By Ven Ram, Bloomberg Markets Live reporter and strategist

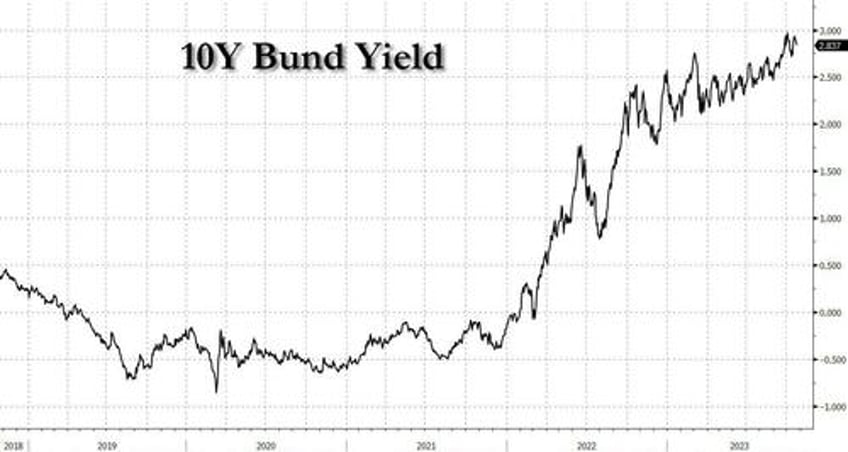

If yields on German bonds have been held aloft by dominant correlations with Treasuries, there’s a new flank that has opened this month that adds impetus to the move: action that is taking place almost 6,000 miles across to the east in Japan.

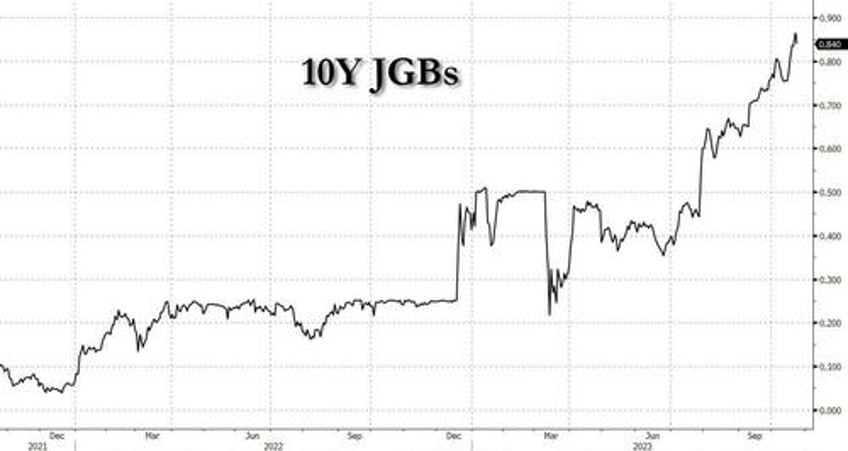

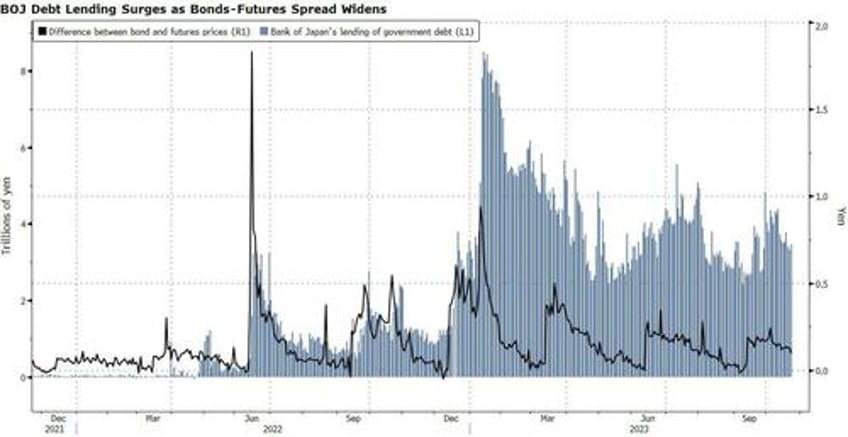

The Bank of Japan waded into the market yet again on Tuesday to staunch surging local yields. It also vowed to offer 1t yen worth of five-year loans to commercial banks, which the entities can then use to buy debt, thereby blunting any jump in yields. It wasn’t the first time this month the central bank had to intervene to defend its yield curve control.

The BOJ has spent trillions of yen since the start of the year, just to ensure that yields don’t spiral beyond control and tighten policy settings unwittingly for fear of thwarting a return to sustained inflation. While a central bank can theoretically throw oodles of money to defend its policies, that defense isn’t endless.

There comes a point in any intervention where the tipping point is determined not by the amount of money spent in defense of a policy but by the dislocations that it spawns. When companies find that the backdrop has crumbled to such an extent that they can no longer issue new bonds and yield spreads blow out, the trillions spent in such intervention pale into insignificance and policymakers have to give in, willy-nilly.

While 10-year Treasury yields have pulled back after reaching 5%, it’s hard to say with conviction that the bond rout is over — especially given the surge in real-risk premiums. Should that selloff be rekindled, bonds in Japan will test higher and higher yields, making the BOJ’s defense of the curve more onerous by the day.

Any indications that the BOJ is prepared to tweak its curve control and/or abandon its negative-rate policy will ripple through to the other markets, reinforcing yields from across Germany to the US even higher. Which is why the BOJ’s actions — whether at next week’s policy meeting or beyond — are more important for the direction of bunds than what the European Central Bank says on Thursday.