By Michael Msika, Bloomberg Markets Live reporter and strateigst

European carmakers are so cheap that investors are pricing them to fail, seeing long-term growth and pricing power faltering as global competition intensifies. Except for their deep value, it’s hard to find a positive among the mounting headwinds.

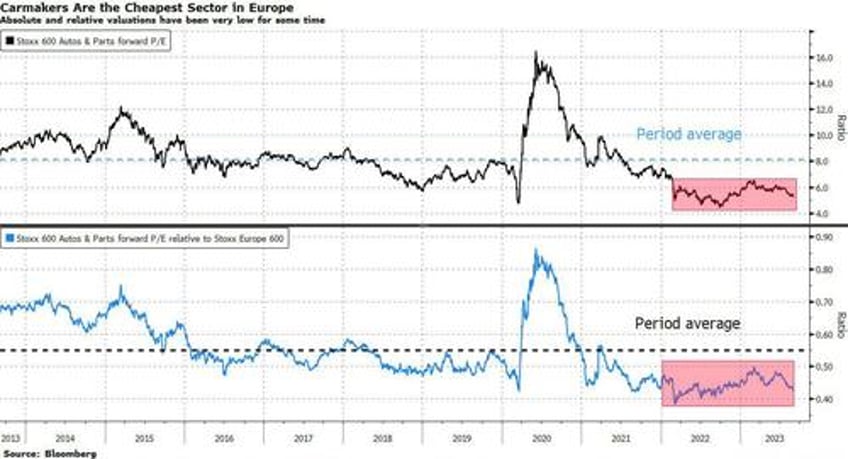

Carmakers have been extremely cheap for nearly two years. The Stoxx 600 autos and parts forward price-to-earnings ratio is hovering around 5.3 times, near the bottom of a 17-year range and about a 60% discount to the broader market. Slowing demand, lower growth in China, fierce competition in electric vehicles and eroding pricing power are building a wall of worries for the sector.

“The sector is priced to lose substantial market share in upcoming years and, if correct, this would ultimately signal the end of the road for one of Europe’s most important industrial sectors,” say Bernstein analysts including Daniel Roeska. “Market valuations imply a free-cash-flow mean-reversion of -22% and long-term growth of 1.5%.”

The analysts believe the market is “too pessimistic,” assuming operational improvements achieved in the past year will erode, while long-term growth will be subdued. While carmakers face numerous challenges, they see some value, with outperform ratings on Mercedes and Renault, and a market-perform view on BMW, Stellantis and Volkswagen. While the latter is “overvalued,” both Stellantis and Renault are “essentially priced to go out of business,” they say.

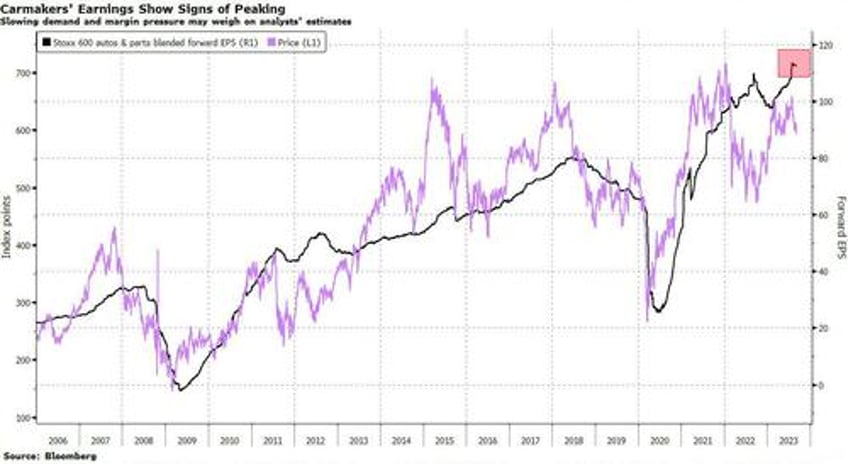

On average, sell-side analysts are holding a positive view. The Stoxx 600 autos and parts is the subindex with the most upside seen over the next 12 months at 30%. Earnings forecasts have been on the rise this year, reaching a record high in August, but have stalled since, with cracks in the bull case finally showing in estimates.

Last week, UBS downgraded Volkswagen and Renault to sell on intensifying competition from Tesla and Chinese rivals. Earlier this month, Tesla announced a revamp of its Model 3, while again slashing prices on several variants, increasing fears of an EV price war. Meanwhile, new-model announcements at the IAA Mobility car show in Munich haven’t been a strong catalyst so far.

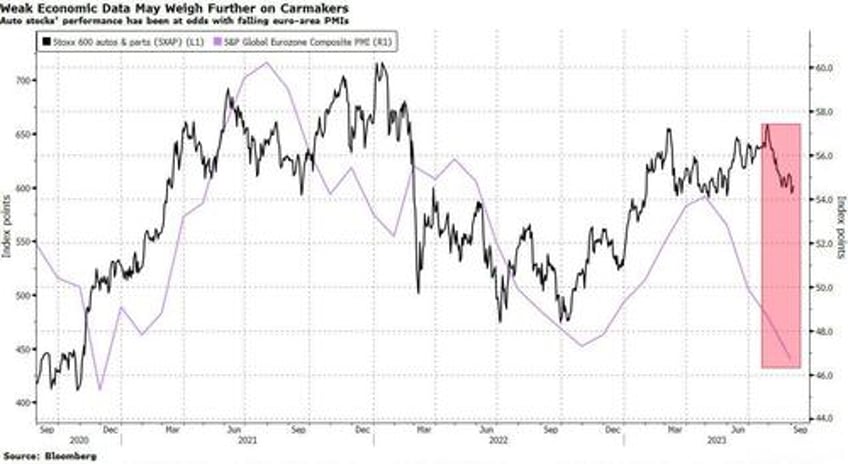

The sector is up 14% this year, outperforming the broader market, but most gains were achieved at the beginning of the year. Since then, it’s been a volatile ride, and the past month has been a struggle, with the SXAP falling 5.6%, the worst-performing subgroup of the Stoxx 600 over that period. European PMI data hasn’t shown any sign of recovery, which could weigh further on the sector, while slowing growth in China is seen as a major issue for exposed carmakers like BMW and Porsche, according to Citi analysts.

“China represents about 30% of global car demand, and about 70% of global BEV demand,” say analysts including Harald Hendrikse, who see yuan weakness as an additional risk to EPS. They estimate that 33% of BMW, 30% of Porsche, 26% of Volkswagen, and 23% of Mercedes Ebit come from China, while Stellantis and Renault have little exposure. “European auto OEMs tend to be highly correlated with China growth sentiment,” they say.

Overall, confidence is low among equity strategists and asset allocators, with many, including those at JPMorgan, Barclays and Bank of America, keeping a bearish view on the sector on likely waning pricing power, slowing economic growth and softening car demand.

“Autos look cheap on a range of valuation measures, such as price-to-book, as well as on EV/Ebitda,” says JPMorgan strategist Mislav Matejka. “However, the sector is strongly correlated to activity momentum, and could be hurt as PMIs stay subdued.”