Two weeks after bursting the AI bubble, JPM's truthy trading desk (not to be confused with the bank's flip-flopping sellside propaganda) has taken the hammer to the myth of a "resurgent" US consumer. Here is JPM consumer trader Brian Heavey with some truth bombs that will quickly make persona non grata to the Biden department of bullshit.

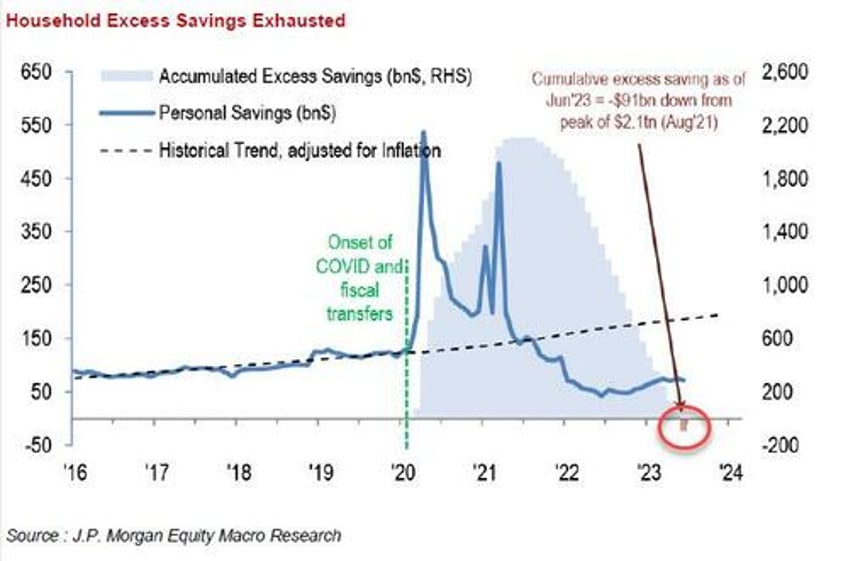

Sentiment is quickly turning very negative across retail/discretionary (seeing weakness across retail, casual diners, casinos etc). What's driving it? While the continued spike in crude is getting the most attention, we've anecdotally heard that data across the complex is beginning to roll as the Back-to-School tailwind fades (which drove a lot of the mgmt august optimism) and a renewed focus on the myriad of consumer headwinds: longer term impact of inflation/higher-for-longer rates, student debt repayment and consumer personal savings depletion.

While price action was more extreme yesterday, the bleed continues and we are seeing zero bid for discretionary.

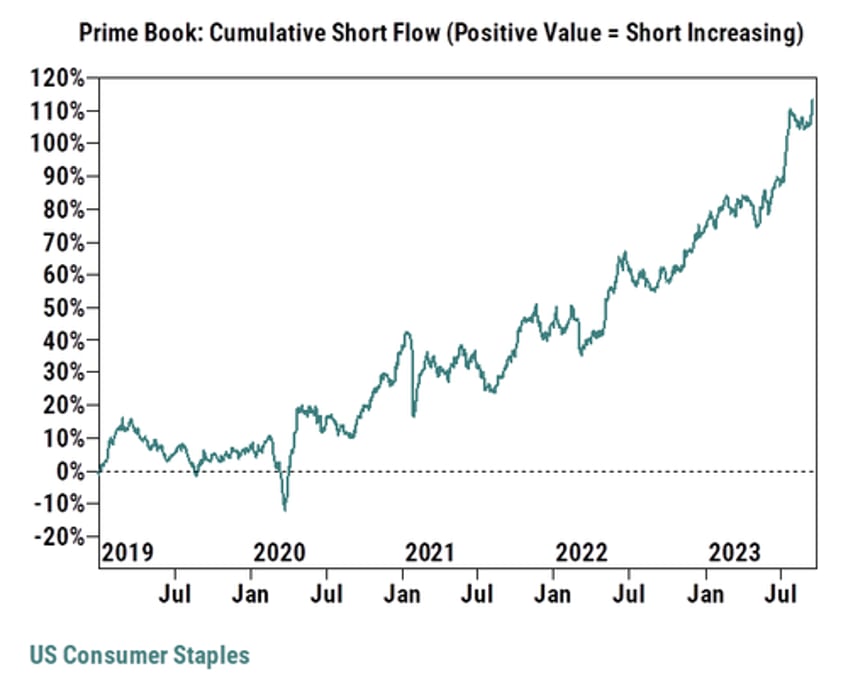

Defensive rotation continuing as we see HF demand for Staples (covering packaged food despite the food disinflation narrative) and long demand for HPC/Beverages. We are seeing HFs press shorts in the levered consumer names (cruise lines, casinos).

IWM/Small cap weakness not helping. While the IWM has been a big underperformer, it has held the 200d multiple times over the past 2 months. We ware now seeing the IWM and equal weight (RSP) break through key levels of support.

It's not just JPM; Goldman consumer trader Scott Feiler writes that the big drop in retail names this week has sparked a burst of inbound client queries:

3 question marks here does not seem like enough to explain the amount of inbounds that came our way on group performance today. Retail underperformed by 145 bps, but single name performance under the surface told a significantly worse story. Just look at W -10%, GPS -10%, AEO -6%, BURL -6%, VFC -5%, TGT -3%, etc., all on seemingly no “new” news. There are a range of reasons to point to that could explain some underperformance, including oil another +1% today and +20% the last 3 weeks, a WSJ story about student debt resumption (not really new) and some investor feedback about weakening data post back-to-school and some possible early tax-loss selling. Instead though....

....is it Just a Reduction of Belief in the Soft Landing Trade? All of the reasons above in bullet 1 seem possible. Today was not just positioning though, as both owned and shorted names traded off about equally, on limited new news. Instead, what stood out was many consumer names that have struggled in their respective sub-sectors were down the most. To me, that seems like an implementation of a view that a consumer soft landing is less likely. Most of the names down the biggest today are names that are pitching turnarounds and probably at least somewhat reliant on a consumer that cooperates.

The Goldman trader then shares 4 observations why sentiment on the US consumer appears to be collapsing:

1. Consumer Sensitivity: There is clearly some sensitivity around the health of the US consumer. Our take from the retail conference last week was that things seem choppy, but fine for 3Q. The bigger and increasing uncertainty seemed to be on the go-forward, with a view that any consensus that is looking for an acceleration in trend into 4Q and also 2024 seemed like it would be increasingly questioned.

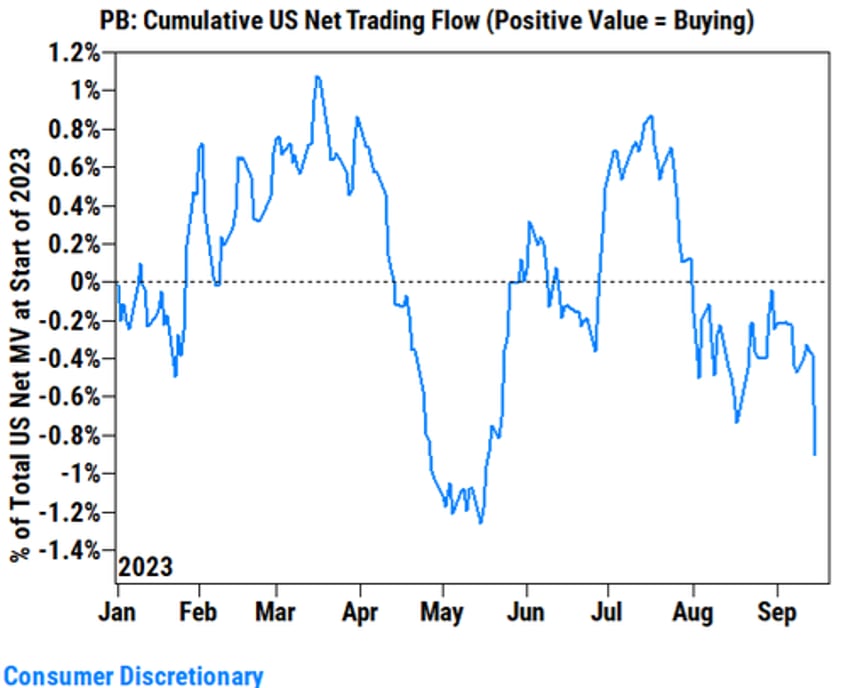

2. Post Event Lulls: A lot of the investor questions the last few days have been around “how did corporates sound about back-to-school?” Corporates sounded good on BTS. It is post event shopping where it sounds like lulls occur. For example, ASO spoke to a good BTS, but mentioned they usually see (and have planned for) lulls in between occasions. Bottom-line, consumers are healthy enough to spend when there is an event (think back-to-school, Black Friday, Holidays), but are becomingly increasingly picky between the big dates on the calendar. That would fit the post event lull theme. However, it doesn’t mean the consumer won’t show up for the next event.3. Discretionary Net Flow Moving Back Towards May Lows

4. Hiding Out in Staples? Nope. Despite a move away from soft landing, the GS PB data shows sizeable net selling in the group (as of this past Friday).

More in the full JPM and GS notes available to pro subs.