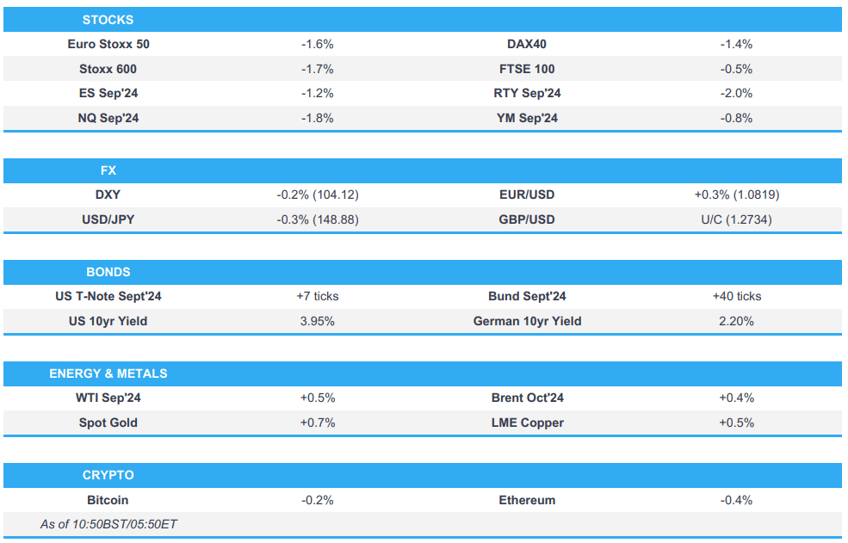

- European bourses/US futures under pressure with the ISM-induced downside exacerbated by tech pressure post-INTC (-21%)

- Chipmakers lower after a grim update from INTC, AMZN lower after earnings, AAPL modestly softer

- DXY pressured overall but with peers generally mixed-rangebound, EUR back above 1.08 while Cable continues to slip post-BoE

- Fixed benchmarks continue to rise with yields pressured across the curve into Payrolls and the first post-FOMC Fed speak

- Crude and XAU in the green, complex benefitting from ongoing geopol. risk premia

- Looking ahead, highlights include US NFP, Durable Goods (R), BoC Market Participants Survey, Comments from BoE’s Pill & Fed's Barkin. Earnings from Chevron & Exxon

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are pressured across the board, Euro Stoxx 50 -1.3%, with the ISM-induced downside continuing and being exacerbated by marked pressure in Intel post-earnings.

- As such, sectors are all in the red; Tech underperforms with heavyweight ASML opening lower by over 6% given INTC, Banking/Finance names hit on the pronounced downside in yields. Overall, the complex has a defensive configuration in-fitting with the broader risk tone.

- DAX 40, -1.2%, pressured with continued downside in Auto names and also its exposure to the tech-woes through Infineon.

- FTSE 100, -0.3%, is one of the better performers with large-cap defensive/energy names cushioning the downside, in addition to strength in IAG and GSK on Co. specifics.

- Stateside, futures are lower across the board, ES -1.0% & NQ -1.7%, NQ lagging given its tech-exposure with RTY -1.5% not far behind given the labour market concerns highlighted by ISM ahead of NFP; post-earnings, INTC -21%, AMZN -8.8% & AAPL -0.4%.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY pressured overall but with peers generally mixed-rangebound, index holding towards lows in a 104.10-42 range.

- EUR recouping from Thursday’s downside and is back on a 1.08 handle, EZ-specifics light with NFP likely to dictate.

- Cable continues to slip after the BoE cut on Thursday; 100- & 200-DMAs in focus just below the 1.27 mark at 1.2681 and 1.2647 respectively.

- JPY firmer, holding just below the 149.00 mark and benefitting from the ongoing pressure in US yields; Thursday’s base at 148.50 in view in the scenario of a dovish payrolls report.

- Antipodeans are a touch firmer but AUD remains in relative proximity to its recent multi-month low of 0.6479.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks continue to climb after the poor ISM Manufacturing report in Thursday’s session, with further upside stemming from the downbeat risk tone on account of marked chip/tech pressure.

- USTs as high as 113-00, extending on Thursday’s 112-26 peak with yields pressured across the curve with 3s through 10s now all sub-4.00% and the 2yr as low as 4.10%.

- EGBs firmer, in-fitting with the above; Bunds as high as 134.92 with resistance touted at 134.98, 135.00 and then 135.22.

- Gilts are directionally in-fitting with peers but nearer to unchanged on the day given the marked outperformance yesterday heading into and after the BoE; holding just off a 100.61 peak, resistance at 100.77 from February.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks in the green despite broader risk aversion as the complex remains propped up by looming geopolitical risks heading into the weekend.

- Focus for the weekend is on when/what the middle-eastern response is to the recent strikes on various commanders/key officials; overnight, reports suggested an attack on Israel could be carried out in days.

- WTI September currently sits within a USD 76.51-77.28/bbl range with Brent October in a USD 79.70-80.46/bbl parameter.

- Spot gold firmer and at the top-end of a USD 2.434-2,468.33.oz intraday range and for the most part holding at yesterday’s USD 2462/oz peak into NFP; base metals are mostly firmer, despite the tone, and perhaps deriving support from recent PBoC remarks which also bolstered the Yuan. Note, the likes of LME Copper and Dalian iron ore are still poised to post a loss for the week.

- BHP's Escondida copper mine workers rejected the contract offer paving the way for a strike, while BHP will request a 5-day government mediation to negotiate with the Escondida union.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swiss CPI YY (Jul) 1.3% vs. Exp. 1.3% (Prev. 1.3%); MM (Jul) -0.2% vs. Exp. -0.2%

NOTABLE US HEADLINES

- Apple Inc (AAPL) Q3 2024 (USD): EPS 1.40 (exp. 1.35), revenue 85.78bln (exp. 84.53bln), Products rev. USD 61.56bln (exp. 60.63bln), iPhone rev. USD 39.30bln (exp. 38.95bln), iPad revenue USD 7.16bln (exp. 6.63bln), Mac rev. USD 7.01bln (exp. 6.98bln), Wearables, home and accessories rev. USD 8.10bln (exp. 7.79bln), Service rev. USD 24.21bln (exp. 23.96bln), Greater China rev. USD 14.73bln (exp. 15.26bln). Shares -0.3% in the pre-market.

- Amazon.com Inc (AMZN) Q2 2024 (USD): EPS 1.26 (exp. 1.03), rev. 148bln (exp. 148.56bln). Shares -8.3% in the pre-market.

- Intel Corp (INTC) Q2 2024 (USD): Adj. EPS 0.02 (exp. 0.10), rev. 12.83bln (exp. 12.94bln). Shares -21% in the pre-market.

GEOPOLITICS

- US President Biden and Israeli PM Netanyahu discussed new defensive military deployments, according to the White House.

- "American officials estimate that a significant Iranian attack will be carried out against Israel within a few days.", via IsraelHayom.

- "Israeli media: Letter from Knesset members to Netanyahu supporting the incursion into Lebanon", according to Al Arabiya.

- Syrian Observatory says Iranian militias in Deir Ezzor (city in Syria) raise alert; Iranian militias evacuate their headquarters in Albu Kamal in Deir Ezzor, via Al Arabiya.

CRYPTO

- Bitcoin is softer despite the downbeat USD as the general risk tone weighs and perhaps with focus on MicroStrategy numbers overnight.

APAC TRADE

- APAC stocks suffered firm losses following the bloodbath and flight-to-quality stateside which was triggered by weak ISM Manufacturing data, while geopolitical concerns and mixed earnings added to the downbeat sentiment.

- ASX 200 declined amid the broad weakness and with firm losses seen across all sectors.

- Nikkei 225 fell beneath 37,000 for the first time since April, while the Topix index followed the benchmark into correction territory.

- Hang Seng and Shanghai Comp. were pressured which saw the former give up the 17,000 status and the mainland index also retreated, while there were bearish comments on trade from a Mofcom official who stressed the seriousness of difficulties and challenges in foreign trade.

- SK Hynix (000660 KS) was pressured by over 10% in APAC trade as chip stocks continued to sell off.

NOTABLE ASIA-PAC HEADLINES

- China MOFCOM official said the complexity of the foreign trade environment is rising and we should take into full account the seriousness of the difficulties and challenges in foreign trade, as well as noted that they will use many bilateral mechanisms to help enterprises actively respond to unreasonable trade restrictions.

- Japanese Finance Minister Suzuki said they will analyse the impact of forex volatility on the economy and respond appropriately. Suzuki added that stock prices are determined in the market based on various factors such as economic conditions and he is closely watching stock moves with a sense of urgency.

- Japanese Industry Minister Saito said economic fundamentals aren't bad when asked about the sharp fall in the stock market, while he added that a strong movement is seen in investment and wage hikes are continuing.

- BoJ's Uchida to hold a press conference following on from a local business leaders meeting in Hakodate on 7th August

- PBoC advisor reportedly said that China should ramp up fiscal stimulus to generate growth and set a firm inflation target, via Reuters citing remarks from advisor Yiping.

- Nintendo (7974 JT) Q1 (JPY) Net 80.9bln (exp. 79bln), Operating 54.5bln (exp. 83bln), Recurring Profit 113bln, -55.3%. Switch: Sold 2.1mln units (prev. 3.91mln Y/Y); maintains FY sales forecast of 13.5mln units (prev. 15.7mln)

DATA RECAP

- South Korean CPI MM (Jul) 0.3% vs. Exp. 0.25% (Prev. -0.2%)

- South Korean CPI YY (Jul) 2.6% vs. Exp. 2.5% (Prev. 2.4%)

- Australian PPI QQ (Q2) 1.0% (Prev. 0.9%)

- Australian PPI YY (Q2) 4.8% (Prev. 4.3%)