There is some good news and some bad news for China bulls this morning (local time).

First the good news: since mainland China (aka A-shares) were closed for the past week, mainland Indexes such as the Shanghai Shenzhen CSI 300 are up - just barely - because after opening up almost 11% to catch up with the frenzied rally in offshore markets and ETFs, the index has erased almost all gains since it closed for trading on Sept 30.

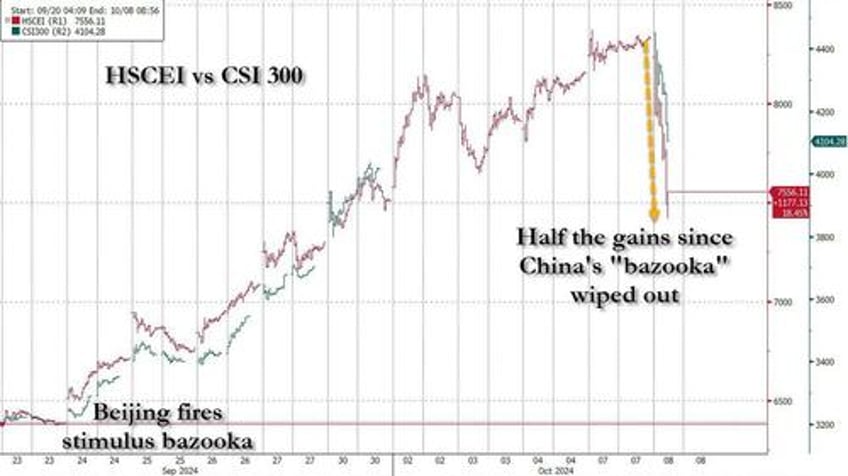

For the real action, one has to go to neighboring Hong Kong, which was open while China was closed, and which proceeded to soar as much as 30% since the China stimulus bazooka was fired on Sept 23 (just two days after we said it would be). It's also were the bad news is because one look at what the local Hang Seng China Enterprises Index is doing, and HK longs will want to throw up: as shown below, not only are HK stocks down as much as 11% after the open, but they have somehow managed to wipe out almost half the gains since the bazooka was launched in less than two hours!

What sparked this liquidation? Well, yesterday China unveiled yet another "emergency" stimulus meeting, this time held by the National Development and Reform Commission (i.e., China's central planning bureau). Expectations were high that just like the emergency Sept 26 Politburo meeting which was led by president Xi himself, today China would unveil even more sweet, sweet stimmies.

Alas it was not meant to be, and the press conference led by Zheng Shanjie, chairman of China’s top economic planner, the National Development and Reform Commission was an epic dud: in it, Shanjie said that while external risks and downward economic pressures were increasing, they remained confident of achieving the full-year GDP growth target. He said new policy measures will focus on expanding domestic demand, increasing support and the property and capital markets.

In short, nothing new, and certainly nothing even remotely close to the Rmb 10 trillion in fiscal stimmies that many were expecting. As UBS writes, "the NDRC press conference has released no details on fiscal stimulus so far, with the Q&A session ongoing. Zheng Shanjie along with deputy heads Liu Sushe, Zhao Chenxin, Li Chunlin and Zheng Bei, were widely expected to announce an action plan at the press conference. As a result, USDCNH is coming up, while iron ore and copper are declining. Shenzhen’s ChiNext has narrowed gains to 13% from more than 18% earlier as China returned from the Golden Week holiday."

What is the take home message here? First, that Jim Cramer was - as usual - a fade.

Cramer: "You have to come in China stocks right now"

— zerohedge (@zerohedge) October 2, 2024

That's the top.

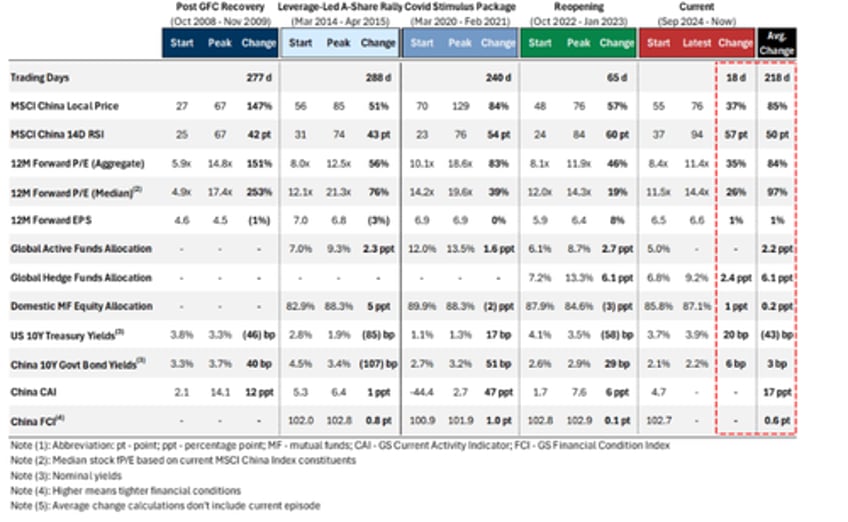

The second, and far more important message, is that the half life of Beijing's latest attempt to goose markets, at just around 10 days is the shortest of all...

... and it means that with the market having called Beijing's bluff, Xi has two options:

- Do another half-assed attempt to stimulate the economy with the very limited measures already unveiled, which he knows - and more importantly the market knows - will achieve nothing, and spark another market crash and economic meltdown, or

- Do what Goldman trader Borislav Vladimirov laid out yesterday, when he said that China Must Do QE Now, "Or It Will End Up In A Bigger Hole In 12 Months."

And since for Xi the time for half-measures is now over, especially if he wants to avoid a deflationary spiral, social insurrection and political mutiny, this only leaves one option open: the truly nuclear one. The only question is when, because while the market may have peaked at +30% the first time China tried to goose markets, the next time we are talking triple digits, not to mention $3K gold and $100K+ bitcoin.