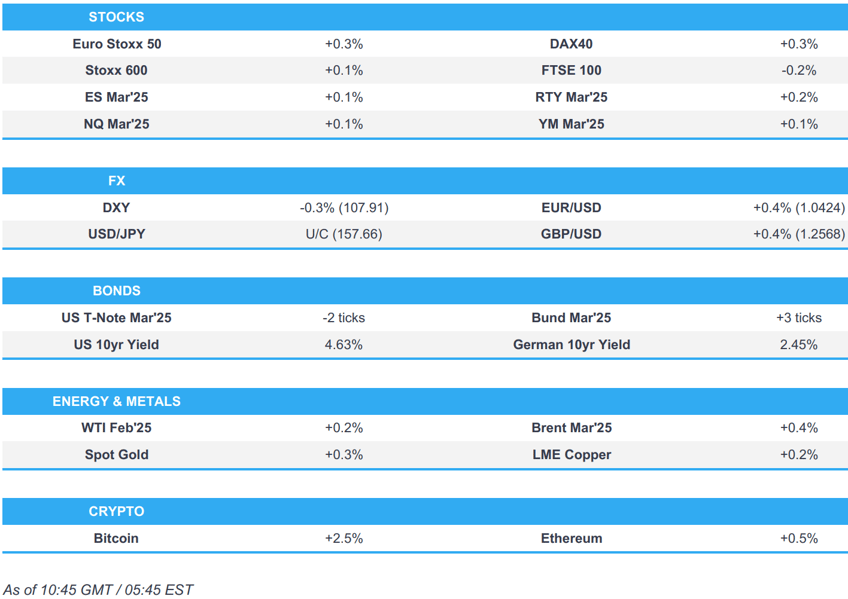

- European bourses are mixed, US futures gain slightly.

- USD remains soggy vs. peers, EUR digests CPI metrics, Antipodeans lead.

- USTs are contained into data, EGBs lift slightly on HICP, Gilts lag.

- A choppy start for crude while spot gold benefits from the broadly softer Dollar.

- Looking ahead, US ISM Services PMI, JOLTS Job Openings, International Trade, Canadian Imports/Exports, Comments from Fed's Barkin, Supply from the US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses opened mostly in the red, but sentiment lifted slowly as the morning progressed to display a more mixed picture in Europe.

- European sectors began the morning with a slight negative bias, but now display a more mixed picture. Financial Services takes the top spot, joined closely by Retail and then by Basic Resources to complete the top 3. The latter is buoyed by gains in underlying metals prices. Banks sit at the foot of the pile, but with losses to a similar magnitude as Insurance and Healthcare.

- US equity futures are incrementally in the green, with the NQ/ES ultimately taking a breather after the tech-led strength seen in the prior session.

- Nvidia (NVDA): At CES 2025, Nvidia CEO unveiled its GeForce RTX 50 series GPU (RTX 5070-5090, priced USD 549-1,999) featuring Blackwell architecture and GDDR7 memory. It also introduced Project Digits, a USD 3,000 AI supercomputer with the GB10 Grace Blackwell Superchip, and announced AI advancements for robotics and self-driving cars.

- Deutsche Bank has turned Overweight on European equities vs the US. Upgrades the European Healthcare sector to Overweight.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. all peers with DXY down for a third consecutive session. Recent price action for the Greenback has been dictated by the recent Washington Post report that Trump's tariff plans may not be as bad as initially feared. Whilst Trump did later attempt to downplay this, ING is of the view that "there is no smoke without fire". For today's docket, attention will be on ISM services PMI and JOLTS data ahead of NFP on Friday. DXY has been as low as 107.84 but is holding above yesterday's 107.75.

- EUR remains supported after being catapulted from a 1.0294 base yesterday in the wake of reports that the Trump tariff programme may be less stringent than initially feared. The macro focus has been on the December Eurozone inflation report which showed headline HICP advancing to 2.4% from 2.2% as expected and the super-core rate holding steady at 2.7%. Some minor softness was observed in EUR/USD amid expectations of a potentially hotter figure given the outturn for Germany yesterday; currently 1.0430.

- JPY is flat vs. the USD after USD/JPY reached its highest level since July during APAC trade at 158.41. This subsequently triggered some jawboning from Japan's Finance Minister Kato who noted they are recently seeing one-sided, rapid moves and reiterated to take appropriate action against excessive moves. Elsewhere, Barclays have shifted their BoJ view and now see the Bank hiking in March and October vs. previous forecast of January and July

- GBP has extended on yesterday's tariff-induced gains vs. the USD with major fresh macro drivers for the UK on the light side today. As such, Cable has eclipsed yesterday's peak at 1.2550 but has failed to sustain a move above its 21DMA at 1.2573.

- Antipodeans are both at the top of the G10 leaderboard with markets continuing to deliberate the prospect of a potentially more friendly tariff programme by the Trump regime.

- CHF is a touch softer vs. the EUR post-Swiss CPI metrics. Y/Y headline CPI fell to 0.6% from 0.7% as expected, whilst the core rate fell to 0.7% from 0.9% (expected 0.8%). The 0.6% outturn means that the average across Q4 as a whole came in around 0.63% and is shy of SNB's 0.7% projection for Q4. EUR/CHF moved back onto a 0.94 handle following the data and is eyeing the 30th December peak at 0.9441.

- PBoC set USD/CNY mid-point at 7.1879 vs exp. 7.2994 (prev. 7.1876).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat, in a narrow 108-13+ to 108-20 band. Complex awaits US data incl. JOLTS and ISM Services alongside Fed’s Barkin (expected to reiterate remarks from 3rd Jan.) before 10yr supply. Last night’s 3yr auction was soft overall and weighed on USTs into settlement.

- Bunds pressured in-fitting with the above and the tentatively constructive European risk tone ahead of Flash HICP. Before that, the December HICP Y/Y figure for France came in cooler than newswire consensus though hotter than the prior.

- Thereafter, EGBs saw fleeting upside on the EZ data which came in in-line for the headline though with services and core slightly hot, upside perhaps driven by expectations for a hotter headline post-Germany; though, the Bunds upside proved shortlived.

- Gilts are underperforming. UK specifics light aside from Construction PMI which spurred no move and a strong BRC Retail Sales report for December, the latter perhaps weighing on Gilts. Given the pressure, which has taken Gilts to a 91.68 trough just above last week's 91.65 base and the contract low a tick below at 91.64, yields are firmer across the curve with the 30yr above 5.21% and at its highest since 1998. A slightly soft, but robust overall, UK auction spurred little move in Gilts.

- UK sells GBP 2.25bln 4.375% 2054 Gilt: b/c 2.75x (prev. 3.0x), average yield 5.198% (prev. 4.747%) & tail 0.3bps (prev. 0.4bps).

- Germany sells EUR 3.472bln vs exp. EUR 4.5bln 2.00% 2026 Schatz: b/c 2.30x (prev. 2.30x), average yield 2.18% (prev. 1.94%) & retention 22.8% (prev. 19.84%).

- Click for a detailed summary

COMMODITIES

- A relatively choppy start to the session for the crude complex, though benchmarks currently resides near the bottom end of the day’s ranges. Macro developments have been light thus far, so focus will likely be on US ISM Services PMI alongside JOLTS Job Openings. Brent'Mar currently towards the lower end of a USD 75.91-76.36/bbl range.

- Gold is firmer but only modestly so. Upside as a result of the soft USD and relatively tepid risk tone thus far. Furthermore, a modest bullish reaction was seen on China’s monthly reserves figures, which showed the second consecutive monthly increase in gold reserves. At the upper-end of USD 2632-2646/oz parameters, which is entirely within but towards the top-end of Monday’s parameters.

- Copper is modestly firmer, taking impetus from the softer USD and perhaps from the European risk tone, though that has been slightly more tentative thus far. 3M LME Copper holding above the USD 9k handle.

- BofA says natgas balances likely to tighten in 2025 as 2.5 BCF/D of demand growth outruns the 2.1 BCF/D of supply growth, supporting the bullish outlook

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Flash YY (Dec) 2.4% vs. Exp. 2.4% (Prev. 2.2%); services inflation 4.0% (prev. 3.9%); EU HICP-X F,E,A&T Flash YY (Dec) 2.7% vs. Exp. 2.7% (Prev. 2.7%); EU HICP-X F&E Flash YY (Dec) 2.8% vs. Exp. 2.7% (Prev. 2.7%); EU HICP-X F, E, A, T Flash MM (Dec) 0.50% (Prev. -0.60%)

- EU Unemployment Rate (Nov) 6.3% vs. Exp. 6.3% (Prev. 6.3%)

- UK BRC Retail Sales YY (Dec) 3.1% (Prev. -3.4%); Total Sales YY 3.2% (Prev. -3.3%)

- UK Halifax House Prices MM (Dec) -0.2% vs. Exp. 0.4% (Prev. 1.3%); YY 3.30% vs Exp. 4.20% (Prev. 4.80%)

- Swiss CPI YY (Dec) 0.6% vs. Exp. 0.6% (Prev. 0.7%); Core 0.7% vs. Exp. 0.8% (prev. 0.9%)

- French CPI (EU Norm) Prelim YY (Dec) 1.8% vs. Exp. 1.9% (Prev. 1.7%)

- German HCOB Construction PMI (Dec) 37.8 (Prev. 38.0)

- French HCOB Construction PMI (Dec) 42.6 (Prev. 43.7)

- Italian HCOB Construction PMI (Dec) 51.2 (Prev. 48.5)

- EU HCOB Construction PMI (Dec) 42.9 (Prev. 42.7)

- UK S&P Global Construction PMI (Dec) 53.3 vs. Exp. 54.4 (Prev. 55.2)

- Italian CPI (EU Norm) Prelim YY (Dec) 1.4% vs. Exp. 1.6% (Prev. 1.5%); CPI (EU Norm) Prelim MM (Dec) 0.1% vs. Exp. 0.3% (Prev. -0.1%); Consumer Price Prelim YY (Dec) 1.3% vs. Exp. 1.5% (Prev. 1.3%); Consumer Price Prelim MM (Dec) 0.1% (Prev. -0.1%)

NOTABLE EUROPEAN HEADLINES

- Barclays UK December consumer spending was flat Y/Y compared to December 2023.

- ECB Consumer Expectations Survey (Nov): See inflation in next 12 months at 2.6% (prev. 2.5%); 3y ahead sees 2.4% (prev. 2.1%). Economic growth expectations for the next 12 months became more negative, to stand at -1.3% in November, compared with -1.1% in October.

NOTABLE US HEADLINES

- Fed Governor Bowman is reportedly the top candidate to replace Fed's Barr as Vice Chair of Supervision, according to Semafor.

- New York judge denied US President-elect Trump's request to delay sentencing in hush money case, according to a court ruling cited by Reuters.

- US President-elect Trump commented on Truth Social that many people in Canada love being the 51st state and the US can no longer suffer the massive trade deficits and subsidies Canada needs to stay afloat. Furthermore, he stated if Canada merged with the US, there would be no tariffs, taxes would go down, and they would be completely secure from the threat of Russian and Chinese ships constantly surrounding them.

- Canada reportedly considers an early release of retaliatory tariffs against the US, according to The Globe and Mail.

- China Foreign Ministry on US President-elect Trump talking to President Xi through aides, about the exchanges between China/US, says China attaches importance to the remarks of Trump.

GEOPOLITICS

MIDDLE EAST

- Senior Israeli Foreign Ministry official says Israel is fully committed to conclude a hostage deal; the only way to get a deal is to put pressure on Hamas

- Israeli army said it bombed a cell of militants in the town of Tammun, south of Tubas, in the northern West Bank, according to Al Jazeera.

- Hamas leader said they asked for maps outlining the withdrawal process and the atmosphere pointing to an integrated deal to end the war in Gaza, according to Asharq News.

- "Iranian media report that the first phase of manoeuvres to test the defense systems of the Natanz nuclear facility has begun", according to journalist Elster.

OTHER

- North Korea confirmed Monday's launch of a new hypersonic missile, while it was separately reported that North Korea plans to launch an ICBM before the Trump inauguration, according to Chosun Ilbo. In relevant news, South Korean acting President Choi said they are to respond sternly to North Korean provocation and that North Korea missile test poses a significant security threat.

CRYPTO

- Bitcoin continues to remain near the prior day's peaks, holding just shy of the USD 102k mark.

- CFTC's Benham says he is concerned that regulation for digital assets, which include Bitcoin and other crypto's, remain insufficient; is to step down from his position on Jan 20, via the FT.

APAC TRADE

- APAC stocks were mostly higher following the tech strength stateside where Nvidia briefly reclaimed the largest market cap title and closed at a fresh record.

- ASX 200 eked mild gains as strength in tech and telecoms picked up the slack from the weakness in the utilities, miners and materials sectors, while advances were limited amid disappointing Building Approvals data which showed a wider-than-expected contraction.

- Nikkei 225 outperformed on a break above the 40,000 level with the index propelled by a weaker currency.

- Hang Seng and Shanghai Comp were pressured from early in the session with heavy losses in Hong Kong after the Pentagon added several companies including Tencent (700 HK) and CATL to the US list of firms alleged to help Beijing's military, while the downside in the mainland was gradually cushioned following the announcement that China is to hold a briefing on consumer goods trade-in program on Wednesday involving officials from the PBoC, MoF and NDRC.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Secretary Yellen spoke with Chinese Vice Premier He Lifeng and discussed economic developments, while she raised issues of concern including China's non-market policies and industrial overcapacity, as well as expressed serious concern about 'malicious' cyber activity by Chinese state-sponsored actors. Furthermore, she underscored 'significant consequences' facing Chinese companies for material support to Russia, according to Reuters.

- Japanese Finance Minister Kato said they are seeing one-sided and sudden FX moves. He reiterated that it is important for currencies to move in a stable manner reflecting fundamentals. Kato said he is alarmed over FX moves including those driven by speculators and will take appropriate action against excessive moves, while he also commented that they cannot rule out the chance of Japan going back to deflation.

- Japan's Keizai Doyukai (business lobby) Chief Ninami says wage growth this year at big firms will likely match levels similar to that of last year.

- Japan's Chamber of Commerce and Industry Head says the number of small/medium-sized firms which will raise wages should rise slightly this year.

DATA RECAP

- Australian Building Approvals (Nov) -3.6% vs. Exp. -1.0% (Prev. 4.2%, Rev. 5.2%)

- Chinese FX Reserves (Monthly) (Dec) 3.202Trl vs. Exp. 3.247Trl (Prev. 3.266Trl); Gold reserves USD 191.3bln (prev. 193bln); Gold reserves 73.29mln/oz (prev. 72.9mln)