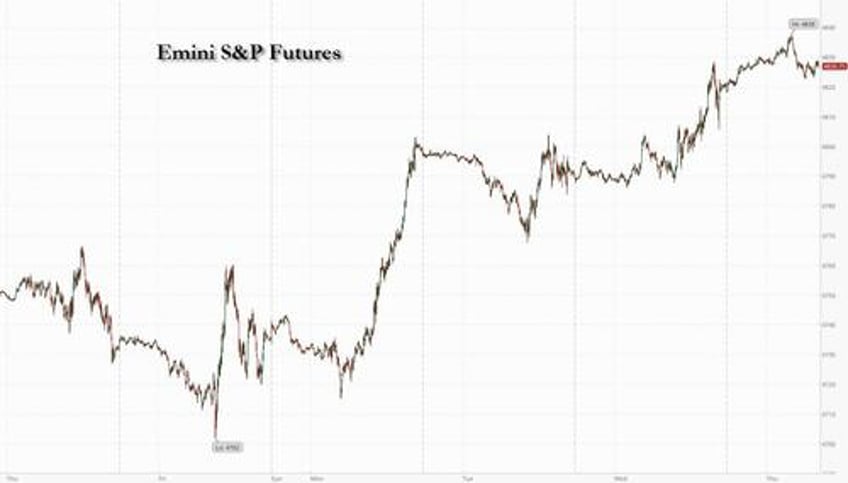

US equity futures tracked European and Asian stocks higher, but were off session highs as investors prepared for inflation data that will help clarify the path for Fed rates. As of 7:50am, S&P 500 futures pointed to small gains of about 0.1% after the gauge wiped out all losses from the start of the year and closed just short of an all-time high set two years ago on the back of the latest gamma squeeze in Mag 7 stocks; nasdaq 100 futures however continued their relentless meltup, and were 0.4% higher. After ramping all day, stocks eased off in the last minutes of trading during Wednesday's session, after the NY Fed's incompetent president John Williams said monetary policy is now likely sufficiently tight to guide inflation back to the 2% target, but that more evidence will be needed before any rate cuts emerge. JPM Asset Management, however, thinks Fed rate cuts could top current forecasts. Cryptocurrency stocks extended an advance in premarket trading after regulators approved exchange-traded funds that invest directly in Bitcoin, which jumped but it was ether that soared higher as the market attention now turns to frontrunning it ahead of its own ETF approval in a few months. US Treasuries climbed, with the yield on the 10-year benchmark dipping below 4%. Oil prices jumped after an oil tanker was boarded by Iranian military off the coast of Oman. WTI rises 1.6% to trade near $72.50 while Brent is above $78 a barrel.

In premarket trading, Citigroup slipped after the bank said it would set aside a $1.3 billion reserve covering risk in both Argentina and Russia. Piper Sandler said the bigger reserve build was the “only real surprise” in the filing, and that it expects the charges to make for a “super-messy” print on Friday. Here are some other notable premarket movers: