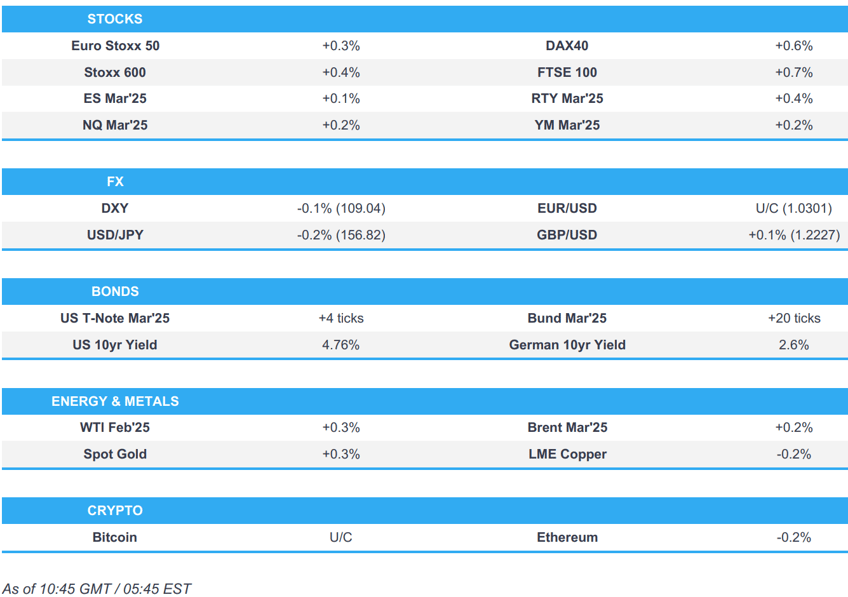

- Stocks hold modest gains, FTSE 100 outperforms post-CPI; US bank earnings due.

- DXY lower ahead of US CPI, GBP resilient in the wake of soft inflation metrics, JPY leads.

- Gilts inflated by CPI, JGBs dented by Ueda & USTs await CPI.

- Choppy trade in crude while precious metals tilt higher and base metals trade mixed.

- Looking ahead, US CPI, OPEC MOMR, Fed Beige Book, Speakers including BoE's Taylor, Fed’s Barkin, Kashkari, Williams & Goolsbee. Earnings from JPMorgan, Goldman Sachs, BlackRock, Citi, Wells Fargo, Bank of New York Mellon.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses generally opened modestly firmer, and have trudged a little higher as the morning progressed; Stoxx 600 +0.3%. The DAX 40 & FTSE 100 outperform vs peers; +0.6% and +0.7% respectively.

- European sectors hold a strong positive bias, with only a couple of industries residing in the red/flat. Real Estate is the outperformer today, buoyed by gains in UK homebuilders after the cooler-than-expected inflation figures out of the region. Consumer Products is the slight laggard today, joined by Food Bev & Tobacco and Healthcare.

- US equity futures are very modestly in positive territory, as traders await the day’s key US CPI print. US corporate earnings will get into full swing as key financials publish Q4 metrics today.

- Dutch government imposes new controls on some computer chip measuring equipment, to be implemented on 1st April 2025, according to a government statement; ASML (ASML NA) sees no additional impact from latest Dutch measures.

- Tesla (TSLA) to suspend part of new Model Y lines in China for upgrades, via Bloomberg; Tesla Model 3 output will also be suspended over Lunar New Year

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is lower, largely as a by-product of JPY strength in the run up to US CPI data. On which, headline US CPI is expected to rise +0.3% M/M in December. The release follows hot on the heels of yesterday's softer-than-expected outturn for PPI. DXY has returned to a 108 handle with a session trough at 108.96.

- EUR is flat vs. the USD as EZ-specific drivers remain light aside from various ECB commentary. On which, ECB's de Guindos has been on the wires noting that the disinflation process is well on track. EUR/USD is currently treading water above the 1.03 mark vs. yesterday's 1.0238 low. The next upside target comes via the 9th Jan high at 1.0321.

- JPY is the clear outperformer across the majors following comment from BoJ Governor Ueda who said the BoJ will raise rates and adjust the degree of monetary support if improvement in the economy and price conditions continues, while he added that he wants to discuss and decide whether to raise rates at next week's policy meeting. USD/JPY has slipped onto a 156 handle for the first time since 6th January; current session low at 156.72 vs YTD trough at 156.23.

- GBP marginally weaker vs. peers following soft UK inflation metrics which saw Y/Y CPI print @ 2.5% vs. Exp. 2.6%, core Y/Y 3.2% vs. Exp. 3.4%, services 4.4% vs. exp. 4.9% and MPC 4.7%. Typically, such a soft outturn would trigger more pronounced softness in GBP. However, given concerns surrounding the UK's fiscal position, the subsequent pullback in yields has been seen as a positive for the domestic economy. Price action for the GBP was relatively choppy, with a brief dip reversed to a session high of 1.2241; upside which faded a touch to current 1.2219.

- Antipodeans are both marginally firmer vs. the USD alongside a quiet antipodean calendar. AUD is now up for a third session in a row after printing a multi-year low on Monday at 0.6130.

- PBoC set USD/CNY mid-point at 7.1883 vs exp. 7.3240 (prev. 7.1878).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are in the green and just off the session highs of 107-16+. Yields lower across the curve with the long-end leading and the curve as a whole flattening a touch. The session’s main event is US CPI, the headline M/M is expected to remain at 0.3%.

- Gilts were inflated by 68 ticks at the open and have since lifted to a 90.19 peak. From the data, the main point of focus is on the Services metric which eased below market and BoE forecasts to the lowest rate since March 2022 - this led market pricing to shift dovishly. The jump in Gilts has sparked an associated pullback in yields with the 10yr moving from 4.89% at end-of-play on Tuesday to a 4.80% low this morning.

- Modest two-way action on the UK's 2034 auction results but with Gilts ultimately coming under some very modest pressure and veering back towards the 90.00 handle - despite a decent outing.

- JGBs came under pressure overnight after remarks from BoJ Governor Ueda in which he said he wants to discuss and decide on whether to increase rates at the January meeting. More broadly, he added that the US economy and momentum towards Spring wage talks are key points and branch managers' views on the latter have been encouraging. Remarks which took a 140.55 low, just above the week’s 140.51 base, posting downside of a handful of ticks.

- Bunds are firmer on the session in-fitting with global peers. 2024 growth data for Germany was bleak as expected with the prelim. figures pointing to a consecutive year of contraction. Furthermore, forward-looking remarks from the Economy Ministry were also downbeat. At the top-end of a 130.32-74 band, if the upside continues then we look to 130.98 from Monday before the WTD high at 131.09.

- UK sells GBP 4bln 4.25% 2034 Gilt Auction: b/c 2.80x (prev. 2.87x), avg yield 4.808% (prev. 4.332%) & tail 0.9bps (prev. 1.3bps).

- Germany sells EUR 1.19bln vs exp. EUR 1.5bln 2.50% 2054 Bund and EUR 0.754bln vs exp. EUR 1bln 1.80% 2053 Bund.

- Click for a detailed summary

COMMODITIES

- Crude price action has been choppy today with participants awaiting US CPI for a larger impulse, although geopolitical risks remain as Russia and Ukraine target each others' energy infrastructure whilst an Israel-Hamas ceasefire deal is seemingly imminent, although sticking points remain. Some weakness in the complex was seen after the EIA OMR, which trimmed its 2025 world oil demand growth forecast. Brent Mar sits in a 79.62-80.64/bbl parameter at the time of writing.

- Modest gains for precious metals with prices supported by a softer Dollar and a lack of macro newsflow at the time of writing. Spot gold currently resides in a USD 2,669.36-2,688.56/oz range.

- Mixed trade across base metals with copper prices indecisive since APAC trade amid the mixed and choppy sentiment seen across global markets.

- Private inventory data (bbls): Crude -2.6mln (exp. -1.0mln), Distillate +4.9mln (exp. +0.8mln), Gasoline +5.4mln (exp. -2mln), Cushing +0.6mln.

- EU is considering a gradual ban on Russian LNG and aluminium, according to Bloomberg. It was earlier reported that the EU Commission intends to propose a ban on imports of Russian primary aluminium in the latest package of sanctions.

- IEA OMR: Trims 2025 world oil demand growth forecast to 1.05mln BPD (prev. 1.1mln BPD); says new US sanctions on Russia could significantly disrupt Russian oil supply and distribution chains. Global oil supply is projected to rise by 1.8mln BPD in 2025 to 104.7mln BPD, compared with an increase of 660k BPD in 2024. While it is too early to fully quantify the potential impact from these new measures, some operators have reportedly already started to pull back from Iranian and Russian oil.

- Russia to provide crude oil and LNG to Vietnam, according to a statement cited by Reuters.

- India's December Gold imports at USD 4.7bln, according to Trade Ministry.

- Russia's Kremlin says possible EU sanctions on Russian aluminium could destabilise an "already fragile market". Says "nothing can be ruled out" when it comes to Russia's response to the latest US sanctions on the energy sector.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Dec) 2.5% vs. Exp. 2.6% (Prev. 2.6%); Core 3.2% vs. Exp. 3.4% (Prev. 3.5%); Services 4.4% vs. Exp. 4.9% vs. BoE Exp. 4.7% (Prev. 5.0%), lowest services rate since March 2022.

- UK CPI MM (Dec) 0.3% vs. Exp. 0.4% (Prev. 0.1%); Core 0.3% vs. Exp. 0.5%; Services 0.3% (Prev. -0.1%)

- UK ONS House Price Index (Nov) Y/Y 3.3% (Prev. 3.4%)

- German Wholesale Price Index YY (Dec) 0.1% (Prev. -0.6%); MM (Dec) 0.1%.

- German Full Year GDP (2024) -0.2% vs. Exp. -0.2% (Prev. -0.3%); exports -0.8%; Government budget recorded financial deficit of EUR 113bln at end-2024.

- EU Industrial Production MM (Nov) 0.2% vs. Exp. 0.3% (Rev. 0.2%); Industrial Production YY (Nov) -1.9% vs. Exp. -1.9% (Prev. -1.2%, Rev. -1.1%).

NOTABLE EUROPEAN HEADLINES

- ECB's Lane said they are essentially still in economic recovery mode and Eurozone GDP grew 1.1% in 2024, while they will have some improvement in investment in 2025 and the savings rate will come down in Eurozone though not massively. Furthermore, Lane said the labour market is resilient for now and services inflation will come down in the coming months, as well as noted that if inflation stabilises around 2%, rates will go to neutral.

- ECB's de Guindos says the disinflation process is well on track. The balance of macroeconomic risks has shifted from concerns about inflation to concerns about low growth. The high level of uncertainty calls for prudence in setting rates. Severe global trade frictions could increase the fragmentation of the world economy. Uncertainty about fiscal policy and its present challenges could weight on the borrowing costs. Will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance. The risks to economic growth remain tilted to the downside. Not committing to any particular rate path.

- ECB's Villeroy says practically won battle against inflation; on France, says risks to 0.9% French growth forecast for 2025 are on the downside, but we do not see a recessionGovernment needs to detail savings and tax measures needed to achieve its new deficit forecasts of 5.4% of GDP this year.

- Riksbank's Bunge says making it easier to borrow will not solve challenges in the housing market. Economy is close to a turning point but risks remain. Sweden is in a mild recession but 2025 outlook is favourable. Forecast is that rates may be cut one more time during H1 2025; judges that it is better to cut in the near term rather than wait.

- Germany Economy Minister says outlook for exports is modest; consumer recovery not in sight. Inflation dampening factors should dominate over the course of the year.

NOTABLE US HEADLINES

- US President-elect Trump announced on Truth Social that Keith Sonderling will serve as the next United States Deputy Secretary of Labor.

- The US is planning to unveil additional regulations designed to keep advanced chips made by TSMC (2330 TT/TSM) and Samsung Electronics (005930 KS) from flowing to China, according to Bloomberg.

- US Treasury Secretary Yellen says the US economy is doing well, but more work needed to invest in infrastructure, labour force and R&D

GEOPOLITICS

MIDDLE EAST

- "Security sources: The IDF has not been instructed to change the methods of fighting in Gaza despite the progress of negotiations", according to Al Jazeera.

- Israel gov't has reportedly set new conditions which could undermine the Gaza negotiations, via Sky News Arabia citing sources; among those is that the Israeli Army would remain 700 metres into Rafah.

- White House National Security Adviser Sullivan said hopefully we will close out a Gaza hostage deal this week, while he also commented that Iran's weakness is a concern because it may force them to rethink nuclear weapons posture.

- Iranian President Pezeshkian said Iran never plotted to kill Trump during the US election campaign and will never do that, according to NBC News.

- "Iranian Vice President: We discovered Israel's planting of explosives inside centrifuges", according to Al Arabiya.

RUSSIA-UKRAINE

- Russian Defence Ministry say they have struck critical energy infrastructure in Ukraine.

- Ukrainian President Zelensky says Russia targeted Ukraine's gas infrastructure in air strikes today.

- Russia said its forces captured two settlements in eastern Ukraine.

OTHER

- US President-elect Trump's incoming National Security Adviser Waltz said he wants to deal with the backlog of weapons to Taiwan.

CRYPTO

- Bitcoin is essentially flat and holds just shy of USD 97k; Ethereum supported at the USD 3.2k level.

APAC TRADE

- APAC stocks were choppy after a similar performance stateside where PPI data printed cooler-than-expected ahead of the incoming US CPI report.

- ASX 200 failed to sustain early gains with upside in consumer stocks, real estate and financials offset by losses in tech and miners.

- Nikkei 225 faded its opening advances with price action indecisive amid a lack of notable drivers and ongoing uncertainty regarding BoJ policy.

- Hang Seng and Shanghai Comp were softer as trade frictions lingered with the US finalising rules to effectively ban Chinese vehicles and it also banned imports for over 30 entities over Uyghur forced labour, while China placed 7 US firms on the unreliable entity list for involvement in arms sales to Taiwan. Nonetheless, some of the downside was stemmed following the PBoC's firm liquidity effort in which it conducted a CNY 960bln 7-day reverse repo operation.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said they will raise rates and adjust the degree of monetary support if improvement in economy and price conditions continues, while he wants to discuss and decide whether to raise rates at next week's policy meeting. Furthermore, he said the US economy and momentum towards Spring wage talks are key points and noted that the branch managers' meeting showed an encouraging view on pay, as well as stated that the timing of adjusting monetary policy is up to future economy, price and financial conditions.

- South Korean authorities have arrested impeached President Yoon, while Yoon said it is deplorable to see a series of illegal acts of law enforcement including his arrest and noted he agreed to attend investigators' questioning to prevent bloodshed despite its illegality.