First it was Michael Hartnett, warning that the "Explosion In Gold Shows Investors Are Preparing For The Endgame", now it's Bloomberg's turn.

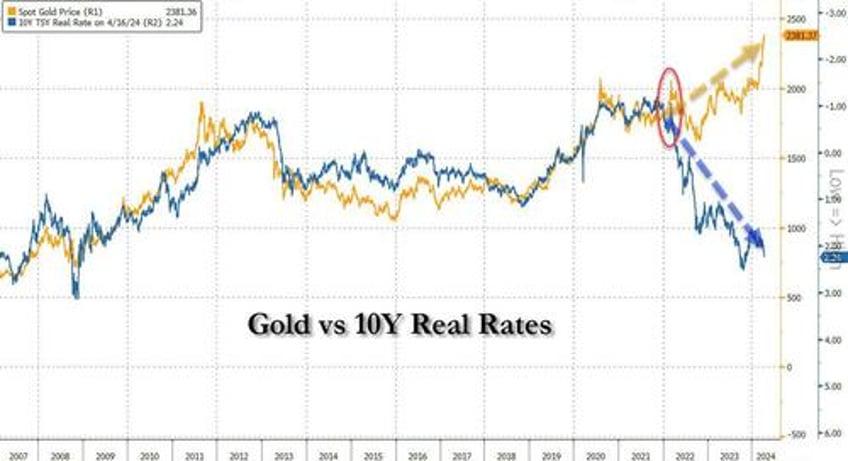

According to BBG Markets Live reporter Mark Cranfield, the resilience of precious metals in the face of rising bond yields and a strong US dollar suggests investors are hedging against currency debasements. Central banks adding to their gold holdings in recent months only supports that view.

As Cranfield correctly notes, there is nothing better to concentrate the mind of conservative investors than being fearful that whichever currency they hold isn’t being wholeheartedly defended by its lender of last resort. Indeed, there is more than a hint of a competitive devaluation cycle going on in the developed and emerging worlds.

This week has seen a flurry of verbal intervention rounds to support currencies from policymakers, but traders can see through the smokescreen. There is almost no appetite to deplete central bank reserves, especially when Jerome Powell says the Fed can take its time to lower rates, which will keep the US dollar underpinned.

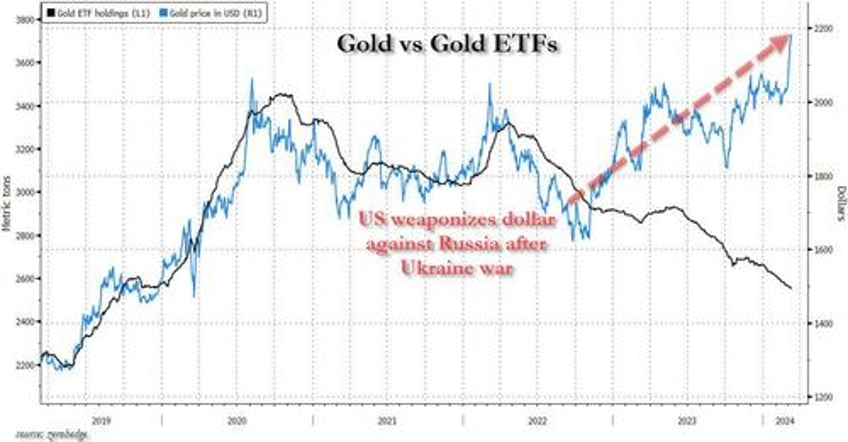

Gold is even defying the trend of falling ETF holdings (although as shown in the chart below, there is no mystery why gold decoupled from gold ETFs in the middle of 2022 amid a record central bank buying bonanza).

Finally, the Bloomberg commentator observes that there is an icing on the cake for lovers of precious metals when geopolitical angst stays in the forefront of daily news summaries. Gold and silver are portable. They may be a bit heavy to carry, but everybody knows what they are and what they are worth when you show them a coin or a bar. And in case they get too heavy, there is always bitcoin...