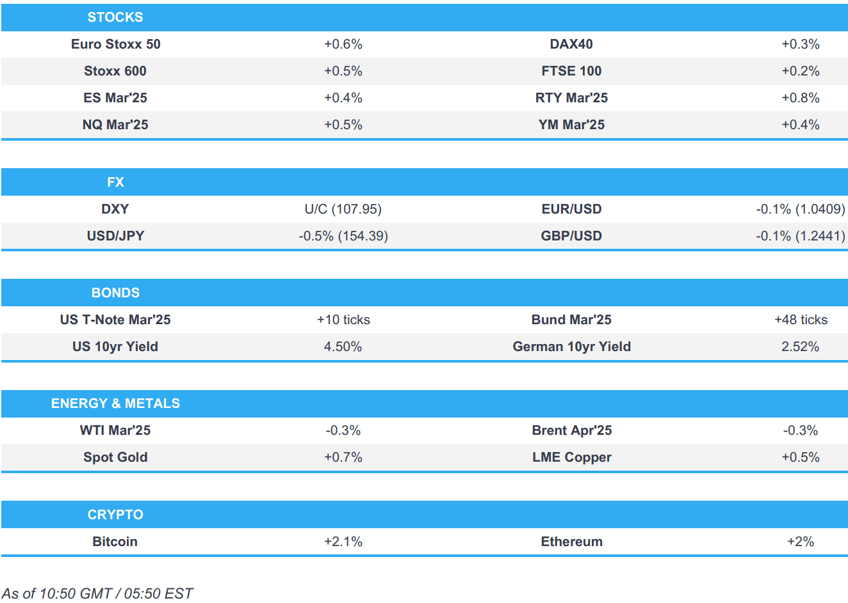

- European bourses hold an upward bias into the ECB; RTY outperforms post-FOMC.

- Big-Tech results were mixed; META +2.4%, MSFT -3.5%, TSLA +1.7%

- USD steady post-FOMC, EUR eyes ECB 25bps rate cut; USD/JPY below 154.50.

- Powell props up bonds, weaker-than-expected EZ GDP spurred little reaction in Bunds ahead of the ECB.

- Crude slips on tariffs and growth fears, base metals edge a little higher despite China being on holiday.

- Looking ahead, US GDP Advance (Q4), PCE Prices Advance (Q4), Jobless Claims, Japanese Tokyo CPI & Retail Sales, ECB & SARB Policy Announcements, Comments from ECB President Lagarde.

- Earnings: Apple, Intel, Visa, US Steel, UPS, Mastercard, Blackstone, Caterpillar, Cigna & Mobileye.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.5%) are generally modestly firmer across the board, as sentiment improves from a mostly mixed APAC session; the AEX/IBEX 35 are the European outperformers.

- European sectors hold a strong positive bias; aside from the top performer, the breadth of the market is fairly narrow. Real Estate leads, whilst Telecoms is pressured by BT (-3.5%) post-earnings. For Banking names, BBVA (+3.5%) gains after it beat estimates and announced a near EUR 1bln share buyback. Caixabank (-1%) slips a little lower after lending income came under pressure. Deutsche Bank (-4.5%) sinks after its results (details below).

- US equity futures are entirely in the green, in the aftermath of the FOMC meeting and then the dovishly-viewed Powell press conference thereafter - as such, the economy-linked RTY (+1%) outperforms; NQ +0.4%.

- Big Tech earnings after-hours were varied; Microsoft (-3.5%, strong Q4 but disappointing cloud outlook), Meta (+2.4%, earnings beat), Tesla (+1.7%, Q4 results missed but Musk promises autonomous robotaxi).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EUROPEAN EARNINGS SUMMARY

- BBVA (BBVA SM) +4%: FY beat. Buyback approved.

- Caixabank CABK SM) -0.3%: Q4 beat. Sees NII down mid-single-digit in 2025.

- Deutsche Bank (DBK GY) -2.4%: Q4 metrics mostly beat, PBT posted a notable miss.

- Evolution (EVO SS) -5.8%: Q4 beat. 2025 priority is growth and increasing market share, intends to repurchase EUR 500mln of shares.

- H&M (HMB SS) -5.4%: Q4 mixed, dividend increased.

- Hapag Lloyd (HLAG GY) +0.4%: FY beats.

- Roche (ROG SW) +0.6%: FY metrics exceeded guidance, Core EPS beat upgraded Co. forecast. FY25 sales increase guided in the mid-single-digit range.

- Sanofi (SAN FP) +1.4%: Q4 miss, plans a 2025 buyback.

- Shell (SHEL LN) +0.9%: Q4 miss. Announces a 3.5bln buyback. Q4 metrics incl. net impairment charges and reversals of 2.2bln, and net losses from asset sales.

- STMicroelectronics (STM FP) -7.9%: Q4 metrics post modest beats. Q1 revenue guidance missed. Commenced a programme to resize the global cost base.

- Swatch (UHR SW) -4.7%: FY metrics missed. Expects demand in China to be "rather restrained" Note, also hit by a drop in Swiss watch exports in December

- Wizz Air (WIZZ LN) -7.3%: Q4 miss and cut guidance.

US EARNINGS SUMMARY

- IBM (IBM) +8% pre-market: Q4 earnings and revenue exceeded expectations. Software revenue grew 10%, driven by AI and Red Hat, while consulting revenue fell 2%, and it sees +5% annual growth in FY25

- Meta (META) +2.4% pre-market: Q4 sales up 21% and net income rising 49%; its AI's userbase reached 700mln monthly users. CEO Zuckerberg said it will be a "really big year" for AI, expects Meta AI to be the leading AI assistant.

- Microsoft (MSFT) -3.5% pre-market: Reported disappointing Azure growth forecasts, higher-than-expected capex, and concerns over competition from cheaper Chinese AI models, raising investor fears of a price war and delayed returns on substantial AI investments.

- Tesla (TSLA) +1.7% pre-market: Q4 earnings and revenue missed expectations, and its vehicle sales profit margin narrowed; while shares initially slipped on the release, they rebounded as investors focussed on the automaker's plans to launch cheaper EVs in early 2025 and test autonomous vehicles in June, as well as cost-cutting measures and future self-driving prospects.

FX

- DXY is trivially higher as the dust settles on yesterday's FOMC policy announcement. Price action yesterday saw the USD spike higher as the FOMC removed language over progress on inflation before fading the move as Powell downplayed the change in language. For today's docket, focus is on the advance release of Q4 GDP and PCE data with the former expected to print at 2.6% vs. prev. 3.1%. Greater attention will likely fall on tomorrow's monthly PCE metrics. DXY is currently steady within yesterday's 107.74-108.29 range.

- EUR is marginally softer vs. the USD. This morning has seen disappointing GDP outturns for France and Germany which culminated in the EZ-wide figure printing at 0.0% Q/Q vs. Exp. 0.1%; EUR was unreactive. Looking forward, focus is very much on today's ECB policy announcement. A 25bps cut is nailed on and the policy statement will likely reiterate the bank's meeting-by-meeting and data dependent approach. Clues will be on any negative emphasis on the growth outlook which some could see as a signal to price the terminal Deposit Rate closer to 1.5/1.75% vs. the current 2% level. EUR/USD is currently tucked within yesterday's 1.0381-1.0443 range and below its 50DMA at 1.0426.

- JPY is firmer vs. the USD with not much in the way of fresh macro drivers out of Japan. USD/JPY is ultimately lower on the week on account of the risk-aversion triggered on Monday by the sell-off in US large cap tech stocks. USD/JPY is back below its 50DMA at 154.86.

- GBP is steady vs. the USD and EUR with fresh drivers for the UK lacking as yesterday's speech by Chancellor Reeves failed to have any follow-through into the GBP. Cable currently sits towards the top end of yesterday's 1.2393-1.2463 range.

- Antipodeans are both lacking firm conviction and failed to sustain overnight gains in the absence of pertinent drivers and tier-1 data releases. AUD/USD is steady after three consecutive sessions of losses which dragged the pair to a 0.6209 low yesterday.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are bid and eclipsed Wednesday’s 109-09 pre-FOMC peak by half a tick. In brief, the FOMC statement sparked a hawkish move given the removal of the line around inflation progress, causing USTs to hit a 108-22 session low; thereafter, the move pared as Powell clarified this was just a tightening of the statements language, not a signal. As such, if we surpass the 109-09 top more convincingly then we look to 109-12 from Monday after which there is a bit of a gap until 110-00. Ahead, a slew of earnings and then US GDP/PCE (Q4) prints.

- Bunds are firmer, in-fitting with USTs directionally and have just eclipsed Wednesday’s best to a 131.85 peak. As it stands, action is seemingly a continuation of the post-Powell bullish move from Wednesday. For the bloc, specifics this morning include Flash GDP data which came in softer-than-expected but spurred no real reaction, following weaker than forecast German and Italian numbers; the German metrics were weighed on by export activity, which printed “significantly lower” Q/Q in the GDP series. Ahead, the ECB; a 25bps is widely expected so more focus will lie on President Lagarde's press conference on any clue on where the terminal rate could be.

- Gilts are bid in tandem with peers. Chancellor Reeves continues to do the media rounds taking up her growth plan from Wednesday’s session. The most pertinent line being she expects the economy to feel the benefit within the current Parliament, while this is a positive for Gilts and her fiscal position, it remains to be seen if it is realised. Gilts find themselves at a 92.50 peak. Stopping just shy of Wednesday’s 92.54 best.

- UK sells GBP 1.5bln 0.125% 2026 Gilt via Tender: average yield 3.88% (prev. 3.97%).

- Italy sells EUR 6.25bln vs exp. EUR 5.0-6.25bln 3.00% 2029, 3.85% 2035, 3.35% 2035 BTP & EUR 2.75bln vs Exp. 2.25-2.75bln 2.105% 2033 CCTeu.

- Click for a detailed summary

COMMODITIES

- Subdued trade across crude oil following a rangebound overnight session after yesterday's slide in prices. Recent losses have been attributed to tariff fears after US President Trump's recent rhetoric and ahead of the looming Mexico, Canada, and China tariffs on February 1st. On the EZ growth front, this morning's metrics showed that the German economy shrank more than expected in Q4 (-0.2% vs. Exp. -0.1% (Prev. 0.1%), not boding well on demand. Brent Apr in a USD 74.98-75.81/bbl parameter.

- Precious metals trade higher across the board with upside seen ahead of the European open despite a lack of macro drivers at the time. That being said, it's worth noting that Chinese markets are away and thus potential European flows could've helped. Spot gold resides in a USD 2,758.39-2,776.64/oz range with the next upside level the 24th Jan peak (USD 2,786.06/oz).

- Base metals are firmer in what is seemingly broad-based metals upside following an uneventful APAC session with Chinese markets also away on holiday. 3M LME copper trades in a USD 9,042.10-9,119.15/t after briefly dipping under USD 9,000/t yesterday.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU GDP Flash Prelim YY (Q4) 0.9% vs. Exp. 1.0% (Prev. 0.9%); GDP Flash Prelim QQ (Q4) 0.0% vs. Exp. 0.1% (Prev. 0.4%)

- EU Unemployment Rate (Dec) 6.3% vs. Exp. 6.3% (Prev. 6.3%, Rev. 6.2%)

- EU Services Sentiment (Jan) 6.6 vs. Exp. 6.0 (Prev. 5.9, Rev. 5.7); Selling Price Expec (Jan) 8.7 (Prev. 7.6, Rev. 7.5); Economic Sentiment Jan) 95.2 vs. Exp. 94.1 (Prev. 93.7); Consumer Confid. Final (Jan) -14.2 vs. Exp. -14.2 (Prev. -14.2); Cons Infl Expec (Jan) 20.2 (Prev. 21.0, Rev. 21.2); Industrial Sentiment (Jan) -12.9 vs. Exp. -13.8 (Prev. -14.1)

- German GDP Flash YY SA (Q4) -0.2% vs. Exp. 0.00% (Prev. -0.30%); GDP Flash YY NSA (Q4) -0.4% vs. Exp. -0.3% (Prev. 0.1%); GDP Flash QQ SA (Q4) -0.2% vs. Exp. -0.1% (Prev. 0.1%)

- Italian Unemployment Rate (Dec) 6.2% vs. Exp. 5.7% (Prev. 5.7%, Rev. 5.9%)

- Italian GDP Prelim QQ (Q4) 0.0% vs. Exp. 0.1%; GDP Prelim YY (Q4) 0.5% vs. Exp. 0.6% (Prev. 0.4%)

- French GDP Preliminary QQ (Q4) -0.1% (Prev. 0.4%)

- German Import Prices MM (Dec) 0.4% vs. Exp. 0.3% (Prev. 0.9%); YY 2.0% vs. Exp. 1.9% (Prev. 0.6%)

- Swiss KOF Indicator (Jan) 101.6 vs. Exp. 100.2 (Prev. 99.5, Rev. 99.6)

- Spanish CPI YY Flash NSA (Jan) 3.0% vs. Exp. 2.90% (Prev. 2.80%); Core 2.4% (prev. 2.6%)

- UK Mortgage Approvals(Dec) 66.526k vs. Exp. 65.4k (Prev. 65.72k, Rev. 66.061k); Mortgage Lending (Dec) 3.568B GB vs. Exp. 2.6B GB (Prev. 2.474B GB, Rev. 2.547B GB); BOE Consumer Credit (Dec) 1.045B GB vs. Exp. 0.95B GB (Prev. 0.878B GB, Rev. 0.905B GB); M4 Money Supply (Dec) 0.1% (Prev. 0.0%)

NOTABLE EUROPEAN HEADLINES

- UK Government is mulling proposals to relax rules on pension protection fund, reducing the levy it collects from pension scheme.

NOTABLE US HEADLINES

- US President Trump said because the Fed and Chair Powell failed to stop problem they created with inflation, he will do it by unleashing American energy production slashing regulation, rebalancing international trade, and reigniting American manufacturing, while he will make the US financially, and otherwise, powerful again.

- Ronald Reagan Washington National Airport announced all take-offs and landings were halted and emergency personnel were responding to an aircraft incident. Furthermore, the FAA announced that a PSA Airlines Bombardier regional jet collided in mid-air with a Sikorsky H-60 helicopter as it was approaching the runway at Reagan Washington National Airport, while PSA Airlines was operating Flight 5342 for American Airlines (AAL) which took off from Kansas.

- BoC Governor Macklem said the Bank of Canada can ease tariff pain but can’t fix the damage and a big increase in tariffs is a big disruption to the Canadian economy, while he added that if a trade battle comes to pass, it would mean the economy will work less efficiently. Macklem also commented that inflation has come down, inflation is low, and it is thought to stay around the target.

GEOPOLITICS

MIDDLE EAST

- Israeli army says it has recently intercepted a reconnaissance drone launched by Lebanon's Hezbollah.

- Israeli tank fire was reported in the western area of Rafah in the Tel Al-Sultan neighbourhood, according to Al Arabiya.

- Palestinian Authority PM Mustafa said he has every reason to believe the Trump administration will help them all do a right and balanced deal that could hopefully end the conflict in the region, while he added the goal for Gaza is no Hamas or Israel and that the PA rejects the Trump idea of relocating Gazans

RUSSIA-UKRAINE

- European officials are reportedly considering whether Russian gas pipeline sales to the EU should recommence as part of any potential settlement to end the war against Ukraine, via FT citing sources.

LATAM

- Brazilian Central Bank hiked rates 100bps to 13.25%, as expected in a unanimous decision, while it expects a further adjustment of the same magnitude in the next meeting if the scenario evolves as expected. BCB said that beyond the next meeting, the committee reinforces that the total magnitude of the tightening cycle will be determined by the firm commitment to reaching the inflation target and it stated the current scenario requires an even more contractionary monetary policy.

CRYPTO

- Bitcoin is on a firmer footing, and climbs just above USD 105k; Ethereum is just above USD 3.2k.

- NBP says it has not invested and is not considering investing in crypto as they constitute an asset class with very high risk

APAC TRADE

- APAC stocks were ultimately mixed amid the ongoing mass closures in the region and after the choppy performance stateside in reaction to the FOMC, while the first earnings results from the magnificent 7 stocks were also varied.

- ASX 200 climbed to a fresh record high amid broad strength across sectors and further calls for a February RBA rate cut with NAB joining the rest of Australia's big 4 banks in forecasting a cut next month.

- Nikkei 225 swung between gains and losses amid earnings releases and as the index largely shrugged off a firmer currency.

NOTABLE ASIA-PAC HEADLINES

- HKMA said interest rates in Hong Kong might still remain at relatively high levels for some time and that the extent and pace of future US interest rate cuts are subject to considerable uncertainty, in response to the Fed keeping rates unchanged.

DATA RECAP

- Australian Export Prices (Q4) 3.6% (Prev. -4.3%); Import Prices 0.2% (Prev. -1.4%)

- New Zealand ANZ Business Outlook (Jan) 54.4% (Prev. 62.3%)

- New Zealand ANZ Own Activity (Jan) 45.8% (Prev. 50.3%)