By Momoka Yokohama, Bloomberg markets live reporter and strategist

Japan is seeing a record run of stock buybacks that’s supporting investor sentiment after a stalled rally, and accelerated repurchases ahead of upcoming shareholder meetings may provide a fresh tailwind for the market.

Topix-listed companies announced a combined ¥6.3 trillion ($40 billion) in buybacks from the start of April through May 15, the most-ever for the period, according to data compiled by JPMorgan analysts including Rie Nishihara.

Late June is the peak period for annual general shareholder meetings in Japan. Corporate managers may provide details on how buybacks have boosted stock prices at a time when policymakers have been pushing companies to improve returns.

There may also be updates on unwinding of cross-shareholdings with other firms, a tradition that critics say limited competition and aggressive investment. Share buybacks are helping support the market as selling pressure related to this trend mounts.

Analysts expect Japanese stocks to gain a bit more, with those at Mizuho and SMBC Nikko targeting 42,000 and 40,500 respectively for the Nikkei 225 by the end of the year. The average of five brokers stands at 39,640, about 1.8% higher than Tuesday’s closing level, Bloomberg-compiled data show.

“Buybacks in June could be the next point of recovery for Japan’s stock market,” said Kohei Onishi, senior investment strategy researcher at Mitsubishi UFJ Morgan Stanley Securities Co., adding that companies have tended to buy shares before AGMs to push up the stock price.

With the upswing in buybacks, Japanese companies have become the biggest purchaser of the country’s equities, according to Daiwa Securities data. The Bank of Japan was formerly the top buyer via exchange traded funds, but the central bank discontinued such purchases in March.

“For sellers, it’s profitable to sell cross-held shares now,” said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Intelligence Laboratory. Companies will use funds they raised from selling those shares to buy back their own stocks, he said.

The benefits of buybacks may be short-lived, however. Suzuki said that after AGMs, cross-held share selling tends to increase, while ETF managers may unload holdings to pay investors dividends in July.

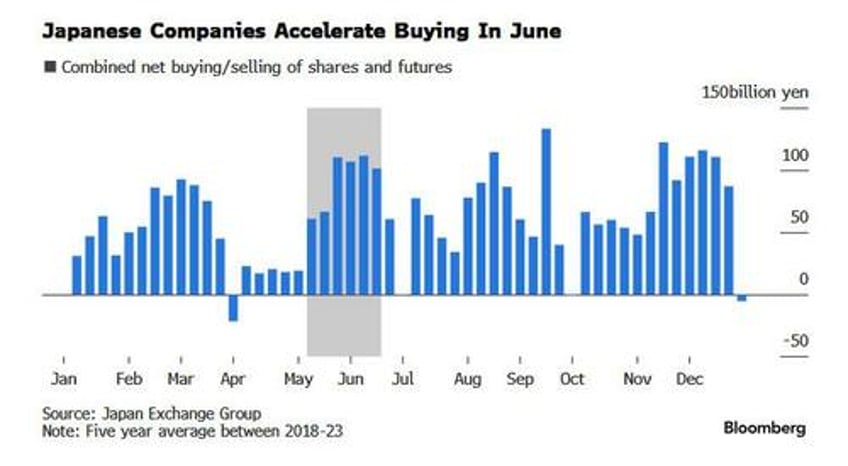

Still, at least for the period from the second week of May, during the time when many companies announce their earnings, to mid-June before shareholder meetings, there’s been big share buying by companies in the past five years, historical data from Japan Exchange Group show. That may have helped the Topix jump 7.4% last June, though the trend isn’t consistent.

This year the market impact could expand thanks to the pullback in April. Onishi at MUMSS said companies usually hesitate to buy back shares when they are rising. That means the slowdown since April gives more incentive for company managers to carry out buybacks ahead of AGMs, he said.