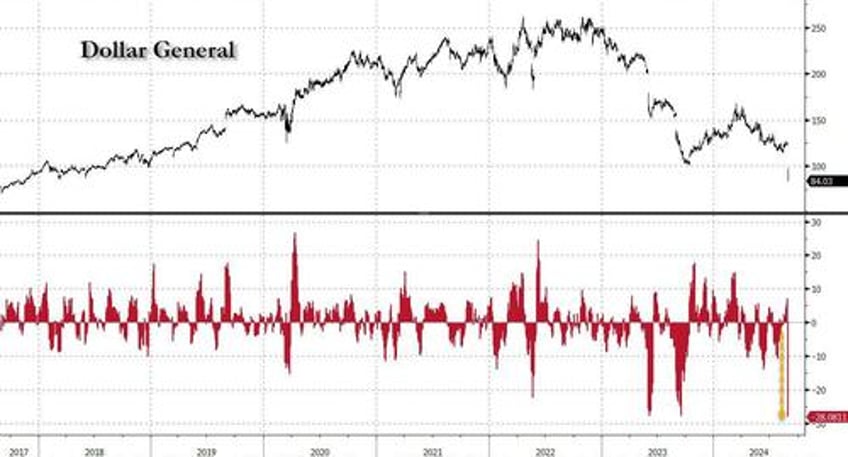

In what should hardly be a surprise after today's record plunge in Dollar General, which is where the lower, pardon Biden middle-class trades down to before it has to downgrade to Five Finger Discount General...

... moments ago two other discretionary consumer icons, Lululemon and Ulta Beauty, reported catastrophic results.

Starting with Ulta Beauty, that favorite every 20-something upwardly mobile (if not so much any more) single woman, not to mention Warren Buffet's latest acquisition (Berkshire bought $267 million worth in Q2) the company reported Q2 results which missed across the board:

- EPS $5.30, down from $6.02 y/y, missing estimates $5.49

- Net sales $2.55 billion, +0.9% y/y, missing estimates of $2.61 billion

- Comparable sales -1.2% vs. +8% y/y, missing estimate +1.32%

- Gross margin 38.3% vs. 39.3% y/y, missing estimates of 38.8%

- Merchandise inventories $2.00 billion, +10% y/y, higher than estimates $1.92 billion

The 2025 forecast was even uglier:

- Sees net sales $11.0 billion to $11.2 billion, a big drop from the previous guidance of $11.5 billion to $11.6 billion, and a huge miss to estimate $11.51 billion

- Sees EPS $22.60 to $23.50, also a huge cut to prior guidance of $25.20 to $26, and a huge miss to estimates of $25.42

- Sees comparable sales -2% to 0%, down sharply from +2% to +3%, and a huge miss to the consensus estimate +1.89%

- Sees operating margin 12.7% to 13%, down sharply from the 13.7% to 14% prior, and a huge miss to the estimate 13.7%

- Sees capital expenditure $400 million to $450 million, saw $415 million to $490 million, estimate $443.4 million

TL/DR: Ulta shares plunged as much as 8% in afterhours trading after the cosmetics retailer lowered its annual projections for comparable sales and profit following weaker-than-expected second-quarter results. Watch as Buffett bails out of the name as quickly as he got in.

But wait, there's more because if ULTA was bad, LULU was just as ugly:

- Net revenue $2.37 billion, missing estimates of $2.41 billion

- Total comp sales +3%, missing estimate +5.63%

- EPS $3.15, beating estimate $2.95

The historicals were bad, but like LULU, guidance was even worse:

Q3 forecast:

- Sees net revenue $2.34 billion to $2.37 billion, missing the estimate $2.41 billion

- Sees EPS $2.68 to $2.73, missing the estimate $2.76

Full year forecast

- Sees net revenue $10.38 billion to $10.48 billion, down sharply from the $10.7 billion to $10.8 billion it saw previously, and also missing the estimate $10.62 billion (Bloomberg Consensus)

- Sees EPS $13.95 to $14.15, also below the previous guidance of $14.27 to $14.47, and vs the consensus estimate $14.00

As Bloomberg notes, the company lowered its sales and profit outlook for the year, adding to concerns on Wall Street that frugal consumers are no longer shelling out for pricey yoga pants and that increased competition is siphoning off customers.

The company now sees sales in a range of $10.38 billion to $10.48 billion this year, down from the previous view of as much as $10.8 billion, offered in early June. Comparable sales, a key retail metric, also missed expectations in the company’s second quarter. Lululemon’s sales growth in North America is slowing as shoppers contend with persistent inflation, higher interest rates and a cooling job market. Comparable store sales fell 3% in the US.

Chief Executive Officer Calvin McDonald’s team has been refining the company’s product assortment to meet demand as shoppers gravitate toward looser-fitting pants. But analysts have questioned some of the company’s product strategies, and noted that rivals such as Alo Yoga and Beyond Yoga appear to be gaining market share.

McDonald said on the call with analysts that he was “disappointed with the recent performance in women’s,” citing missed opportunities because the retailer didn’t offer enough new products in both core and seasonal styles.

According to Bloomberg, Wedbush Securities analyst Tom Nikic said ahead of the results that a guidance cut from Lululemon was “pretty much baked into buyside expectations” after the Vancouver-based company paused sales of its Breezethrough tights and shorts in July. The company said it would make adjustments to the clothes following poor reviews and shopper complaints about the fit. Analysts had seen Breezethrough as a key sales driver.

While the stock was mixed after hours, it had already plunged 50% YTD ahead of earnings, with much of the bad news already in the price. Then again, it appears that US consumers are finally hitting the brick wall, which means the much more downside may be in the near future.