Three weeks ago, when the market suddenly tumbled as the yen carry trade unwound and various derivative triggers sparked a historic - if brief - liquidation that sent the VIX just shy of 70, Michael Hartnett warned to look to several key support levels to determine if the market would hold and recover. Just a few days later, it did, and as his latest Flow Show note writes (available to pro subscribers in the usual place), the big support levels all held in August, among them: 3.8% on the 10Y, 4.0% on the 30Y, 100 DXY, 140 USDJPY, $70 oil, and $60k Bitcoin. Which is why, having previously correctly called the plunge in yields (as the biggest pain trade of the second half), Hartnett now cautions of a "reversal higher in bond yields" which is likely due to:

- policy (Fed rate cut is now completely priced in)

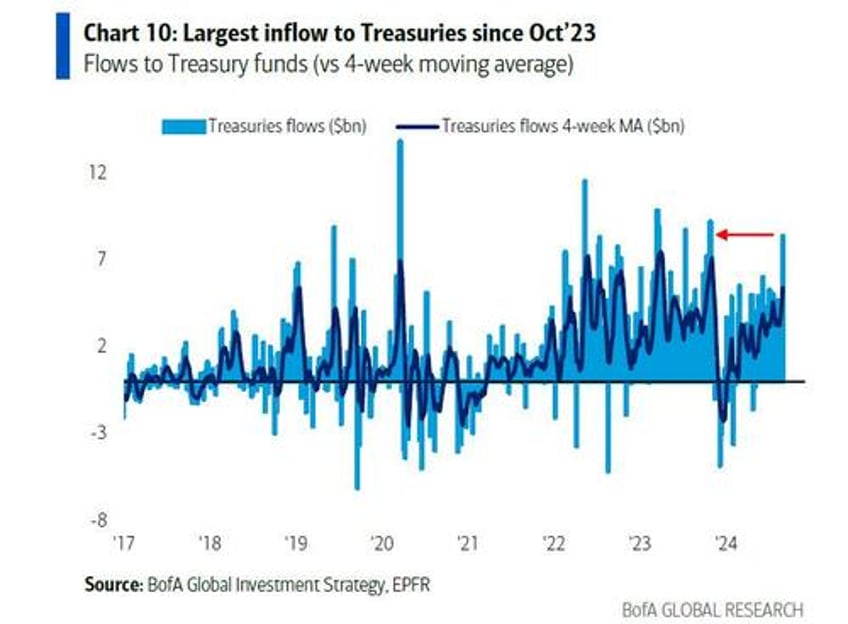

- positioning (Largest inflow to Treasuries since Oct’23 as what was formerly a contrarian trade is now mainstream)