Late yesterday, we warned our premium subscribers, and this morning, moments before the report, we warned everyone else...

Real-time card data indicates a big miss in retail sales https://t.co/V8YwJsw22W

— zerohedge (@zerohedge) February 15, 2024

... that retail sales would be a "jarring" miss, and that's precisely what happened: in fact, it was so bad the January plunge in retail sales was the worst sequential decline since March 2023 and the biggest annual decline since May 2020!

Yet while we were spot on - and those who subscribe hopefully traded on the data and made good $ - there was a distinct group that was very surprised by the result. We are of course talking about Wall Street's erudite research economists who were gloriously wrong about today's retail sales number as shown in the histogram below.

Then again, admitting it was dead wrong without offering some reason why is grounds for immediate termination among economists (the same reasons that apparently nobody could anticipate when making the original prediction, but whatever) and sure enough, shortly after the report, Goldman's Jan Hatzius wrote that "severe winter weather likely weighed on January spending at the margin" yet even he admitted that weather "probably does not explain the bulk of the weakness, given the 0.8% drop in non-store retail spending and the 0.7% increase in restaurant spending (the latter is weather sensitive, the former is generally not)." Some other observations:

That said, weather likely weighed on miscellaneous stores (-3.0%) and potentially on electronics (-0.4%). The winddown of covid boosters likely weighed on health and personal care stores (-1.1%). Retail sales rose at furniture (+1.5%) and department (+0.5%) stores. Combining data from the latest retail sales and CPI reports, we estimate that real core retail sales fell 0.5% in January after +0.8% in December (mom sa). Building materials sales fell 4.1% in January, likely due to weather (this component is not included in retail control).

The retail sales report was below our previous expectations and implies downside to our Q1 GDP and consumption estimates. We will update our GDP tracking estimates after the mid-morning data.

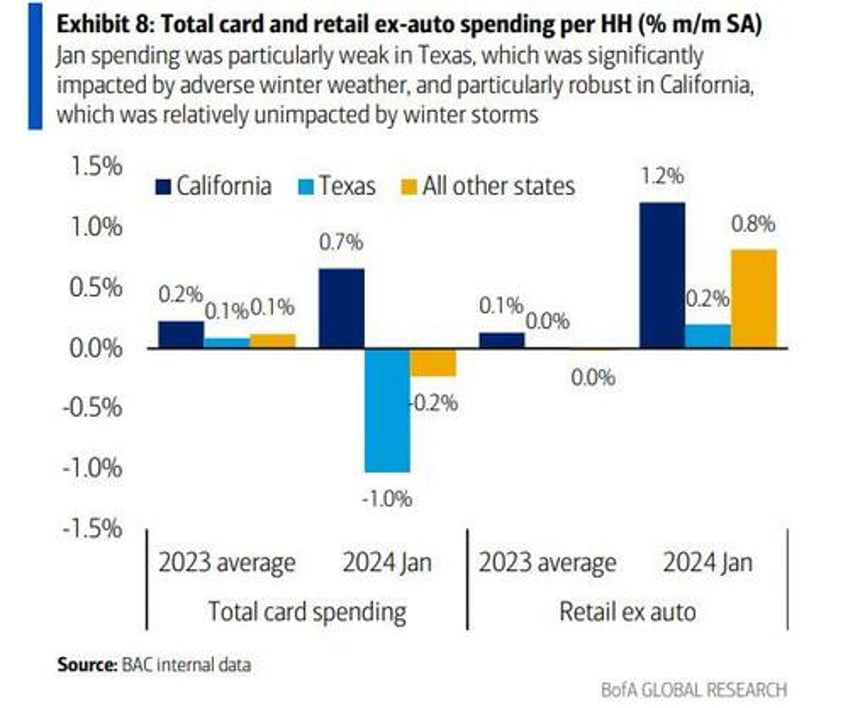

To be sure, last night we did warn that widespread winter storms probably did weigh on retail spending and when looking at BofA card spending data, "unsurprisingly, the impact was largest in the South, where winter weather disruptions are less common."

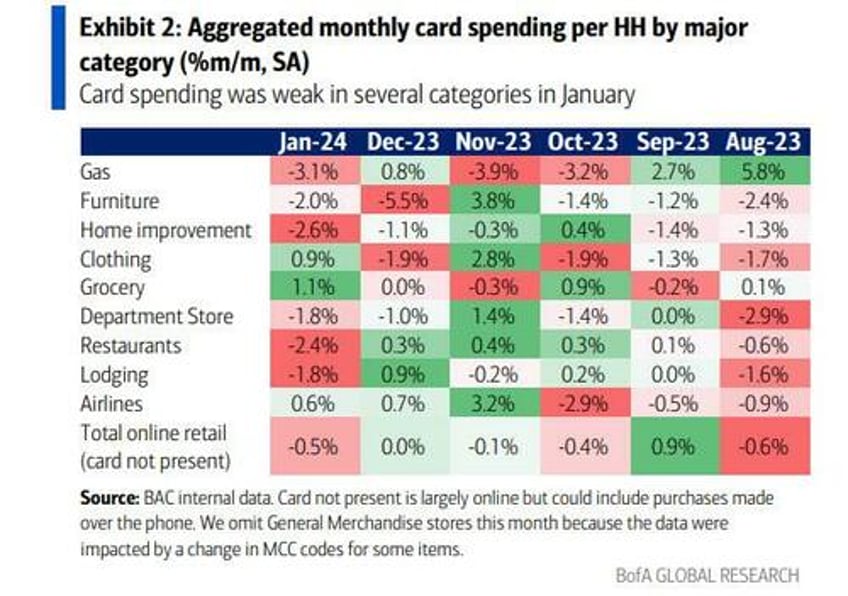

Another way to assess the impact of weather on retail sales is to look at which categories had outsized moves in January: as we observed yesterday, "restaurants and gas were very weak, likely because consumers spent more time than usual at home. Probably for the same reason, there was a large pickup in grocery spending. Interestingly, however, online retail spending (card not present) was down in January."

But while weather perhaps did play a modest role in the big decline (and not like it was a surprise to economists who should have anticipated its impact when submitting their forecasts which make up the median consensus estimate), it was at best nominal since December weather was even more severe.

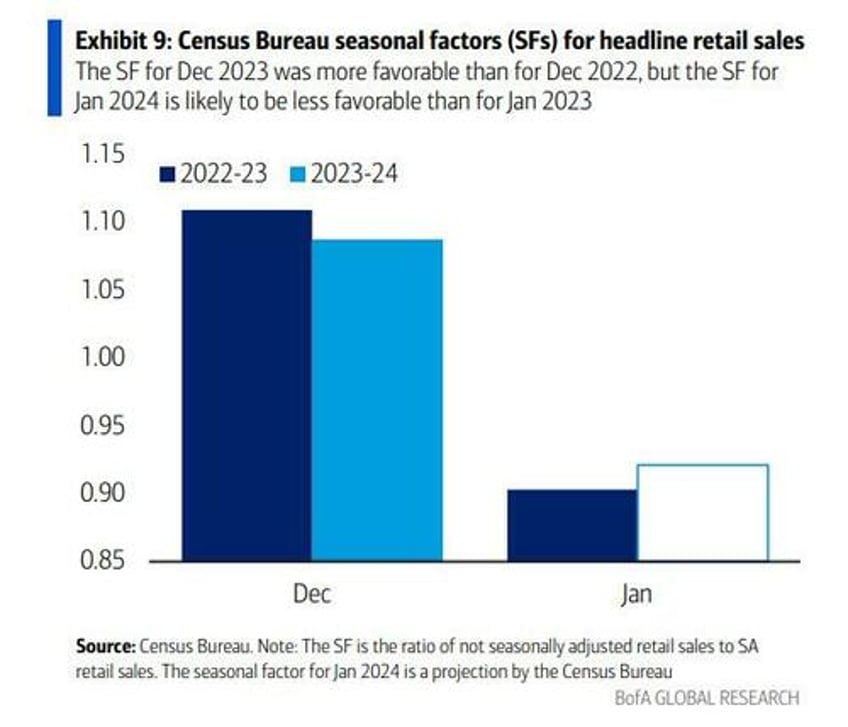

So what else happened? Well, two things. As we explained last night, January retail sales are all about seasonal adjustments, because the unadjusted print in the first month of the year is an elevator lower every year and this month was no different (see highlighted adjustment factor below).

And so, because the seasonal adjustment in December was very generous in December when retail sales soared, buoyed largely by a favorable seasonal adjustment, January was payback time and indeed, the Census Bureau’s projected seasonal adjustments for January 2024 are significantly less favorable than they were in January 2023.

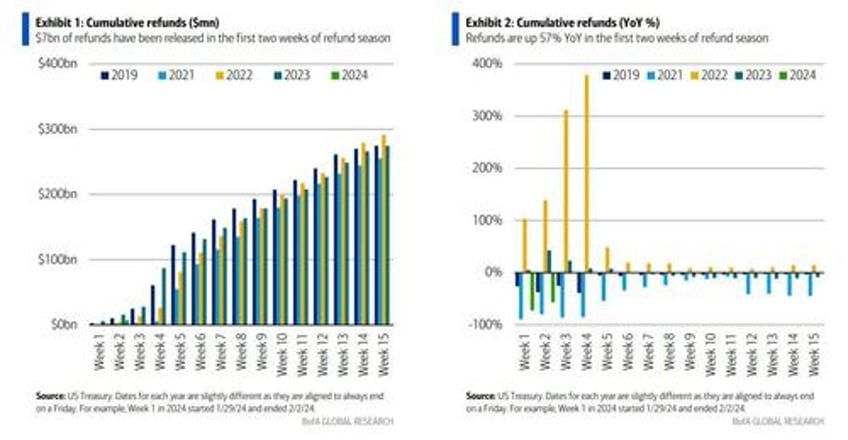

Finally, also yesterday we pointed out that the start of tax refund season has been a disaster, as it has been marred by a shocking plunge in weekly tax refunds which primarily impacts lower income households, and would have an immediate adverse impact on retail sales...

... particularly spending at gas stations and restaurants, which as we now know was particularly weak.

These are the factors we cited last night, and which we said will "crush the Seasonally Adjusted retail sales in January 2024." We were right, and Wall Street was as always wrong. Maybe all those strategists out there should consider an annual subscription to this website. We may even give them a discount.

And now that we know retail sales were a disaster, the question as Mikael Sarwe, head of Nordea's equity strategy, asks is whether this slide in retail sales is noise, or the start of a new and very ominous for Biden and the Democrats, trend.

🇺🇸 Weak retail sales. Noise, or the start of a new trend? pic.twitter.com/kR1hwbxn53

— Mikael Sarwe (@MikaelSarwe) February 15, 2024