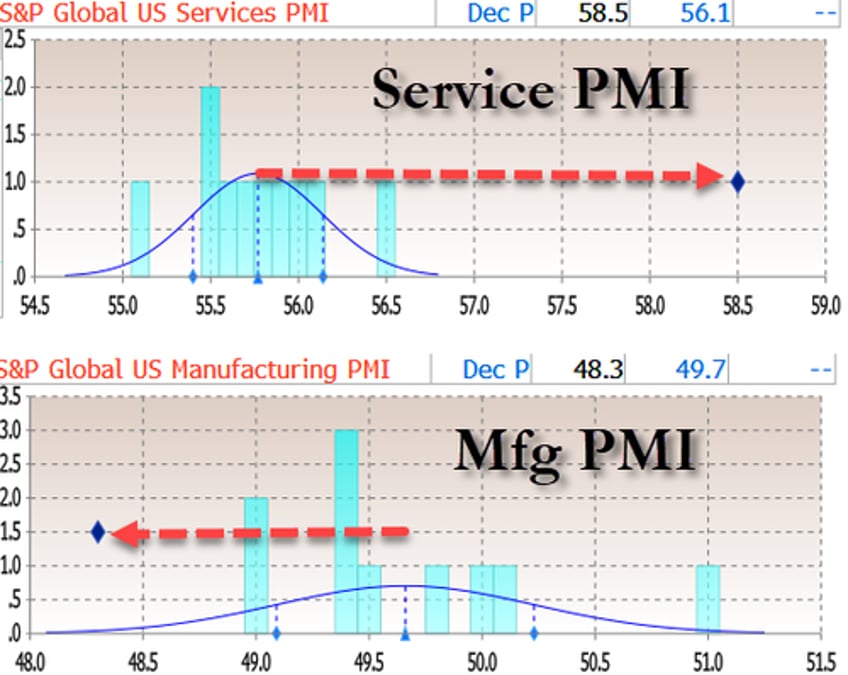

Following Europe's mixed bag of PMIs (Manufacturing contracting harder as Services save the composites in France, Germany, & UK - but all still in contraction overall), S&P Global's US Manufacturing and Services were expected to decline modestly in preliminary December data released this morning.

Analysts were half right... as US Manufacturing PMI plunged to 48.3 (from 49.7 and below all expectations) but US Services soared higher (to 58.5 from 56.1, far above all expectations)

And that has all happened as 'hard' data has been serially outperforming...

Source: Bloomberg

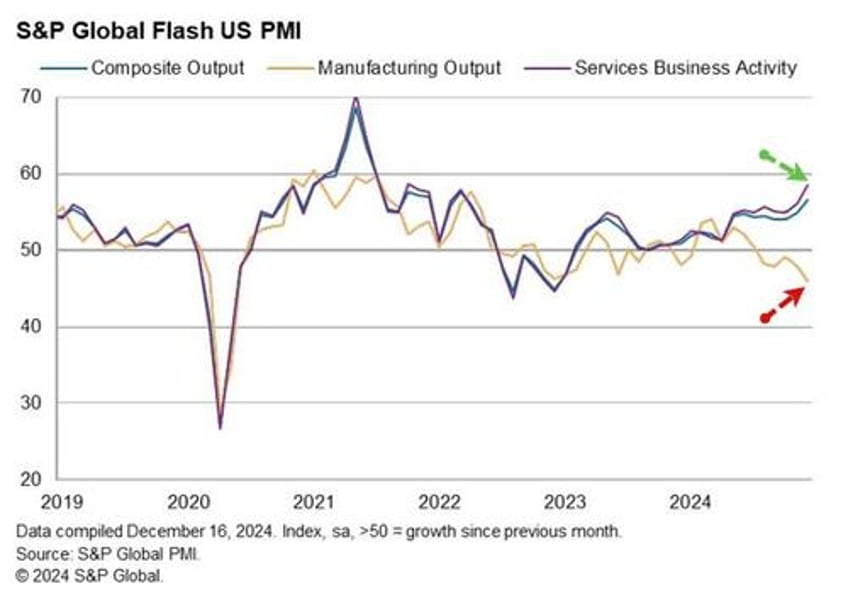

The Services survey hits a 38-month high as US Manufacturing Output plummets to a 55-month low...

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

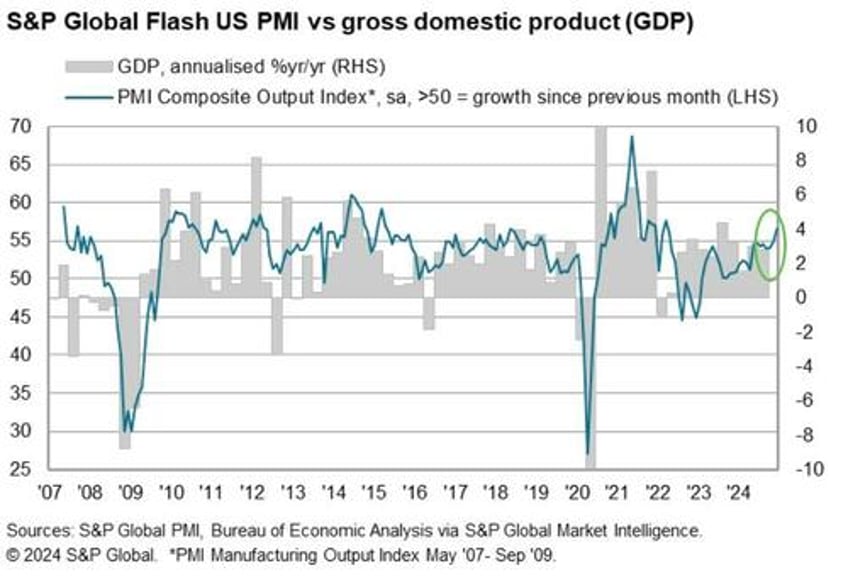

“Business is booming in the US services economy, where output is growing at the sharpest rate since the reopening of the economy from COVID lockdowns in 2021. The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years, consistent with GDP rising at an annualized rate of just over 3% in December.

“It’s a different picture in manufacturing, however, where output is falling sharply and at an increased rate, in part due to weak export demand.

Encouragingly, confidence in the 12-month outlook has lifted to a two-and-a-half year high, suggesting the robust economic upturn will persist into the new year and could also become more broad-based by sector.

However, Williamson notes that some of the high spirits seen after the election in the manufacturing sector have been checked over concerns surrounding tariffs and the potential impact on inflation resulting from the higher cost of imported materials.

December saw raw material prices spike sharply higher amid supplier-led price rises and higher shipping costs, in a reflection of busier supply chains in advance of threatened protectionism in the new year.”

So surging economy and rising prices... not exactly the recipe for more rate cuts this week?