Retail sales - strong; Housing - homebuilder optimism jumped; Industrial Production - better than expected.

'Real' economic data is rising once again as 'soft' survey data collapses (Empire Fed anyone?)...

Source: Bloomberg

Nothing there screams "six rate-cuts or we all die" as the issue remains: the current growth trajectory of the economy does not suggest that rates need to come down at all.

And as this growth/rates tango persists, yields on 10-year Treasuries are creeping higher (up 4bp today to 4.10%), putting pressure on risk assets that are priced relative to rates.

Today's strong data, along with last week's slightly higher than expected inflation report may suggest to some that rate cuts may not be as necessary as urgently as markets have been pricing.. and Waller's comments yesterday pre-inforced that.

Sure enough, rate-cut expectations (timing and size) are tumbling...

Source: Bloomberg

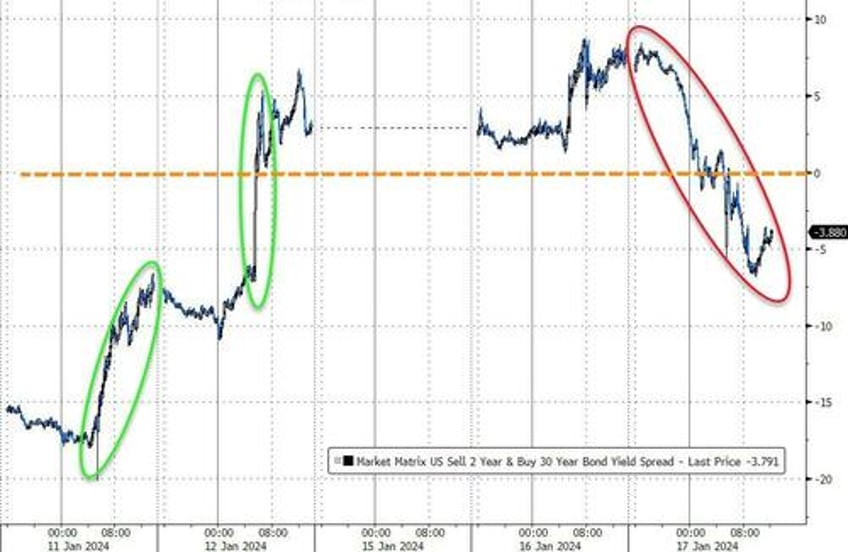

The big drop in rate-cut expectations prompted bond yields to surge higher at the short-end. The entire curve was higher in yields with a major bear flattener (30Y +1bps, 2Y +13bps today)...

Source: Bloomberg

The 10Y Yield extended its spike back above 4.00% today and closed above its 200DMA for the first time since 12/12/23...

Source: Bloomberg

The yield curve (2s30s) flattened back into inversion today...

Source: Bloomberg

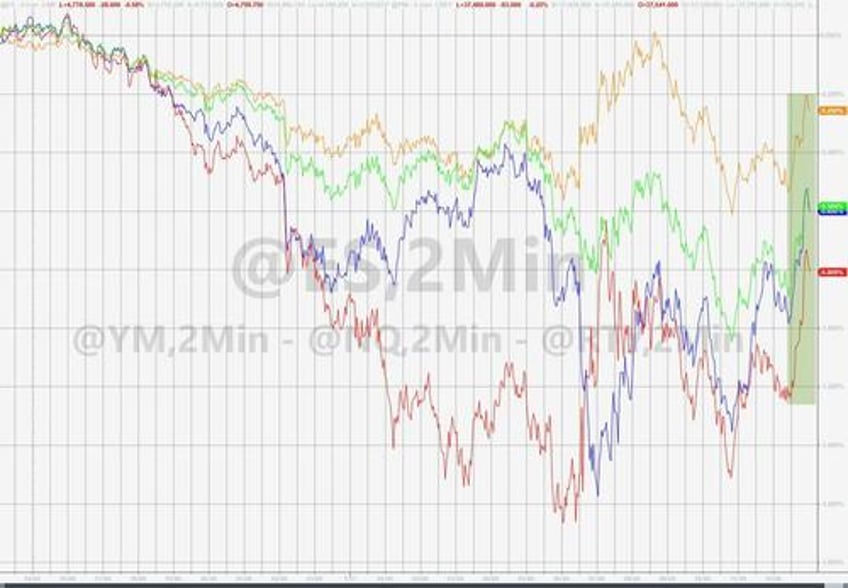

Higher-rates hammered hot stocks as growthy-stuff and crappy-stuff was dumped. Nasdaq and Small Caps lagged, The Dow was the least ugly cow in the abattoir but still lower. A late-day bounce put a bit of lipstick on the pg but still not a pretty day...

MAG7 dumped at the open and never recovered, falling back to unchanged YTD...

Source: Bloomberg

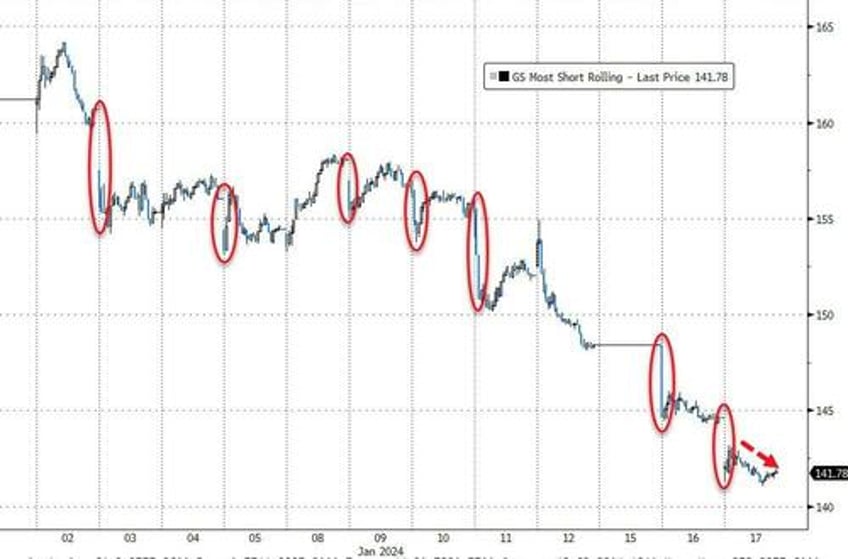

'Most Shorted' stocks dumped at the open... and went lower - no bounce at all!

Source: Bloomberg

This is the second-worst start to a year for 'most shorted' stocks in history (2016 was worse)...

Source: Bloomberg

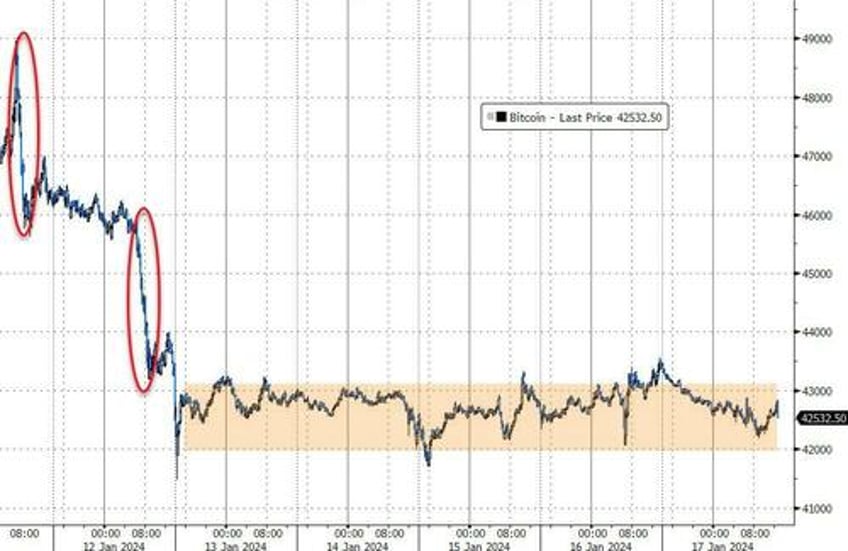

Bitcoin continued in a narrow range since the chaos of last week's spot ETF launch...

Source: Bloomberg

The dollar extended its 'up and to the right' ramp this week. This is now the dollar's best start to a year since 2015.

Source: Bloomberg

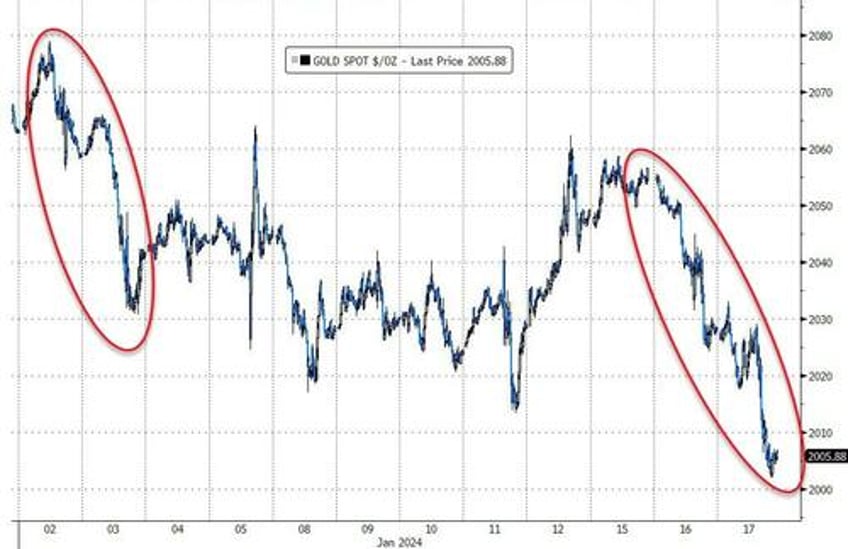

And as the dollar rallied, so gold declines...

Source: Bloomberg

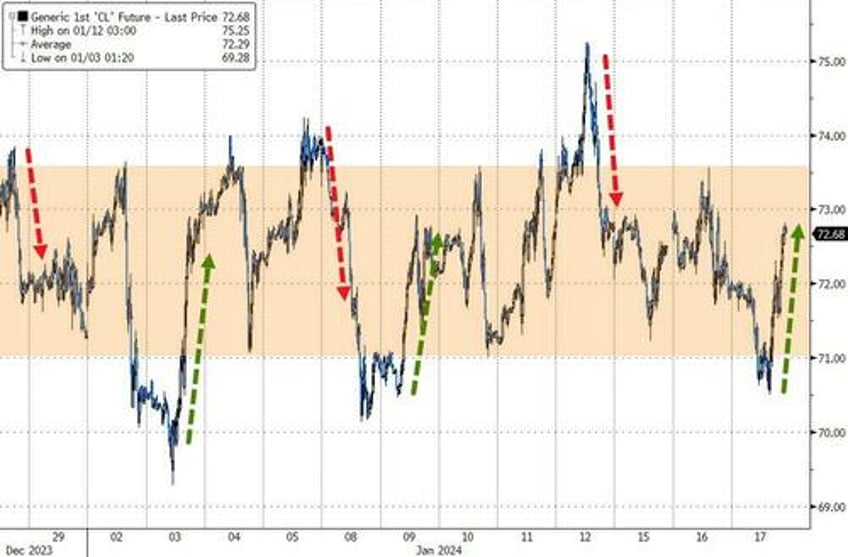

Oil was higher - for a change - with WTI bouncing off $71 back into its YTD range once again...

Source: Bloomberg

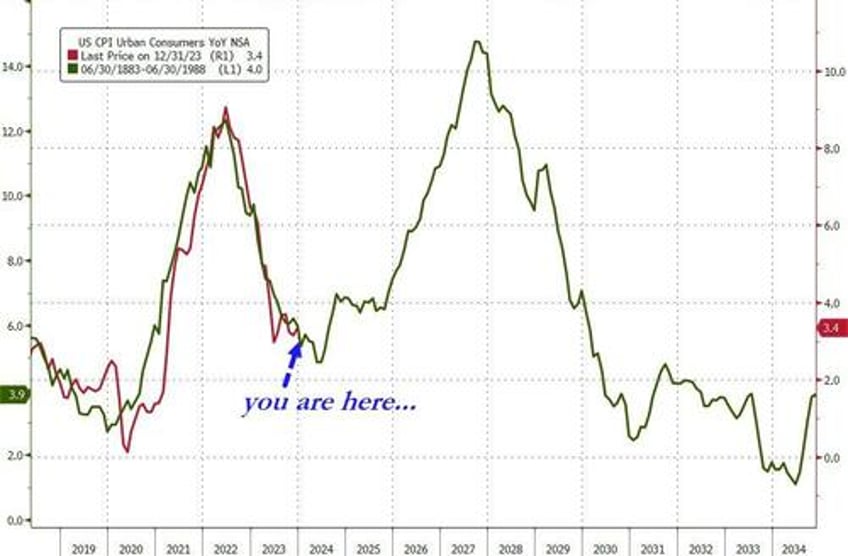

And finally, never forget the 'twin peaks' of the '70s...

Source: Bloomberg

Does Powell really want to be the guy who executed a massive rate-cutting cycle in an election year only to see what is left of The Fed's credbility utterly destroyed when inflation comes roaring back.