The August jobs report highlighted a critical reality: the labor market is cooling off. While the headline figures seemed decent, the underlying data reveals clear warning signs that worker demand is slowing. Investors should pay attention because the link between employment and its impact on the economy and the market is undeniable. While often overlooked, as we will discuss, there is an undeniable link between economic activity and corporate earnings. Employment is the driver of a consumption-based economy. Consumers must produce first before consuming, so employment is critical to corporate earnings and market valuations. We will discuss these in order.

Slowing Labor Market: The First Red Flag

The August jobs report indicated that job creation has slowed dramatically, particularly in crucial manufacturing, retail, and services sectors. For months, we’ve relied on the narrative that a strong labor market could buoy the economy through rough patches. But that narrative quickly falls apart as hiring freezes and job cuts become more common. The data trend is always more critical than the actual employment number. The message is simple: employment is weakening.

However, as discussed in the “Sahm Rule,” full-time employment is a far better measure of the economy than total employment. As noted, the U.S. is a consumption-based economy. Critically, consumers can not consume without producing something first. As such, full-time employment is required for a household to consume at an economically sustainable rate. These jobs provide higher wages, benefits, and health insurance to support a family, whereas part-time jobs do not. It is unsurprising that, historically, when full-time employment declines, a recession typically follows.

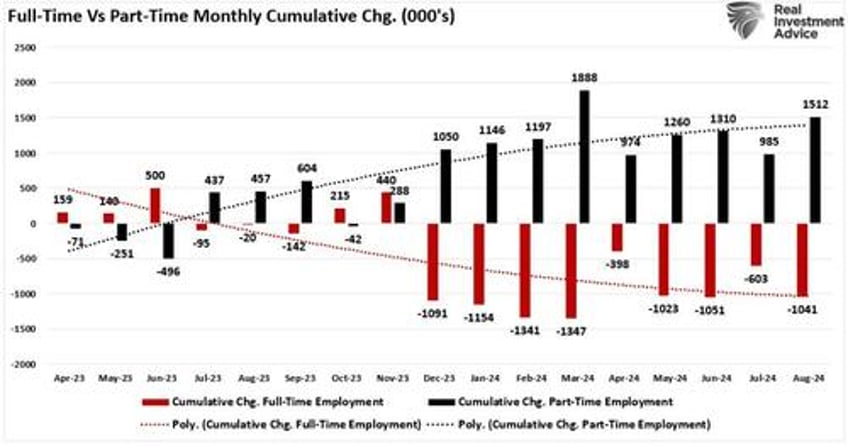

If full-time employment drives economic growth, it is logical that more robust trends in full-time employment are required. However, since 2023, the economy lost more than 1 million full-time jobs versus gaining 1.5 million part-time jobs. That does not scream economic strength.

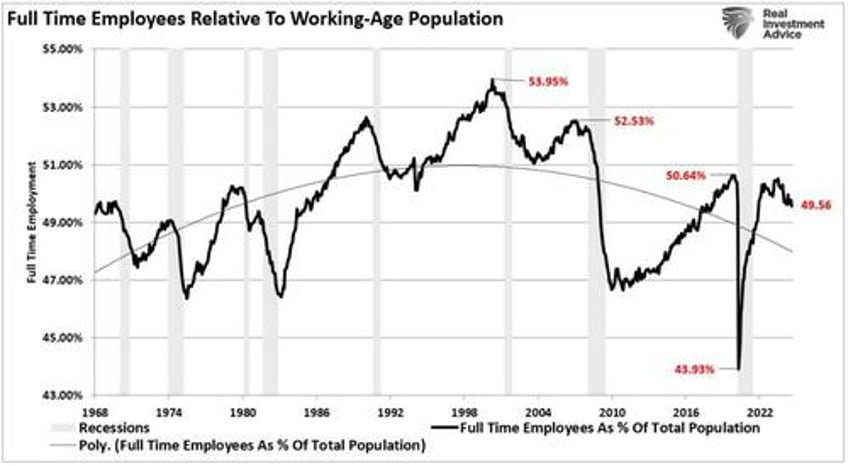

Furthermore, a comparison of full-time employment to the working-age population shows why the U.S. can not sustain annual economic growth rates above 2%.

Since the turn of the century, as the U.S. has increasingly integrated technology and outsourcing to reduce the need for domestic labor, full-time employment has continued to wane. If fewer Americans work full-time, as a percentage of the labor force, the ability to consume at higher rates diminishes as disposable income decreases.

Since corporate earnings depend on economic activity, companies continue to adopt technology and other productivity-enhancing tools to reduce the need for labor. If slower economic demand begins to weigh on corporate profit margins, earnings forecasts will be revised downward in the coming months.

Corporate Earnings Are in Jeopardy

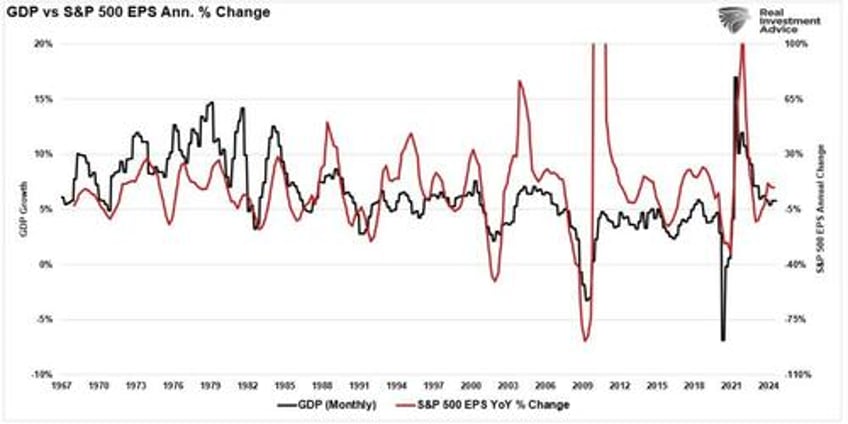

Understanding how a weakening labor market translates into weaker earnings is essential. When companies are uncertain about future demand, they stop hiring and look to cut costs. These cost-cutting measures appear in numerous ways, such as layoffs, automation, outsourcing, or increasing temporary hires. Such measures can buy companies some time but don’t solve declining revenues. When fewer people have jobs or wage growth stalls, consumer spending slows down, and that hits the top line for many companies, particularly in consumer-driven sectors. Unsurprisingly, there is a relatively high correlation between the annual change in GDP and corporate earnings.

As such, given that market participants bid up stock prices in anticipation of higher earnings and vice versa, the correlation between the annual change in earnings and market prices is also high.

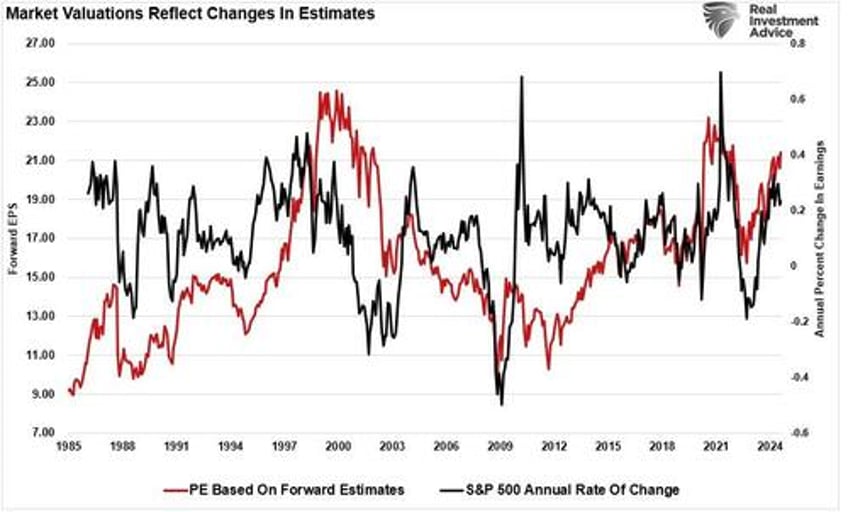

In past economic cycles, we’ve seen how quickly earnings can disappoint when the labor market weakens. Analysts have been overly optimistic about earnings growth, and now the reality of slower consumer demand will force them to adjust their projections. As earnings expectations come down, investors will need to rethink current valuations. This is a straightforward equation—lower earnings lead to lower stock prices as markets reprice current valuations.

Investors should prepare for a slowing labor market’s impact on stock prices. The market is a forward-looking mechanism, and it’s already starting to price in the effects of weaker job growth. Sectors most exposed to consumer spending, such as retail and travel, are likely to see the sharpest declines in stock prices as investors adjust to the reality of softer earnings.

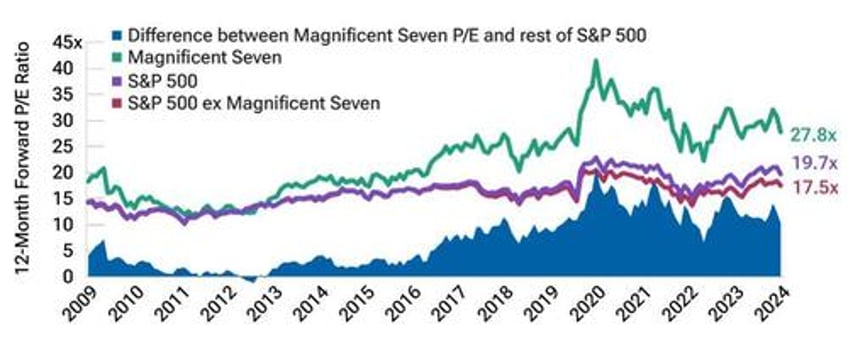

Technology companies, which have driven much of the stock market’s performance this year, will also be vulnerable. These companies rely on high growth expectations to justify their lofty valuations. If the labor market weakens, consumer demand for tech products and services will also fall, leading to earnings misses and stock price declines.

Investor Implications

The broader financial markets are potentially at risk of a “bumpier ride” as the effects of the weakening labor market ripple through the economy. As we’ve seen in previous cycles, investors will begin to move away from riskier assets like stocks and into safer investments such as Treasury bonds. Such a shift could exacerbate market volatility if earnings get revised lower to reflect slower economic activity.

There’s also the question of how the Federal Reserve will respond. A slowing labor market often leads to lower inflation, which might allow the Fed to cut interest rates more aggressively and reverse the current reduction in its balance sheet. However, if inflation remains well above the Fed’s 2% target, despite weaker job growth, the Fed could find its hands tied. A potential market risk is when the Fed gets forced to keep rates elevated while the economy slows. Such would prolong the economic downturn and increase stock price pressure.

Recent employment reports show a clear trend: the labor market is losing momentum. That spells trouble for the economy and the stock market. The slowdown in job creation, coupled with weaker corporate earnings, is setting the stage for increased market volatility.

As noted, with markets still near all-time highs, it is an excellent time to reassess portfolio risk exposures. Rebalancing positions in overvalued growth stocks and shifting toward more defensive assets could be prudent. As we have often said, capital preservation should be the priority in times of uncertainty. The labor market indicates that uncertain times are ahead, and investors should prepare accordingly.