Rumors from Bloomberg reporters earlier this month about Intel considering a divestment in Israeli autonomous driving firm Mobileye Global has been debunked by the chipmaker this morning.

"As the majority shareholder in Mobileye (MBLY), Intel has an unwavering focus on value creation and are excited about the future of its business," Intel wrote in a statement.

Intel said, "We currently do not have any plans to divest a majority interest in the company," adding, "By providing Mobileye with separation and autonomy, we have enhanced its ability to capitalize on growth opportunities and accelerate its path to creating even greater value. We believe in the future of autonomous driving technology and in Mobileye's unique role as a leader in the development and deployment of advanced driver assistance systems (ADAS)."

In 2017, Intel bought the Israeli firm for a little more than $15 billion. By 2022, Mobileye debuted on the public markets via an initial public offering in New York. Shares are down 73% on the year, and down 45% from the IPO price.

Mobileye shares are up 7.5% in premarket trading following the news from Intel.

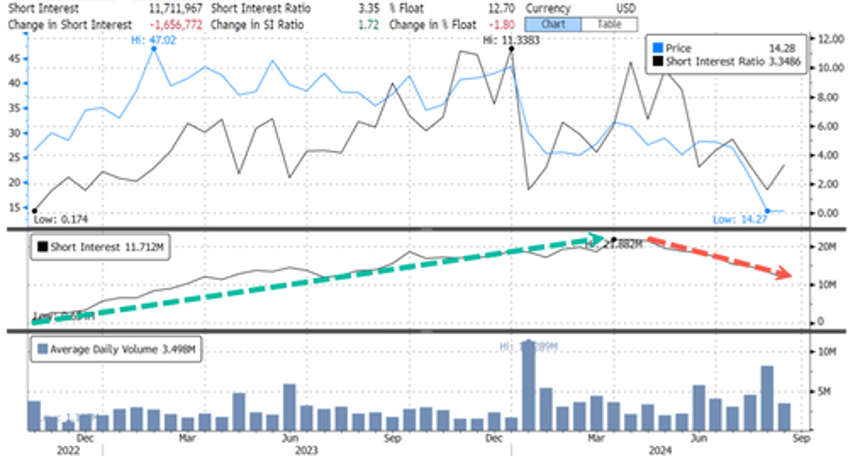

Mobileye's float is 12.7% short, equivalent to about 11.7 million shares. Traders have been unwinding bearish positions since late April.

About a week ago, Goldman's Mark Delaney told clients, "We are buy-rated on MBLY shares. Our 12-month price target is $24, which is based on 30X applied to our Q5-Q8 EBITDA estimate (ex. SBC)."

Earlier this week, Intel CEO Pat Gelsinger informed employees about the chipmaker's next steps in an ambitious turnaround plan, including a deal with Amazon, a pause in European plant expansion, and thousands of more layoffs.