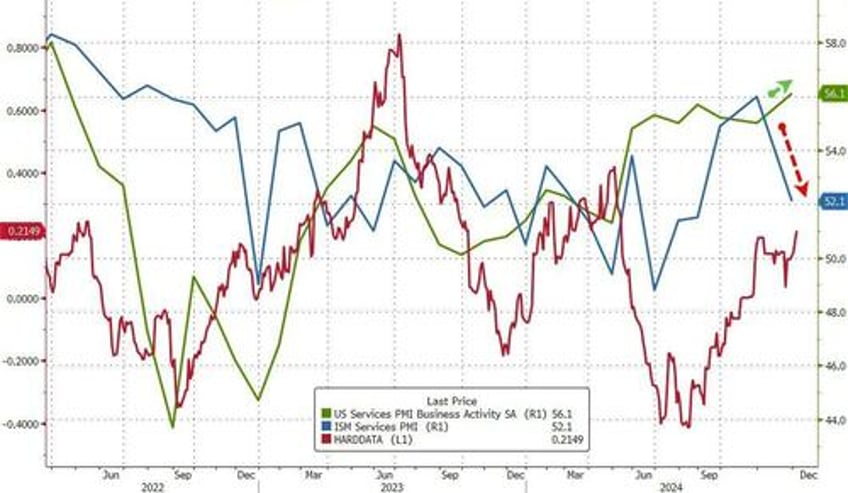

On the heels of US Manufacturing surveys improving yesterday (though both still in contraction) - in the face of what we now know is significant job losses in the industry - this morning's US Services surveys were expected to also see further improvement. But the story - as always - was mixed...

S&P Global US Services PMI rose from 55.0 (Oct) to 56.1 (Nov final) - fastest expansion since March 2022 - but we note that it was down from the 57.0 flash print in early Nov.

ISM Services PMI tumbles from 56.0 (Oct) to 52.1 (Nov) - the biggest drop since June

These moves come along with a surge in 'hard' data in recent months...

Source: Bloomberg

ISM Services was the only survey to turn down this month...

Source: Bloomberg

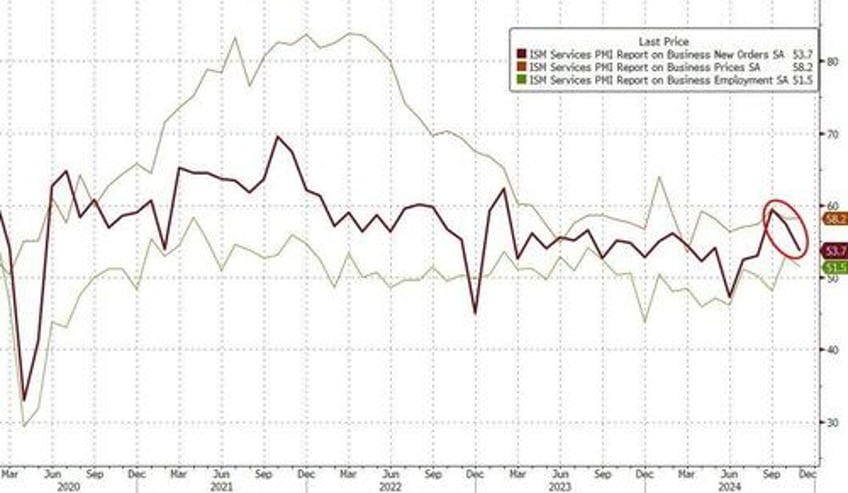

The plunge in new orders was the big driver for ISM Services' disappointment and Prices Paid refuses to drop...

Source: Bloomberg

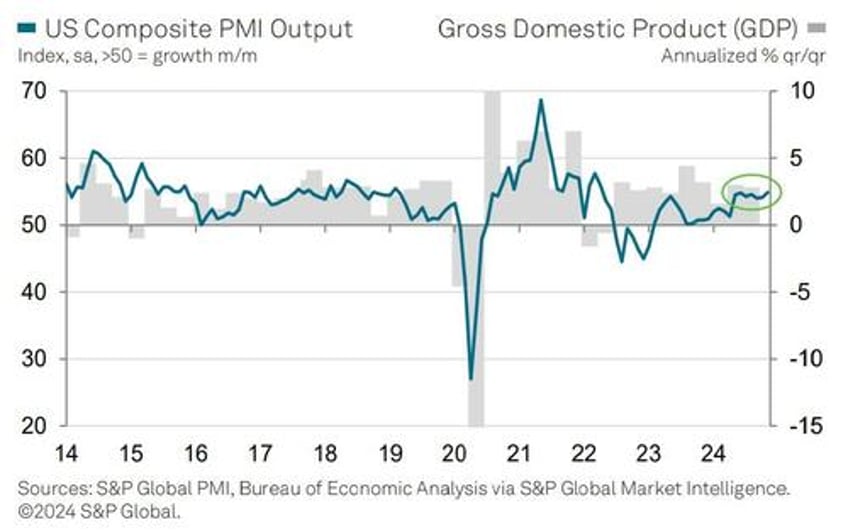

So, while ISM's survey plunges, the S&P Global US Composite PMI Output Index rose to a 31-month high of 54.9 in November from 54.1 in October.

The latest reading signaled a marked monthly increase in output. The overall expansion continued to be driven by services, while manufacturing output decreased again.

As Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, writes:

“Improved service sector output offset a further decline in manufacturing during November, helping drive the overall pace of growth of business activity to the fastest for over two and a half years. The recent survey data are consistent with GDP growing at an annualized 2.6% rate in the fourth quarter, assuming a similarly robust expansion is seen in December.

"Companies have reported stronger demand for services thanks to the clearing of political uncertainty following the election, as well as brighter prospects for the economy in 2025 linked to the incoming administration and hopes for lower interest rates. The latter, alongside strong market gains in recent weeks, has helped drive an especially strong surge in demand for financial services, though November also saw robust growth for business and consumer services."

But, employment was weak...

"It was surprising to see employment continue to fall, given the strength in demand for services reported during November, which hints at ongoing labor supply issues and the potential for stubborn wage growth."

And prices keep rising...

"However, despite another month of above-average input cost inflation in the services sector, average prices charged for services rose only very slightly amid increased competition."

Does any of that sound like a good foundation for cutting rates by 25bps next week?

So maybe The Fed will focus on ISM data not S&P Global's?

In case you were wondering why every other sentiment survey has soared in November post-election on optimism about the new administration, but ISM's did not, here are a few responses from the apparently purple hair brigade they decided to survey?

Anti-Trump talking points unleashed...

“We have concern after the presidential election that tariffs will affect prices for electronics and components in 2025.” [Information]

“Election results and the potential tariff changes would impact inventory and lead to higher prices in the hospital supply chain. What we saw during COVID-19 with startup U.S. production is a warning sign again.” [Professional, Scientific & Technical Services]

“Still waiting to see how presidential cabinet picks shake out, if they are confirmed and how they will affect our operations going forward. Holding capital projects now until the cabinet is complete and we know how federal funds will be dispersed going forward.” [Transportation & Warehousing]

So, politicized sentiment surveys too, eh?