First Zuck and Bezos, now it's Jamie Dimon's turn to sell the top

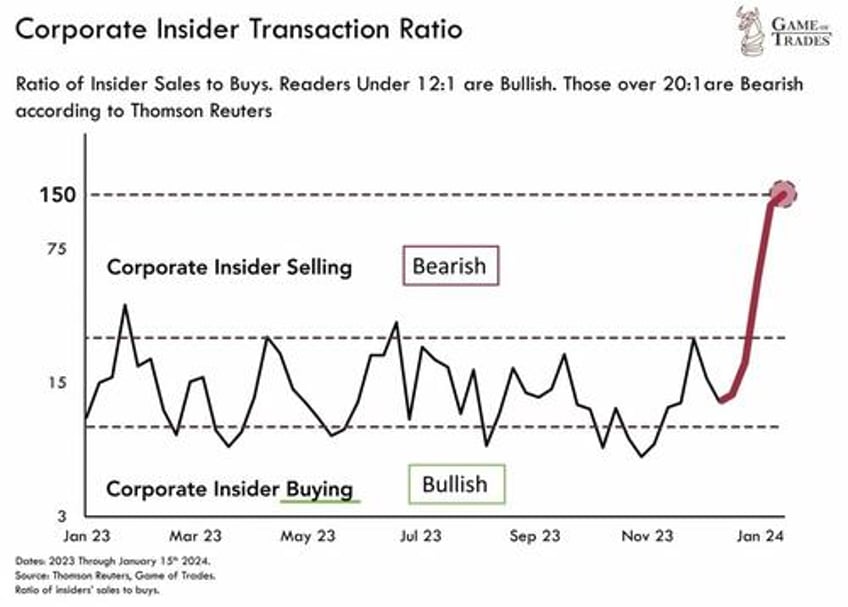

At a time when insiders are dumping stock at a pace not seen in years...

... the CEO of the largest US bank just sold $150 million worth of the bank’s stock, following through on last year’s announcement that he would begin selling shares for the first time since taking the helm 18 years ago.

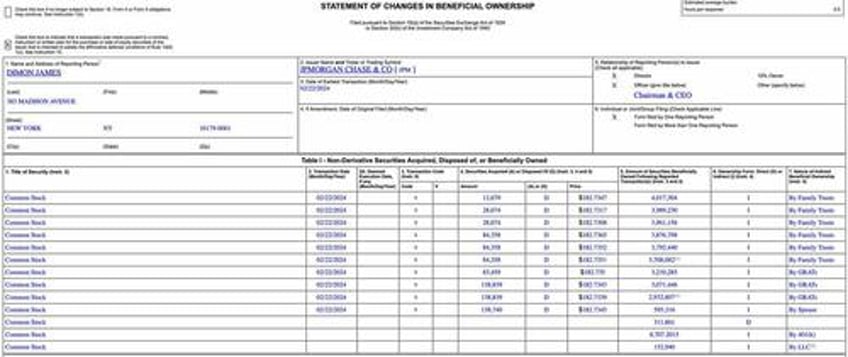

JPM CEO Jamie Dimon and his family sold about 822,000 shares in a series of transactions on Thursday, according to an SEC filing.

“Mr. Dimon continues to believe the company’s prospects are very strong and his stake in the company will remain very significant,” the company said in an October filing about his planned sales. A representative for the firm declined further comment on Friday.

We first learned last October that Dimon planned to sell one million shares, subject to terms of a stock-trading plan.

After today's sale, Dimon continues to hold about 7.7 million shares.

In a time of stress for the banking sector which saw small and regional banks routed in March of last year, JPMorgan has emerged as the clear winner with its stock rallying 27% amid its First Republic Bank deal, which was literally a taxpayer gift (courtesy of the FDIC) in which JPM got all the good assets of the now insolvent bank - with an FDIC loan to boot - while Americans kept everything that was toxic.

JPM shares gained as much as 1.2% on Friday, trading at a record high.