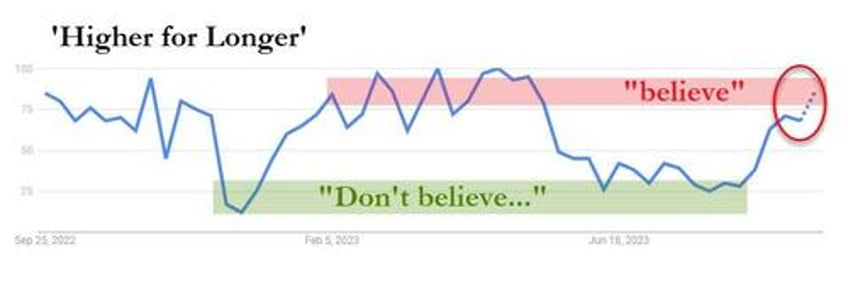

Despite being told - for months - that The Fed wanted to keep rates "higher for longer" and that a 'pause' is not the start of a rate-cut cycle, markets ignored it... until this week. As the following chart of Google Trends shows, it appears people are 'believers' once again...

The Fed's blackout window lifts and the jawboning begins - and everyone said the same thing: "higher for longer":

*FED'S COLLINS: FURTHER FED HIKES 'CERTAINLY NOT OFF THE TABLE', EXPECT RATES MAY HAVE TO STAY HIGHER FOR LONGER

*FED's BOWMAN: MORE RATE HIKES LIKELY NEEDED TO GET INFLATION TO 2%, NEED TO REPEAT MONETARY POLICY ISN'T ON PRESET COURSE

*FED'S DALY: I DON'T GET TO A POINT WHERE I'M READY TO DECLARE VICTORY, UNLIKELY INFLATION WILL REACH 2% GOAL IN 2024

On the week, between the data, the SEP, and the FedSpeak, the market has repriced its expectations for The Fed's rate trajectory significantly with rate-hike odds in 2023 lower and rate-cut odds in 2024 significantly lower...

Source: Bloomberg

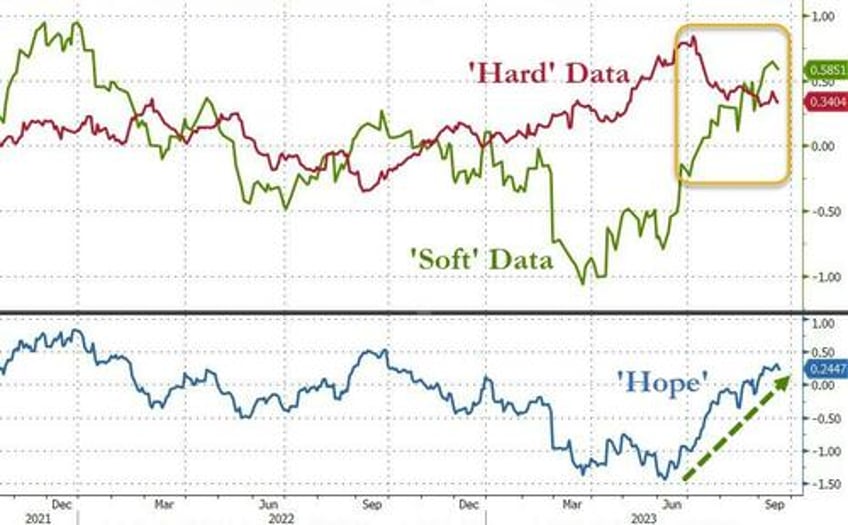

And bear in mind that the supposed 'strength' in US macro data has been driven by 'soft' survey data as 'hard' real data has tanked...

Source: Bloomberg

Small Caps (heavily shorted) and Nasdaq (mega-cap tech, long duration) were the hardest hit on the week with the S&P close behind. The Dow was the prettiest horse in the glue factory, down around 2% on the week. Overall, US equities closed "on the lows" ugly going out...

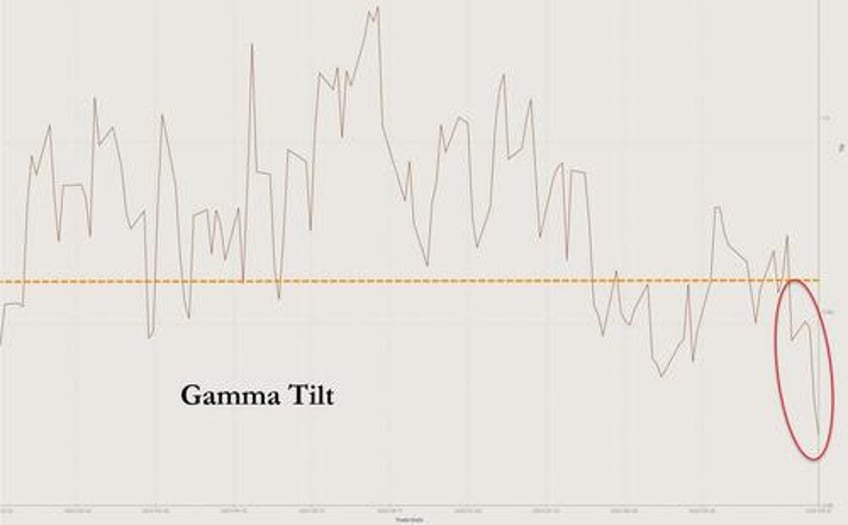

The choppiness seen in the last hour or so was driven by the market's big shift to a negative gamma market...

Source: SpotGamma

All the majors closed below key technical levels...

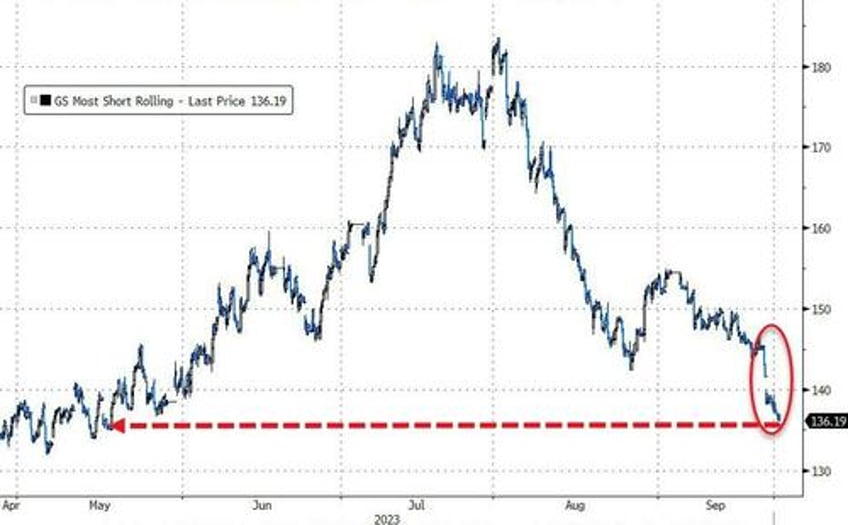

"Most Shorted" stocks are on pace to see their second straight month of declines (and 7th down week of the last 8). This was the biggest weekly decline in the short-basket since March...

Source: Bloomberg

As Goldman traders noted, "It feels like sell-the-rally mode (and the market is susceptible locally to a squeeze given the quick pick-up in shorts). Overall, the equity market seems to be suggesting that economic growth expectations are being downgraded, and soft-landing trades are at risk."

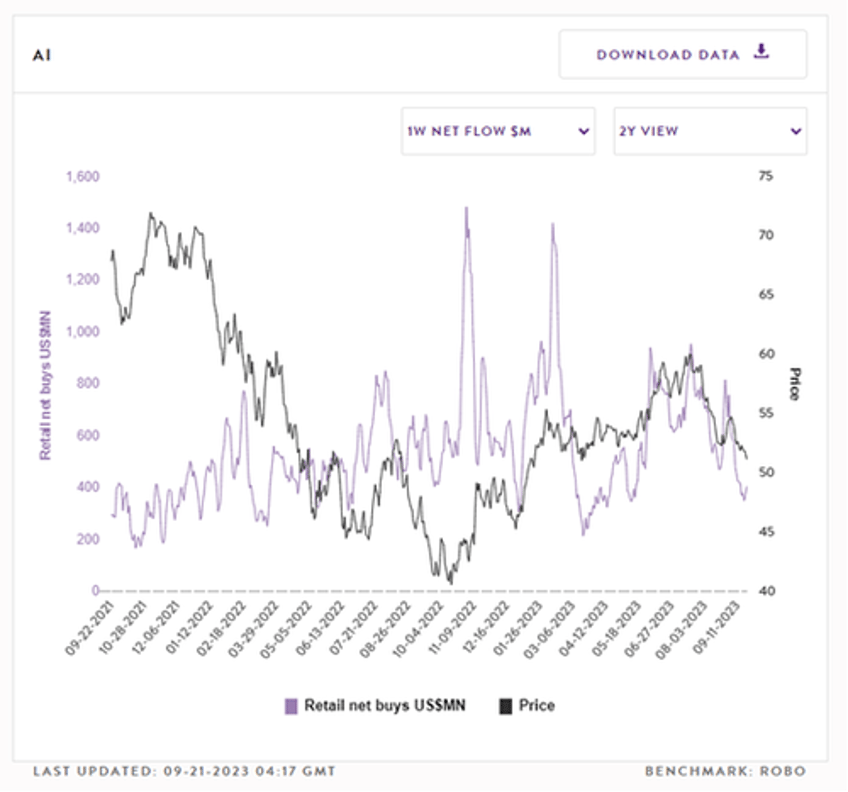

As Vanda Research notes, inflows into the artificial intelligence (AI) sector continue to decline.

Companies such as MSFT, IONQ, AI, as well as NVDA and PLTR are all witnessing diminishing interest from retail investors.

As we extensively analyzed in earlier reports, the combination of waning retail demand and cautious risk sentiment among institutional investors may pose a substantial risk to the AI sector, potentially heralding a pronounced reversal in the weeks ahead.

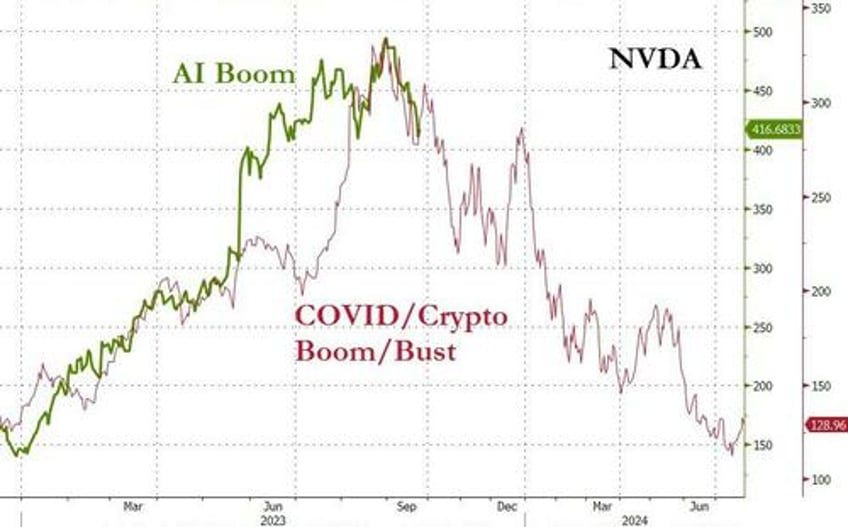

It's a long way down...

Source: Bloomberg

VIX jumped back above 17 on the week (which is a relatively big deal given its compression of late)...

UBS traders noted that high Touch flow skewed to the sell side from Monday through Thursday as Long Only took profits and Tax loss selling picked up. Long Only and Hedge Funds turn buyer Friday.

Market downdraft and VIX uptick trigger systematic fund selling.

Retail continues to sell single stocks against ETFs albeit at a reduced pace this week.

Derivative desk did not see investors chase the downside as positioning already defensive, and the focus remains on sector rotations.

Derivative flows have been large counter-trend to the bid to vols with a massive about of overwriting supply hitting the tape.

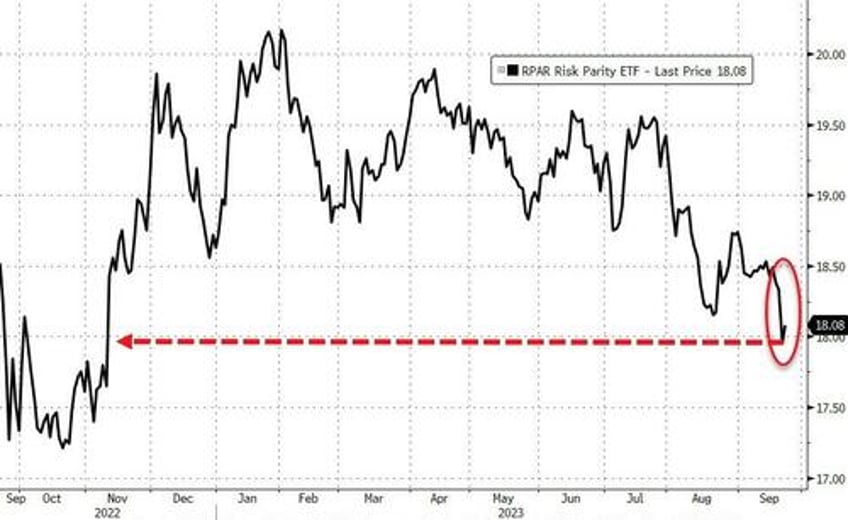

The synchronized slide across stocks, bonds and many commodities hammered risk parity players, as evidenced by the $926 million RPAR Risk Parity ETF suffering its worst day since December and sent the fund to its lowest in 10 months...

Source: Bloomberg

Treasury yields were all higher on the week, despite a pullback today, with the curve basically converging and yields up 9-11bps across the curve...

Source: Bloomberg

For context, the 2Y yield erased most of Wednesday's post-Powell spike...

Source: Bloomberg

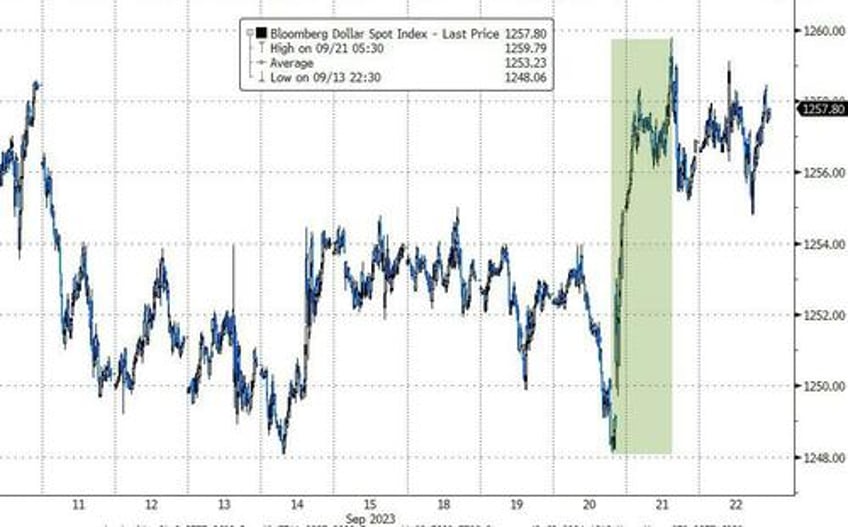

The dollar rallied on the week (up for the 8th week of the last 9)...

Source: Bloomberg

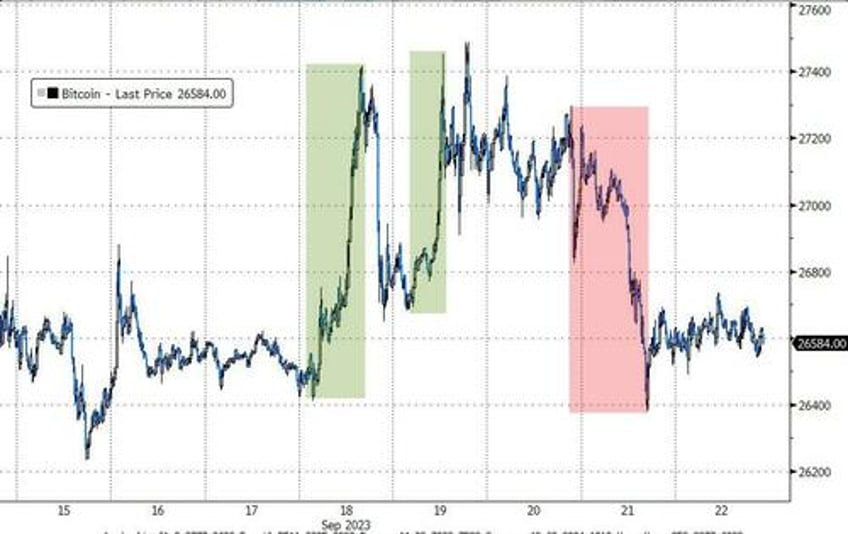

Bitcoin was noisy on the week but basically closed unch around $26,500...

Source: Bloomberg

Oil prices caused lots of excitement intraweek but ended unchanged with WTI hovering around $90.50...

Gold was flat on the week, breaking below its 200DMA...

..., but rallying back this afternoon to get back to that key technical level...

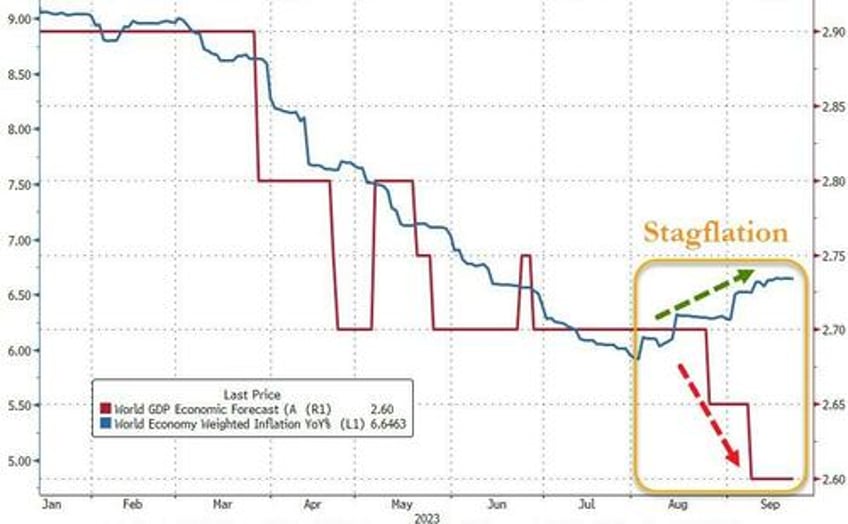

Finally, this morning's PMIs confirmed the overall trend of slowing growth (contraction in manufacturing and low growth in services) along with re-accelerating inflation (prices paid bouncing). That stagflation regime change is evident on a global scale...

Source: Bloomberg

How long before all the 'on hold' central banks start tightening again? Or is the next move a widespread deflationary malaise that brings out the doves?