On Thursday, we polled our followers on X, asking them: "Have you used Grok, ChatGPT, Gemini or any other AI chatbot in the past week?"

Three hours into the poll (with 20 hours left) and more than 8,300 respondents, a majority (62.5%) answered "No." Only 37.5% answered "Yes."

Have you used Grok, ChatGPT, Gemini or any other AI chatbot in the past week?

— zerohedge (@zerohedge) February 15, 2024

It's been 15 months since ChatGPT's debut that ignited the AI boom, sending share prices of Nvidia, Microsoft, Alphabet, and the rest of the "Magnificent Seven" to unfathomable levels. Many are wondering just how long this hype cycle will last.

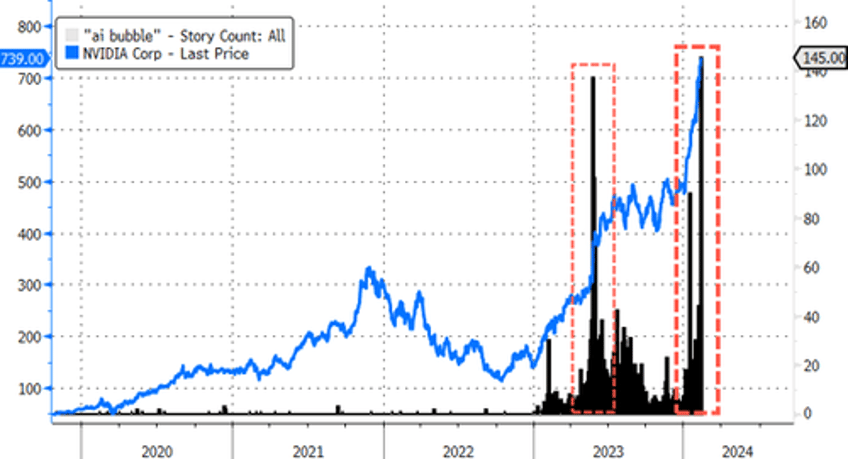

Consider this: As Nvidia shares soar to new heights, the number of stories mentioning "AI Bubble" across corporate media hit new record highs. Look what happened to Nvidia shares last year after "AI Bubble" headlines spikes.

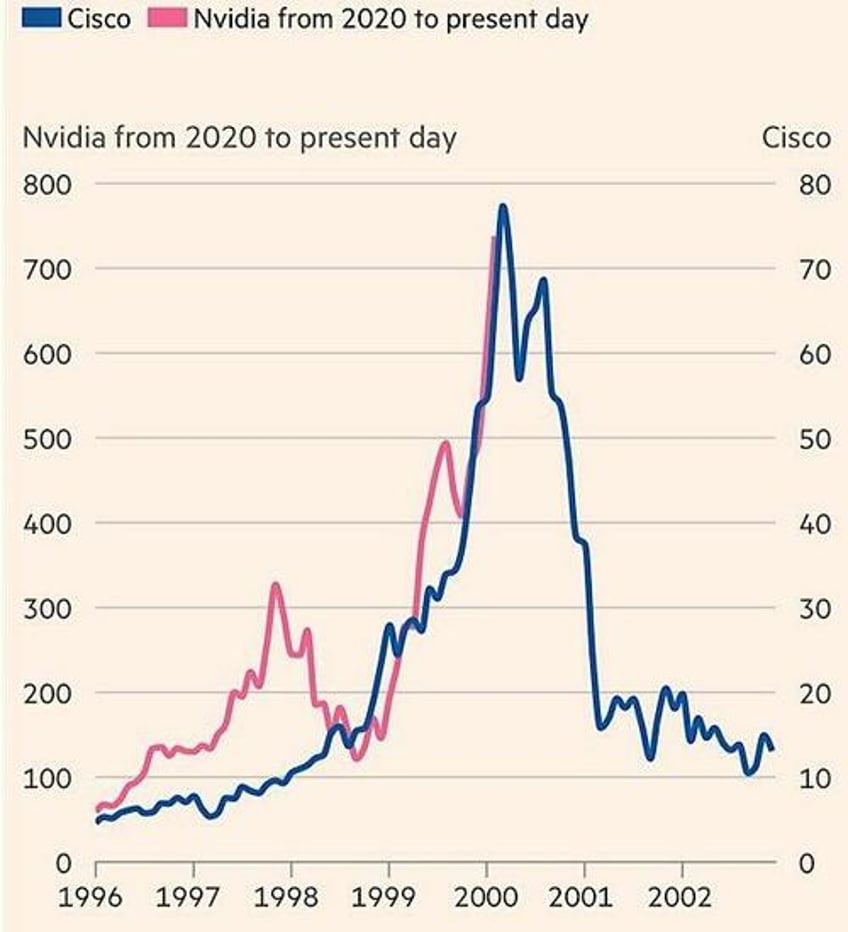

Earlier today, we published a note from Benjamin Picton, Senior Macro Strategist at Rabobank, titled "Stock Prices Have Reached What Looks Like A Permanently AI Plateau," which also cited the Cisco Dot Com analog overlaid with current Nvidia price action.

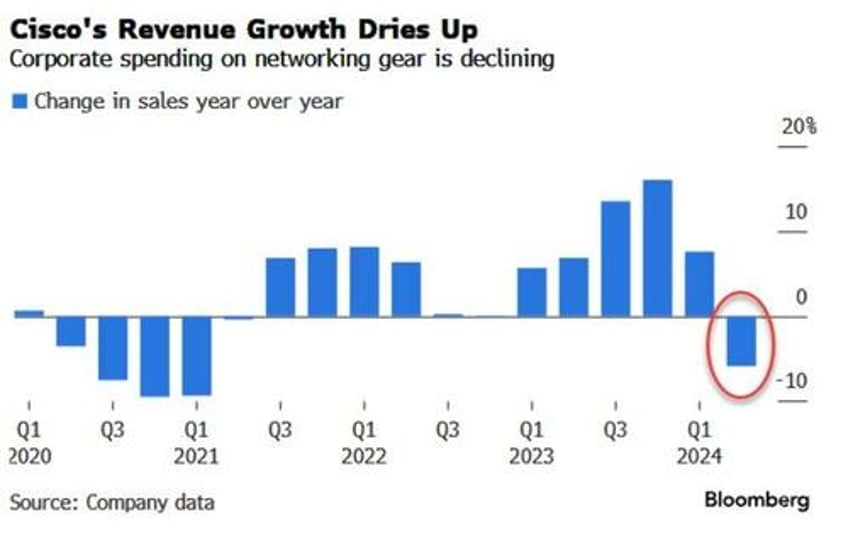

Continuing with Cisco, the world's largest manufacturer of computer networking equipment reported in fourth-quarter earnings that it slashed jobs amid a slowdown in corporate tech spending that wiped out its sales growth.

Whoops!

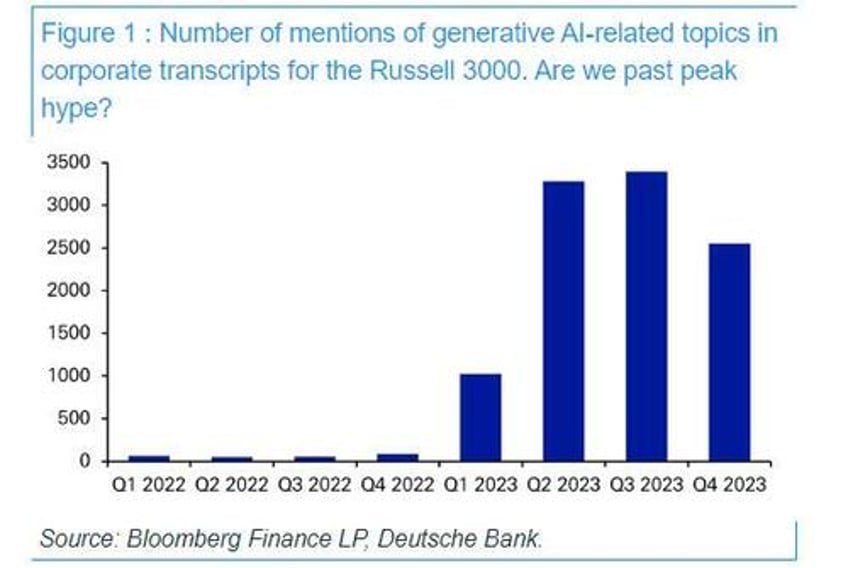

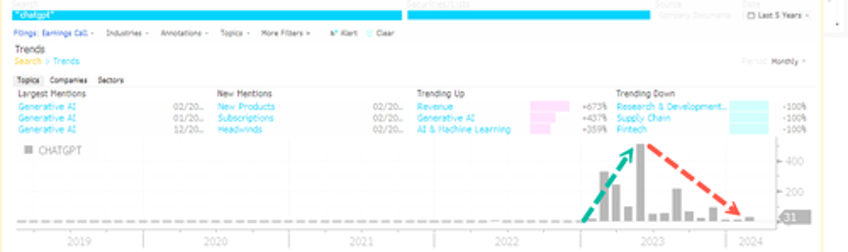

Last month, Deutsche Bank's head of thematic research, Jim Reid, asked, when looking at the declining number of mentions of AI-related topics in Russell 3000 earnings transcripts, if the right way to think about AI is that "the froth is beginning to dissipate as businesses turn their focus onto real-world uses rather than pie-in-the-sky applications."

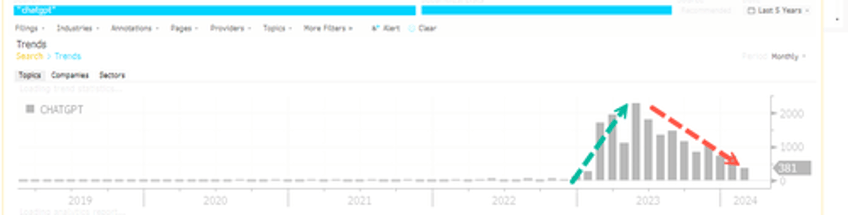

Taking a look at present-day "ChatGPT" mentions in the latest earnings calls, Bloomberg data shows a total collapse:

It's not just earnings calls; mentions of "ChatGPT" across filings have also plummeted.

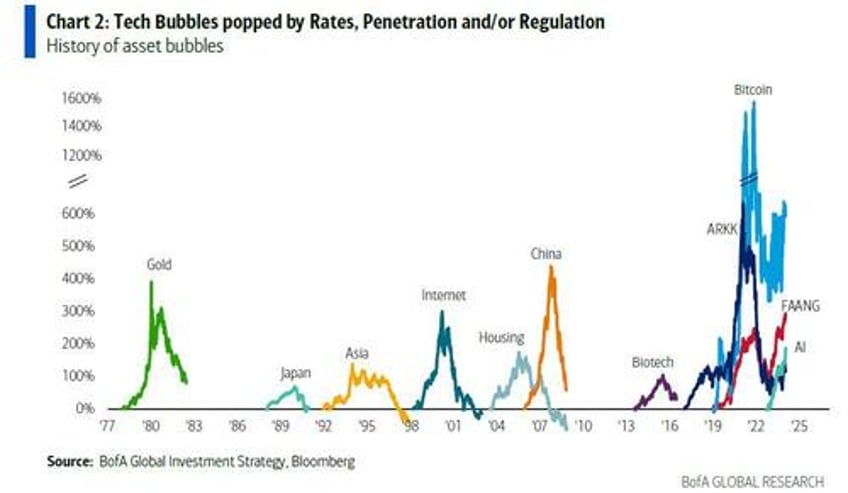

And what could pop the AI bubble?

Well, BofA's Michael Hartnett told clients weeks ago: rates, penetration, regulation.