As we enter the last full week of the year, the natural winding down of activity will be punctuated by bursts of activity, centered around the Fed (Wednesday), the BoJ (Thursday) and the BoE (also Thursday) meetings. In terms of data, the highlights are the global flash PMIs today, US retail sales (tomorrow) and inflation prints from the US (PCE on Friday), Canada (tomorrow), UK (Wednesday), and Japan (Friday).

Outside of that, today’s German government vote of no confidence should almost certainly pave the way for a February 23rd election and tomorrow’s CDU/CSU manifesto announcement will help shape the campaign (more later). Another thing to watch is France where Moody’s surprisingly cut France late on Friday night in a rare unscheduled move, albeit one that brings it in line with S&P and Fitch (also more below).

Let’s expand on some of these highlights now and start with the Fed. Our economists’ preview is here but in brief they expect a 25bps cut and then for them to be on hold for the entirety of 2025 as the SEP should show meaningful revisions to the 2024 economic forecasts, with growth and inflation revised higher and the unemployment rate lower. The median dot is likely to show three additional rate cuts but we think Powell will likely deemphasis this signal in the press conference and be as data dependant as he can be. Powell will also likely emphasise that it is still too early for officials to build any major policy changes from the new Trump administration into their outlook. The long-run dot will likely continue its upward migration, rising to 3.1%. Our economists' estimates of neutral are notably above the Fed’s and we think they will likely continue to move this higher.

The BoJ meeting on Thursday is more uncertain, but most economists expect no change and with only a 16% probability of a hike priced in. Our Chief Japan economist previews the meeting here and goes against consensus in seeing a rate hike as the most likely scenario. One of the reasons why a hike might wait until January though is that MP Ishiba is trying to push a stimulus plan through parliament this month and the BoJ may prefer to avoid political interference and delay the hike.

On Thursday our UK economist expects a BoE hold, with a 9-0 vote decision, keeping the rate at 4.75%. The full preview of the meeting is here. The Riksbank is expected to cut rates 25bps on Thursday in a busy last full week of the year for central banks.

For core PCE on Friday our economists believe it comes in a little soft at 0.16% mom versus 0.27% previously with subcomponents in last Thursday's PPI and Friday's import price data, that feed into this number, on the weaker side. However, the year-over-year rate for core PCE should still tick up from 2.8% to 2.9%.

In Germany, Chancellor Scholz's vote of confidence today is scheduled to start at 1:00 pm CET. The expected loss will likely clear the path to early elections on February 23. More importantly tomorrow sees the CDU/CSU publish their manifesto at 11.30 CET. According to current polls the CDU is likely to lead the next government, and the manifesto could give clearer signals on their economic policy priorities, even if the coalition agreement after the elections could result in policy compromises. The key question is whether the CDU will formally signal an openness to reforming the debt brake at this stage. Recently signalled openness by Merz to discuss reforms might just be intended to create optionality for potential compromises in coalition talks. However, a leaked draft of the CDU election manifesto late last week saw a continued commitment to the debt brake which at this stage is not unexpected and corroborates what our economists expected in their preview of this week's events in Berlin here.

Staying in Europe, the Moody’s downgrade of France late on Friday night to Aa3 from Aa2 with a stable outlook was unscheduled and will surprise many when European markets reopen this morning. Their commentary on future deficits is quite damning but the fact that it’s a stable outlook for now, and that this just brings the rating in line with S&P and Fitch, will likely mean that this is more headline grabbing than massively market moving for now. OAT futures are only a little lower in Asia trading. France’s new Prime Minister Francois Bayrou will meet with far-right leader Marine Le Pen and Jordan Bardella (head of National Rally) at 9am CET this morning to start the process of agreeing a budget. So we may see some headlines post the meeting.

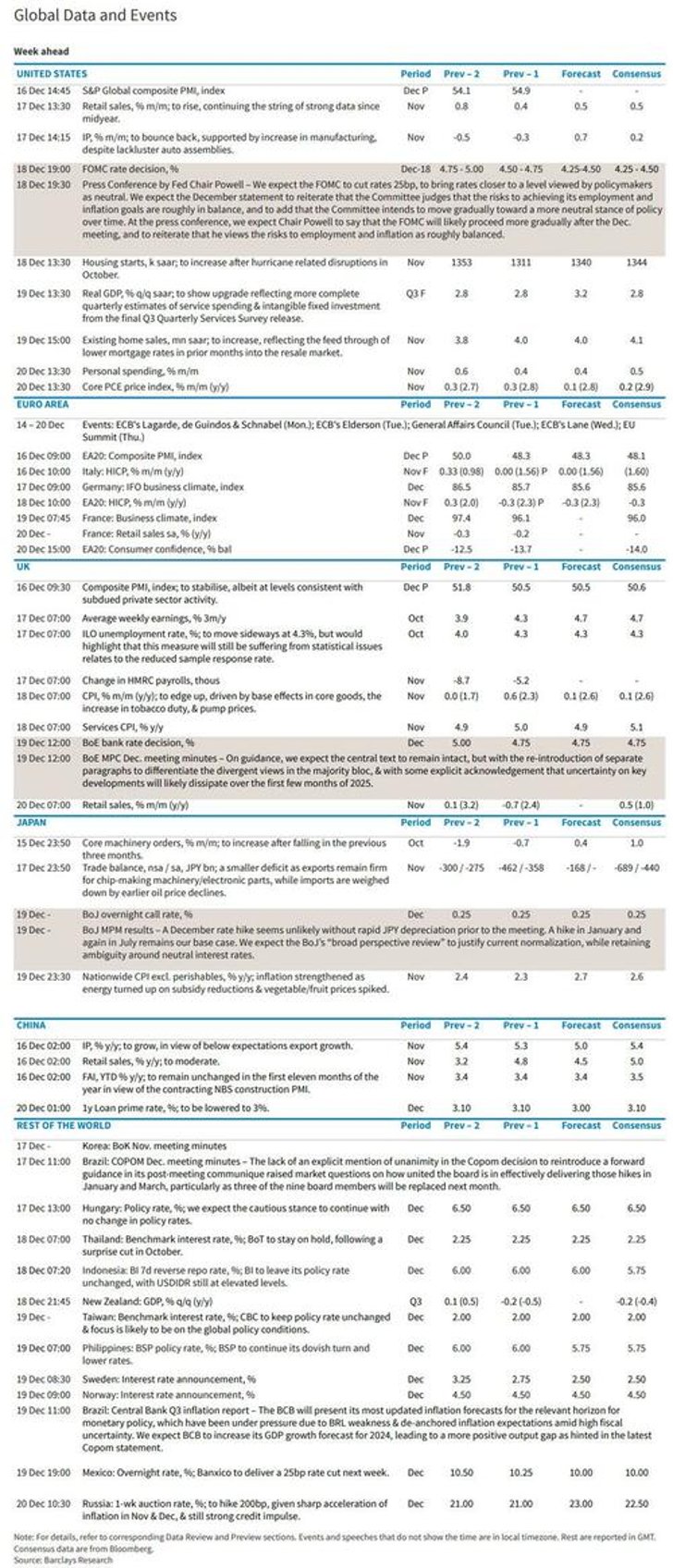

For all the rest of the week's events, here is the full day-by-day week ahead courtesy of Deutsche Bank.

Monday December 16

- Data: US, UK, Japan, Germany, France and the Eurozone December flash PMIs, US December Empire manufacturing index, China November home prices, industrial production, retail sales, property investment, Japan October Tertiary industry index, Italy October general government debt, Eurozone Q3 labour costs, Canada November housing starts and existing home sales

- Central banks: ECB's Lagarde, Simkus, Guindos, Wunsch, Schnabel and Escriva speak

Tuesday December 17

- Data: US November retail sales, industrial production, capacity utilisation, December NAHB housing market index, New York Fed services business activity, October business inventories, UK October average weekly earnings, unemployment rate, November jobless claims change, Japan November trade balance (GMT time), Germany December Ifo survey, Zew survey, Italy October trade balance, Eurozone December Zew survey, October trade balance, Canada November CPI, October international securities transactions

- Central banks: ECB's Kazimir and Rehn speak

- Auctions: US 20-yr Bond (reopening, $13bn)

Wednesday December 18

- Data: US November building permits, housing starts, Q3 current account balance, UK November CPI, RPI, PPI, October house price index, Eurozone October construction output, New Zealand Q3 GDP

- Central banks: Fed's decision, ECB's Muller, Nagel and Lane speak

- Earnings: Lennar

Thursday December 19

- Data: US December Philadelphia Fed business outlook, Kansas City Fed manufacturing activity, November leading index, existing home sales, October total net TIC flows, initial jobless claims, Japan November national CPI (GMT time), Germany January GfK consumer confidence, France December manufacturing confidence, Italy October current account balance, EU27 November new car registrations, October ECB current account

- Central banks: BoJ's decision, BoE's decision, Norges Bank decision, Riksbank decision

- Earnings: Nike, FedEx, Accenture

- Auctions: US 5-yr TIPS (reopening, $22bn)

Friday December 20

- Data: US November PCE, personal income and spending, December Kansas City Fed services activity, China 1-yr and 5-yr loan prime rates, UK November public finances, retail sales, Germany November PPI, France November PPI, retail sales, Italy December consumer, manufacturing confidence, economic sentiment, November PPI, October industrial sales, Eurozone December consumer confidence, Canada October retail sales

* * *

Finally, looking just at the US, Goldman writes that the key data releases this week are the retail sales report on Tuesday and core PCE inflation on Friday. The December FOMC meeting is this week. The post-meeting statement will be released on Wednesday at 2:00 PM ET, followed by Chair Powell's press conference at 2:30 PM.

Monday, December 16

- 08:30 AM Empire State manufacturing survey, December (consensus +10.0, last +31.2)

- 09:45 AM S&P Global US manufacturing PMI, December preliminary (consensus 49.5, last 49.7); S&P Global US services PMI, December preliminary (consensus 55.8, last 56.1)

Tuesday, December 17

- 08:30 AM Retail sales, November (GS +0.5%, consensus +0.5%, last +0.4%); Retail sales ex-auto, November (GS +0.3%, consensus +0.4%, last +0.1%); Retail sales ex-auto & gas, November (GS +0.4%, consensus +0.4%, last +0.1%); Core retail sales, November (GS +0.3%, consensus +0.4%, last -0.1%): We estimate core retail sales expanded 0.3% in November (ex-autos, gasoline, and building materials; month-over-month SA), reflecting moderate spending increases at the start of the holiday season. We estimate a 0.5% increase in headline retail sales, reflecting lower gasoline prices but higher auto sales.

- 09:15 AM Industrial production, November (GS +0.3%, consensus +0.3%, last -0.3%); Manufacturing production, November (GS +0.5%, consensus +0.5%, last -0.5%); Capacity utilization, November (GS 77.1%, consensus 77.3%, last 77.1%): We estimate industrial production increased +0.1%, reflecting strong auto production partially offset by weak natural gas and mining production. We estimate capacity utilization was unchanged at 77.1%.

- 10:00 AM Business inventories, October (consensus +0.1%, last +0.1%)

Wednesday, December 18

- 08:30 AM Housing starts, November (GS +2.8%, consensus +2.4%, last -3.1%)

- 08:30 AM Current account balance, Q3 (consensus -$287.1bn, last -$266.8bn)

- 02:00 PM FOMC statement, December 17-18 meeting: As discussed in our FOMC preview, we expect the FOMC to deliver a 25bp cut at its December meeting. We suspect that the Committee will update the FOMC statement to add a gentle nod toward a slower pace of rate cuts ahead, and we expect the SEP to show a substantial increase in 2024 GDP growth and a bit more momentum in subsequent years, a flat 4.2% path for the unemployment rate, and a 0.2pp increase in the core PCE inflation path in 2024, 2025, and 2026. We expect the median dot to show 3 cuts in 2025 to 3.625%, 2 cuts in 2026 to 3.125%, and a flat path in 2027 at 3.125%. We also expect the median longer run or neutral rate dot to rise 0.125pp to 3% this week. We have revised our forecast for 2025 to eliminate a cut in January; we continue to expect cuts in March, June, and September next year, and now expect a slightly higher terminal rate of 3.5-3.75%.

Thursday, December 19

- 08:30 AM GDP, Q3 third release (GS +2.8%, consensus +2.8%, last +2.8%); Personal consumption, Q3 third release (GS +3.4%, consensus +3.7%, last +3.5%): We estimate no revision on net to Q3 GDP growth at +2.8% (quarter-over-quarter annualized), reflecting a downward revision to consumer spending (-0.1pp to +3.4%) due to softer public transportation and utilities details in the quarterly census survey (QSS), offset by upward revisions to residential investment and net exports.

- 08:30 AM Philadelphia Fed manufacturing index, December (GS 6.0, consensus 2.9, last -5.5)

- 08:30 AM Initial jobless claims, week ended December 14 (GS 230k, consensus 229k, last 242k); Continuing jobless claims, week ended December 7 (last 1,886k): We estimate initial jobless claims declined by 12k to 230k in the week ended December 14th, reflecting partial reversal of the seasonal distortions that boosted the prior two readings.

- 10:00 AM Existing home sales, November (GS +1.8%, consensus +3.0%, last +3.4%)

Friday, December 20

- 08:00 AM Personal income, November (GS +0.4%, consensus +0.4%, last +0.6%); Personal spending, November (GS +0.5%, consensus +0.5%, last +0.4%); Core PCE price index, November (GS +0.13%, consensus +0.2%, last +0.3%); Core PCE price index (YoY), November (GS +2.84%, consensus +2.9%, last +2.8%); PCE price index, November (GS +0.15%, consensus +0.2%, last +0.2%); PCE price index (YoY), November (GS +2.47%, consensus +2.5%, last +2.3%): We estimate personal income and personal spending increased by 0.4% and 0.5%, respectively, in November. We estimate that the core PCE price index rose by 0.13%, corresponding to a year-over-year rate of 2.84%. Additionally, we expect that the headline PCE price index increased by 0.15% from the prior month, corresponding to a year-over-year rate of 2.47%. Our forecast is consistent with a 0.16% increase in our trimmed core PCE measure (vs. +0.17% in October).

- 10:00 AM University of Michigan consumer sentiment, December final (GS 74.6, consensus 74.0, last 74.0): University of Michigan 5-10-year inflation expectations, December final (GS 3.1%, last 3.1%)

Source: Deutsche Bank, Goldman, Barclays