Shares of General Motors are up 1.5% in premarket trading after reporting quarterly profits that exceeded expectations, driven by strong US sales. The impact of strikes was minimal, mainly because United Auto Workers' labor actions began late in the third quarter. However, the automaker has retracted its full-year forecast due to anticipated financial challenges in the fourth quarter, especially as the strike approaches its sixth week.

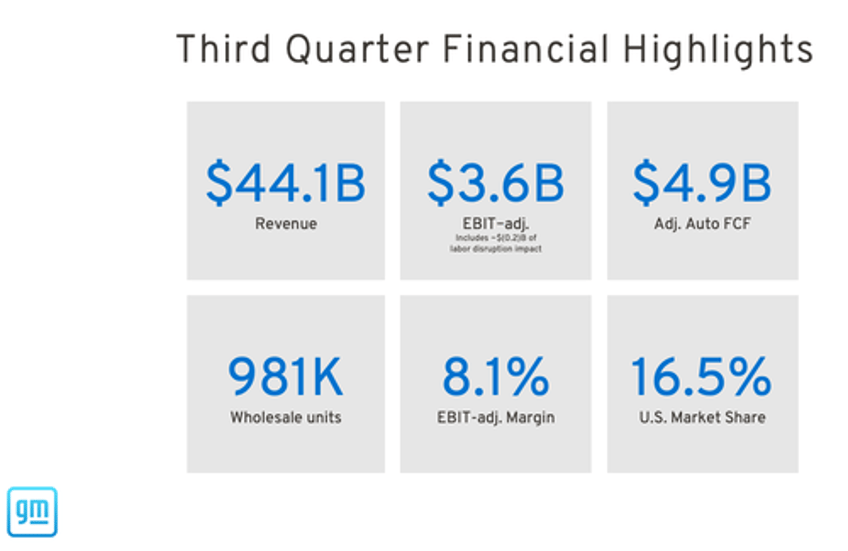

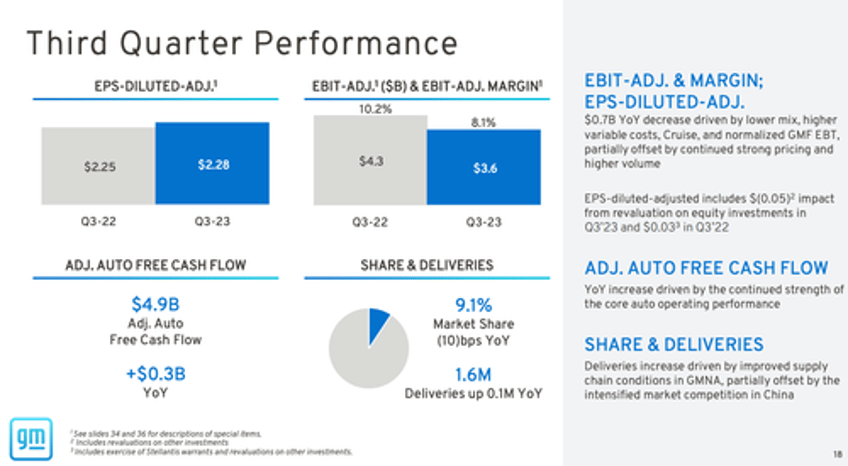

GM reported a third-quarter adjusted profit of $2.28 a share, exceeding Wall Street estimates of $1.84, thanks to its North American segment achieving strong growth with historically high vehicle pricing. Revenue beat analysts' forecasts by $1 billion, reaching $44.1 billion.

"Great vehicles are the foundation, and we have earned leadership in key segments like full-size pickups and full-size SUVs that have consistently strong pricing and margins," CEO Mary Barra said in a letter to investors.

Barra said the automaker will offset higher future labor costs with a $2 billion reduction in fixed costs next year: "It's been clear coming out of COVID that wages and benefits across the US economy would need to increase because of inflation and other factors."

GM's automotive free cash flow grew by over $300 million in the quarter to $4.9 billion. GM CFO Paul Jacobson told journalists on a call that it would hit the top end of the guidance range before the strike started.

Jacobson commented on the ongoing strikes: "We're not going to speculate on the duration and extent of the strike." He said the strike costs the automaker about $200 million weekly.

He said, "We remain hopeful we'll continue to make progress and get this resolved."

Barra also noted in the letter how she defended her current labor contract offer to UAW, indicating the proposal for $84,000 a year is 'historic.'

She warned, "We can't get ourselves into a situation of signing a deal that we can't afford to pay or that doesn't allow us to compete in the global marketplace."

The strikes began on Sept. 15, about two weeks before the end of the third quarter. While the initial impact was limited, the fourth quarter could be challenging for the automaker as it just had to tap JPMorgan Chase Bank for a $6 billion line of credit.