Today was a much less eventful trading session as the market continues to digest yesterday’s surprisingly hawkish tilt from the Fed, even as earnings did not help broader market sentiment as Micron plunged -16% after reporting very weak guidance driven by an inventory correction in certain end markets. Semis plunged -1.6% in sympathy. Housing stocks also underperformed after Lennar -5% acknowledged what everyone knows - a much weaker than anticipated housing market due to elevated rates - and warned of continued margin pressure.

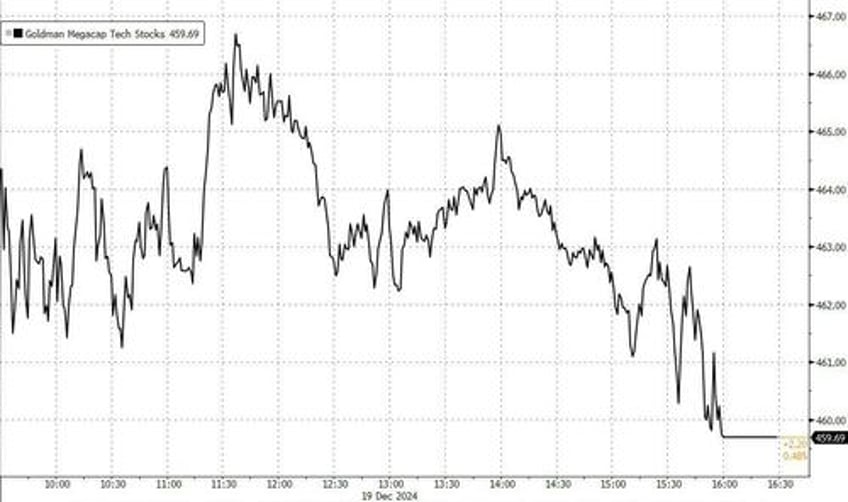

The one bright spot, according to the Goldman trading desk, was megacap tech in a clear “flight to safety” from institutional community after yesterday’s move lower. Goldman's Megacap Tech basket closed +50bps, fading a much greater gain earlier, and there was notable Long Only demand in high quality megacap names like MSFT/META/GOOGL.

More ominously, yields continued to climb higher with the 10yr testing 4.60 to the upside putting pressure on growthier pockets of the market.