British spirits giant Diageo Plc, one of the world's largest drink makers, has seen its London-listed shares nearly halved over the past three years as cash-strapped consumers dial back alcohol spending. The company recently reported its first global sales decline since 2020. Goldman analyst Jack McFerran told clients Tuesday that "there is no sign of a bottom, with risks still skewed to the downside."

The company, which makes Smirnoff vodka, Casamigos tequila, and Johnnie Walker whisky, has faced an "extraordinary environment" amid consumers dialing back on premium liquor consumption.

In July 2024, CEO Debra Crew warned, "You do see persistent inflation that is really weighing on consumers and weighing on their wallets."

Diageo shares in London have plunged 45% since the start of 2022, with market analysts like McFerran still sitting on the sidelines.

He pointed out:

"The mkt have been trying repeatedly to call the bottom here in DGE; I started reading this note hoping to find the case for it, with added bonus of USD earnings and strong Guinness, but the bottom line is there is no sign of that bottom, with risks still to downside."

McFerran cited a note from Goldman's Olivier Nicolai, who covered a survey of 300 US wholesalers that provided unique insights into drinking trends and inventories.

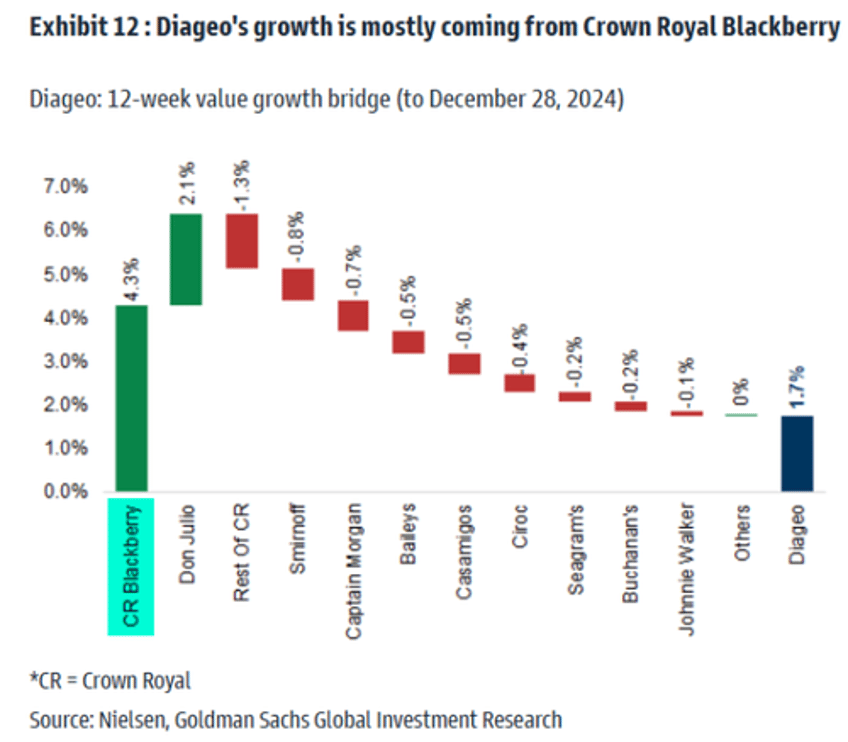

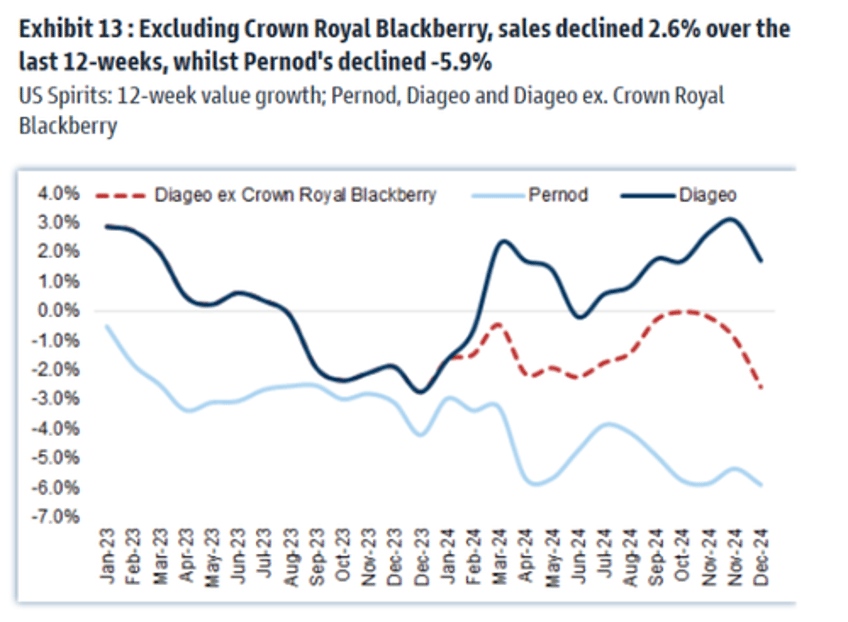

The survey finds that the market expects 3-4% topline growth this year, but much of 2024's success was driven by Blackberry Crown, raising concerns about tough comparisons in March/April.

More from McFerran:

Olivier survey's 300x US wholesalers every six months for the last decade plus. This result gives unique insight into trends and inventories. For DGE the issue is relatively straight fwd, the mkt are expecting the topline to inflect and grow 3-4% this year, but Olivier shows how important Blackberry Crown was in 2024 to the volume which drove mkt share and ultimately translated into a multiple premium, the worry is using the precedent of Pineapple Buchanan, the Crown Blackberry hits big comps come March / April, and those tough comps are going to make it hard for the group to show growth, which means we have another cut ahead of us, and at 17x vs Brown Forman at 19x and the rest of EU beverages 13-14x I struggle even If I don't want to short it. There are a lot of charts in here both this industry note and this stock note, a few highlights from me below, it is a unique and timely data set if you care on spirits and highly recommend a call if you have time this week.

He continued:

I think the impact of Crown Blackberry would surprise most ardent whiskey drinkers, but it is what it is..

This issue from here is an uncomfortable base for 2025, chart 2 shows DGE sales would have been -3% without it

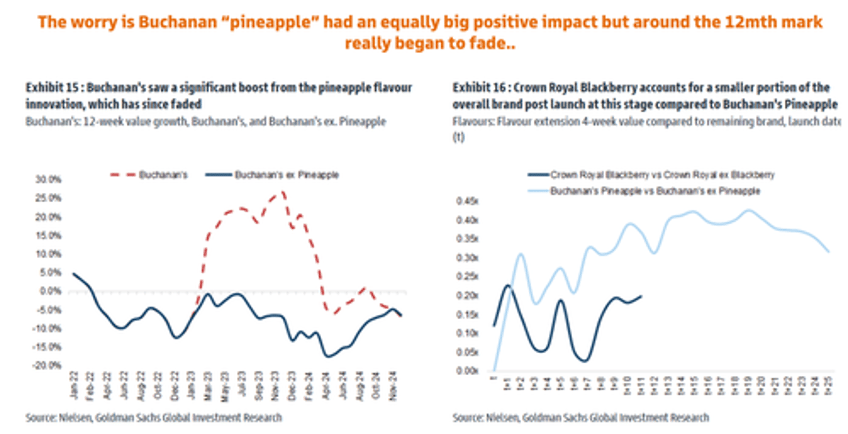

McFerran compared the Crown Blackberry craze among consumers to Diageo's Buchanan "Pineapple" phenomenon, noting that the high demand began to fade around the 12-month mark.

The drinks industry was already in a downturn, and if Crown Blackberry begins to lose popularity with consumers, Diageo's grim outlook will be reaffirmed, potentially leading to lower share prices, as McFerran noted.

In a separate note, Goldman's Nicolai provided clients with several questions and answers about the US spirits industry, with an overall understanding that "We remain cautious into 2025."

Q: Another year of transition for US spirits demand?

A: Our 10th US spirits wholesalers survey (here) points to muted volume growth outlook in the US for 2025. We expect that pricing is unlikely to be a driver, given lower CPI, oversupply of agave, and potential promotional activity; with premiumisation to remain on hold in 2025.

Q: Can Diageo continue to gain share of US spirits?

A: Diageo is currently gaining share in the US, driven by: 1. Crown Royal; and 2. Don Julio. Crown Royal is mostly being driven by Blackberry, launched in March 2024. We believe Diageo will lap tough comps from 2Q CY25, and will likely lose share. We expect further growth and share gain for Don Julio in 2025, although we are concerned about a step-up in promotional activity, owing to agave oversupply and potential imports tariffs.

We expect in line 1H results (Feb 4), but are cautious on FY25/26 in light of a demanding valuation. We expect 0.4% OSG in 1H and a 1.5% EBIT decline, being more cautious on the US but more optimistic on Guinness in Europe. We expect mid-term guidance to be cut, from 5%-7% OSG to mid-single-digit. We are 3% below consensus EPS, seeing no upside to best-in-class FY24 EBIT margin of 28%. Diageo trades on 17x CY25E P/E, vs 21x 10 year average, we remain Sell rated.

The takeaway is that Blackberry Crown's hype cycle with consumers could be set to fade in the coming months, which would undoubtedly worsen outlooks and push share prices lower—a bad sign for those attempting to bottom-fish Diageo.