A mixed day on the macro side, but that never stopped the melt-up in mega-cap tech...

Philly Fed Services jumped into expansion (to two year highs?), Chicago Fed National Activity Index surged, Case-Shiller home prices hit a new record high but appreciation slowed, Conference Board Expectations hovers near decade lows, Richmond Fed Manufacturing tumbled, Dallas Fed Services improved but remains in contraction...

But, overall, both 'hard' (21-month lows) and 'soft' data ended lower on the day...

Source: Bloomberg

Bonds didn't care less - ending the day basically unchanged - but all now lower on the week (with the long-end outperforming)...

Source: Bloomberg

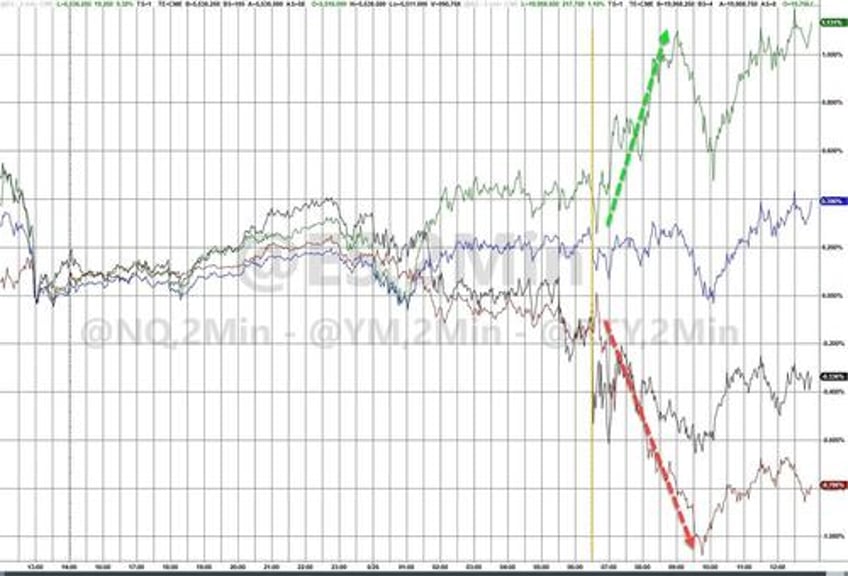

But stocks (well some of them) loved it... as the mega-cap tech names lifted Nasdaq to be the big outperformer. The Dow and Small Caps ended red on the day while the S&P managed gains...

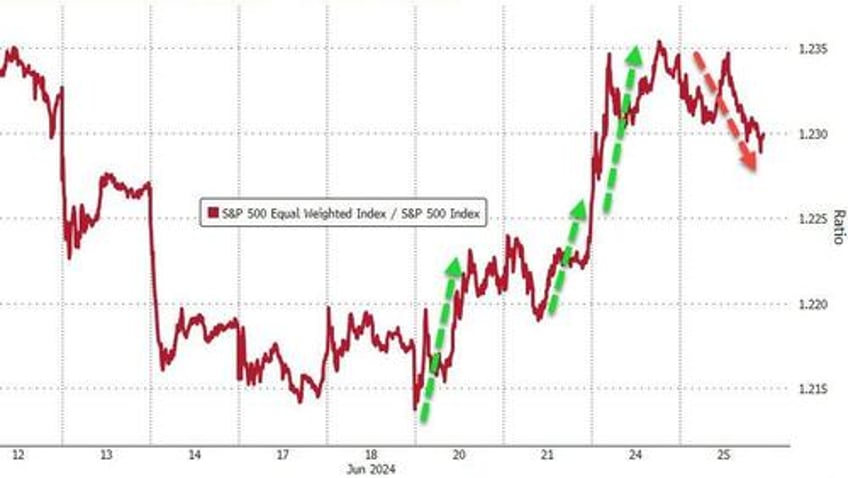

After 3 straight days of outperformance, the equal-weighted S&P lagged the cap-weighted index today as the big names dominated once again...

Source: Bloomberg

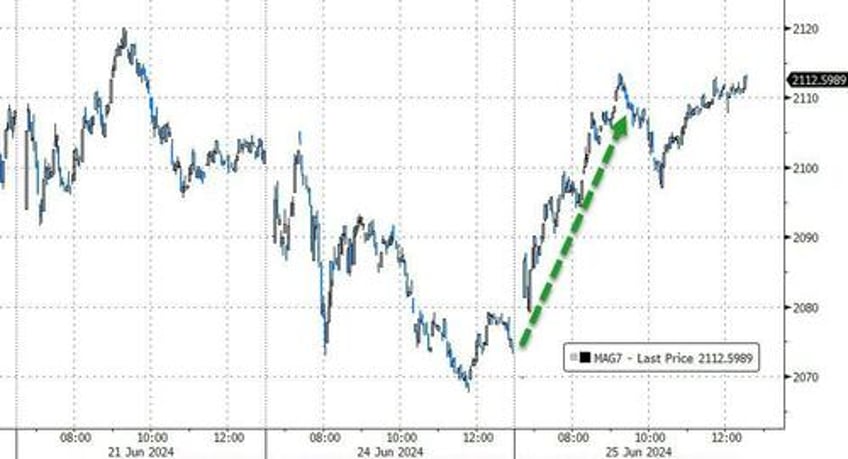

AI-exposed stocks recovered back to AI-at-Risks on the week today...

Source: Bloomberg

...as NVDA ripped back after an 18% decline...

...lifting MAG7 stocks to Friday's highs...

Source: Bloomberg

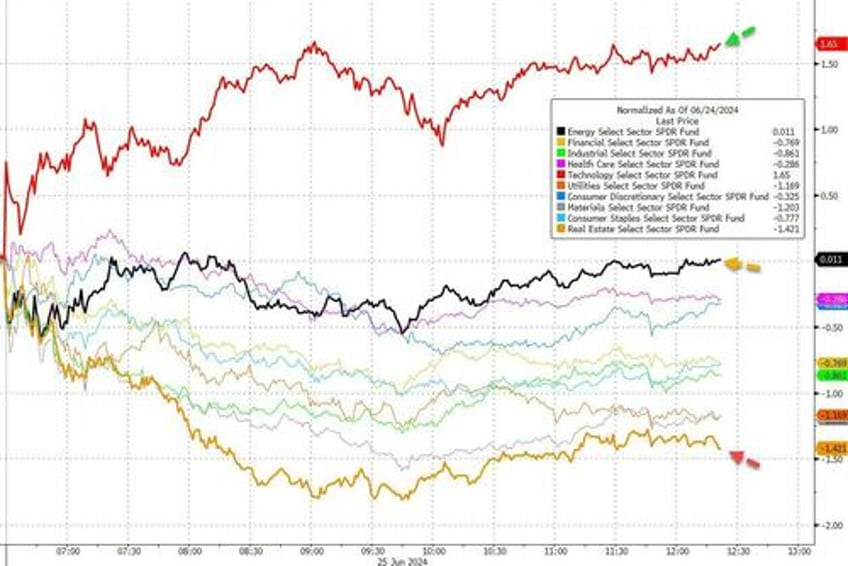

Tech outperformed and Energy was unchanged while all other sectors were red...

Source: Bloomberg

Goldman's trading desk noted that overall activity levels are flat vs. the trailing 2 weeks with market volumes down -14% vs the 10dma

Our floor tilts -4% better for sale, exclusively driven by LOs

LOs are -27% better for sale with Tech supply once again a standout, ranking in the 93rd %-ile. Other pockets of supply include Comms Svcs, HCare, Cons Disc & Indust. Demand is modest across Fins & REITs

HFs are basically paired buy vs. sell. Short ratio ticking up to 53%. We are seeing demand for Mats, Fins, Utes and Tech with most of the supply concentrated in Macro Products, while Energy, REITs and Cons Disc also tilt slightly for sale

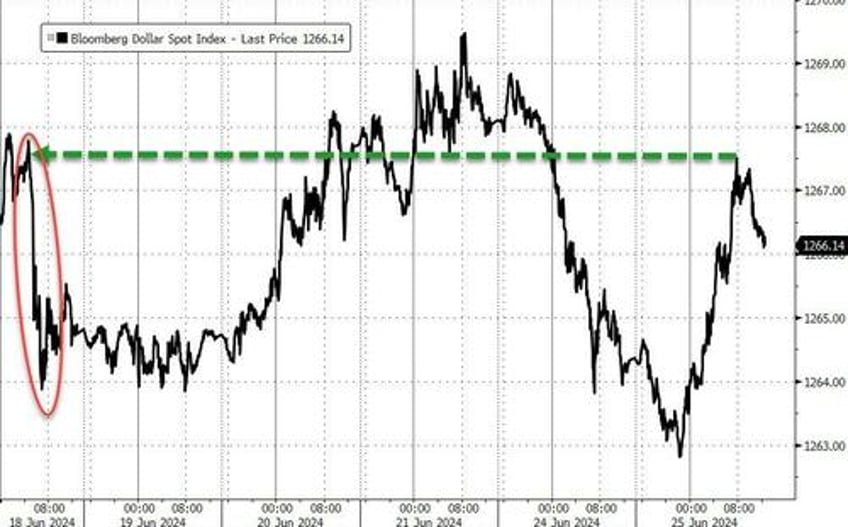

The dollar bounced back to last Wednesday's highs...

Source: Bloomberg

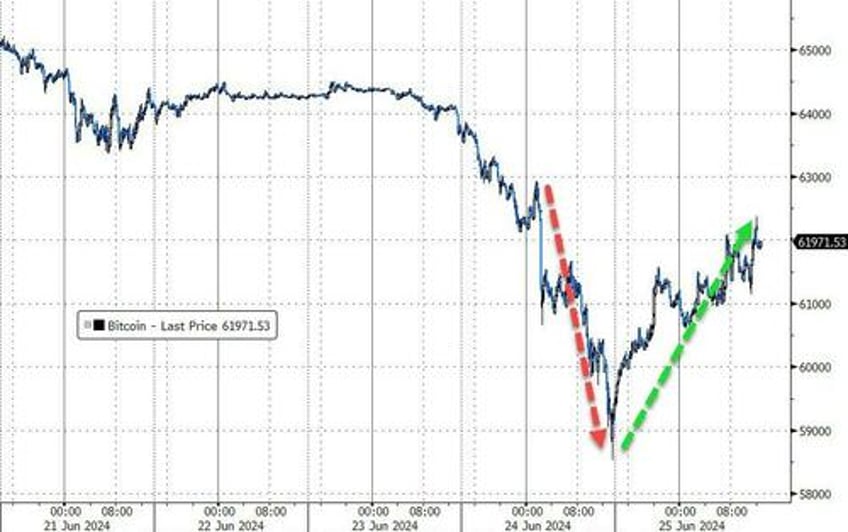

Bitcoin was bid aggressively despite some German govt moving bitcoin headlines. BTC bounced off $59k (close-ish to its 200DMA) back up to pre-Mt.Gox headline levels...

Source: Bloomberg

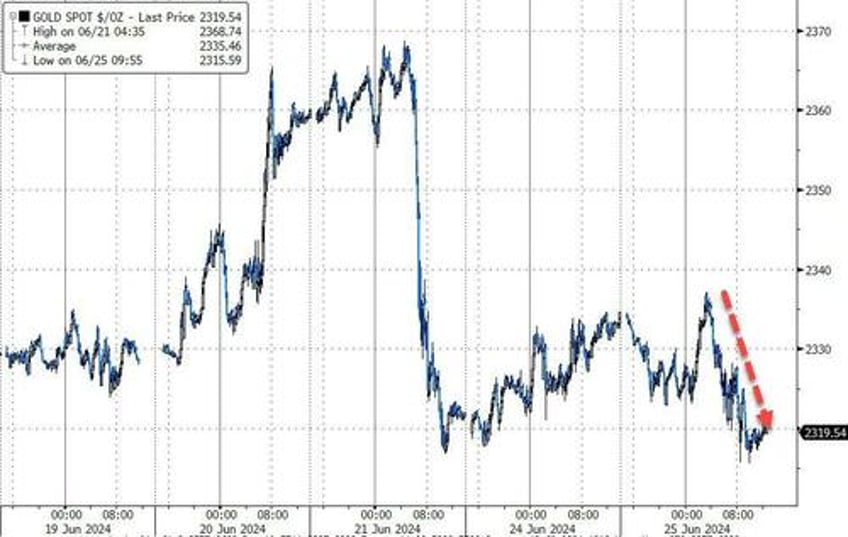

Gold traded back down to Friday's lows...

Source: Bloomberg

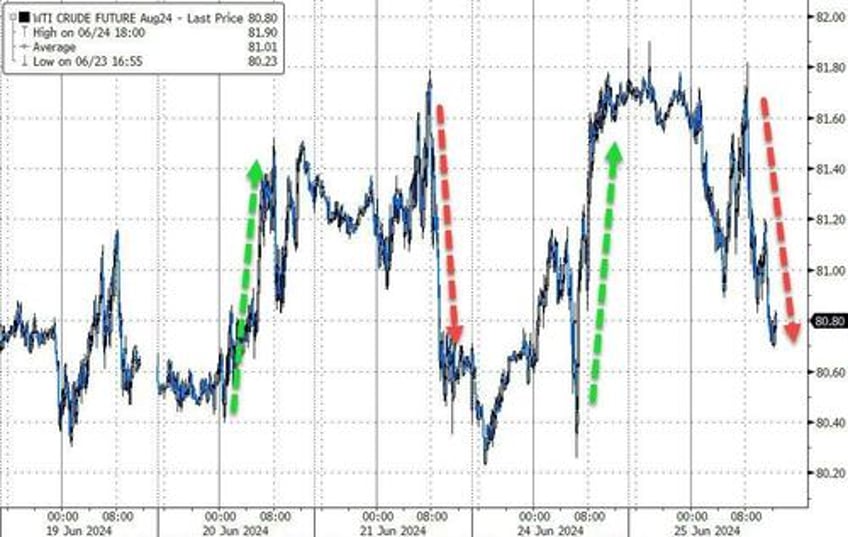

Oil traded back into its own range of the last week...

Source: Bloomberg

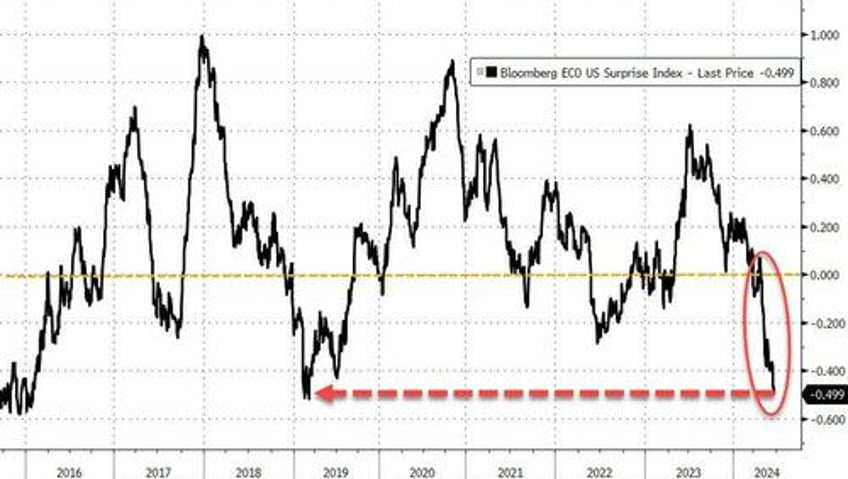

Finally, some context, the US Macro Surprise Index is at its weakest since March 2019...

Source: Bloomberg

That looks more like a crash-landing than a 'soft' landing... but we know that's not true because The Fed keeps telling us how well the economy is doing and the Biden admin keeps reminding Americans how lucky they are to have his economic policies...