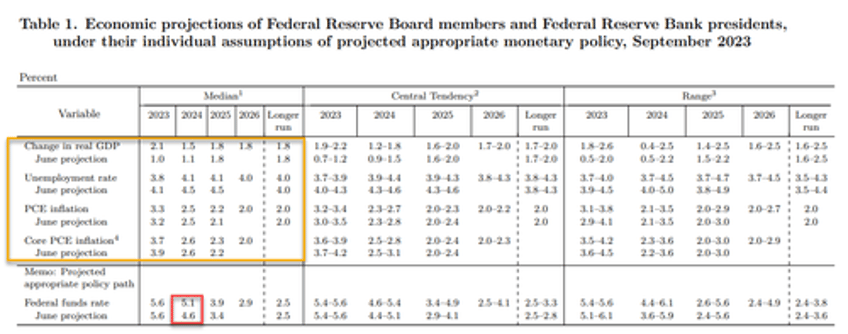

The Fed shocked markets today when it in its latest dot plot, the FOMC - which kept rates unchanged as expected - raised the median 2024 dot to indicate that it expects to cut rates just two times to 5.1% instead of the 4 cuts projected previously, 125bp of cuts in 2025 (vs. 125bp previously), for a cumulative 175bp of cuts in 2024-2025—50bp less than in the June projections—and 100bp of cuts in 202, as a result of modestly stickier inflation, stronger overall growth and lower unemployment. Additionally, 12 of the FOMC participants projected one more hike this year while 7 participants projected that the funds rate would remain unchanged.

While on the surface this would be dire news for stocks, the reality is that none of this matters for two simple reasons: i) the Fed's predictions are always wrong, especially about the future, and ii) the US economy - still artificially buoyed by staggering debt outflows (such as the $1 trillion issued in the just the past three months) - is about to hit a brick wall, putting an abrupt end to the Fed's attempt to "cool" the economy which is about to fall off a cliff.

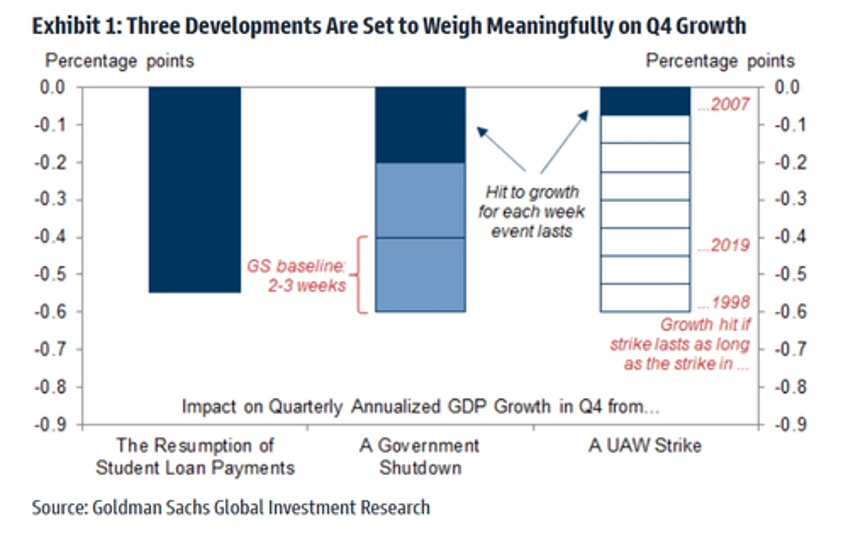

Let's start with the former, where we remind readers that one week ago Goldman, which has been one of the biggest cheerleaders of Bidenomics, said that Q4 GDP is about to slump for three reasons:

- First, the resumption of student loan payments, which will subtract (at least) 0.5% (and likely much more) from quarterly annualized GDP growth

- Second, the federal government shutdown looks all but assured: a government-wide shutdown would reduce quarterly annualized growth by around 0.2% for each week it lasted after accounting for modest private sector effects.

- Third, reduced auto production from the ongoing UAW strike would reduce quarterly annualized growth by 0.05-0.10% for each week it lasted.

The impact of these three factors is shown in the chart below...

... which ignores other negative factors, such as the accelerating deterioration in US consumption.

But while a sudden airpocket in US GDP would be bad enough, and certainly force the Fed to reassess its hawkish dot plot, the punchline is that current GDP growth, which as we noted recently had been estimated by the AtlantaFed's GDPNow at a ludicrous 5.9% for Q3...

On August 24, the #GDPNow model nowcast of real GDP growth in Q3 2023 is 5.9%. https://t.co/T7FoDdhwe0 #ATLFedResearch

— Atlanta Fed (@AtlantaFed) August 24, 2023

Download our EconomyNow app or go to our website for the latest GDPNow nowcast. https://t.co/NOSwMl8hc0 pic.twitter.com/Otd2WEDLYs

... is about to be revised lower. Sharply lower.

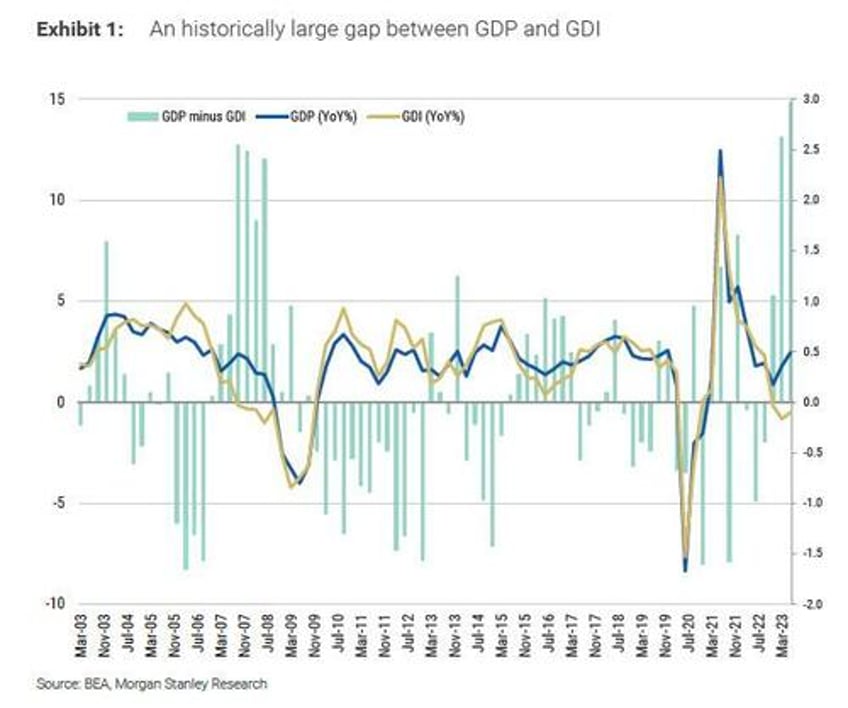

In a recent note from Morgan Stanley's chief US economist Ellen Zentner (available to pro subscribers in the usual place), she writes that the BEA will "likely make a meaningful downward revision to GDP in its annual revision on September 28."

Here, Zentner points out something we first brought attention to last month, namely the record gap between GDP and GDI...

The difference between GDP and GDI is the biggest in US history. It should be identical, but it isn't. pic.twitter.com/erjWHysI1g

— zerohedge (@zerohedge) August 30, 2023

... and notes that "the gap between GDP and GDI is at a 20-year high and our analysis of the last 20 annual revisions indicates that GDP will correct lower" to wit:

Every year the BEA revises its annual GDP and GDI (Gross Domestic Income) numbers, incorporating annual revisions of the underlying data (like retail sales, capital goods shipments, etc). We believe this year's revision, to be released on September 28, is likely to be significant because of the large gap between GDP (at 2.5%Y in 2Q23) and GDI (-0.5%Y). In addition, this revision will be more comprehensive as the BEA re-benchmarks GDP to data from the quinquennial economic census.

Next, Morgan Stanley's models analyzed the last 20 annual revisions and concluded that GDP is likely to be revised downward by -50bp to -80bp:

- GDP and GDI tend to converge in most revisions, especially when the GDP-GDI gap is large.

- Our simple models imply that a GDP downward revision between -50bp and -80bp to 2Q23%Y is possible.

- GDI might revise upwards, between +40bp and +60bp.

- The expected downward revision in payrolls next year is also consistent with a downward GDP revision.

While there are much more details in the full pdf report, below we excerpt some of the highlights, starting with the basic definitions:

On September 28, 2023 the Bureau of Economic Analysis (BEA) will publish comprehensive revisions to the National Income and Product Accounts (NIPA), which includes Gross Domestic Product (GDP) and Gross Domestic Income (GDI). GDI has been running well below GDP, opening up the largest gap in annual growth rates in the last 20 years. Based on our analysis of annual revisions over the last 20 years, we expect a downward revision to the year-over-year percent change in 2Q23 GDP of -50bp to - 80bp. The magnitude and direction of revision can influence how monetary policymakers determine the appropriate level of interest rates. We expect the upcoming revision to GDP to give the Fed evidence from inflation and the labor market that it has done enough.

The BEA publishes two measures that track economic activity: Gross Domestic Product (GDP) and Gross Domestic Income (GDI). Both indicators aim to measure the same thing, the domestic production of good and services in a given period of time, but their approaches differ. While GDP measures production from the expenditure side of the equation, GDI keeps track of the income generated from production (wages, profits, and other income).

The two paint vastly different economic pictures, owing to different approaches, such as methodologies, sources of data, coverage and timing differences in data collection. Hence, it shouldn’t be surprising that these series often diverge. But today GDI is pointing to contraction, while GDP implies that the economy has been expanding above potential growth in the last year. Exhibit 2 shows the data series for both GDP and GDI annual rates back to 2003, as the data stand today. Both series are highly correlated, with a coefficient of 0.91, but the recent gap that has opened up is remarkable – the largest in the last 20 years. GDP grew at a rate of 2.5%Y in 2Q23, whereas GDI declined by -0.5%Y.

The data revision hits next week: it will slash GDP.

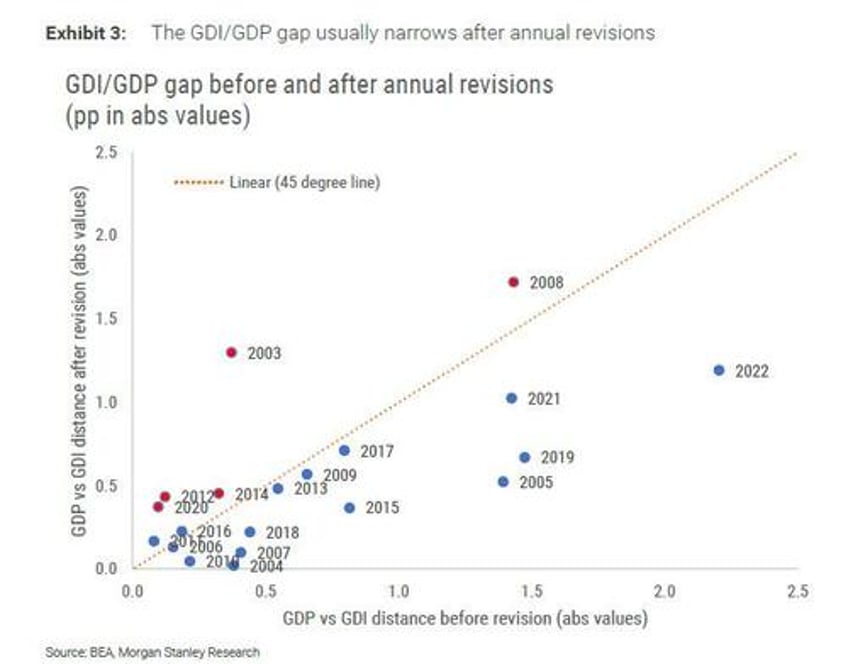

The GDP and GDI series are not final and will get revised soon. Once a year the BEA revises its GDP and GDI estimates, incorporating revisions to many of the data inputs it uses to compute the series. This year, the BEA will release its annual revision on September 28, concurrently with the final estimate of 2Q23. What might happen then? Predicting data revisions is particularly hard, but looking at past benchmark revisions helps. In this note we study the last 20 annual benchmark revisions and explain the work behind our conclusion that 2Q23%Y GDP is likely to by revised downward by -50bp to -80bp.

What typically happens in these revisions? The GDI/GDP gap typically closes. Data on past benchmark revisions reveal that in most years the gap between GDP and GDI narrows. Exhibit 3 shows the distance between GDP and GDI for the last quarter available before the revision is released (pp difference between %YoY rates, in absolute terms). Most years (depicted in blue) are close to, or below the 45 degree line, pointing to a larger gap before than after the revision. Out of the last 20 annual revisions, 13 decreased the GDP-GDI gap and only 4 increased it by more than 10bp (red dots). Focusing on the more relevant subset of revisions done when the gap is higher than 0.5pp, the gap closed in 8 out of 9 occasions.

What will happen after the revision?

GDP will likely be revised down toward GDI. Not only does the GDI/GDP gap tend to close in absolute terms, but we also find evidence that GDP usually converges toward GDI in YoY% rates. Exhibit 4 shows the relationship between the percentage point difference between GDI and GDP before the revision (latest quarter available before revision, YoY%) and the change in GDP growth rate after the revision (pp difference after vs before). There is a positive link between the two variables suggesting that a negative GDI/GDP difference like the one we have now might result in a downward revision to GDP. In Exhibit 4 we show two linear fits, one using the 20-year sample and the other only focusing on the revisions where the GDI/GDP gap closed, with a stronger link between the variables. Using the predictions from these simple models, we would expect to see a downward revision to 2Q23 YoY% GDP of as much as -50bp to -80bp

There's more: after slashing GDP, the US will also revised jobs... lower.

Payrolls get revised too, and we expect a downward revision. Payrolls have an annual benchmark revision that is published in February each year. The revision adjusts the level of payrolls through March of the prior year. For example, a new revision will be published in Feb-24, adjusting payroll levels from April-22 to Mar-23. And a preliminary estimation of the upcoming revision points to a decrease in payroll YoY% growth rates of -0.2pp.

We find that downward annual payroll revisions typically imply lower revised GDP, but they are not associated with GDI changes.... Our estimates suggest that a -0.2% revision in payrolls alone might imply a downward revision of 0.3% in GDP 2Q23 YoY% but no change in GDI.

But even if we ignore the upcoming contraction in US jobs (yes a negative YoY growth rate means the US will have lost jobs in the past year after all the revisions, something the Philadelphia Fed already informed us several months ago), the GDP revision alone will be enough to crush the Fed's tightening plans, because assuming the upper-end of the MS range of downward revisions (-0.5% to -0.8% from GDP-GDI revisions and another -0.3% from payroll revisions, and applying it to current consensus GDP growth in Q3 and Q4 (+2.9% and +0.6%), it means that while Q3 GDP may still be on the cusp of a positive print, Q4 GDP will almost certainly be negative, especially if the previously discussed three factors - resumption of student loan payments, UAW strike and government shutdown - end up impacting the economy more adversely than the traditionally optimistic Goldman Sachs estimates.

It's also why Zentner concludes that "downward revisions to GDP growth rates will be one of the factors keeping the Fed from hiking further, supporting our expectation that 5.375% is the peak federal funds rate in this cycle." Now if only the Fed had at least one or two capable analysts who were able to make this kind of analysis ahead of time, and not - as always - be caught with its pants down when we learn in a few months that the US entered (another) recession in 2023.

In other words, while the Fed is busy making (erroneous) forecasts about 2024, 2025 and 2026, US growth is currently on the cusp of contraction and - should oil prices continue to rise which they will - recession. And yes, forget a 5.1% Fed Funds rate at the end of 2024... 0% is much more likely.

Much more in the full Morgan Stanley note available to pro subs.