- APAC stocks were choppy after a similar performance stateside where PPI data printed cooler-than-expected ahead of the incoming US CPI report.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 0.5% on Tuesday.

- DXY is flat, EUR/USD rests just below 1.03, Cable is pivoting around the 1.22 mark, JPY leads.

- BoJ Governor Ueda said he wants to discuss and decide whether to raise rates at next week's policy meeting.

- Looking ahead, highlights include German Wholesale Price Index, FY GDP, UK CPI, EZ Industrial Production, US CPI, IEA OMR, OPEC MOMR, Fed Beige Book, BoE's Taylor, ECB’s de Guindos, Fed’s Barkin, Kashkari, Williams & Goolsbee, Supply from UK & Germany, Earnings from JPMorgan, Goldman Sachs, BlackRock, Citi, Wells Fargo, Bank of New York Mellon.

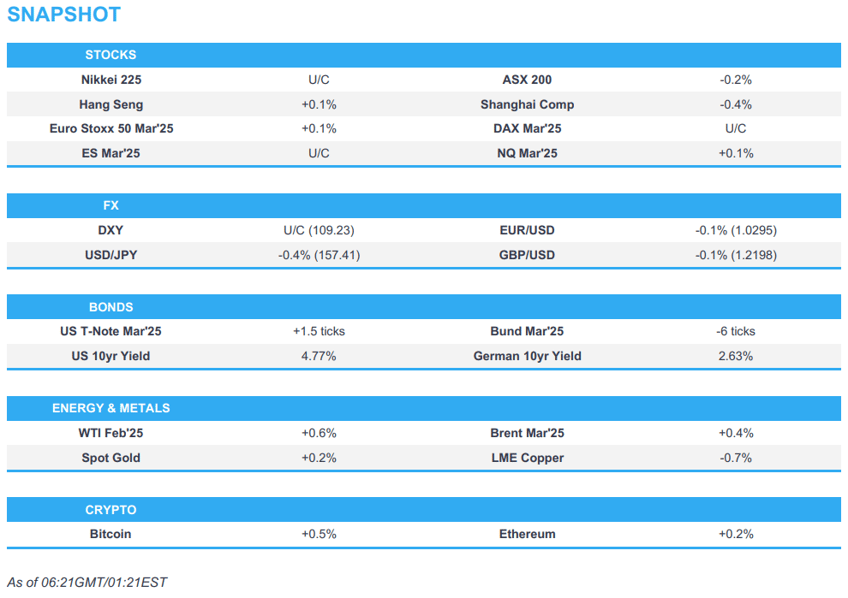

SNAPSHOT

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were mostly higher in what was a choppy session ahead of US CPI data although futures had initially bounced on a cool US PPI print. Thereafter, stocks and Treasuries were indecisive as markets remained tentative over the direction of US yields with the latest Reuters poll suggesting 2/3 of bond strategists surveyed see the 10yr yield surpassing 5% in 2025. In terms of the sectors, outperformance was seen in Utilities, Materials and Real Estate, whereas Healthcare and Communications were the biggest losers with the former weighed on by Eli Lilly's disappointing preliminary Q4 weight loss drug numbers.

- SPX +0.11% at 5,843, NDX -0.13% at 20,757, DJIA +0.52% at 42,518, RUT +1.13% at 2,219.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump announced on Truth Social that Keith Sonderling will serve as the next United States Deputy Secretary of Labor.

- Some of the backers of US President-elect Trump's tariffs are getting exasperated by the reports he's going to dial it back, according to WaPo's Stein.

- The US is planning to unveil additional regulations designed to keep advanced chips made by TSMC (2330 TT/TSM) and Samsung Electronics (005930 KS) from flowing to China, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks were choppy after a similar performance stateside where PPI data printed cooler-than-expected ahead of the incoming US CPI report.

- ASX 200 failed to sustain early gains with upside in consumer stocks, real estate and financials offset by losses in tech and miners.

- Nikkei 225 faded its opening advances with price action indecisive amid a lack of notable drivers and ongoing uncertainty regarding BoJ policy.

- Hang Seng and Shanghai Comp were softer as trade frictions lingered with the US finalising rules to effectively ban Chinese vehicles and it also banned imports for over 30 entities over Uyghur forced labour, while China placed 7 US firms on the unreliable entity list for involvement in arms sales to Taiwan. Nonetheless, some of the downside was stemmed following the PBoC's firm liquidity effort in which it conducted a CNY 960bln 7-day reverse repo operation.

- US equity futures (ES U/C, NQ +0.1%)) were little changed as participants brace for today's key inflation numbers and big bank earnings results.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 0.5% on Tuesday.

FX

- DXY traded rangebound after weakening on the cooler-than-expected PPI print and as focus now turns to the incoming CPI data and Fed speakers.

- EUR/USD plateaued around the 1.0300 level after yesterday's outperformance post-PPI and with comments from ECB's Holzmann who does not think the ECB can lower rates too quickly and noted that core inflation is still closer to 3% than 2%.

- GBP/USD remained indecisive near the 1.2200 focal point after recently lagging behind major peers and with UK inflation data scheduled later.

- USD/JPY was contained amid a lack of catalysts and data releases for Japan but later saw some mild headwinds after comments from BoJ Governor Ueda who said they will raise rates and adjust the degree of monetary support if improvement in the economy and price conditions continues, while he added that he wants to discuss and decide whether to raise rates at next week's policy meeting.

- Antipodeans were uneventful amid a quiet calendar and the cautious mood seen in Asia-Pac stocks, while there was also very little reaction seen to the PBoC's continued efforts to push back against yuan weakness through its daily reference rate setting.

- PBoC set USD/CNY mid-point at 7.1883 vs exp. 7.3240 (prev. 7.1878).

FIXED INCOME

- 10yr UST futures remained afloat after marginally benefitting from the cooler-than-expected PPI data but with trade kept rangebound as CPI data looms.

- Bund futures languished at contract lows after its recent slip beneath the 131.00 level and with EUR 2.5bln of Bund issuances scheduled later.

- 10yr JGB futures lacked firm direction in the absence of any tier-1 data releases and amid ongoing uncertainty surrounding next week's BoJ policy decision, while Japan's 2-year yield later rose to its highest since 2008 after comments from BoJ Governor Ueda who said he wants to discuss and decide whether to raise rates at next week's policy meeting.

COMMODITIES

- Crude futures traded rangebound after the prior day's weakness and constructive geopolitical dialogue, while the latest private sector inventory data was mixed as there was a wider-than-expected drawdown in headline crude inventories but gasoline and distillate stockpiles showed substantial builds.

- Private inventory data (bbls): Crude -2.6mln (exp. -1.0mln), Distillate +4.9mln (exp. +0.8mln), Gasoline +5.4mln (exp. -2mln), Cushing +0.6mln.

- US EIA STEO stated 2025 US crude production is seen at 13.55mln BPD (prev. 13.52mln bbls) and 2026 US crude production is seen at 13.62mln BPD, while both 2025 and 2026 US oil demand is seen at 20.5mln bpd.

- EU Commission intends to propose a ban on imports of Russian primary aluminium in the latest package of sanctions.

- EU is considering a gradual ban on Russian LNG and aluminium, according to Bloomberg. It was earlier reported that the EU Commission intends to propose a ban on imports of Russian primary aluminium in the latest package of sanctions.

- Spot gold slightly eased back after ultimately gaining yesterday owing to a weaker dollar post-PPI but with price action limited as CPI looms.

- Copper futures were indecisive amid the mixed and choppy sentiment seen across global markets.

CRYPTO

- Bitcoin edged higher overnight to above the USD 97,000 level albeit in a choppy fashion.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said they will raise rates and adjust the degree of monetary support if improvement in economy and price conditions continues, while he wants to discuss and decide whether to raise rates at next week's policy meeting. Furthermore, he said the US economy and momentum towards Spring wage talks are key points and noted that the branch managers' meeting showed an encouraging view on pay, as well as stated that the timing of adjusting monetary policy is up to future economy, price and financial conditions.

- US is finalising the rules to effectively ban Chinese vehicles which could include Polestar (PSNY), according to The Verge.

- South Korean authorities have arrested impeached President Yoon, while Yoon said it is deplorable to see a series of illegal acts of law enforcement including his arrest and noted he agreed to attend investigators' questioning to prevent bloodshed despite its illegality.

GEOPOLITICS

MIDDLE EAST

- Israel and Hamas agreed in principle to a ceasefire draft deal and if all goes well, will be finalised this week, according to CBS.

- Israeli PM Netanyahu was informed on Tuesday of the possibility of reaching an agreement within hours, according to Al Arabiya.

- Southern Command discussed preparations for a gradual withdrawal of IDF forces from Gaza, according to the Israel Broadcasting Corporation.

- Hamas did not deliver their response because Israel did not clarify the areas of its withdrawal, according to Al Arabiya citing a Hamas source.

- White House National Security Adviser Sullivan said hopefully we will close out a Gaza hostage deal this week, while he also commented that Iran's weakness is a concern because it may force them to rethink nuclear weapons posture.

- Iranian President Pezeshkian said Iran never plotted to kill Trump during the US election campaign and will never do that, according to NBC News.

RUSSIA-UKRAINE

- Russia said its forces captured two settlements in eastern Ukraine.

OTHER

- US President-elect Trump's incoming National Security Adviser Waltz said he wants to deal with the backlog of weapons to Taiwan.

EU/UK

NOTABLE HEADLINES

- ECB's Lane said they are essentially still in economic recovery mode and Eurozone GDP grew 1.1% in 2024, while they will have some improvement in investment in 2025 and the savings rate will come down in Eurozone though not massively. Furthermore, Lane said the labour market is resilient for now and services inflation will come down in the coming months, as well as noted that if inflation stabilises around 2%, rates will go to neutral.

- Head of France's Socialist party said that if his party does not get a clear response from the PM to its demands on pension reform, then they will vote in favour of no-confidence against the government.