The S&P 500 is down 32bp as AI continues to dominate headlines ahead of Microsoft ($3.3TN), Meta ($1.7TN) and Tesla ($1.3TN) results on Wednesday evening. AI Power is retracing, up 1.4%, whilst AI Software Pioneers are 2.1%, reversing some of the basket's outperformance from the last two days. AI Semis are lower by 80bp and subdued with Nvidia down 5%. Bullish arguments around the secular theme focus on competition fuelling technological advances which will only increase the proliferation/adoption of AI in the long run. Meanwhile, some are questioning the veracity of DeepSeek’s claim around training costs.

With a dovish pause by the Fed largely priced in, and only a true shock set to move markets, attention will turn to the first three tech megacaps and Mag 7 member s- MSFT, META and TSLA - set to report after the close. Here is what Wall Street expects, with perspective from JPM, Goldman and UBS traders.

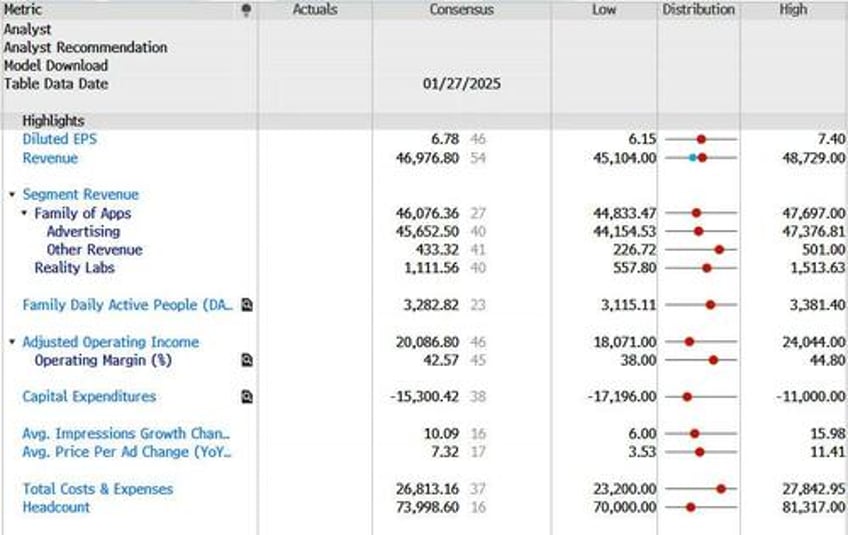

META PREVIEW – META felt like everyone’s favorite Mag Cap long through a lot of H2 according to JPM TMT specialist Jack Atherton, but heading into the Q4 print there is a lot of controversy that has left faster money investors on the sidelines: 1) FX downgrades, 2) potential 2025 capex shock and depreciation driven downgrades, 3) Trump uncertainty (this worry has reduced following Zuck’s pivot), 4) risk from Healthcare ads, 5) tougher comps, and 6) return to net hiring.

Here, UBS trader Kelsey Perselay chimes in and notes that Meta shares have gone through a confluence of trading activity, but with stock at $671, the setup is a little tricker with perhaps some of the impending earnings news already playing out: "There is still nervousness around FY25 opex and Q1 revenue FXN guide, with some questioning how much upside there is to revenue through the year." With the magnitude of these numbers, there are some fears around lackluster FCF growth, but investors also understand this cycle for an eventual revenue ramp in 2026. The bull case remains ongoing growth in ad revenue grinding out a return for the stock, and investors are still looking at the same valuation of 25x a $30 EPS for 2026 and around a $750 price target.

The pre-announced capex guide of around $65BN in 2025, some $15 more than consensus, was in line with buyside expects and removes that overhang into the print. The DeepSeek news has brought a wave of new question marks around mid-term capex, the expansion of the Llama/opensource ecosystem, and potential regulatory recourse from aiding the building out of a Chinese competitor. Net-net, most investors thought the DS news would act as a positive for META as a primary consumer of AI infrastructure (rather than a seller). Unlikely we hear anything new on TikTok but any possible engagement/advertiser tailwinds from the brief outage will be topical on the call. Investors continue to like the LT story but its not obvious what drives a re-rating and consensus EPS has downside risk, so many feel like there could be a better entry point.

- Positioning Score (1 = max short/UW, 10 = max long/OW): 7

- Buyside Bars (per JPM): Investors looking for Q4 revenue growth near top end of guide ~19% FXN (guide +12-20%) and Q1 guide +17-18% FXN (high-end). Opex guide ~$115-116b high-end and Capex ~$60-65b (already announced).

- Bogeys (per UBS):

- Q4 Ad Revenue Growth FXN: 19-20%, just below high end of guide

- Q4 Total Revenue: $47.5 bn versus guide $45-$48 bn (FX)

- Q1 Total Revenue: $41-41.5 bn versus consensus at $41.9 bn (FX)

- FY25 Capex: $60-$65 bn

- FY25 Opex : $112-$117 bn

- FY25 EPS: around $27

- FY26 EPS: around $28-29

- Implied Move: 7%, which would lag the average 11% fluctuation following the past eight results. The put skew also shows that traders are far less risk averse now than before the last release, when it was much steeper.

* * *

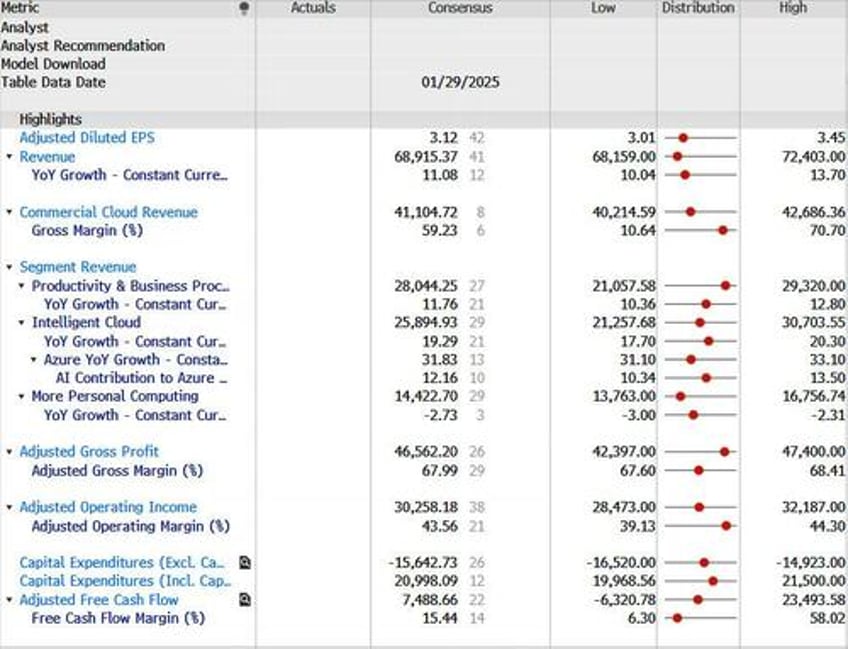

MSFT PREVIEW - After a challenging H2’24 (stock -21% vs Mag7), it feels like MSFT has become a bit of a “sneaky long” to start the year and investors position for the promised Azure acceleration against attractive valuation (~26x C26 GAAP EPS). That said, the JPM trader believes that there is definitely still some nervousness around the phasing of Azure acceleration (FH2 or FQ3) which could place risk on the FQ3 guide (some suggesting mgmt comments at recent industry conference were suggestive of this). If Azure continues to disappoint, it’s too hard to ignore the other concerns… capex return justifications, disappointing M365 copilot take up, OpenAI relationship, earnings risk (FX, depreciation, OAI losses). A strong Azure print/guide should drive a nice re-rating here. There are lots of new discussion topics for the call that have emerged in recent weeks too… OpenAI relationship and The Stargate Project, implications from DS to mid-term capex, early thoughts on the Trump administration.

According to UBS, Microsoft sentiment is a 7/10, with positioning somewhat mixed, and "leaning a shade negative." On the positive front, bulls are picking at the modestly improving cloud checks, 2H Street Azure numbers are coming down, solid ChatGPT monthly active user data, all which sets the scene for this so called 2H acceleration management has been discussing. Bears, on the flip, are anchoring their caution to EU softness and data center delays, along with trickier comps from leap year in 1Q. All this sets the scene for perhaps limited upside to numbers, especially if the 2H acceleration proves more 4Q weighted (even though I’m told management essentially nixed such concerns). Capex is of course still topical and likely to linger until visibility into either the Azure growth rate acceleration and/or Copilot adoption improves.

- Positioning Score (1 = max short/UW, 10 = max long/OW): 7

- Buyside Bars: FQ2 Azure growth +32-33%cc (guide +31-32%cc) and FQ3 guide for a v slight acceleration (i.e. +33-34%cc). Buyside at $21-21.5B FQ2 capex (incl capital leases) vs FQ1 $20B.

- Implied Move: 4%, with the skew flattening in recent days

* * *

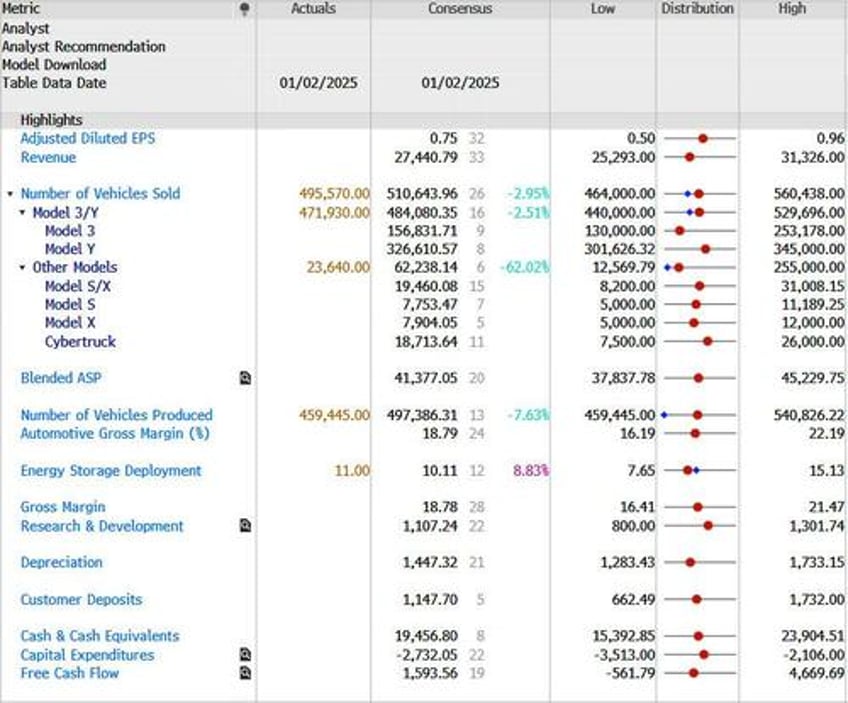

TSLA - JPM expects a Q4 miss in EPS (70c vs cons at 75c) and some other banks are similarly below buyside on auto GMs ex-credits at ~15% but also heard fair amount of folks in line with cons at ~16% so would say range of buyside expectations is 15.0-16.0% and anything above or below would be a surprise to buyside. There has been a lot of talk during preview discussions about the 20-30% delivery growth target Elon set on the Q3 call as buyside is well below that but many do not think he will walk it back this early after giving it, so it’s something folks are watching but no definitive expectation for an update on that front – similarly many are wondering if impact of IRA rollback will be framed or addressed by Elon. The “bar” on a Robotaxi update is not pushing timing definitively, and it’s not as if there was a very clear timing framework set at the 10/10 Robotaxi day other than saying later in 2025, but if he were to definitively push timing into 2026 that would be received poorly by investors. The low-price model (called Model 2 by many) is expected to launch in next 6 months so an update on that is also a focal point. TSLA’s stock post-election has been trading more on Elon/Trump headlines than auto-related TSLA headlines although that shifted with the disappointing Q4 delivery update at the start of January (i.e. stock sold off in response) so do think above $400 the above expectations and items will matter for how it trades this week since much of the initial rally post Trump’s win is still in the stock so trading more on the fundamental updates – of course, it’s TSLA… and it’s Elon… so this could very well change this week with what’s most important to the stock, but that’s the general gist of earnings setup convos on TSLA as of late.

- Bogeys (sellside consensus)

- EPS, Adj+ 0.754

- Revenue 27.206B

- Gross Margin 18.945%

- Operating Profit 2.682B%

- EBIT 2.669B%

- CapEx -2.721B

- Implied Move:8%, which is below the 12% average swing following past results; the stock has a call skew as traders shifted their wagers after Trump’s election to favor further gains in the stock.